Are UK used trade prices directly related to retail used car prices?

16 October 2019

By Anthony Machin, Head of Content and Product, Glass’s

16 October 2019

Over the past three years, used car trade and retail prices in the UK have continued to show consistency. Through 2017 and for most of 2018, the development of average prices was benign, but data show evidence of a gently increasing trend. This was brought on by inflationary pressures in the new car market, coupled to strong retail demand in the used car market.

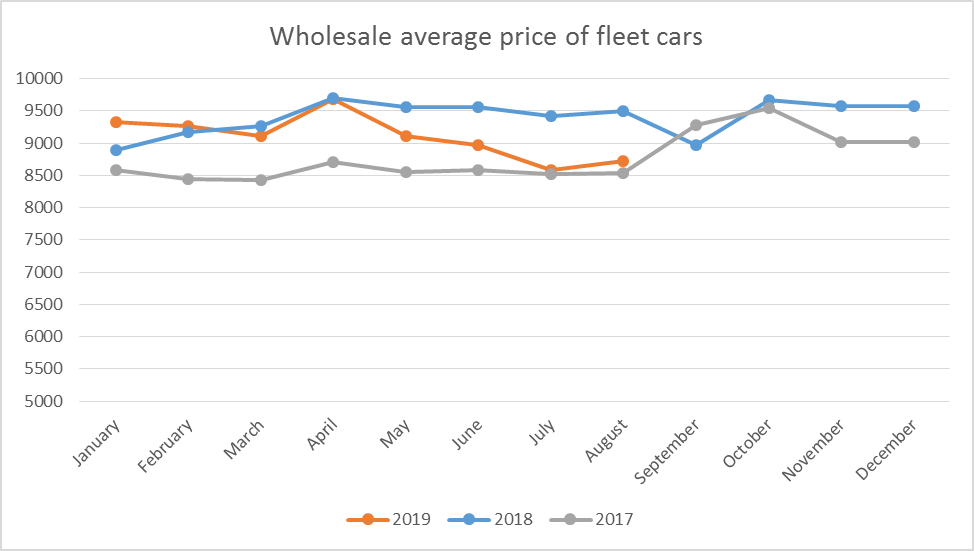

Wholesale market analysis

Using wholesale market analysis from Glass’s, the UK division of Autovista Group, the following chart shows the average wholesale prices for typical ex-fleet cars aged between 2½ and 4½ years at auction. In this example, there is an increase in 2017 and early 2018, followed by a flattening in the last quarter of 2018 and a subsequent decline since the start of 2019.

