Are the Ukraine war and rising fuel prices accelerating the transition to electric vehicles?

10 May 2022

Autovista24 senior data journalist Neil King explores the impact of the Ukraine war and rising fuel prices on the transition to electromobility with Autovista Group experts.

The war in Ukraine will facilitate the transition to electromobility, according to more than half of respondents in a poll taken during the latest Autovista24 webinar – How is the Ukraine conflict impacting Europe’s automotive markets?

There are a number of factors that could lead to an increase in interest surrounding electric vehicles (EVs), many of which have been accelerated by the situation in Ukraine. Such factors will link with other areas, such as increased regulation of the automotive industry, particularly vehicle emissions and governments banning the registration of internal-combustion engines in certain markets, to change the automotive landscape.

Rising fuel prices are certainly serving as a catalyst in the transition to electromobility, although this trend started before Russia invaded Ukraine. Nevertheless, as the war persists and potentially intensifies, there is anxiety that the situation will worsen in the coming years, which will further benefit EVs.

There are compelling arguments that support a faster transition to electric vehicles:

- There is an ambition in many markets and from customers to reduce the dependency on oil, which could deliver positive momentum;

- Total cost of ownership (TCO) for battery-electric vehicles (BEVs) might benefit in those markets where electricity costs do not rise as swiftly as those for fossil fuels; and

- It could also help stimulate demand for plug-in hybrids (PHEVs), both new and used, as they can effectively deliver both perceived independence from oil and flexibility if a longer range is necessary, especially as ranges grow with the latest model launches.

There are also some scenarios that could derail the transition:

- List prices are rising across all powertrains, not just for internal-combustion engine (ICE) technology; and

- Customers may delay buying/replacing a car altogether until some of the uncertainty has lifted around the development of the war, energy costs, and the economic impact.

‘Rising oil prices will help to increase acceptance of EV technology in the mass market,’ said Christof Engelskirchen, Autovista Group chief economist. ‘The vast majority knows that the future will be electric and exposure to fossil fuels may move EVs forward in the purchase funnel.’

There is a caveat though. ‘If the war lasts for a long time, this will have a greater economic impact and demand for cars in general may come under pressure, which will neither serve the industry nor customers well across all powertrain types,’ Engelskirchen explained.

Ukraine war a ‘mosaic piece’

The share of electric vehicles is consistently rising across new-car markets. It came close to 20% in European new-car registrations in 2021 and surpassed this threshold in the first quarter of 2022. Nevertheless, it is important to note that the transition to EVs is primarily happening due to Europe’s green deal, incentives, and emissions targets.

‘There are much stronger market influencers, and the Ukraine war and higher fuel costs are just pieces in the mosaic, along with powerful incentives and tax schemes and CO2 penalties shaping OEM production and sales strategies,’ said Andreas Geilenbruegge, head of valuations and insights at Schwacke (part of Autovista Group).

In terms of used-car prices, the supply shortage that has been building up over the past two years, because of the COVID-19 pandemic and semiconductor shortages, has pushed prices up, albeit more for ICE than EVs. ‘The very least is that we expect prices to stabilise, and possibly rise further depending on how supply shortages intensify. There is certainly much evidence that supply constraints are growing’ commented Engelskirchen.

‘The Ukraine war worsens supply challenges for OEMs. So, even if demand for cars may be depressed by inflation and economic uncertainty, the lack of cars will keep used-car prices up and possibly lead to further increases – also for EV technologies that did not benefit as much as ICE technology over the past two pandemic years,’ Engelskirchen added.

As in the new-car market, the war in Ukraine is certainly a contributory factor in the transition to electromobility, but there are countless other considerations.

Electrifying new-car markets

Underlying demand stands to benefit as higher fuel prices improve the attractiveness of new electric vehicles, both because of preferential TCO and consumers seeking to reduce their dependence on fossil fuels. Furthermore, carmakers are prioritising certain markets as semiconductor shortages extend delivery times. EVs are also prioritised as manufacturers strive to meet emissions targets. However, the consequences of the war in Ukraine, along with rising fuel prices, are just two of many factors that are driving the transition to electromobility.

