ACEA: European charging infrastructure growing slower than EV demand

02 November 2020

2 November 2020

The charging infrastructure for electric vehicles (EVs) in the EU still falls far below what is needed, and remains unevenly distributed across member states despite strong growth, says the European Automobile Manufacturers’ Association (ACEA).

The findings come from ACEA’s just-published second edition of its annual study, ′Making the Transition to Zero-Emission Mobility’, which tracks progress on the development of the charging network and the incentives that are needed to support the uptake of EVs.

The research shows that sales of electrically-chargeable cars (battery-electric vehicles and plug-in hybrids) in the EU increased by 110% between 2017 and 2019. During the same period, however, the number of charging points grew by just 58%, to under 200,000 in 2019. This clearly highlights that investment in the charging infrastructure is not rising as quickly as sales of EVs.

′In order to drive the shift to zero- and low-emission vehicles, governments across the EU need to ramp up investments in charging and refuelling infrastructure, and need to put in place meaningful and sustainable incentives to stimulate sales of alternatively-powered vehicles,’ ACEA said in a statement on the key findings of the report.

′This is potentially very dangerous, as we could soon reach a point where growth of electric-vehicle uptake stalls if consumers conclude there are simply not enough charging points where they need to travel, or that they have to queue too long for a fast charger,’ ACEA director general Eric-Mark Huitema said.

Limited fast charging, uneven distribution

ACEA’s analysis reveals that, in 2019, only one in seven charging points in the EU was a fast charger. Only 28,586 charging points were suitable for fast charging, i.e. with a capacity of ≥22kW, whereas the vast majority, 171,239 points, were chargers with capacity of <22kW. Moreover, ACEA cautioned that many of the ′normal’ charging points that are included in EU statistics are ′common-or-garden, low-capacity power sockets that are not suitable for charging vehicles at an acceptable speed, such as ordinary power outlets in garages.’

