How to recharge Europe’s battery-electric vehicle market

Highlights, takeaways and what you can do to stay abreast of electrification across Europe’s main markets

What was it?

On 5 June, 2024 – our automotive experts featuring Autovista24 Editor Thomas Geggus, Chief Economist Christof Engelskirchen, Director of Business Development Christoph Ruhland and Director of Content (EV Volumes) Christian Schneider joined forces to dissect Europe’s battery-electric vehicle market in exploring business-critical questions around the sector.

Tell me more about your products

Main takeaways

In case you missed it, here are 5 conclusions drawn from the discussion:

1. BEVs may absolutely make a comeback

Though a struggle for consumers, European industrial policies are still very much aiming for a transition to BEVs. Governments now need to follow a carrot-and-stick strategy to make it happen.

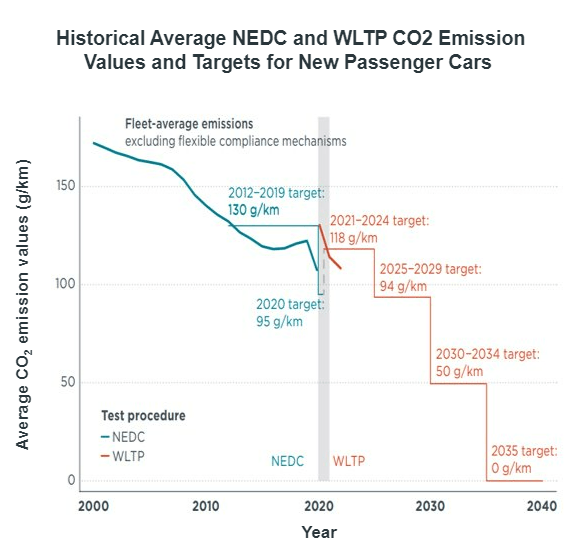

- In 2023 all OEMs/ pools met their specific targets for PC; estimated over-compliance of 14g CO2/km

- From 2025 to 2029, a ZLEV (Zero/Low Emission Vehicle) crediting system will ease targets

- Since 13 April 2023: stronger CO2 emission standards in place for 2030ff and 2035ff:

- Eco-innovations may create further credits

2. Battery-health certification is crucial for manufacturers

Remarketing a traditional ICE is relatively straight-forward when compared with BEVs. The standard measures of time and distance are less informative, with next to no indicators about driving or charging behaviour.

Carmakers need a strong used-EV market to meet sales targets – and battery health certification, along with increased transparency around battery repair costs – will go a long way towards this cause.

3. PHEVs with bigger batteries are a good stop-gap

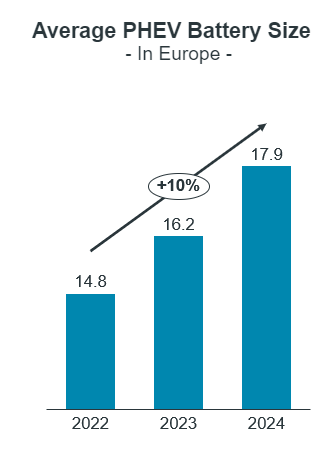

There was a lot of potential for PHEVs to be the perfect transition from ICEs to BEVs. But poor range effected by small batteries curbed demand for the technology.

This is quickly changing as a new wave of PHEVs with larger batteries has started to hit the market – better fitting the needs of daily commuting with real EV driving ranges exceeding 60 kilometres.

4. AC charging may be best for mass-market

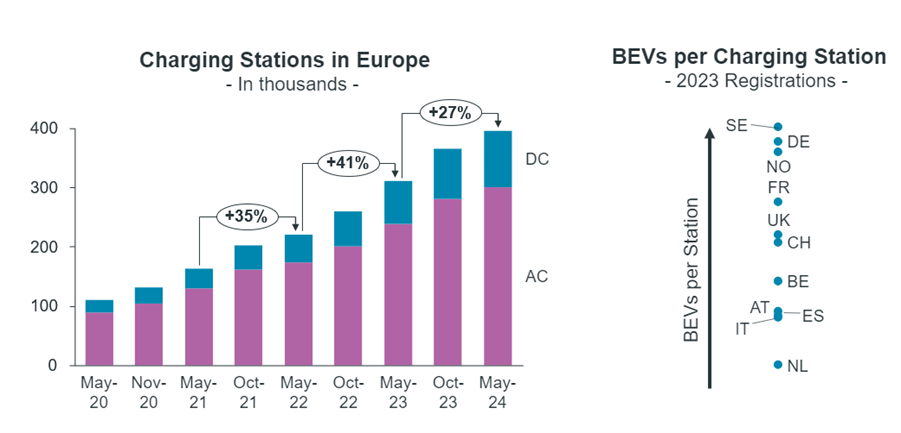

As market share for electric vehicles continues to grow, there is a call to improve public charging.

