Are light-commercial vehicles the pandemic’s residual-value winners?

18 May 2021

Senior data journalist Neil King considers the surge in residual values of new light-commercial vehicles (LCVs) across Europe, alongside healthy demand for new examples in the wake of the COVID-19 pandemic.

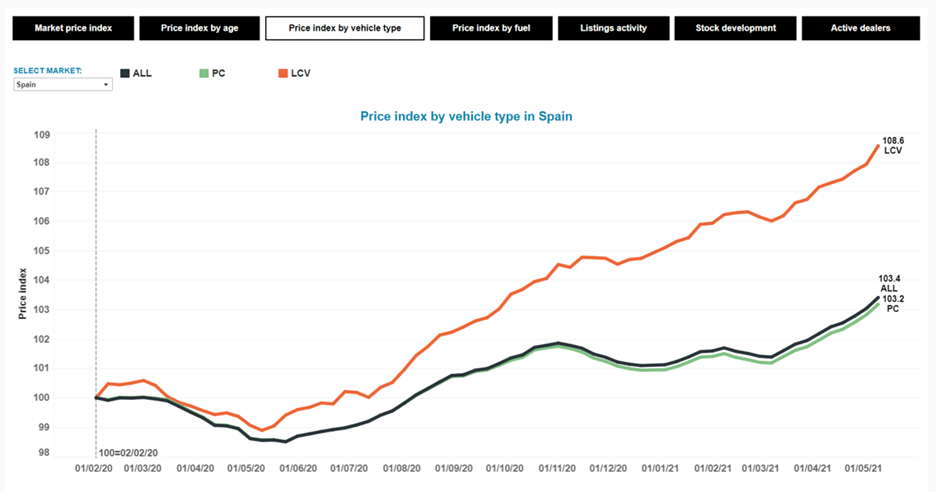

The residual-value (RV) index of used LCVs is higher than for passenger cars in the 10 markets covered by Autovista Group’s COVID-19 tracker. Moreover, they are above the pre-pandemic level of February 2020. In addition to the rise in home deliveries, the disruption to supply of new vans has further driven demand and prices in the used market. This is due to the so-called ′Amazon effect’ as more people work from home and non-essential retail suffered from closures. In several markets, including Austria, France, Germany, and Spain (which has especially suffered economically in the pandemic), RVs of used LCVs are now registering 108-110 on the residual-value price index. The index started in February 2020 with a value of 100. Price index by vehicle type in Spain, February 2020 to May 2021

Price index by fuel type in Spain, February 2020 to May 2021

Note: The index shows the average movement of the prices of all vehicles on offer. If the index moves from 1 to 0.99 over a week, buyers would need to pay on average 1% less for the same vehicle than the week before.

′The lack of new LCVs created by the supply-chain issues and, more specifically, the parts shortages, is affecting all manufacturers. The demand is now higher, but new stock is increasingly limited. Used LCVs are compensating for this lack of product. This is the main reason behind the very good residual-value performance,’ commented Ana Azofra, head of valuations and insights, Autovista Group, Spain.

Unprecedented situation in Poland

Among the countries tracked by Autovista Group, Poland is exhibiting the strongest RV performance, with a price index of 117.5 in the week to 9 May. As in other markets, the constrained supply of new vans, along with the significant development of door-to-door deliveries, is redirecting customers to the used market, especially for the youngest vehicles. This is even despite the healthy 6.2% growth in registrations of new LCVs in the first quarter of 2021, compared to the same pre-pandemic period in 2019.

Price index by vehicle type in Poland, February 2020 to May 2021 Price index by fuel type in Poland, February 2020 to May 2021

Note: The index shows the average movement of the prices of all vehicles on offer. If the index moves from 1 to 0.99 over a week, buyers would need to pay on average 1% less for the same vehicle than the week before.

′For LCVs, the duration of usage or rental is much longer than for passenger cars, so stock was always limited and, due to production problems, we can now observe critical undersupply. This undersupply, and higher demand due to the greater transport need, as well as last year’s market lockdown and the postponement of some purchase decisions, means there is a visible effect on prices. Independent of vehicle age, demand is high across the whole used-LCV market.

Not only the youngest and most expensive vans, but also older and cheaper vehicles, are under pressure. This is a completely unusual situation that I have never experienced in the past and can be observed in each segment of the market – small, medium and heavy,’ explained Marcin Kardas, head of editorial at Autovista Polska.

Pronounced undersupply in the UK

In conjunction with the high demand for LCVs in the UK, the supply of new vans is further constrained by the lower volumes coming into the country post-Brexit, and the need for right-hand-drive examples.

′Fleets have not been able to replace vehicles in many cases, which has meant that the steady supply of used stock is not there. The result is that there is a shortage of stock, which in turn is pushing up prices, especially for late-year Euro 6 stock. The introduction of clean-air and ultra-low emissions zones (CAZ/ULEZ) in many towns and cities has also increased demand/prices as buyers seek out compliant stock. There is a knock-on effect for chassis convertors, who, after furloughing staff through the pandemic, are struggling to keep up with demand. All of these issues have meant that lead-in times are pushed into 2022 already for many models,’ commented Andy Picton, chief commercial vehicle editor at Glass’s.

