Insight: Forecourt resurgence for petrol cars in the UK

07 June 2017

07 June 2017

Glass’s seeing a gradual uplift in petrol residual values

Whilst visiting dealerships around the UK, the most notable comment being voiced over the past few weeks is that more customers appear to be out looking for a petrol car than has been the case in the past couple of years.

There is also the belief that there has been a slight increase in the number of diesels being part exchanged for some dealers, but at this stage this is hard to quantify. Sourcing used petrol cars has become the preoccupation of many trade buyers. Recent visits to car auctions by Glass’s editors across the country has supported this assertion, as interest and the money being paid for petrol variants begins to increase.

At this stage there is not a seismic shift in buying trends, but it is a shift nonetheless. The motor industry is used to the public reacting to negative press coverage. Maybe a more appropriate question is whether the Government is leading the negativity towards diesel, or is it just the press? The end result may be the same, with the gradual shift away from diesel expected to continue in the retail segment. Fleets, and other high-usage end users, however, will find it harder to justify such a change in the short term due to the perceived additional cost in fuel of running a petrol model.

The knock-on effect will start to be felt, to a greater extent, if small and medium cars with diesel engines become less desirable and values gradually weaken. Petrol variants of the same popular models could however find themselves conversely in greater demand. The main issue with any such shift, is that a supply imbalance would likely create upward and downward shifts in values. It is worth remembering however that currently the shift is not huge.

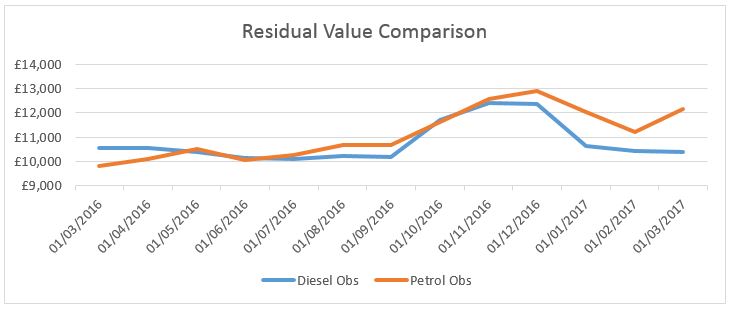

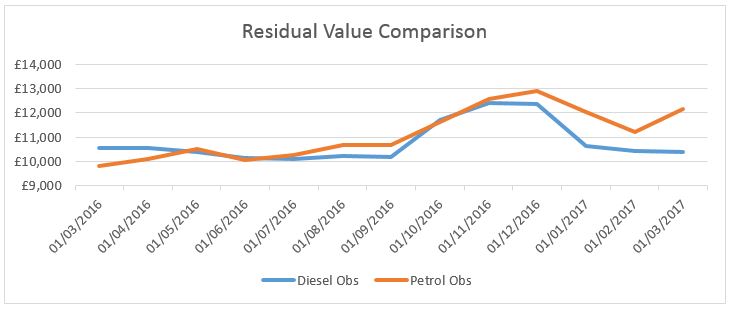

These emerging changes are hard to prove using data alone. However, if we look at recent trade observation data gathered by Glass’s and look at the C segment (Focus size models), which is the best example of this size of car that is sufficient enough to require a diesel power plant and is popular at 5 years of age with retail buyers, we see that petrol values are reducing by a lesser degree. Over the course of the last 3 months they have reduced on average by £199, whilst diesel has reduced by £286.

With younger cars (up to 2 years of age), when sold at auction, the residual values show a more remarkable picture. The average residual value of C-segment petrol cars as at March 2017 was £12,139 or 55.3% of original cost new price compared to diesels at £10,395 (49.5%). Just one year earlier (March 2016), petrols were lower at £9,806 (52.9%) and diesels were higher at £10,565 (51.1%).

The chart shows that for cars presented at auction over the period March 2016 to March 2017, a gradual uplift in the residual values of petrol cars has occurred over their diesel counterparts and it looks like March 2017 as a single month was quite significant. Although a single month’s figures must be viewed with some caution, there is evidence to show the change that is gaining much press focus, appears to be in play.

Jonathan Brown

Car Editor

Glass’s

The chart shows that for cars presented at auction over the period March 2016 to March 2017, a gradual uplift in the residual values of petrol cars has occurred over their diesel counterparts and it looks like March 2017 as a single month was quite significant. Although a single month’s figures must be viewed with some caution, there is evidence to show the change that is gaining much press focus, appears to be in play.

Jonathan Brown

Car Editor

Glass’s

The chart shows that for cars presented at auction over the period March 2016 to March 2017, a gradual uplift in the residual values of petrol cars has occurred over their diesel counterparts and it looks like March 2017 as a single month was quite significant. Although a single month’s figures must be viewed with some caution, there is evidence to show the change that is gaining much press focus, appears to be in play.

Jonathan Brown

Car Editor

Glass’s

The chart shows that for cars presented at auction over the period March 2016 to March 2017, a gradual uplift in the residual values of petrol cars has occurred over their diesel counterparts and it looks like March 2017 as a single month was quite significant. Although a single month’s figures must be viewed with some caution, there is evidence to show the change that is gaining much press focus, appears to be in play.

Jonathan Brown

Car Editor

Glass’s