October new-car registrations in Germany fall by 3.6%

04 November 2020

4 November 2020

A total of 274,303 new-passenger cars were registered in Germany last month, falling by 3.6% when compared with October 2019. While private registrations did rise by 6.8% to take a market share of 38.1%, new commercial registrations dropped by 9.1% to a share of 61.8%.

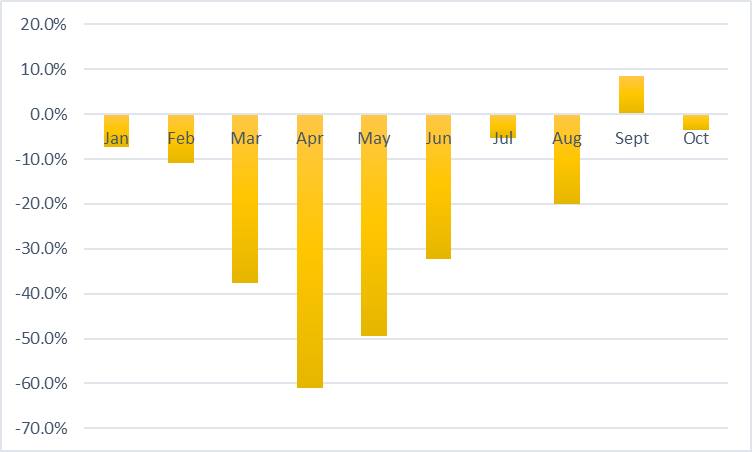

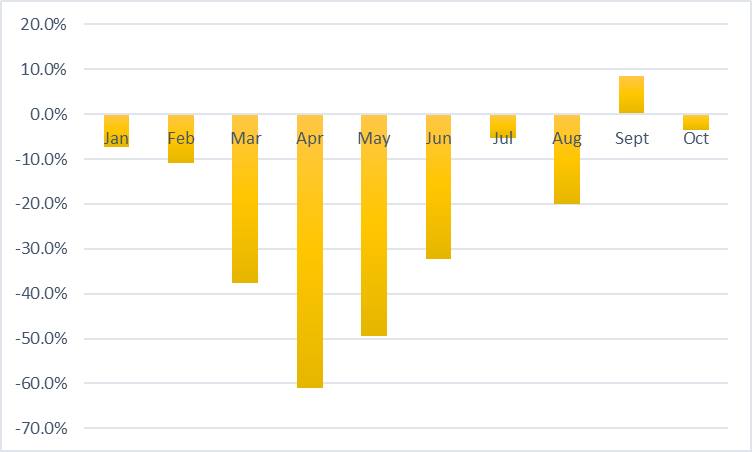

Buoyed by incentive schemes and what looked to be a return to some kind of normalcy, September’s results did appear promising, bucking the previous month-on-month declines. However, this hopeful spike has been followed up by Germany’s ninth month of declining registration figures this year, as revealed by the country’s automotive authority Kraftfahrt-Bundesamt (KBA).

New-car registrations, Germany, year-on-year percentage change, January to October 2020

Data source: KBA

Powertrains and segments

Following on from September, alternative drivetrains once again posted impressive three-digit rates of growth last month. With 23,158 units taking to roads, battery-electric vehicles (BEVs) saw an increase of 365.1% compared with October 2019, accounting for 8.4% of the registration volume. A total of 62,929 hybrids were registered, securing 22.9% of the market and up 138.5% on last year. These figures included 24,859 plug-in hybrids (PHEVs), which were up 257.8%, with a market share of 9.1%. Average CO2 emissions fell by 15.4% to 131.4g/km in October.

Fossil fuels were once again the most common drivetrain, despite declining registration figures. Some 42.1% of new cars were powered by petrol, with 115,382 registrations, falling by 29.8% compared with last year. A total of 26% were equipped with a diesel engine, down 18.9% with 71,370 registrations. With less than 1% of the market, 872 cars were powered by liquid gas (0.3%) and 566 by natural gas (0.2%). Both gas-powered vehicles together recorded growth of 67.8%.

The small car and sports car segments both posted increases (up 24.6% and 4% respectively), alongside the motorhome segment, which experienced the greatest growth at 83.8%. Meanwhile, minivans (-36.2%), large-capacity vans (-19.7%) and the compact class (-11.9%) all recorded double-digit drops. Despite a fall of 5.3%, SUVs remained at the top of the pile with a market share of 21.7%, followed by the compact class at 19.6%.

