From early adopters to mass market, what is in store for used BEVs?

09 May 2023

As governments start pulling the plug on incentives and early adopters have been largely served, battery-electric vehicle (BEV) uptake could face headwinds. As OEMs target the mass market, Christof Engelskirchen, chief economist at Autovista Group, explains what will happen to used-car residual values (RVs).

Policy drives adoption

Despite an ongoing rise in the number of new-BEV registrations across Europe, inherent consumer demand has not driven adoption, industrial policy has. This is exemplified by the varying rates of adoption across different countries. For example, in the first three months of 2023, more than 75% of new vehicles registered in Norway were all electric, compared to roughly 5% in Italy and Spain.

Electric adoption is Nordic-led, with a third of all light-vehicles registrations in Sweden, Finland and Denmark made up of BEVs. In Iceland, nearly half of registrations are all electric. The Netherlands is ahead of China with a BEV adoption rate of more than 25%. Meanwhile, Europe’s other biggest automotive markets, such as France, Germany and the UK hold less than 15% BEV-share, each.

BEV share of light-vehicle registrations, first quarter 2023, by country

It would be easy to assume used-car markets simply follow new-car trends on a time delay. However, used-car markets have been deprived of government incentives. So, while new-car buyers benefitted heavily from switching to electric vehicles (EVs), used-car buyers saw little to no encouragement.

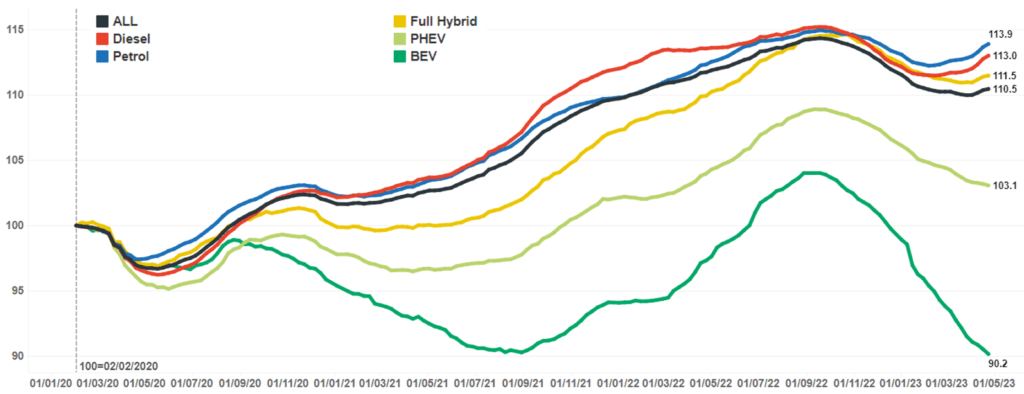

This can be observed in the evolution of used-car prices over the last three years:

- Internal-combustion-engine (ICE) vehicles are being driven out of the new-car market and high demand for used ICE-vehicles is meeting reduced supply. So, used-car prices have been rising more than for any other powertrain

- Hybrid-electric vehicles (HEVs), arguably not much different from an ICE model, follow very closely

- Plug-in hybrids (PHEVs) already perform worse on used-car markets

- BEV RVs have lost much more steam compared to January 2020. They benefitted the least from industrial policy, alongside supply shortages and the pandemic over the past two years.

Used-car market price index by fuel type, Sweden

The graph above highlights RV performance in Sweden, a market with high BEV adoption. Several caveats must be considered for the curves shown. First, the majority of used-car transactions still belong to ICE vehicles. All-electric RV curves are more volatile. Second, due to a limited offering, the performance of individual, more dominant brands and models, has a greater impact on the BEV curve compared with petrol and diesel vehicles.

