Autovista Group forecasts 20% decline in UK new-car registrations in 2020

06 April 2020

6 April 2020

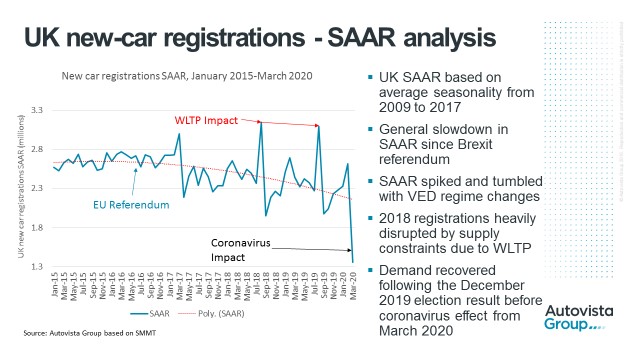

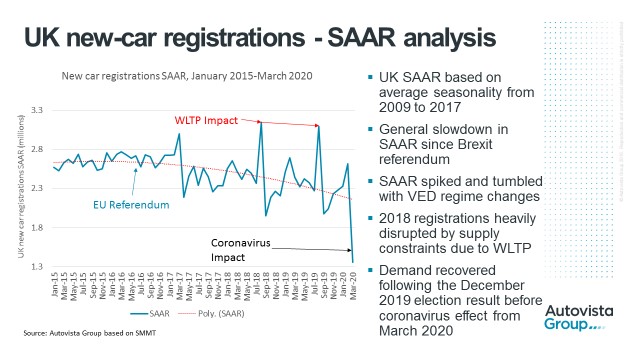

New-car registrations in the UK plummeted 44.4% year-on-year in March. Accordingly, the seasonally-adjusted annualised rate (SAAR) has fallen to below 1.4 million units – lower than the annual registrations recorded at the time of the 2007-8 global financial crisis. Autovista Group’s senior data journalist Neil King discusses three forecast scenarios for 2020 to 2022.

As the global COVID-19 pandemic continues, current dominating questions for the automotive industry are: how quickly can the coronavirus pandemic be contained; how long will the automotive sector suffer disruption; and how quickly can the market recover? The three scenarios below grapple with these questions.

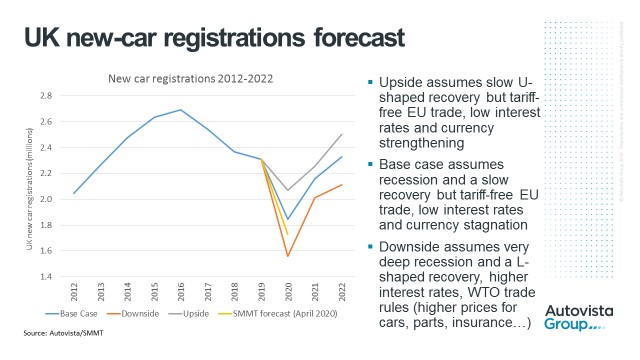

Given the dramatic impact of the coronavirus (COVID-19) on the automotive sector in the UK and globally, the Autovista Group base-case forecast for 2020 has been revised downwards to a 20% contraction, from 3% previously. In this base-case scenario, disruption is expected to continue for about six months.

′In our base case-scenario, I foresee a loss of 600,000 registrations in the coming months but not all of this pent-up demand will be recovered by the end of the year and hence the decline to 1.84 million registrations in 2020, 20% down on 2019,’ explained King.

In a downside scenario, disruption to new-car registrations is assumed to continue for most of 2020, resulting in a loss of some 750,000 registrations and limited opportunity for recovery of the losses later in 2020. The forecast for this worst-case scenario is for UK new-car registrations to fall to 1.56 million units, down 32.5% on 2019.

In an upside scenario, disruption to the UK automotive sector will be more short-lived, with a significantly lower loss of registrations and much more opportunity to recover the losses later in the year. In this scenario, fewer than 250,000 registrations will be lost and the forecast is for 2.07 million registrations in 2020, down 10.5% on 2019.