Battle of the brands

Among the German brands, both Audi and Opel achieved double-digit growth last month, up 23.1% and 22.6% respectively. In contrast, Smart (-34.9%), Ford (-25.9%), Porsche (-19%), Volkswagen (VW) (17%) and BMW (14.4%) recorded double-digit declines. Meanwhile, both Mini and Mercedes saw slightly smaller declines at 7.6% and 2.7% respectively. VW managed to hold on to the largest proportion of new car registrations at 17.2%.

Figures looked to be just as turbulent for the import brands. Double-digit increases were recorded by Lexus (77.2%), Dacia (58.1%), Renault (27.9%) and Fiat (21.2%). While in contrast, Mazda (-38.6%), Jaguar (-27.3%), Ssangyong (-27.2%), Mitsubishi (-24.5%), Alfa Romeo (-23.3%) and DS (-21.2%) all posted significant declines. Skoda (up 7.7%) was once again the largest imported brand in terms of new registrations share, with 6.3% of the market.

As the automotive industry fights battles on multiple fronts against coronavirus (COVID-19), tightening regulations, and new technologies, the German government is considering a €2 billion aid package for the sector. With the money slated to help carmakers and industry suppliers make the switch to greener engines and automated driving, this money could help the industry during a troubled transition.

Data source: KBA

Powertrains and segments

Following on from September, alternative drivetrains once again posted impressive three-digit rates of growth last month. With 23,158 units taking to roads, battery-electric vehicles (BEVs) saw an increase of 365.1% compared with October 2019, accounting for 8.4% of the registration volume. A total of 62,929 hybrids were registered, securing 22.9% of the market and up 138.5% on last year. These figures included 24,859 plug-in hybrids (PHEVs), which were up 257.8%, with a market share of 9.1%. Average CO2 emissions fell by 15.4% to 131.4g/km in October.

Fossil fuels were once again the most common drivetrain, despite declining registration figures. Some 42.1% of new cars were powered by petrol, with 115,382 registrations, falling by 29.8% compared with last year. A total of 26% were equipped with a diesel engine, down 18.9% with 71,370 registrations. With less than 1% of the market, 872 cars were powered by liquid gas (0.3%) and 566 by natural gas (0.2%). Both gas-powered vehicles together recorded growth of 67.8%.

The small car and sports car segments both posted increases (up 24.6% and 4% respectively), alongside the motorhome segment, which experienced the greatest growth at 83.8%. Meanwhile, minivans (-36.2%), large-capacity vans (-19.7%) and the compact class (-11.9%) all recorded double-digit drops. Despite a fall of 5.3%, SUVs remained at the top of the pile with a market share of 21.7%, followed by the compact class at 19.6%.

Battle of the brands

Among the German brands, both Audi and Opel achieved double-digit growth last month, up 23.1% and 22.6% respectively. In contrast, Smart (-34.9%), Ford (-25.9%), Porsche (-19%), Volkswagen (VW) (17%) and BMW (14.4%) recorded double-digit declines. Meanwhile, both Mini and Mercedes saw slightly smaller declines at 7.6% and 2.7% respectively. VW managed to hold on to the largest proportion of new car registrations at 17.2%.

Figures looked to be just as turbulent for the import brands. Double-digit increases were recorded by Lexus (77.2%), Dacia (58.1%), Renault (27.9%) and Fiat (21.2%). While in contrast, Mazda (-38.6%), Jaguar (-27.3%), Ssangyong (-27.2%), Mitsubishi (-24.5%), Alfa Romeo (-23.3%) and DS (-21.2%) all posted significant declines. Skoda (up 7.7%) was once again the largest imported brand in terms of new registrations share, with 6.3% of the market.

As the automotive industry fights battles on multiple fronts against coronavirus (COVID-19), tightening regulations, and new technologies, the German government is considering a €2 billion aid package for the sector. With the money slated to help carmakers and industry suppliers make the switch to greener engines and automated driving, this money could help the industry during a troubled transition.

Data source: KBA

Powertrains and segments

Following on from September, alternative drivetrains once again posted impressive three-digit rates of growth last month. With 23,158 units taking to roads, battery-electric vehicles (BEVs) saw an increase of 365.1% compared with October 2019, accounting for 8.4% of the registration volume. A total of 62,929 hybrids were registered, securing 22.9% of the market and up 138.5% on last year. These figures included 24,859 plug-in hybrids (PHEVs), which were up 257.8%, with a market share of 9.1%. Average CO2 emissions fell by 15.4% to 131.4g/km in October.