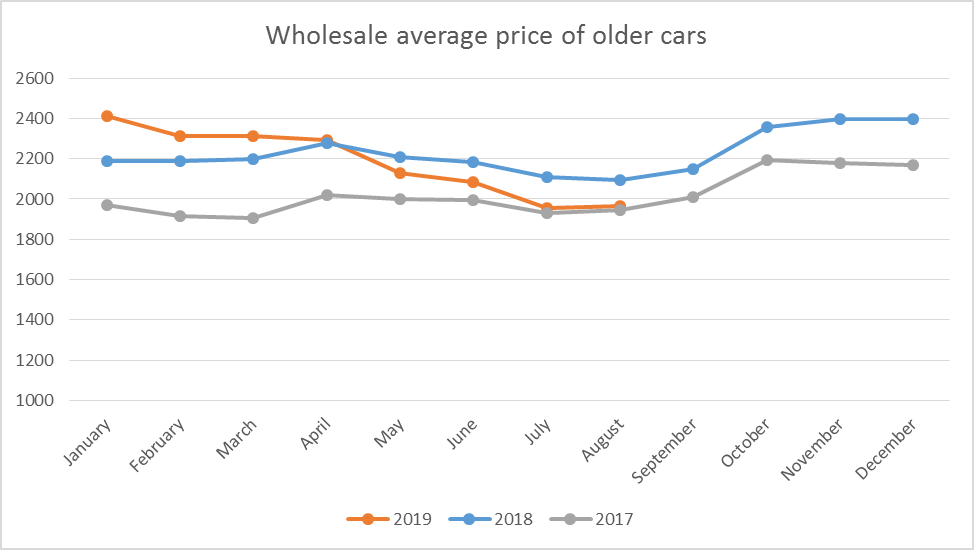

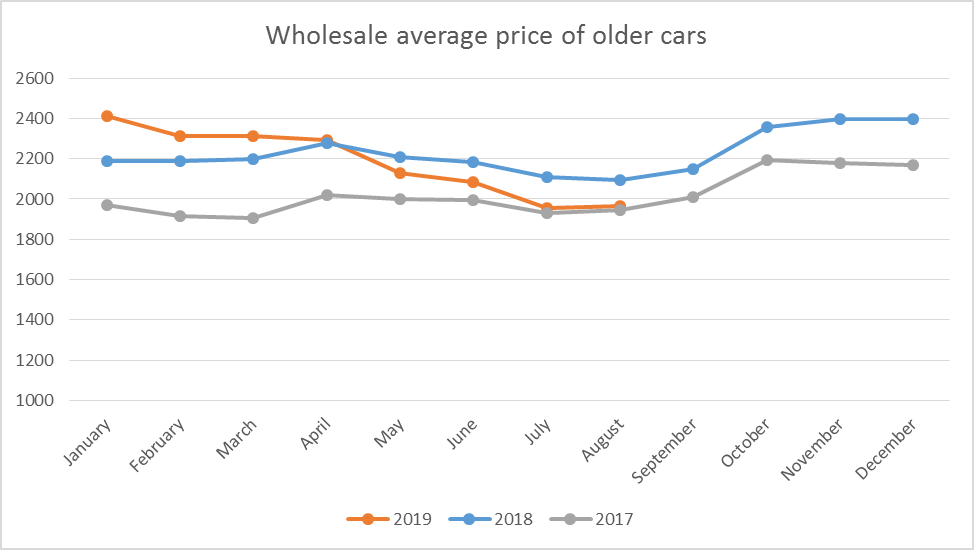

Older cars follow a similar pattern. The following chart illustrates wholesale prices for cars aged over 6½ years falling significantly over the last six months. Today, for this age group of cars, wholesale prices are 20% lower in the UK than at the start of 2019.

Older cars follow a similar pattern. The following chart illustrates wholesale prices for cars aged over 6½ years falling significantly over the last six months. Today, for this age group of cars, wholesale prices are 20% lower in the UK than at the start of 2019.

Retail market analysis

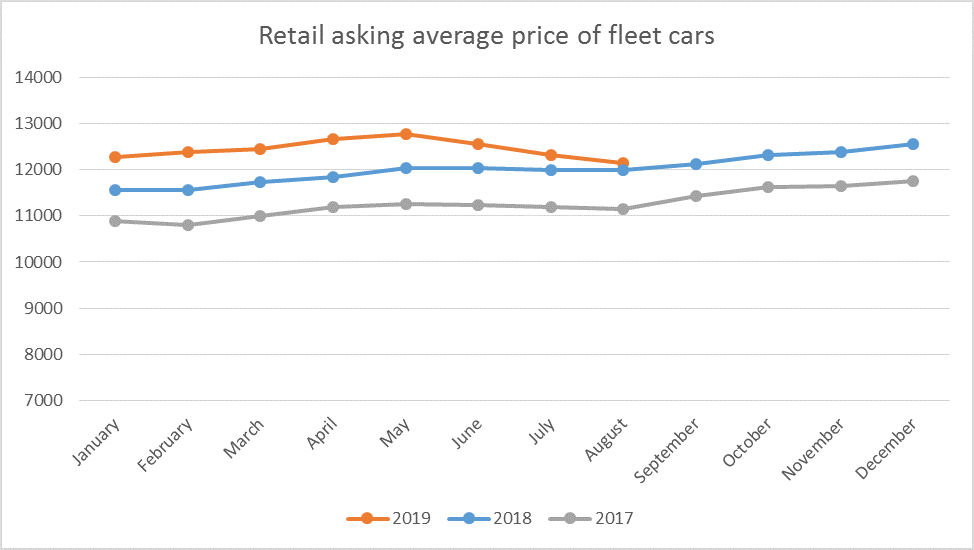

The illustration below uses Glass’s Live Retail Prices for average retail prices of ex-fleet cars from 2017 to 2018 and shows average prices continuing to rise into 2019. Nevertheless, since May 2019, average prices have started to decline in the UK, albeit remaining just ahead of previous years.

Retail market analysis

The illustration below uses Glass’s Live Retail Prices for average retail prices of ex-fleet cars from 2017 to 2018 and shows average prices continuing to rise into 2019. Nevertheless, since May 2019, average prices have started to decline in the UK, albeit remaining just ahead of previous years.

