Arval survey reveals growth in corporate car sharing in the Netherlands

13 June 2017

13 June 2017

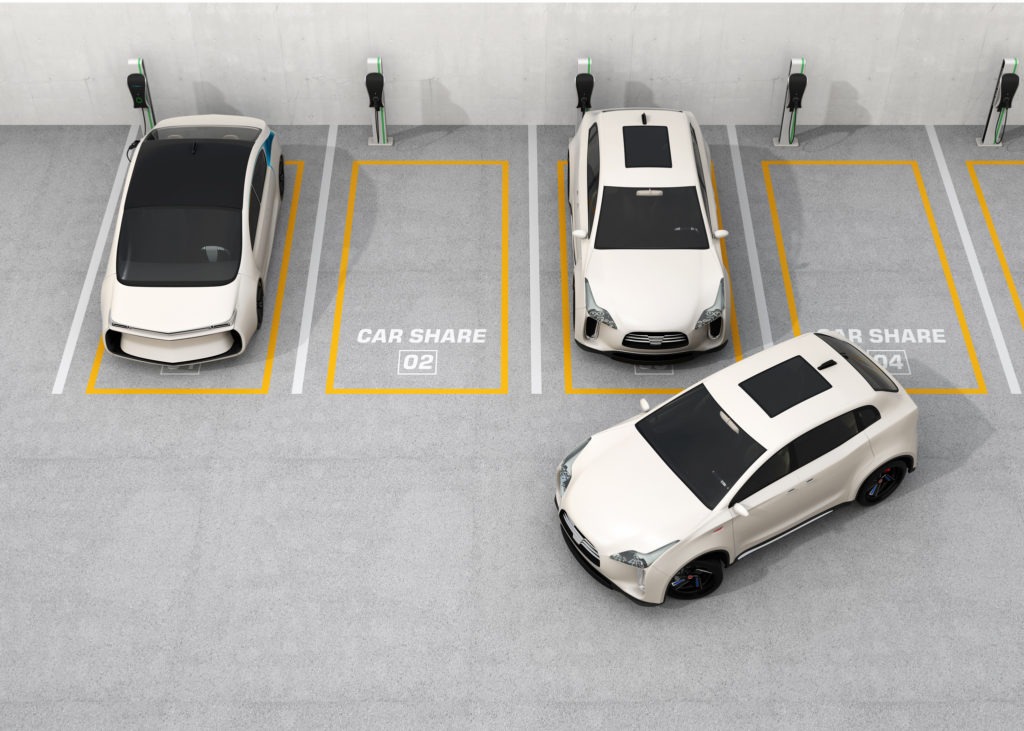

A survey into smart mobility initiatives conducted by Arval reveals that three times more companies in the Netherlands now offer car sharing in their fleet than in 2014. Cars are often made available for trips between company premises and are increasingly seen as an important part of the mobility offering.

Arval Sales Director Matthijs Wouters said: ′The Netherlands holds top position in Europe when it comes to company car sharing. This is shown by the annual Corporate Vehicle Observatory. Companies are seeing the mobility wishes of their personnel change. Many still want the traditional company car, but many also want flexibility in the mobility offering. This includes public transport as the best option within the city, but cars for business meetings.’

According to FleetEurope, ′Among companies with more than 50 fleet cars, almost half (42%) already use car sharing, and another 9% will probably do so within three years.’

Carmakers themselves are keenly eyeing car-sharing solutions as they do not want to be consigned to the role of suppliers to mobility service providers such as Uber. ′This is a subsidy business, you do not earn money with it yet,’ Stefan Bratzel of the Bergisch-Gladbach business school in Germany told Automobilwoche. However, demand is rising, especially in cities, as evidenced by recent successes reported by BMW’s Drive Now and Daimler’s Car2Go car-sharing initiatives. Moreover, the increasing automation and electrification of vehicles is increasingly challenging the traditional model of car ownership.

′We want to precisely understand where the mobility needs are″¦ and how to make money with it’ said DriveNow CEO Sebastian Hofelich. As a general point, Automobilwoche reports that ′According to a study by the Boston Consulting Group (BCG), car ownership is only cheaper when more than 7500 kilometres are driven per year.’ Providing car sharing is therefore also an attractive solution for companies as fleet managers seek to improve the usage of company cars that may otherwise sit idle at company premises.

Car sharing also offers a form of advertising for carmakers as it allows drivers to test their new models. ′In principle, they are paid test drives,’ says Bratzel, adding that ′manufacturers are entering new target groups.’ This is certainly the case when it comes to electric vehicles as many customers have their first electric driving experience through car sharing. For example, the BMW i3 still sells in limited volumes at dealerships but more than 280,000 customers have been exposed to it through DriveNow. ′There is an incredible curiosity,’ says Hofelich. Nevertheless, ′marketing is not the main thing,’ says Hofelich, adding that ′the main issue is to understand how to make such a venture profitable.’

′If the car manufacturers are not able to gain a foothold in this service world, they will become suppliers to the services that control the platform,’ says Bratzel.