High risks and high rewards of the agency model for new-car sales

24 October 2022

Dr Christof Engelskirchen, chief economist of Autovista Group, discusses the implications of the agency model for new cars and whether the anticipated benefits outweigh the challenges.

All the disruptions that have tormented the automotive industry over the past three years have also served as an incubator for the digitalisation of the car-buyer’s customer journey. There is little debate that the new blueprint in car buying is omnichannel, with the desired customer journey between channels being truly seamless and the buying experience haggle-free.

Several automotive brands are on board with this view and are in the process of implementing the ‘agency model’ for their car sales and distribution. This either means transitioning existing dealer contracts into the new setup, possibly initially only in parts, or setting up this model from scratch.

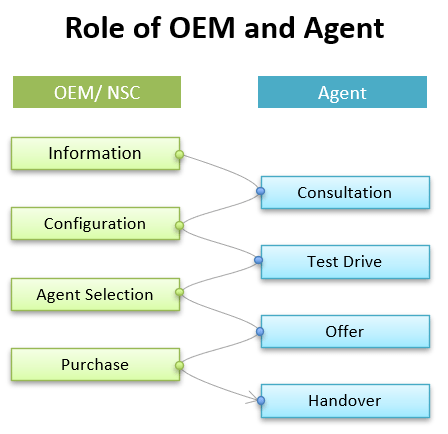

In principle, under the agency model the carmaker takes over full ownership of the information, pricing, and contracting parts of the value chain. These parts will largely take place in an online environment. The ‘agent’ (previously dealer) maintains a physical environment for customer interaction, consults the buyer in the process, offers test drives, and deals with handover logistics. Only with a very clear differentiation around these roles can a truly seamless, haggle-free customer journey be established.

Roles of the carmaker/national sales company (NSC) and agent in the agency model

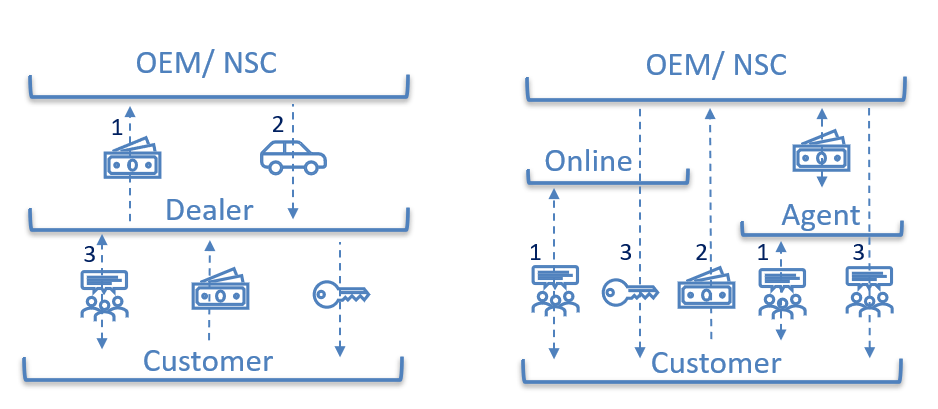

In the past, the carmaker was kept out of the loop on final offer prices and contractual arrangements. The customer relationship was held almost exclusively by the dealer. De facto, OEMs did not know who their customers were. The dealer negotiated the final price and bore the asset risks for demonstrator models, as well as either fully or partially for cars returning as part of leasing/PCP-finance arrangements. They also bore any default risk associated with their customers.

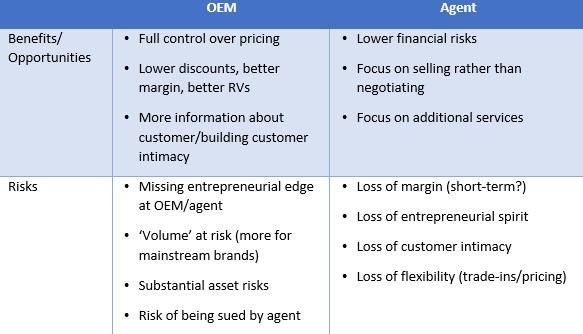

Agency model enables pricing discipline

Traditionally, OEMs have rolled cars off the production line and dealers have absorbed the volumes and sold them. At times of overcapacity, and with volume bonuses and dealers pooling supply, the consequences were often heavily discounted cars, which had negative implications for margins and residual values (RVs), which in turn again negatively impacted margins.

Under the agency model, manufacturers absorb the asset risks for all cars they produce as they are the contracting partner. They also have access to all the information that previously only the dealer had. An expected benefit for the OEM under the agency model is full control over pricing and discounts, which could result in lower new-car discounting. Low discounts are an impactful driver of superior RV performance of a vehicle and support OEMs throughout the virtuous cycle of high transaction prices à stable RVs à low subsidies in leasing contracts à positive bottom-line impact.

There exist numerous variations to agent roles and financial rewards. They receive a provision for every sale that they are involved in and receive demo cars for test drives. They could receive rewards for administering test drives, and when they hand over the car. They might get further kickbacks, for example, related to customer-service evaluations.

Changing relationships in the traditional (left) and agency (right) models

Substantial challenges for agency model

The agency model brings the OEM much closer to the customer, and enables them to apply pricing discipline, but there are substantial challenges around its application as well.

- Carmakers’ balance sheets massively expand under the agency model, as they hold all assets until the sale. This problem becomes aggravated as the trend to leasing/PCP-finance arrangements is rising, adding more assets and asset risks to their balance sheets.

- There is a palatable risk of the agency model resulting in a loss of entrepreneurial spirit for the dealer/agent.

- Customer loyalty may now be built at an OEM level but is possibly lost at the agent level.

- At times of low supply and high demand (seller’s market), it is easy to control and dictate prices for new cars; once supply pressures ease and we possibly transition towards a buyer’s market, the agency model might lack agility and flexibility. At the very minimum, it requires a build-up of staff, pricing intelligence, and powerful workflow solutions at OEM level.

- Especially with hybrid models, where some cars are distributed via the traditional dealer model and some via the agency model, OEMs may risk margin as they bear new costs and investments, while not being able to fully benefit from anticipated efficiencies around the agency model.

- Volume is at risk if cars are wrongly priced. With more and more OEMs adopting the agency model, price transparency and comparability rises. A non-competitive price position may result in a loss of a sale. Mainstream brands may be more exposed to this risk than premium brands, as they require a higher asset turnover.

- There are new areas of conflict between OEMs and agents. The latter bears lower financial risks but still substantial ones. Should a sale not conclude because cars are priced wrongly, or the system is down, the agent’s profit and loss (P&L) is directly affected by this, as they cannot counter flexibly like in the past.

Risks and opportunities for the application of the agency model

Agency-model advocates expect it to be the only setup capable of truly enabling an omnichannel, seamless, and haggle-free customer journey. It is promising but objectively presents new and substantial challenges that are difficult and possibly expensive to tackle. As many of the world’s largest automotive groups roll out an agency model, there will be opportunities to evaluate whether it delivers the expected benefits.