Fossil fuels were once again the most common drivetrain, despite declining registration figures. Some 42.1% of new cars were powered by petrol, with 115,382 registrations, falling by 29.8% compared with last year. A total of 26% were equipped with a diesel engine, down 18.9% with 71,370 registrations. With less than 1% of the market, 872 cars were powered by liquid gas (0.3%) and 566 by natural gas (0.2%). Both gas-powered vehicles together recorded growth of 67.8%.

The small car and sports car segments both posted increases (up 24.6% and 4% respectively), alongside the motorhome segment, which experienced the greatest growth at 83.8%. Meanwhile, minivans (-36.2%), large-capacity vans (-19.7%) and the compact class (-11.9%) all recorded double-digit drops. Despite a fall of 5.3%, SUVs remained at the top of the pile with a market share of 21.7%, followed by the compact class at 19.6%.

Battle of the brands

Among the German brands, both Audi and Opel achieved double-digit growth last month, up 23.1% and 22.6% respectively. In contrast, Smart (-34.9%), Ford (-25.9%), Porsche (-19%), Volkswagen (VW) (17%) and BMW (14.4%) recorded double-digit declines. Meanwhile, both Mini and Mercedes saw slightly smaller declines at 7.6% and 2.7% respectively. VW managed to hold on to the largest proportion of new car registrations at 17.2%.

Figures looked to be just as turbulent for the import brands. Double-digit increases were recorded by Lexus (77.2%), Dacia (58.1%), Renault (27.9%) and Fiat (21.2%). While in contrast, Mazda (-38.6%), Jaguar (-27.3%), Ssangyong (-27.2%), Mitsubishi (-24.5%), Alfa Romeo (-23.3%) and DS (-21.2%) all posted significant declines. Skoda (up 7.7%) was once again the largest imported brand in terms of new registrations share, with 6.3% of the market.

As the automotive industry fights battles on multiple fronts against coronavirus (COVID-19), tightening regulations, and new technologies, the German government is considering a €2 billion aid package for the sector. With the money slated to help carmakers and industry suppliers make the switch to greener engines and automated driving, this money could help the industry during a troubled transition.

Data source: KBA

Powertrains and segments

Following on from September, alternative drivetrains once again posted impressive three-digit rates of growth last month. With 23,158 units taking to roads, battery-electric vehicles (BEVs) saw an increase of 365.1% compared with October 2019, accounting for 8.4% of the registration volume. A total of 62,929 hybrids were registered, securing 22.9% of the market and up 138.5% on last year. These figures included 24,859 plug-in hybrids (PHEVs), which were up 257.8%, with a market share of 9.1%. Average CO2 emissions fell by 15.4% to 131.4g/km in October.

Fossil fuels were once again the most common drivetrain, despite declining registration figures. Some 42.1% of new cars were powered by petrol, with 115,382 registrations, falling by 29.8% compared with last year. A total of 26% were equipped with a diesel engine, down 18.9% with 71,370 registrations. With less than 1% of the market, 872 cars were powered by liquid gas (0.3%) and 566 by natural gas (0.2%). Both gas-powered vehicles together recorded growth of 67.8%.

The small car and sports car segments both posted increases (up 24.6% and 4% respectively), alongside the motorhome segment, which experienced the greatest growth at 83.8%. Meanwhile, minivans (-36.2%), large-capacity vans (-19.7%) and the compact class (-11.9%) all recorded double-digit drops. Despite a fall of 5.3%, SUVs remained at the top of the pile with a market share of 21.7%, followed by the compact class at 19.6%.

Battle of the brands

Among the German brands, both Audi and Opel achieved double-digit growth last month, up 23.1% and 22.6% respectively. In contrast, Smart (-34.9%), Ford (-25.9%), Porsche (-19%), Volkswagen (VW) (17%) and BMW (14.4%) recorded double-digit declines. Meanwhile, both Mini and Mercedes saw slightly smaller declines at 7.6% and 2.7% respectively. VW managed to hold on to the largest proportion of new car registrations at 17.2%.

Figures looked to be just as turbulent for the import brands. Double-digit increases were recorded by Lexus (77.2%), Dacia (58.1%), Renault (27.9%) and Fiat (21.2%). While in contrast, Mazda (-38.6%), Jaguar (-27.3%), Ssangyong (-27.2%), Mitsubishi (-24.5%), Alfa Romeo (-23.3%) and DS (-21.2%) all posted significant declines. Skoda (up 7.7%) was once again the largest imported brand in terms of new registrations share, with 6.3% of the market.

As the automotive industry fights battles on multiple fronts against coronavirus (COVID-19), tightening regulations, and new technologies, the German government is considering a €2 billion aid package for the sector. With the money slated to help carmakers and industry suppliers make the switch to greener engines and automated driving, this money could help the industry during a troubled transition.