EVs make great strides across European markets in 2020

05 February 2021

Last year the European automotive sector saw an overall decline of 3 million registrations due to COVID-19, but not all fuel types were impacted equally. While the pandemic will weigh heavily on people’s memories of 2020, it may also mark a historic fork in the road as the industry turns towards electromobility.

In Q4, nearly one in six (16.5%) passenger cars registered in the EU was an electrically-chargeable vehicle (EV). Overall in 2020 hybrid-electric vehicles (HEVs) made up 11.9% of total passenger car sales, up from 5.7% the previous year. Following closely behind, EVs including battery-electric vehicles (BEVs) and plug-in hybrids (PHEVs), took 10.5% of the new-car market, compared to 3% in 2019.

′Stimulus packages introduced by governments to boost demand, following the unprecedented impact of COVID-19 on car sales, sought to stimulate alternatively-powered vehicles in particular, further driving demand for low and zero-emission cars,’ the European Automobile Manufacturers Association (ACEA) notes.

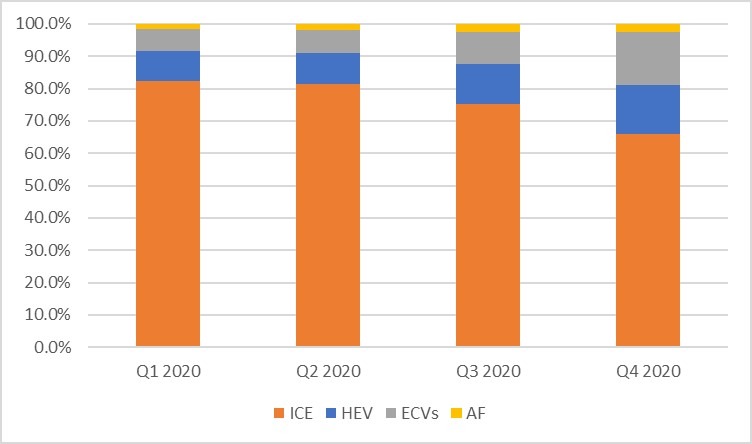

New-passenger cars in Europe by fuel type over last four quarters of 2020

EU registrations of EVs surpassed HEV sales for the first time in Q4 of 2020. They rose from 130,992 in 2019 to nearly half a million, a leap of 262.8%. ACEA points to government incentives as being largely responsible for the meteoric rise in BEV and PHEV numbers, increasing 216.9% and 331% respectively. Germany is a primary example of generous incentives equalling strong gains, with BEV registrations growing by over 500% in Q4 of 2020.

HEVs saw sales double in the same period, up 104.7%, from 212,612 units in 2019 to 435,260 last year, accounting for 15.1% of the market. ′For the first time ever, more than one million units of both hybrid-electric (1,182,792) and electrically-chargeable (1,045,831) passenger cars were sold in the EU from January to December 2020,’ ACEA explains.

Alternative fuels also experienced a rise in registrations in the three months of 2020. Ethanol (E85), liquid petroleum gas (LPG) and natural gas (NGV) grew by 19.6% to 69,877 units in Q4. This was largely thanks to an increase in LPG sales (up 69.5%). Registrations of NGVs contracted during the same period (down 35.3%).

Alternatively-powered vehicles (APVs) represented 34% of the market in Q4, with nearly one million registrations (up 143.9% compared to 2019). Apart from in Cyprus, APV registrations rose across the EU from October to December 2020. Major gains were posted by Germany (up 236.6%), France (up 156.7%) and Italy (up 108.9%); all boosted by sales of BEVs and PHEVs at the end of the year.

ICE melts

While EVs might have seen the beginning of a long upwards trend, new-car registrations in 2020 were still dominated by internal combustion engines (ICEs). Conventional fuel types took home the vast majority of the new-car market last year at 75.5%.

While this is an impressive share, both diesel and petrol cars saw significant losses, with diesel engines taking the brunt of the impact. The engine’s full-year market share in 2020 fell to 28% after sliding to 25.4% in Q4 from 30.5% in the same period in 2019. Between October and December, diesel registrations fell by 23% to 730,837 units.

Meanwhile, demand for petrol fell by 33.7% to 1.2 million in Q4 of 2020 from 1.7million units in the same reporting period the previous year. This translated to a market share of 40.6%, down from 56.6% in the last quarter of 2019. With the exception of Ireland, all EU markets saw declines of petrol registrations in this three-month period, including Germany (down 30.9%), France (down 37.5%), Spain (down 33.8%) and Italy (36.7%). However, petrol did still account for nearly half (47.5%) of EU passenger car sales.