Monthly Market Update: RVs maintain upward trend in October with switch to used cars

26 October 2021

The active market-volume index retreated in most of Europe’s used-car markets in October, with demand outstripping constrained supply. Moreover, consumers are switching to the used-car market in droves as they are unwilling to accept the higher prices and long delivery times of new cars. The increased demand for young used cars is cascading down to older used cars and residual values (RVs) of three-year-old models rose yet again in October. Consequently, the 2021 RV outlook has been upgraded in Austria. France, Italy, and Switzerland.

Autovista Group has recently extended its coverage of used-car markets in the dashboard to include Austria and Switzerland. It also includes a breakdown of key performance indicators by fuel type, average new-car list prices and sales-volume and active market-volume indices.

Even RVs of standard, non-plug-in hybrids (HEVs) and plug-in hybrids (PHEVs) are holding up well, despite the arrival of new players on the used market, as they can substitute for the lack of cars with internal-combustion engines (ICE). However, battery-electric vehicles (BEVs) continue to struggle as the rise in supply, partly because of tactical new-car registrations, is not absorbed by used-car buyers.

Austria supplies 10% below pre-pandemic

Since the beginning of the year, the Austrian used-car market has been characterised by stable demand and continued low supply, explains Robert Madas, Eurotax (part of Autovista Group) valuations and insights manager, Austria and Switzerland.

On average across all passenger cars aged two to four years, the supply volume in October was approximately 10% lower than at the beginning of 2020. Diesel vehicles in particular are missing from the market, with a drop of 18.2% compared to the start of last year. At the same time, sales activity for diesel cars in September was 17.5% higher than in January 2020.

Average days to sell have decreased by 2.1 days compared to September. This is way below the figures from last year: on average, a two-to-four-year-old car is on offer for 55.1 days, down from 62 days a year ago. Diesel cars are selling the fastest, averaging 53 days.

This market environment has led to a further increase in RVs of 36-month-old cars, which have risen by 6.5% year on year to retain 45.6% of their value. HEVs are currently leading with a trade value of 47.4%, followed by petrol cars (46.7%) and PHEVs (46.6%). In contrast, RVs of three-year-old BEVs have declined significantly and currently stand at 37.4% (down 5.1% year on year). The reasons for this, apart from the significantly higher supply volumes, are the faster technology ageing of older BEVs as well as the attractive subsidies on the new-car market.

Madas assumes that the market parameters will not change in the medium term, so that RVs for three-year-old passenger cars will probably continue to rise this year and next. Only when the new-car market picks up significantly, and thus volumes on the used-car market also increase, are values likely to come under pressure. This will probably not be the case before 2023.

Used-car switch in France

RVs have been strongly increasing in France for several weeks because of a transfer of consumers from the new-car market to the used-car market due to delivery delays and a lack of used-car stock, writes Yoann Taitz, Autovista Group’s regional head of valuations and insights, France and Benelux.

When looking at the new-car market, two important points explain why consumers are switching to used cars: the semiconductor crisis has led to extended delivery times, and list prices have been steadily increasing for several months. The price rises are related to the chips shortage, but also new safety (NCAP) and emissions standards, Taitz explains.

When considering the used-car market, there are three key points.

- Used-car stocks have been drying up since July 2020 because of the measures taken by the French government after the first lockdown

- There has been a halt in sales to the rental channel since mid-2020 because of the COVID-19 crisis, explaining the recent lack of used cars on the market

- There has been an extension of leasing contracts for fleet customers since 2020 because of the pandemic, but also due to changes to fuel-type choices, explaining a lack of 36/48 month-old cars.

‘To sum up, the demand increase, coupled with a drop in supply, explains the value increases, or at least stability, for all fuel types except BEVs,’ Taitz highlights.

Electrified vehicles under mounting pressure

Toyota, which has a healthy sales strategy in terms of RV management, was leading the used-car market for a long time in terms of HEV volumes. However, new competitors have arrived on the market in recent months, such as Renault and Hyundai, while Toyota’s volumes have increased too. Hence, the increased supply is leading to lower RVs. Nevertheless, RVs remain high as HEVs are a good alternative to PHEVs in terms of price, especially for consumers who cannot charge their car regularly.