Source: Autovista Group/SMMT

Extent of losses

The outlook for 2021 is largely dictated by the extent of the losses to registrations incurred in 2020 – the higher the loss in 2020, the higher the pent-up demand to be released in 2021. This explains why the steepest growth is forecast in the downside scenario and the weakest growth in the upside scenario.

Aside from the dramatic effects of the coronavirus pandemic, uncertainty still remains surrounding the terms of the UK’s future trading relationship with the EU. Autovista Group’s base-case scenario assumes a deep recession and a slow recovery but ongoing free trade with the EU. In this scenario, the new-car market is forecast to grow 17% and 8% in 2021 and 2022 respectively, returning the market to the 2019 level in 2022.

Trade with the EU

A downside scenario factors in the UK not reaching a trade agreement with the EU, resulting in a very deep recession and L-shaped recovery. The key consequence for the automotive sector is that WTO trade rules would be applied, resulting in higher prices for cars as well as for replacement parts and insurance. In this downside forecast, new-car registrations are forecast to increase 29% in 2021 but only by 5% in 2022. At 2.1 million registrations, the market would still be 200,000 units lower in 2022 than in 2019.

In an upside ″slow u-shaped recovery″ scenario, the comparatively limited impact of COVID-19 in 2020 is fundamentally recovered in 2021, with registrations growth of 9.0% anticipated. In conjunction with a trade deal that secures ongoing free trade between the UK and the EU, the new-car market is forecast to grow by a further 11% in 2022. At 2.5 million registrations, the UK new-car market would then be at its highest level since 2016.

Lowest March since bi-annual plate change

The significant contraction of new-car registrations in March, reported today by the SMMT, was to be expected given the lockdown measures imposed by the UK Government on 23 March in an attempt to limit the spread of COVID-19. 203,370 fewer cars were registered than in March 2019, as showrooms closed in line with government advice. This is the lowest figure for the month of March since the UK moved to a bi-annual number-plate system but even more dramatic declines have been reported in other markets, where lockdown measures came into force earlier.

′With the country locked down in crisis mode for a large part of March, this decline will come as no surprise. Despite this being the lowest March since we moved to the bi-annual plate change system, it could have been worse had the significant advanced orders placed for the new 20 plate not been delivered in the early part of the month. We should not, however, draw long-term conclusions from these figures other than this being a stark realisation of what happens when economies grind to a halt,’ said Mike Hawes, SMMT chief executive.

′How long the market remains stalled is uncertain, but it will reopen and the products will be there. In the meantime, we will continue to work with government to do all we can to ensure the thousands of people employed in this sector are ready for work and Britain gets back on the move,’ Hawes added.

Source: Autovista Group/SMMT

Extent of losses

The outlook for 2021 is largely dictated by the extent of the losses to registrations incurred in 2020 – the higher the loss in 2020, the higher the pent-up demand to be released in 2021. This explains why the steepest growth is forecast in the downside scenario and the weakest growth in the upside scenario.

Aside from the dramatic effects of the coronavirus pandemic, uncertainty still remains surrounding the terms of the UK’s future trading relationship with the EU. Autovista Group’s base-case scenario assumes a deep recession and a slow recovery but ongoing free trade with the EU. In this scenario, the new-car market is forecast to grow 17% and 8% in 2021 and 2022 respectively, returning the market to the 2019 level in 2022.

Trade with the EU

A downside scenario factors in the UK not reaching a trade agreement with the EU, resulting in a very deep recession and L-shaped recovery. The key consequence for the automotive sector is that WTO trade rules would be applied, resulting in higher prices for cars as well as for replacement parts and insurance. In this downside forecast, new-car registrations are forecast to increase 29% in 2021 but only by 5% in 2022. At 2.1 million registrations, the market would still be 200,000 units lower in 2022 than in 2019.