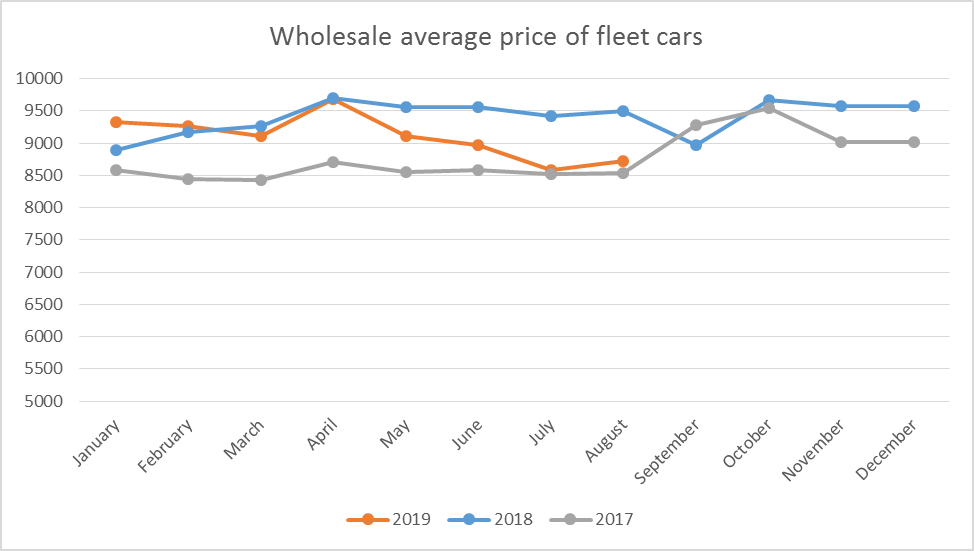

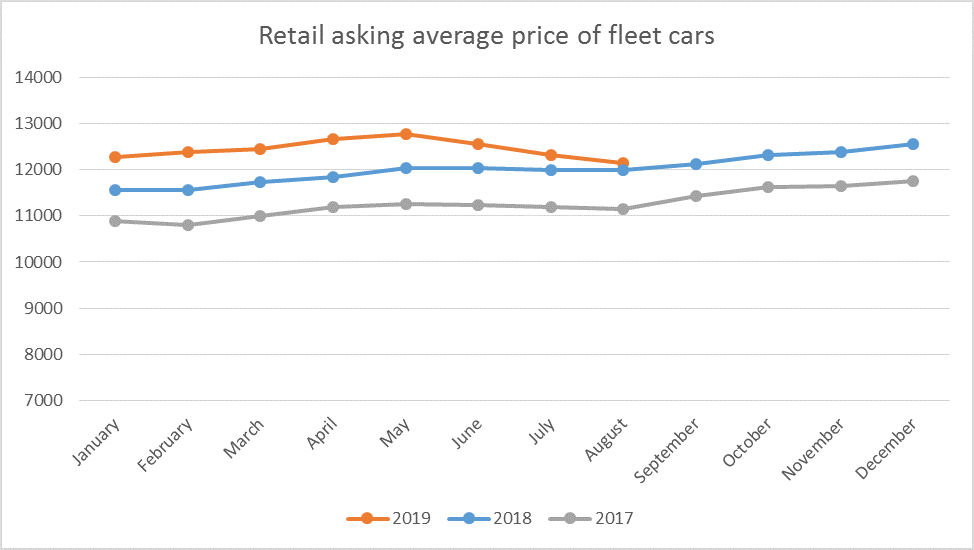

The average retail trend in the older car market matches the fleet car market, with average retail asking prices shown in the chart below.

The average retail trend in the older car market matches the fleet car market, with average retail asking prices shown in the chart below.

Wholesale vs retail pricing reaction

Programmed to seek value, used car dealers always want to maximise margin. They will never pay more than is necessary for stock. The wholesale market is therefore acutely sensitive to supply and demand changes, and reacts much more quickly than the retail market to these fluctuations.

At the other end of the used car equation, dealers are unwilling to discount asking prices as quickly. Here, margins are the main driver of a viable business. It is only as significant undercutting from competitors starts to affect retail sales that dealers will reduce asking prices to compete.

The perfect storm in the used car market

Weaker prices over the past nine months in the wholesale market are, to some extent, the result of traders reacting to record high wholesale prices. However, this has happened in parallel to weakening demand in the retail market as customers react to Brexit delays, whilst vendors continue to cling to the promised residual forecast values of three years ago. These factors are resulting in wholesale volumes continuing to grow.

Relying solely on either retail data or wholesale data in the used-car arena can give a one-dimensional reading on the sector and can easily lead to used car businesses losing money and playing catch-up in a fast-paced, ever-evolving market. Glass’s data provides instant insight into both sides of the market, enabling users to fine-tune their buying and selling strategies whilst delivering their required margins. In effect, although there is some relationship between retail and trade used car prices, this is not a direct relationship during times of market fluctuations. Therefore, trusting a single source of data to illustrate the dynamics in both sides of the market can lead to significant margin losses for dealers and resellers of used vehicles.

Wholesale vs retail pricing reaction

Programmed to seek value, used car dealers always want to maximise margin. They will never pay more than is necessary for stock. The wholesale market is therefore acutely sensitive to supply and demand changes, and reacts much more quickly than the retail market to these fluctuations.

At the other end of the used car equation, dealers are unwilling to discount asking prices as quickly. Here, margins are the main driver of a viable business. It is only as significant undercutting from competitors starts to affect retail sales that dealers will reduce asking prices to compete.