In Glass’s monthly LCV market update for April, Picton noted that ′April has seen the used market in resilient form, with prices remaining strong and high first-time conversion rates for anything that is retail-ready. Average sales prices paid in April decreased by 2.84% versus March, but remain 62.78% higher than at the same point last year – the first full month of the pandemic.’ Picton is hopeful that vehicle de-fleets will start to find their way into the wholesale market soon.

′Although this will improve the supply of stock into the used market, there remain delays surrounding the supply of new vehicles to the UK. As a result, high prices look set to persist for the remainder of the year.’ One positive effect of the pandemic, however, is that rental companies have prospered. Some businesses, such as Royal Mail, are hiring additional vans to meet growing home-delivery requirements brought about by shop closures during the pandemic.

Registrations recovery

Registrations of new LCVs in Europe, encompassing the EU, EFTA and the UK, increased by 26.2% year on year in the first quarter of 2021, according to the European Automobile Manufacturers’ Association (ACEA).

This was largely because of the low base of comparison last year, but the magnitude of growth was higher than the 24.6% year-on-year contraction in the first three months of 2020. Accordingly, LCV registrations were only 5.1% lower than in the same period in 2019. To put this into context, registrations of new-passenger cars were still 26.3% down on 2019 levels in the first quarter of 2021.

Eleven of the 30 European markets tracked by ACEA registered more LCVs in the first quarter of 2021 than in 2019, with double-digit growth in Greece and Sweden. However, restrictions on dealer activity affected the German and UK markets, which were down 7.5% and 5.2% respectively compared to 2019.

The Spanish market succumbed to weak economic activity, contracting by more than a quarter compared to the first three months of 2019. Nevertheless, without these issues and constrained supply because of semiconductor shortages, the total European LCV market could have even recovered to pre-crisis levels.

′Both the Ford plant in Kocaeli, Turkey, and the Volkswagen plant in Poznan, Poland, have been forced to shut due to semiconductor shortages. Renault is also producing reduced-specification models due to the lack of components,’ Picton noted.

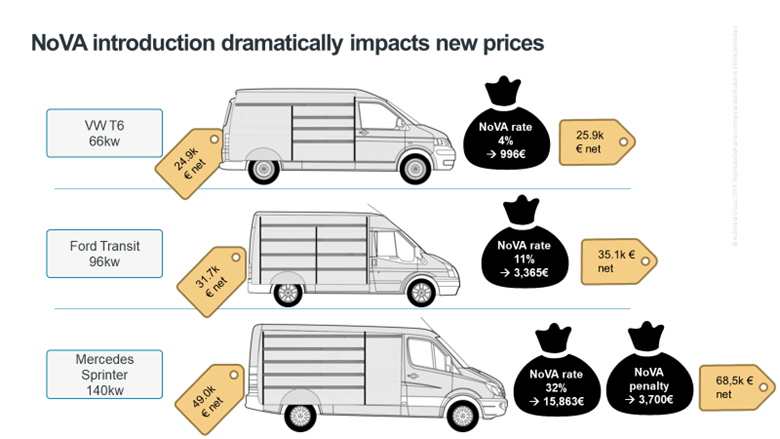

Nevertheless, Austria experienced record registrations of new LCVs in the first quarter of 2021. ′LCVs are an especially hot topic because an emissions tax will be imposed on them for the first time from July. This will make many popular models more expensive, by approximately 10% to 30% depending on CO2,’ explained Robert Madas, valuations and insights manager, Autovista Group, Austria and Switzerland.

NoVA introduction dramatically affects prices

Rising emissions

One downside of the surging demand for LCVs is the environmental impact. A new study by Transport & Environment (T&E) shows that emissions of new vans increased by an average of 0.2% over the last three years. Moreover, ′EU emissions rules are so weak that most vanmakers are able to meet them without selling a single zero-emissions vehicle. With home deliveries on the rise, vans are the EU’s fastest-growing source of road transport emissions,’ according to the group.

It is worth noting that there are questions about the potential for electric LCVs to replace internal combustion engines due to their limited range. ′Range strongly depends on the weight of the vehicle, which is very significant for commercial vehicles. From a usage point of view, electric LCVs have only disadvantages except for zero CO2 emissions,’ Kardas commented.

′Many OEMs introduced ′heavy-duty’ Euro-standard engines (Euro VId) on their heavy LCV ranges last year in order to avoid emissions penalties. This is a way to cope with the situation and growing costs,’ he added. Kai Seidemann, LCV market analyst at Schwacke, concluded that ′a very limited offer in the market dictates the price and, in my opinion, also shows that the electrification of the LCV sector has a lower priority than meeting demand in this challenging period.’