RVs of PHEVs are high too, in line with their list prices. However, PHEVs are sensitive to any increase in volumes. Even if the volumes remain modest, compared to ICE models, they have risen in recent months, explaining the decrease in RVs. There are also many more PHEVs being offered by mainstream brands, explaining the reduction in list prices.

Despite the semiconductor shortages, OEMs are favouring production and sales of BEVs on the new-car market to reduce average fleet emissions. However, the market is still facing difficulties as buyers are not confident in the use of BEVs, which is not helped by their high list prices. Hence lots of BEVs have been sold in tactical channels since the beginning of summer, which is detrimental to RVs. ‘The future level depends on their acceptance in the used-car market and although volumes sold on the new-car market are still very low compared to petrol and diesel cars, they are still far too high given the low used-car demand, explaining the latest monthly decline in values,’ concludes Taitz.

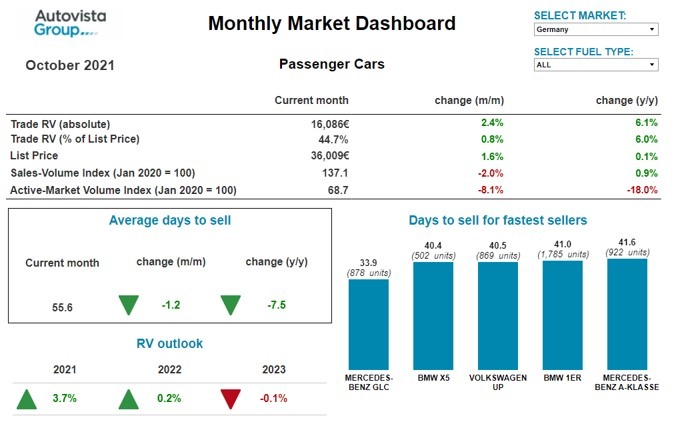

Diesel impacted in Germany

For vehicles of all ages, the available supply and stock days on the German used-car market remain far below average. In the case of three-year-old diesels, the decline is particularly pronounced due to the weak fleet year of 2018, with listings almost halving since the start of the pandemic, explains Andreas Geilenbruegge, head of valuations and insights at Schwacke (part of Autovista Group).

Both BEVs and PHEVs, on the other hand, are experiencing a volume upswing with a 2% to 4% share of used-car transactions for cars registered new in 2020 and 2021. However, this is a long way from the 10%-14% electrically-chargeable vehicle (EV) share of new-car registrations in those years. The downside of this volume development is reflected in their prices and stock days.

Although PHEVs can be used to substitute for unmet customer demand for ICE vehicles, there is an increasing discrepancy between the transacted and offer prices of older used PHEVs. Dealer price optimism seems to be ‘overheating’ a little and runs the risk of overshooting the mark, whereby consumers will no longer follow this price spiral. Three-year-old petrol cars show a similar spread, albeit much less pronounced, and are still within the normal range, but with a tendency to overpricing.

‘Unless there is a sudden and unexpected collapse in customers’ desire to buy, the year is heading for record turnover in the used-car trade,’ Geilenbruegge says. This is despite the relatively low volume of transactions, with changes of ownership of cars aged less than five years 9% down year on year through September.

Seasonal adjustment in Italy

In October, there was a slight drop in RVs in Italy compared to last month, of just 0.4%. ‘However, it would be wrong to interpret this as a drop in interest in the used car-market or the start of a reversal of the trend that has characterised this year, as it is rather a seasonality effect,’ says Marco Pasquetti, forecast and data specialist, Autovista Group Italy.

Comparing the market’s performance against last year, the average RV is 5.1% higher, sales in the used-car market are up 7.3%, and a car is sold on average after 58.8 days, 5.3 fewer days than a year ago. All five of the fastest-selling models were sold in less than 40 days, a clear sign of a very buoyant used-car market that is benefiting from delays in new-vehicle deliveries.

Looking at the different fuel types, petrol and diesel vehicles are still the best performers, with RVs, after 36 months and 60,000km, retaining 41.2% and 44.9% of list price, respectively.

BEVs are increasing in volume but remain on sale for an average of 114 days before being sold. ‘Their market share is still marginal, and RVs are very low in percentage terms (29.8%) due to the pressure stemming from the strong incentive plan on the new-car market, which, although currently exhausted, is likely to be refinanced,’ comments Pasquetti.