The perfect storm in the used car market

Weaker prices over the past nine months in the wholesale market are, to some extent, the result of traders reacting to record high wholesale prices. However, this has happened in parallel to weakening demand in the retail market as customers react to Brexit delays, whilst vendors continue to cling to the promised residual forecast values of three years ago. These factors are resulting in wholesale volumes continuing to grow.

Relying solely on either retail data or wholesale data in the used-car arena can give a one-dimensional reading on the sector and can easily lead to used car businesses losing money and playing catch-up in a fast-paced, ever-evolving market. Glass’s data provides instant insight into both sides of the market, enabling users to fine-tune their buying and selling strategies whilst delivering their required margins. In effect, although there is some relationship between retail and trade used car prices, this is not a direct relationship during times of market fluctuations. Therefore, trusting a single source of data to illustrate the dynamics in both sides of the market can lead to significant margin losses for dealers and resellers of used vehicles.

Older cars follow a similar pattern. The following chart illustrates wholesale prices for cars aged over 6½ years falling significantly over the last six months. Today, for this age group of cars, wholesale prices are 20% lower in the UK than at the start of 2019.

Older cars follow a similar pattern. The following chart illustrates wholesale prices for cars aged over 6½ years falling significantly over the last six months. Today, for this age group of cars, wholesale prices are 20% lower in the UK than at the start of 2019.

Retail market analysis

The illustration below uses Glass’s Live Retail Prices for average retail prices of ex-fleet cars from 2017 to 2018 and shows average prices continuing to rise into 2019. Nevertheless, since May 2019, average prices have started to decline in the UK, albeit remaining just ahead of previous years.

Retail market analysis

The illustration below uses Glass’s Live Retail Prices for average retail prices of ex-fleet cars from 2017 to 2018 and shows average prices continuing to rise into 2019. Nevertheless, since May 2019, average prices have started to decline in the UK, albeit remaining just ahead of previous years.

The average retail trend in the older car market matches the fleet car market, with average retail asking prices shown in the chart below.

The average retail trend in the older car market matches the fleet car market, with average retail asking prices shown in the chart below.

Wholesale vs retail pricing reaction

Programmed to seek value, used car dealers always want to maximise margin. They will never pay more than is necessary for stock. The wholesale market is therefore acutely sensitive to supply and demand changes, and reacts much more quickly than the retail market to these fluctuations.

At the other end of the used car equation, dealers are unwilling to discount asking prices as quickly. Here, margins are the main driver of a viable business. It is only as significant undercutting from competitors starts to affect retail sales that dealers will reduce asking prices to compete.

The perfect storm in the used car market

Weaker prices over the past nine months in the wholesale market are, to some extent, the result of traders reacting to record high wholesale prices. However, this has happened in parallel to weakening demand in the retail market as customers react to Brexit delays, whilst vendors continue to cling to the promised residual forecast values of three years ago. These factors are resulting in wholesale volumes continuing to grow.

Relying solely on either retail data or wholesale data in the used-car arena can give a one-dimensional reading on the sector and can easily lead to used car businesses losing money and playing catch-up in a fast-paced, ever-evolving market. Glass’s data provides instant insight into both sides of the market, enabling users to fine-tune their buying and selling strategies whilst delivering their required margins. In effect, although there is some relationship between retail and trade used car prices, this is not a direct relationship during times of market fluctuations. Therefore, trusting a single source of data to illustrate the dynamics in both sides of the market can lead to significant margin losses for dealers and resellers of used vehicles.

Wholesale vs retail pricing reaction

Programmed to seek value, used car dealers always want to maximise margin. They will never pay more than is necessary for stock. The wholesale market is therefore acutely sensitive to supply and demand changes, and reacts much more quickly than the retail market to these fluctuations.

At the other end of the used car equation, dealers are unwilling to discount asking prices as quickly. Here, margins are the main driver of a viable business. It is only as significant undercutting from competitors starts to affect retail sales that dealers will reduce asking prices to compete.

The perfect storm in the used car market

Weaker prices over the past nine months in the wholesale market are, to some extent, the result of traders reacting to record high wholesale prices. However, this has happened in parallel to weakening demand in the retail market as customers react to Brexit delays, whilst vendors continue to cling to the promised residual forecast values of three years ago. These factors are resulting in wholesale volumes continuing to grow.

Relying solely on either retail data or wholesale data in the used-car arena can give a one-dimensional reading on the sector and can easily lead to used car businesses losing money and playing catch-up in a fast-paced, ever-evolving market. Glass’s data provides instant insight into both sides of the market, enabling users to fine-tune their buying and selling strategies whilst delivering their required margins. In effect, although there is some relationship between retail and trade used car prices, this is not a direct relationship during times of market fluctuations. Therefore, trusting a single source of data to illustrate the dynamics in both sides of the market can lead to significant margin losses for dealers and resellers of used vehicles.