Bosch to create European semiconductor supply chain

11 November 2021

German technology group Bosch, one of the world’s biggest automotive suppliers, is working towards addressing the crippling semiconductor supply crisis that has added to carmakers’ woes. The company wants to create a European supply chain for silicon carbide (SiC) semiconductors that it says will bring about a more energy-efficient and sustainable economy.

The tech group is now leading a consortium, made up of 34 companies, universities, and research institutes from seven European countries that have teamed up to work towards establishing a resilient European supply chain.

The automotive industry has seen an ongoing structural deficit, with demand for semiconductors being higher than the ability to produce them. Worldwide bottlenecks have affected the supply of products relying on chips, including not only cars but also a range of electronics.

‘Transform’

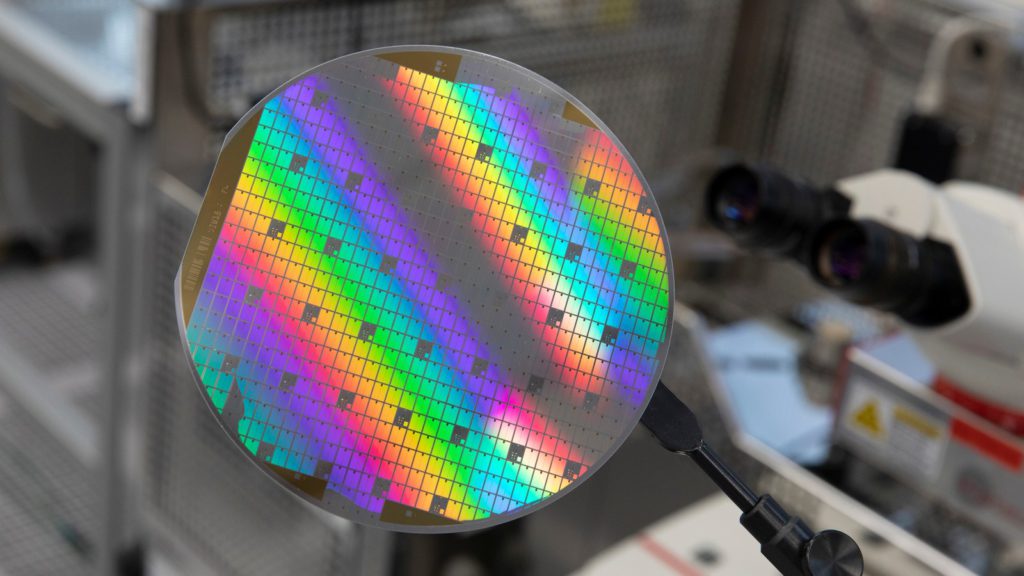

As part of a project dubbed ‘Transform’ that is being funded by the EU, Bosch and other participants have now dedicated themselves to look at all aspects of building a supply chain, focused on wafers and other basic materials, as well as finished SiC power semiconductor devices and power electronics.

‘The aim of the Transform project is to secure a leading role for Europe in new technologies based on silicon carbide,’ said Jens Fabrowsky, executive vice-president of the Bosch automotive electronics division.

The publicly-funded project is scheduled to run until 2024 and has a budget of more than €89 million. It joins a range of other projects looking at sustainable ways to improve energy efficiency in areas including electromobility and renewable energy. SiC semiconductors and the electronic components containing them are seen as ‘the most efficient use of the electricity at our disposal,’ Bosch said.

SiC market set to grow

The company cited a study by market research company Yole, which forecasts that the SiC market will grow on average by 30% a year to $2.5 billion (€2.2 billion) between now and 2025. Demand for this type of technology is bound to grow swiftly, especially with regards to energy applications such as electric-vehicle powertrains, charging stations, and power supply infrastructure.

The project will also look at the development of new SiC technology, aiming to secure the availability of machinery and equipment that are needed to produce this technology by European suppliers. Why does Bosch focus specifically on SiC technology? Because it brings with it numerous benefits that can save substantial amounts of energy, making it more environmentally friendly.

‘Conventionally, the chips in [semiconductor] devices are made of ultra-pure silicon. In the future, however, this will increasingly be replaced by silicon carbide, which offers numerous advantages over pure silicon,’ Bosch said.

‘Silicon carbide semiconductors display better electrical conductivity while also ensuring that much less energy is dissipated in the form of heat. In addition, power electronic applications with SiC chips can be operated at much higher temperatures, with the result that a simpler cooling system is required, which also saves energy. And finally, silicon carbide has a higher electric-field strength, meaning that components made of this material can be smaller in design while nonetheless delivering a higher power-conversion efficiency.’

Bosch recently confirmed it is ramping up chip production at its German and Malaysian plants. The company said last month it would spend €400 million at its Dresden, Reutlingen and Penang factories. Bosch is now intending to systematically expand its semiconductor production, hoping to support customers as European car production is continuing to fall due to the chip crisis.

In September, the European Commission proposed a European Chips Act covering research and production capacity, prompted by the disruptive chip shortage. The continent heavily relies on Asian-made chips and is aiming to make Europe more resilient to external supply deficits.

What are the trends across Europe on energy, body-types or models?

Find out more using Residual Value Intelligence

FIND OUT HOW