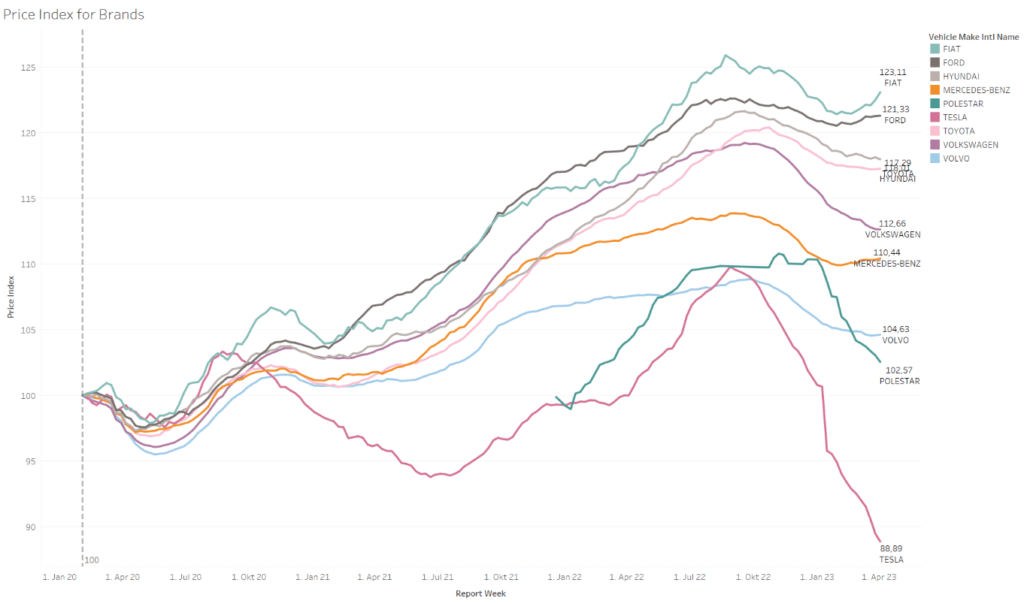

Tesla price cuts dampen used prices

Plotting the price index by brands instead of by powertrain reveals that Tesla’s used-car offer prices have suffered over the past weeks, following the brand’s lowering of new-car prices. This is directing the BEV curve downwards, spilling over to other used cars on offer.

Used-car market price index by brand, Sweden

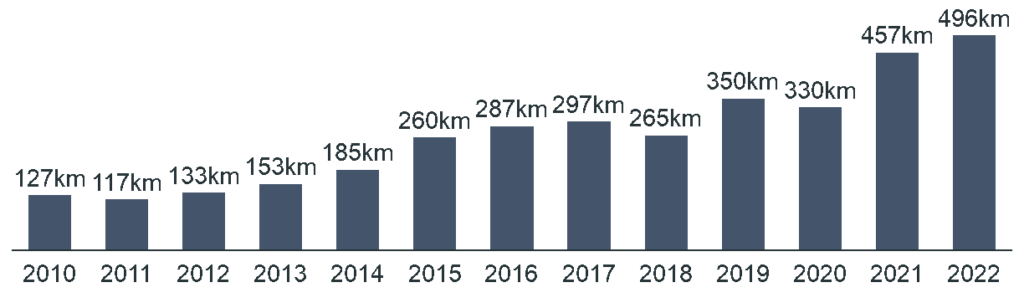

Lifecycle depreciation strikes for BEVs

There is a further reason for the perceived inferior performance of BEV used-car values. The technology is more exposed to lifecycle depreciation than ICE models. This is due to massive technological advancements, such as higher ranges, that have been achieved in the past few years.

Electric cars launched in 2021 and 2022 had 450km to 500km of range (WLTP) on average. This drives down the prices of the majority of used BEVs currently on offer, which are typically four to five years of age. These models are simply inferior in terms of daily suitability compared to more recently launched vehicles.

Average range of newly-launched BEVs, 2010 to 2022

Source: Autovista Group

Note: passenger cars; WLTP values; estimated where NEDC available, only: at factor 0.81

These disadvantages can be somewhat compensated for with improved infrastructure, but this is another substantial challenge. According to EV-volumes.com data from October 2022, the Netherlands has more than 60,000 public charging stations.

