Dealers set for large losses as coronavirus recovery begins

04 May 2020

4 May 2020

As Europe heads down the path towards a ′new-normal’, dealerships can start counting the cost of a long period of inactivity. With stock levels not reducing, and residual values slipping, the economic impact may be substantial, as Autovista Group’s chief economist Christof Engelskirchen and director of valuations Roland Strilka discovers.

Autovista Group has covered the grinding halt of the automotive industry and the impact of coronavirus (COVID-19) lockdowns in several stories and podcasts over the past weeks. The industry is now slowly starting to emerge in some markets. After Austria, Germany has entered the ramp-up phase. France and Spain are starting to ease restrictions.

It is crucial for national economies to start to define and move towards a new-normal. The main reason is that the economic losses which have been building up during this period of minimal activity are tremendous. We estimate that they lie in the area of €1.8 billion for dealers in Europe alone from the start of lockdowns until the end of April.

Table 1: Economic cost of dealer shutdown in Austria and Europe

|

|

Avg. used car price (EUR) |

Loss in RV since beginning of lockdown |

Stock days increase since beg. lockdown |

Stock day costs per day (EUR) |

Aging loss per vehicle since beg. lockdown (EUR) |

Number of vehicles on offer from dealers |

Lockdown-induced economic loss of dealers |

|

DE |

21,246 |

0.9% |

11 |

10 |

187 |

1,150,000 |

561,153,836 |

|

FR |

17,543 |

0.2% |

22 |

10 |

154 |

550,000 |

225,105,989 |

|

ES |

17,643 |

0.9% |

18 |

10 |

155 |

232,000 |

114,576,352 |

|

UK |

17,457 |

0.6% |

13 |

10 |

153 |

460,000 |

178,564,503 |

|

IT |

17,133 |

0.9% |

19 |

10 |

151 |

350,000 |

173,176,795 |

|

BIG 5 |

19,038 |

0.7% |

15 |

10 |

167 |

2,829,914 |

1,252,577,475 |

|

EU 28 |

|

|

|

|

|

|

1,789,396,393 |

Source: Autovista Group analysis

Table 1 illustrates the mechanics of this estimate. There are three elements to the calculation:

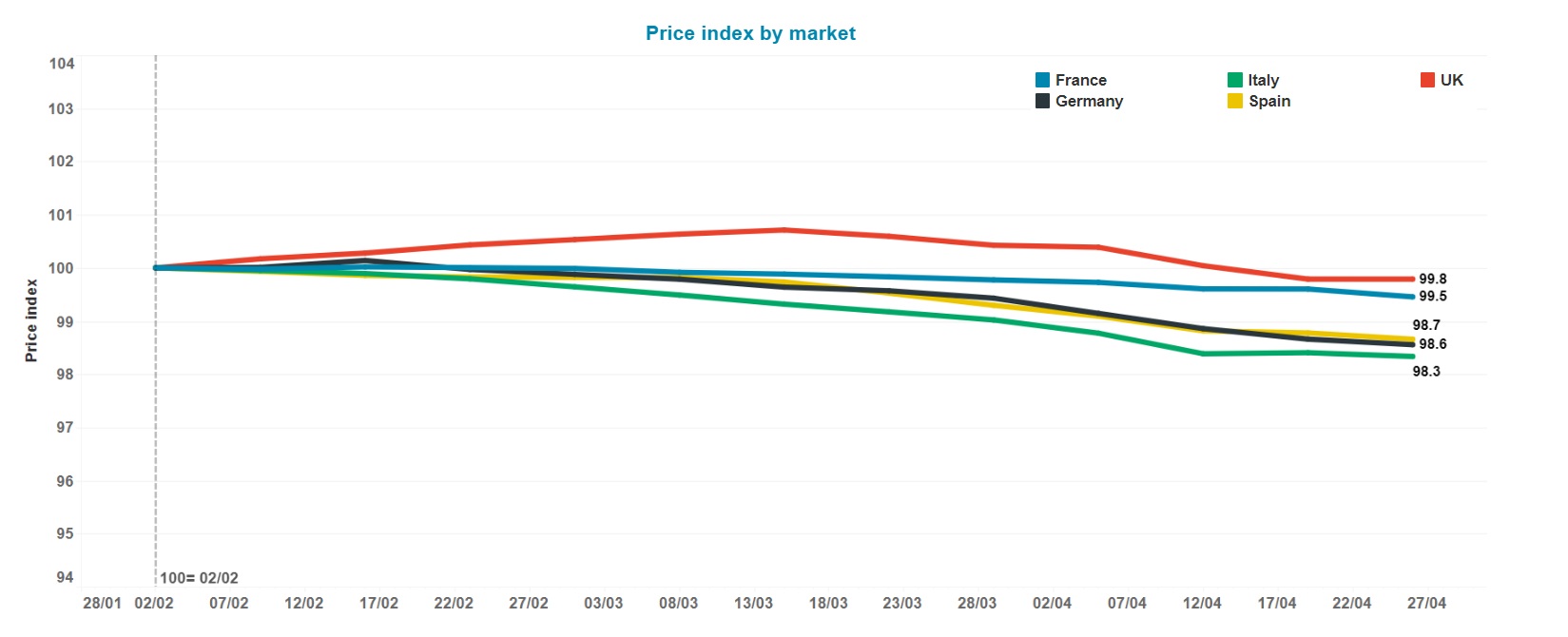

- First, there are – albeit currently small – losses in residual values observed across markets for the period of the lockdown. We expect these to continue to build up over the coming weeks and months, as discussed in our whitepaper on the RV impact of coronavirus. The main reason for the pressure on RVs is the building economic crisis. Latest forecasts estimate economies in Europe will contract by around 7%, and potentially more, in 2020. Forecast institutes do not anticipate a quick economic recovery, and this will wash through to purchasing power and private demand. We also see a more negative development of used-car prices in countries that have had no, or a more relaxed lockdown but more exposure to the economic impact of the crisis. Used-car values in Sweden, which did not have a lockdown and Finland, where dealers remained open over the past weeks, show a bigger decline in RVs than those markets that had largely shut down (Graph 1). The economic pressure that dealers are experiencing may overcompensate any pent-up demand and shortage of new car supply.

- Secondly, ′days-in-stock’ figures have risen during lockdowns and every additional day costs money, in particular associated with lending. We estimate that these costs are around €10 per vehicle per day of lockdown.

- Thirdly, we estimated the loss in value due to the ageing of the individual vehicle. These costs come on top of those incurred due to the capital employed.

Graph 1: Used car price index by market

Source: Autovista Intelligence, Residual Value Intelligence (RVI), COVID-19 Tracker dashboards

These economic losses keep building up the longer markets remain shut. Pressure on dealers will rise to turn stock around quickly, once they reopen. During the ramp-up phase it will be important for OEMs to support dealers financially and help them install appropriate programmes and tools to avoid giving in to the temptations of discounting. We laid out measures for dealers to take that avoid putting the focus on discounts.

Autovista Group’s latest thinking, insight, and data on the coronavirus pandemic and its impact on the automotive industry can be found here. Be the first to know when we publish something new – sign up to the Autovista Group Daily Brief.