In an upside ″slow u-shaped recovery″ scenario, the comparatively limited impact of COVID-19 in 2020 is fundamentally recovered in 2021, with registrations growth of 9.0% anticipated. In conjunction with a trade deal that secures ongoing free trade between the UK and the EU, the new-car market is forecast to grow by a further 11% in 2022. At 2.5 million registrations, the UK new-car market would then be at its highest level since 2016.

Lowest March since bi-annual plate change

The significant contraction of new-car registrations in March, reported today by the SMMT, was to be expected given the lockdown measures imposed by the UK Government on 23 March in an attempt to limit the spread of COVID-19. 203,370 fewer cars were registered than in March 2019, as showrooms closed in line with government advice. This is the lowest figure for the month of March since the UK moved to a bi-annual number-plate system but even more dramatic declines have been reported in other markets, where lockdown measures came into force earlier.

′With the country locked down in crisis mode for a large part of March, this decline will come as no surprise. Despite this being the lowest March since we moved to the bi-annual plate change system, it could have been worse had the significant advanced orders placed for the new 20 plate not been delivered in the early part of the month. We should not, however, draw long-term conclusions from these figures other than this being a stark realisation of what happens when economies grind to a halt,’ said Mike Hawes, SMMT chief executive.

′How long the market remains stalled is uncertain, but it will reopen and the products will be there. In the meantime, we will continue to work with government to do all we can to ensure the thousands of people employed in this sector are ready for work and Britain gets back on the move,’ Hawes added.

Source: Autovista Group based on SMMT data

Residual-value upside

Among the Big 5 European car markets, the UK is most pessimistic about the economic consequences of the combination of coronavirus and the Brexit aftermath. There would seem to be little trust in how the UK Government has been dealing with the crisis and whatever pent-up demand there may be, the fragility of the economy is hugely concerning. Our Glass’s UK editorial team allocates the highest probability to the ″deep recession, slow recovery″ base-case scenario. That is one where it will take up to six months to gain control over the pandemic and where monetary and fiscal stimuli have hardly any positive impact on the economy and private consumption. As a result, economic growth in the UK will be negative in 2020 and 0% in 2021.

Despite stark pessimism in how the UK will digest the economic aftermath of the pandemic in combination with the Brexit negotiations, there is a positive note. The expected impact on used-car values is not as severe as in other markets even in this darker scenario. By 2021, the UK will have fully recovered in terms of used-car prices to levels close to today.

Limited elasticity

The main reason is the limited elasticity in the market, together with the fact that supply of new cars has dramatically reduced and is unlikely to ramp up again soon. The expectation is a continued supply shortage during the economic downturn. Whilst the weaker British Pound is not helping, there is some pent-up demand containing the risks of further drops in used-car values. Head of content and product at Autovista Group’s UK subsidiary Glass’s, Anthony Machin said: ′Across the world, the automotive industry faces unfamiliar challenges. In the UK, after a strong start to 2020, like many around the world the car market is closed as the population adapts to new ways of working, socialising and shopping.’

Source: Autovista Group based on SMMT data

Residual-value upside

Among the Big 5 European car markets, the UK is most pessimistic about the economic consequences of the combination of coronavirus and the Brexit aftermath. There would seem to be little trust in how the UK Government has been dealing with the crisis and whatever pent-up demand there may be, the fragility of the economy is hugely concerning. Our Glass’s UK editorial team allocates the highest probability to the ″deep recession, slow recovery″ base-case scenario. That is one where it will take up to six months to gain control over the pandemic and where monetary and fiscal stimuli have hardly any positive impact on the economy and private consumption. As a result, economic growth in the UK will be negative in 2020 and 0% in 2021.

Despite stark pessimism in how the UK will digest the economic aftermath of the pandemic in combination with the Brexit negotiations, there is a positive note. The expected impact on used-car values is not as severe as in other markets even in this darker scenario. By 2021, the UK will have fully recovered in terms of used-car prices to levels close to today.