An advanced charging network is crucial for a comfortable and relacing BEV experience. And whilst DC charging is faster, AC charging may be a more economical alternative that can support mass-market EV adoption.

5. Chinese brands don’t necessarily pose a threat to European manufacturers

Both Europe and China depend on global trade – and the latter does not yet exhibit the same private purchasing power as other developed markets.

If we can agree to a level playing field, then Chinese manufacturers will enrich competition and deliver choice to consumers.

How can I stay on top of emerging residual value trends for BEVs?

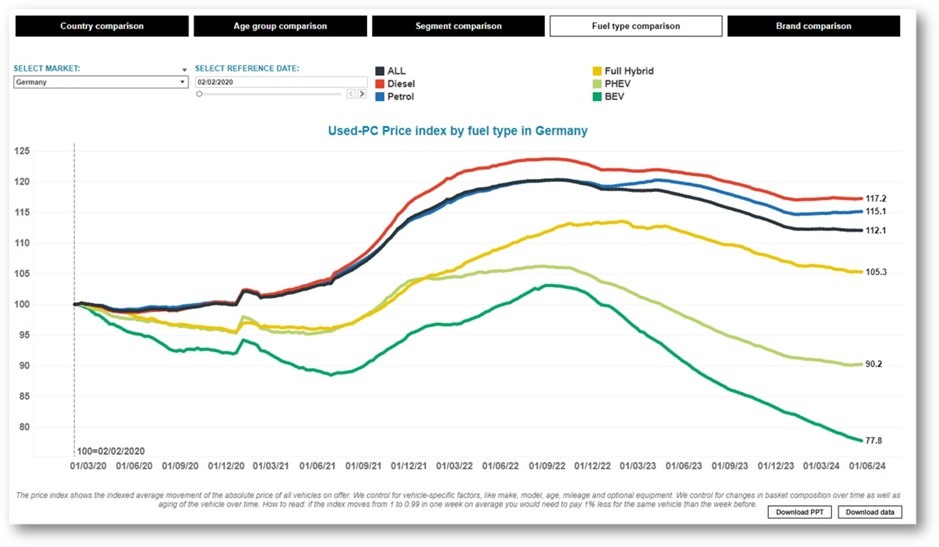

Following the residual value spike in 2021, residual values appear to be on the decline – particularly where BEVs and PHEVs are concerned.

You can continue to track and monitor residual value developments using Residual Value Intelligence: our cutting-edge visualisation tool showing market-weighted residual value developments across 7 markets for multiple granularities over time.

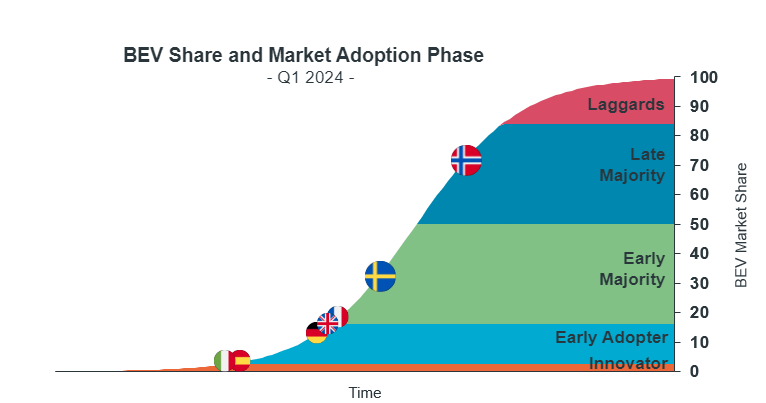

How can I track electric-vehicle adoption rates across Europe’s main markets?

Take your electric-vehicle market intelligence to the next level with our trusted electric vehicle data and information.

Our data centre also features information on batteries, including total demand for batteries in electric vehicles as well as current and future cell chemistries to feed into your analyses and manage future risk effectively.