‘The short-term effect of the war on oil prices versus electricity prices is unlikely to be the decisive factor for an EV push. There is increasing demand for EVs, but the other influencing factors – incentives, more models on offer, availability, TCO, investments in infrastructure – are the main reasons for the increase in my view,’ said Robert Madas, Eurotax (part of Autovista Group) regional head of valuations, Austria, Switzerland, and Poland.

This view is echoed in other markets. Marco Pasquetti, forecast and data specialist for Autovista Group in Italy also sees growing EV sales in the coming months, but this is more attributable to the resurrection of funding for purchase incentives. Similarly, Yoann Taitz, Autovista Group regional head of valuations and insights, France and Benelux, sees French people looking much more at EVs than before the fuel-price increase. ‘Even if EVs do not fit their usage, people are asking for them.’

However, Taitz sees the current movement as temporary in France – not just because of high fuel prices, but also because of the country’s incentive reduction from July 2022. ‘To benefit from the €6,000 incentive, the new car has to be delivered by the end of September. Currently, dealers are promising delivery for this summer, but it will become harder to meet the delivery deadline, which will reduce the interest in BEVs.’

Higher costs for raw materials such as nickel for electric-vehicle batteries are expected to drive up list prices. ICE cars will also be affected, with higher costs for palladium, for example, which is a critical material in catalytic converters. Nevertheless, cars run the risk of being priced out of the market and this applies especially to electric vehicles.

‘EV list prices are steadily increasing, which will also have an impact on demand. Furthermore, the French government froze the electricity-price increase at 4% in November 2021, while it should have increased by 40%. Sooner or later, there will be a strong price increase for electricity, which will apply a brake to the transition,’ said Taitz.

Christian Schneider, Autovista Group head of analytics raised wider concerns about the potential for higher electricity costs. ‘In a lot of countries, including Germany, consumers pay high taxes on fuel. If people consume less fuel, the governments lose a lot of tax income. If they do not want to cut costs or add further debt, they need to get higher tax revenues from other sources. Potentially from higher taxes on energy. If more people drive EVs, there will be higher demand for energy in times of low supply, so energy prices could rise even further.’

Given the long delivery times, any powertrain-mix developments will largely not translate into new-car registrations until 2023.

‘New-car registrations today are to a large extent a reflection of orders 12 months ago. As this will not change significantly within the upcoming months, we will see the effects of the Ukraine war earliest in mid-2023,’ said Geilenbruegge.

However, the long delivery times do stand to divert consumers to the used-car market.

Residual values – spike or trend?