Limited elasticity

The main reason is the limited elasticity in the market, together with the fact that supply of new cars has dramatically reduced and is unlikely to ramp up again soon. The expectation is a continued supply shortage during the economic downturn. Whilst the weaker British Pound is not helping, there is some pent-up demand containing the risks of further drops in used-car values. Head of content and product at Autovista Group’s UK subsidiary Glass’s, Anthony Machin said: ′Across the world, the automotive industry faces unfamiliar challenges. In the UK, after a strong start to 2020, like many around the world the car market is closed as the population adapts to new ways of working, socialising and shopping.’

Source: Autovista Group/SMMT

Extent of losses

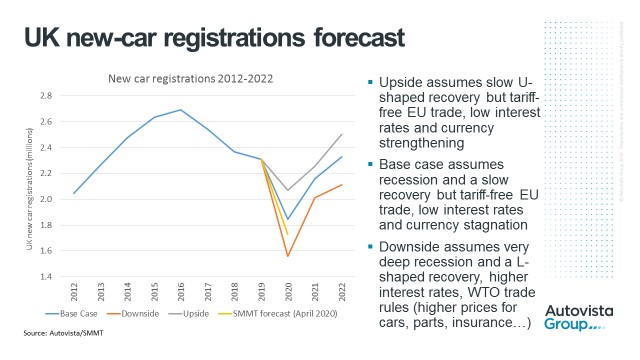

The outlook for 2021 is largely dictated by the extent of the losses to registrations incurred in 2020 – the higher the loss in 2020, the higher the pent-up demand to be released in 2021. This explains why the steepest growth is forecast in the downside scenario and the weakest growth in the upside scenario.

Aside from the dramatic effects of the coronavirus pandemic, uncertainty still remains surrounding the terms of the UK’s future trading relationship with the EU. Autovista Group’s base-case scenario assumes a deep recession and a slow recovery but ongoing free trade with the EU. In this scenario, the new-car market is forecast to grow 17% and 8% in 2021 and 2022 respectively, returning the market to the 2019 level in 2022.

Trade with the EU

A downside scenario factors in the UK not reaching a trade agreement with the EU, resulting in a very deep recession and L-shaped recovery. The key consequence for the automotive sector is that WTO trade rules would be applied, resulting in higher prices for cars as well as for replacement parts and insurance. In this downside forecast, new-car registrations are forecast to increase 29% in 2021 but only by 5% in 2022. At 2.1 million registrations, the market would still be 200,000 units lower in 2022 than in 2019.

In an upside ″slow u-shaped recovery″ scenario, the comparatively limited impact of COVID-19 in 2020 is fundamentally recovered in 2021, with registrations growth of 9.0% anticipated. In conjunction with a trade deal that secures ongoing free trade between the UK and the EU, the new-car market is forecast to grow by a further 11% in 2022. At 2.5 million registrations, the UK new-car market would then be at its highest level since 2016.

Lowest March since bi-annual plate change

The significant contraction of new-car registrations in March, reported today by the SMMT, was to be expected given the lockdown measures imposed by the UK Government on 23 March in an attempt to limit the spread of COVID-19. 203,370 fewer cars were registered than in March 2019, as showrooms closed in line with government advice. This is the lowest figure for the month of March since the UK moved to a bi-annual number-plate system but even more dramatic declines have been reported in other markets, where lockdown measures came into force earlier.

′With the country locked down in crisis mode for a large part of March, this decline will come as no surprise. Despite this being the lowest March since we moved to the bi-annual plate change system, it could have been worse had the significant advanced orders placed for the new 20 plate not been delivered in the early part of the month. We should not, however, draw long-term conclusions from these figures other than this being a stark realisation of what happens when economies grind to a halt,’ said Mike Hawes, SMMT chief executive.

′How long the market remains stalled is uncertain, but it will reopen and the products will be there. In the meantime, we will continue to work with government to do all we can to ensure the thousands of people employed in this sector are ready for work and Britain gets back on the move,’ Hawes added.

Source: Autovista Group/SMMT

Extent of losses

The outlook for 2021 is largely dictated by the extent of the losses to registrations incurred in 2020 – the higher the loss in 2020, the higher the pent-up demand to be released in 2021. This explains why the steepest growth is forecast in the downside scenario and the weakest growth in the upside scenario.