Meanwhile, Germany, one of the biggest automotive markets in Europe, has around 36,000. Although, Data from the country’s Federal Network Agency claims 69,925 standard and 13,261 fast-charging points were in operation in February this year.

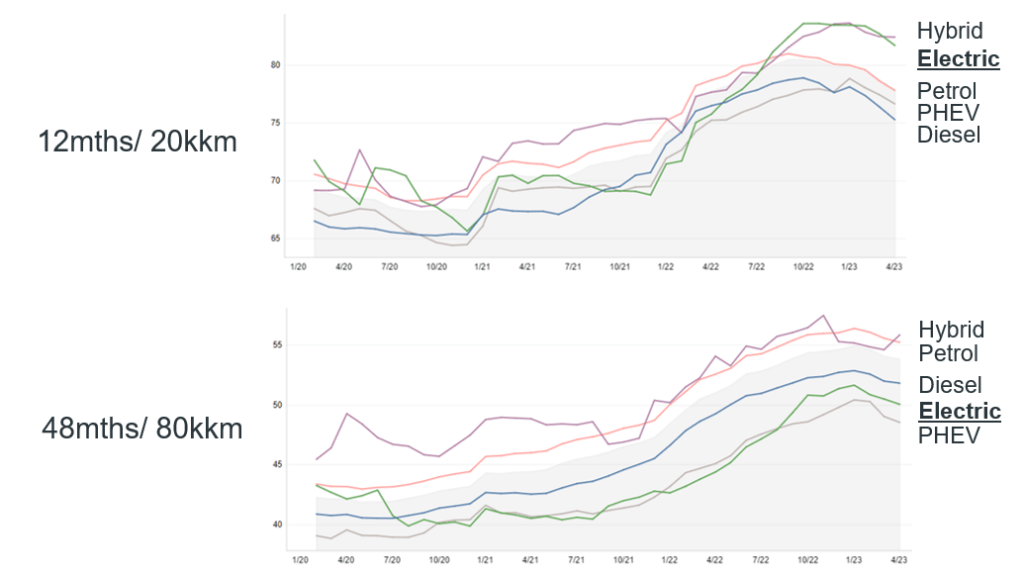

Examining the different age clusters of vehicles also offers further proof that lifecycle depreciation matters more for BEVs than for ICE vehicles. Within the age cluster of 12 months/20,000km (young-used cars), BEVs and hybrid vehicles, outperform other powertrains. It appears that used-BEV buyers appreciate the technological advancements of recently launched models and are willing to pay a premium.

Moving to an older-age cluster of 48 months/80,000km, BEVs cannot compete with the other powertrains. This exemplifies the power of lifecycle depreciation and how disadvantages associated with suitability for daily use trigger a lower willingness to pay for used BEVs.

By age cluster, retail RVs in % by powertrain type, Switzerland

New decisive phase for the BEV

Innovators and early adopters have now been largely served, and OEMs have declared that the mass market is next. To increase mass-market appeal, more affordable vehicles in smaller segments are needed.

This is a substantial challenge, and compounded by reduced government subsidies, it is a trend that will be ongoing. It is unlikely that car buyers can or will shoulder decreased incentives. New-car prices have also been rising substantially over the past three years, although they will come down for BEVs as the technology develops.

Tesla moved first and cut prices in its all-electric line-up. The risk of a price war around new EVs is further compounded by fresh and powerful competition from China. Software-led vehicle development and design have levelled the playing field. Now, new players are finding it easier to enter Europe’s automotive market.

The lack of supply of BEVs from incumbent manufacturers will also help pave the way for competition from Asian brands. Not only will these new entrants to the European market be able to offer their line-up at lower price points than current suppliers, but additional players also translate to a risk of volume pressure for BEVs as well.

On used-car markets, Autovista Group is modelling a decline in RVs across powertrain types in almost all European countries. Supply is still constrained, so used-car prices will not fall off a cliff. Consistently across Europe, BEVs will suffer more than ICE vehicles as price pressure increases on used-car markets. The reasons are lifecycle depreciation, new volume and price pressure on new-car markets, as well as the transition towards more affordable EVs.