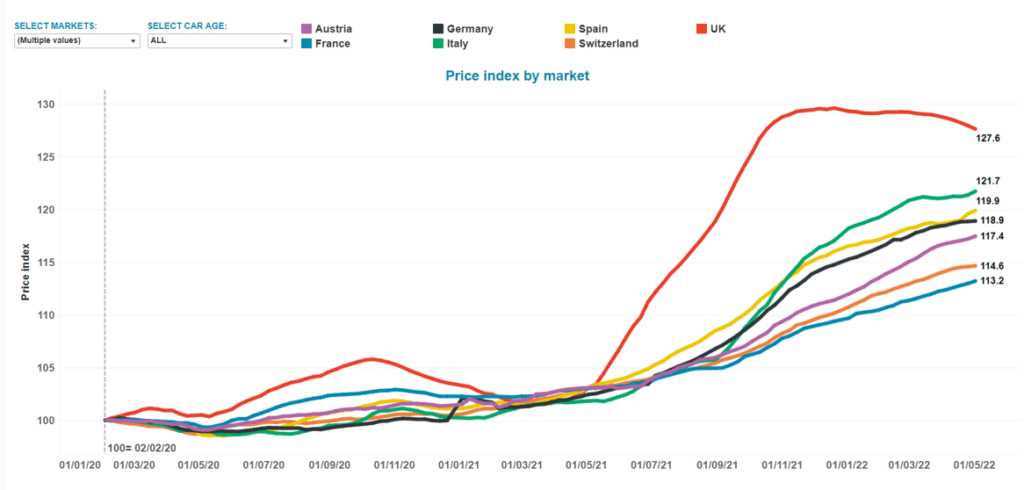

As supply bottlenecks are not easing and delivery times for new cars extend, partly because of the impact of the war in Ukraine, high residual values are sustained or even rising further in key European markets, except the UK.

Residual-value price index, selected European markets, February 2020 to May 2022

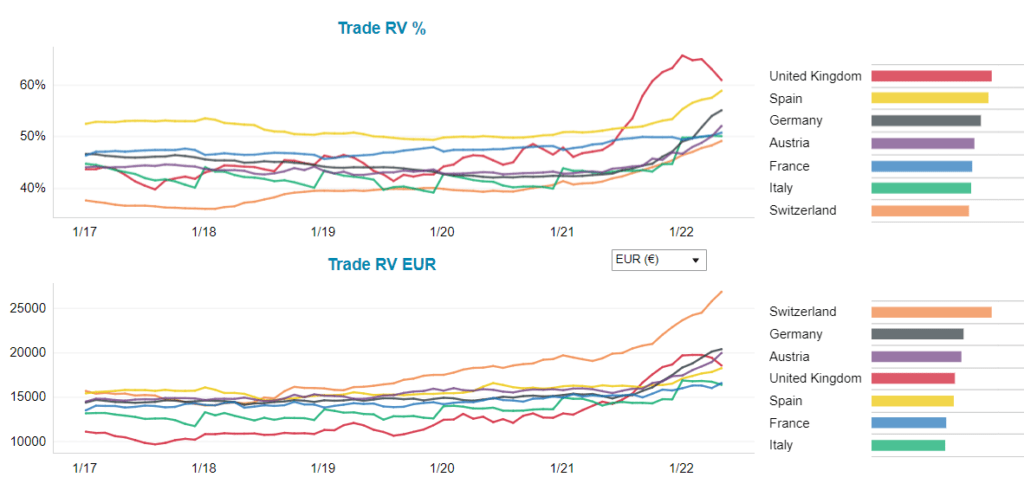

Residual values of BEVs continue to rise across Europe too, both in absolute value and retention (%RV) terms. Rising fuel prices and long lead times, exacerbated by the war in Ukraine, are invariably increasing demand for used BEVs, helping to absorb the increasing supply. If fuel prices come down, however, these developments may prove to be a short-term spike and the upward trend is not expected to persist.

BEV RV developments, selected European markets, January 2017 to May 2022

‘From my point of view, it is too early to talk about a structural shift to EVs and currently the impact on RVs is much more a consequence of the semiconductor crisis than the Ukrainian conflict. But I can confirm a current irrational increase in demand for used EVs due to higher fuel prices,’ said Taitz.

Jayson Whittington, Glass’s (part of Autovista Group) chief editor, cars and leisure vehicles highlighted that the current offer of £1,500 (€1,755) towards the cost of buying a new BEV in the UK, which is only available if the list price is £32,000 and below, does little to incentivise the switch. Moreover, there are no incentives for buying used models, but activity has been strong for several months in the used-car market.

‘With second-generation EV technology now hitting the used-car market, the choice of cars with increased ranges and aesthetic appeal has increased. It is also likely that used cars are being snapped up so that company-car drivers can benefit from lower taxation without having to wait the six to 12-month lead times for a new one, which is helping to support EV RVs.’

Whittington concluded that while used EV sales are rising, this is not hugely related to the war in Ukraine.