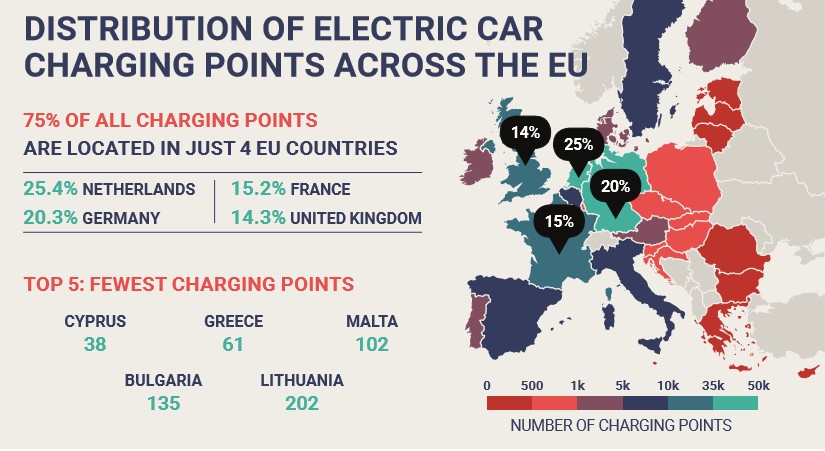

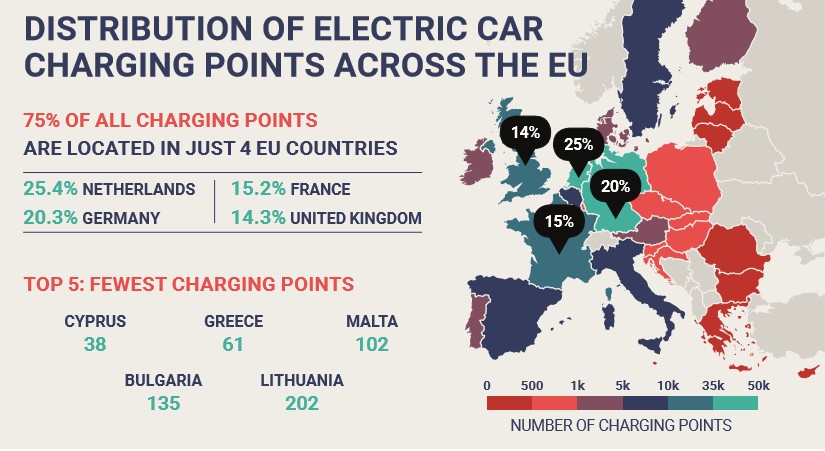

Another key finding of ACEA’s report is that the charging infrastructure remains highly unevenly distributed throughout the EU. Four countries covering just 27% of the region’s surface area – the Netherlands, Germany, France and the UK – accounted for more than 75% of all charging points in 2019. The country with the greatest infrastructure, the Netherlands, had over 1,000 times more charging points than the country with the weakest infrastructure – Cyprus, with just 38 charging points.

Source: ACEA

EV uptake correlated with GDP

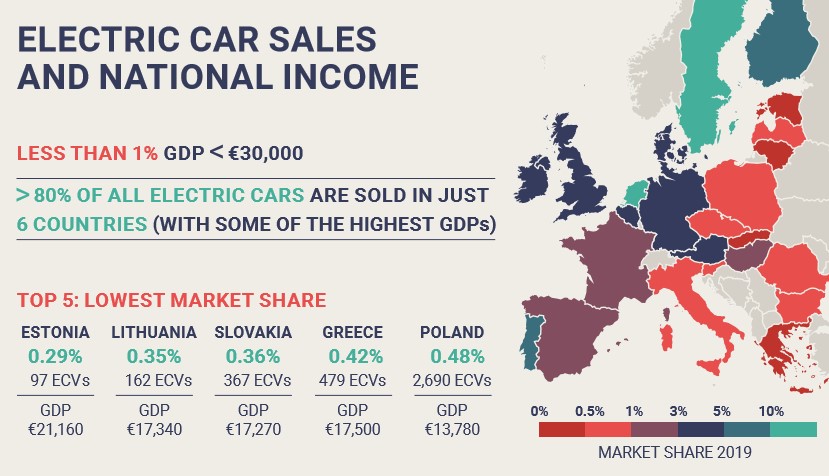

ACEA’s report also reiterates that the uptake of EVs is ′directly correlated to a country’s GDP per capita, showing that affordability is a major barrier to consumers.’ All countries with an EV share of less than 1% have a GDP below €30,000, including EU member states in Central and Eastern Europe, but also Italy and Greece. 80% of all electric cars sold in 2019 were in just six EU countries, with some of the highest GDPs, according to the report.

Source: ACEA

EV uptake correlated with GDP

ACEA’s report also reiterates that the uptake of EVs is ′directly correlated to a country’s GDP per capita, showing that affordability is a major barrier to consumers.’ All countries with an EV share of less than 1% have a GDP below €30,000, including EU member states in Central and Eastern Europe, but also Italy and Greece. 80% of all electric cars sold in 2019 were in just six EU countries, with some of the highest GDPs, according to the report.

Source: ACEA

ACEA has been calling on the European Commission to fast track the review of the EU Alternative Fuels Infrastructure Directive as part of its COVID-19 recovery plan, including ′clear and binding deployment targets for all member states.’ Huitema emphasised that ′with Europe’s higher climate ambitions in mind, there is now an even greater urgency to upgrade the infrastructure requirements for all alternative vehicles.’

According to conservative estimates by the European Commission, at least 2.8 million charging points will be needed by 2030. This equates to a 14-fold increase compared to 2019. Last year, LeasePlan called for one million charging stations by 2025. Autovista Group’s Daily Brief journalist, Tom Geggus, recently spoke with industry insiders to discover how electromobility is changing fleets.

Source: ACEA

ACEA has been calling on the European Commission to fast track the review of the EU Alternative Fuels Infrastructure Directive as part of its COVID-19 recovery plan, including ′clear and binding deployment targets for all member states.’ Huitema emphasised that ′with Europe’s higher climate ambitions in mind, there is now an even greater urgency to upgrade the infrastructure requirements for all alternative vehicles.’