Since the end of September, a bonus is also available for the purchase of used cars with low CO2 emissions. Autovista Group therefore expects a slightly positive impact on the RVs of BEVs, although this is likely to be more visible during 2022.

Upward trend in Spain

Used-car transactions in Spain are higher than in 2020 and performing better than new-car registrations. However, the shortage of product continues to suppress growth and volumes are still below the 2019 level, with a diminishing chance of being able to surpass it this year, says Ana Azofra, Autovista Group head of valuations and insights, Spain.

This shortage of supply is speeding up sales of current stock and is sustaining the upward trend in RVs, the pace of which has accelerated in recent months. On average, a three-year-old used car with 60,000km could be sold in October for approximately €275 more than in September.

But this upward trend is not the same for all fuel types. HEVs, which already started in a strong position, show stability in their average transaction prices, albeit slightly underperforming petrol and diesel cars. Their stock days are generally slightly lower than for ICE models.

Petrol cars saw the greatest improvement in their average prices on the used-car market in October, followed by diesels. With a 40% reduction in the number of diesel models in stock compared to last year, their healthy RVs continue to rise.

At the other end of the scale, the supply of BEVs into the used-car market continues to increase, but with insufficient demand to absorb them. The outlook for these models is worsening as their constraints remain unresolved: high new-car prices, incentive pressures on RVs, and a charging infrastructure that is lagging behind other major European markets.

Swiss supply volume 20% lower

For some time now, the Swiss used-car market has been characterised by stable demand and low supply. On average across all two-to-four-year-old passenger cars, the supply volume in October was 21.3% below the level at the beginning of 2020, notes Madas.

Diesel cars are particularly missing on the market, with supply approximately 37% down compared to the beginning of 2020, whereas the sales volume is at a similar level. For petrol cars, where there are also significantly fewer offers on the market than at the beginning of 2020 (down 15%), and hybrids of all types, market activity is particularly high in relation to available supply.

The supply of PHEVs and especially BEVs has increased significantly since the beginning of 2020. Demand for PHEVs exceeds supply but for BEVs, supply and demand remain balanced.

After a decline in recent months, the average days to sell rose slightly for a short time but are now declining again: a passenger car aged two-to-four years is in stock for 65 days. Petrol cars are selling especially quickly, after an average of 61 days, followed by diesel with 67 days and PHEVs with 78 days.

This market environment has led to a further increase in the average RV percentage of 36-month-old passenger cars, to 44% (+10.1% compared to October 2020). Petrol cars posted strong year-on-year gains of 10.6%, to 45.1%, as too did diesel cars (up 9.1% to 42.1%).

Regarding the future development of RVs, supply will be decisive. As cumulative new-car registrations are markedly lower this year than before the crisis (down 20.4% compared to 2019), Madas assumes that market parameters will not change in the medium term. ‘RVs for three-year-old used cars will probably continue to rise this year, and at the beginning of next year, before stabilising over the course of 2022,’ he concludes.

UK consumers impatient

Although new-car registration volumes in the UK have been severely disrupted by supply-chain challenges, demand remains strong. However, consumers who are unwilling to accept the long lead times necessary to take delivery of a new car are switching to the used-car market, says Jayson Whittington, Glass’s (part of Autovista Group) chief editor, cars and leisure vehicles.

Ordinarily, transactions of younger used cars demand would increase in this scenario but due to the impact of the pandemic last year, the volume of short-cycle business was significantly reduced and used examples are in very short supply. ‘Consumers are therefore turning to slightly older cars, increasing demand on a supply of used stock that is already under pressure,’ Whittington notes.

Consequently, used-car values in the UK have risen for seven consecutive months, with the average RV of a three-year-old car sitting 25.6% higher than in October last year.

Strong used retail demand continues in the UK, as demonstrated in the average time it took a dealer to retail a unit in October. At 33.8 days, this was 3.6 days faster than last year and over three weeks less than in any other country featured in this report. Dealers are, therefore, needing to replenish stock regularly, underpinning exceptionally strong wholesale activity.

‘Over the last month, 92% of auction stock sold on the first time of asking, underlining how strong current demand is and perhaps reflecting the shortage of used cars entering auction channels,’ Whittington adds.

View the October 2021 monthly market dashboard for the latest pricing, volume and stock-days data.