According to conservative estimates by the European Commission, at least 2.8 million charging points will be needed by 2030. This equates to a 14-fold increase compared to 2019. Last year, LeasePlan called for one million charging stations by 2025. Autovista Group’s Daily Brief journalist, Tom Geggus, recently spoke with industry insiders to discover how electromobility is changing fleets.

Source: ACEA

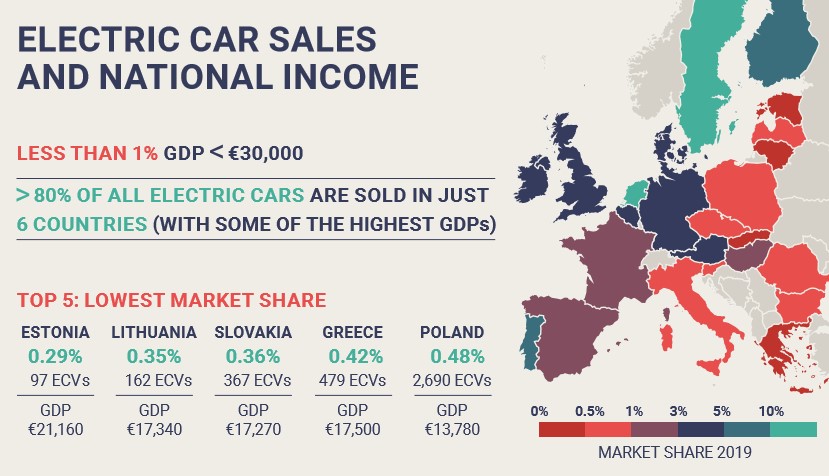

EV uptake correlated with GDP

ACEA’s report also reiterates that the uptake of EVs is ′directly correlated to a country’s GDP per capita, showing that affordability is a major barrier to consumers.’ All countries with an EV share of less than 1% have a GDP below €30,000, including EU member states in Central and Eastern Europe, but also Italy and Greece. 80% of all electric cars sold in 2019 were in just six EU countries, with some of the highest GDPs, according to the report.

Source: ACEA

EV uptake correlated with GDP

ACEA’s report also reiterates that the uptake of EVs is ′directly correlated to a country’s GDP per capita, showing that affordability is a major barrier to consumers.’ All countries with an EV share of less than 1% have a GDP below €30,000, including EU member states in Central and Eastern Europe, but also Italy and Greece. 80% of all electric cars sold in 2019 were in just six EU countries, with some of the highest GDPs, according to the report.

Source: ACEA

ACEA has been calling on the European Commission to fast track the review of the EU Alternative Fuels Infrastructure Directive as part of its COVID-19 recovery plan, including ′clear and binding deployment targets for all member states.’ Huitema emphasised that ′with Europe’s higher climate ambitions in mind, there is now an even greater urgency to upgrade the infrastructure requirements for all alternative vehicles.’

According to conservative estimates by the European Commission, at least 2.8 million charging points will be needed by 2030. This equates to a 14-fold increase compared to 2019. Last year, LeasePlan called for one million charging stations by 2025. Autovista Group’s Daily Brief journalist, Tom Geggus, recently spoke with industry insiders to discover how electromobility is changing fleets.

Source: ACEA

ACEA has been calling on the European Commission to fast track the review of the EU Alternative Fuels Infrastructure Directive as part of its COVID-19 recovery plan, including ′clear and binding deployment targets for all member states.’ Huitema emphasised that ′with Europe’s higher climate ambitions in mind, there is now an even greater urgency to upgrade the infrastructure requirements for all alternative vehicles.’

According to conservative estimates by the European Commission, at least 2.8 million charging points will be needed by 2030. This equates to a 14-fold increase compared to 2019. Last year, LeasePlan called for one million charging stations by 2025. Autovista Group’s Daily Brief journalist, Tom Geggus, recently spoke with industry insiders to discover how electromobility is changing fleets.