Aside from the dramatic effects of the coronavirus pandemic, uncertainty still remains surrounding the terms of the UK’s future trading relationship with the EU. Autovista Group’s base-case scenario assumes a deep recession and a slow recovery but ongoing free trade with the EU. In this scenario, the new-car market is forecast to grow 17% and 8% in 2021 and 2022 respectively, returning the market to the 2019 level in 2022.

Trade with the EU

A downside scenario factors in the UK not reaching a trade agreement with the EU, resulting in a very deep recession and L-shaped recovery. The key consequence for the automotive sector is that WTO trade rules would be applied, resulting in higher prices for cars as well as for replacement parts and insurance. In this downside forecast, new-car registrations are forecast to increase 29% in 2021 but only by 5% in 2022. At 2.1 million registrations, the market would still be 200,000 units lower in 2022 than in 2019.

In an upside ″slow u-shaped recovery″ scenario, the comparatively limited impact of COVID-19 in 2020 is fundamentally recovered in 2021, with registrations growth of 9.0% anticipated. In conjunction with a trade deal that secures ongoing free trade between the UK and the EU, the new-car market is forecast to grow by a further 11% in 2022. At 2.5 million registrations, the UK new-car market would then be at its highest level since 2016.

Lowest March since bi-annual plate change

The significant contraction of new-car registrations in March, reported today by the SMMT, was to be expected given the lockdown measures imposed by the UK Government on 23 March in an attempt to limit the spread of COVID-19. 203,370 fewer cars were registered than in March 2019, as showrooms closed in line with government advice. This is the lowest figure for the month of March since the UK moved to a bi-annual number-plate system but even more dramatic declines have been reported in other markets, where lockdown measures came into force earlier.

′With the country locked down in crisis mode for a large part of March, this decline will come as no surprise. Despite this being the lowest March since we moved to the bi-annual plate change system, it could have been worse had the significant advanced orders placed for the new 20 plate not been delivered in the early part of the month. We should not, however, draw long-term conclusions from these figures other than this being a stark realisation of what happens when economies grind to a halt,’ said Mike Hawes, SMMT chief executive.

′How long the market remains stalled is uncertain, but it will reopen and the products will be there. In the meantime, we will continue to work with government to do all we can to ensure the thousands of people employed in this sector are ready for work and Britain gets back on the move,’ Hawes added.

Source: Autovista Group based on SMMT data

Residual-value upside

Among the Big 5 European car markets, the UK is most pessimistic about the economic consequences of the combination of coronavirus and the Brexit aftermath. There would seem to be little trust in how the UK Government has been dealing with the crisis and whatever pent-up demand there may be, the fragility of the economy is hugely concerning. Our Glass’s UK editorial team allocates the highest probability to the ″deep recession, slow recovery″ base-case scenario. That is one where it will take up to six months to gain control over the pandemic and where monetary and fiscal stimuli have hardly any positive impact on the economy and private consumption. As a result, economic growth in the UK will be negative in 2020 and 0% in 2021.

Despite stark pessimism in how the UK will digest the economic aftermath of the pandemic in combination with the Brexit negotiations, there is a positive note. The expected impact on used-car values is not as severe as in other markets even in this darker scenario. By 2021, the UK will have fully recovered in terms of used-car prices to levels close to today.

Limited elasticity

The main reason is the limited elasticity in the market, together with the fact that supply of new cars has dramatically reduced and is unlikely to ramp up again soon. The expectation is a continued supply shortage during the economic downturn. Whilst the weaker British Pound is not helping, there is some pent-up demand containing the risks of further drops in used-car values. Head of content and product at Autovista Group’s UK subsidiary Glass’s, Anthony Machin said: ′Across the world, the automotive industry faces unfamiliar challenges. In the UK, after a strong start to 2020, like many around the world the car market is closed as the population adapts to new ways of working, socialising and shopping.’

Source: Autovista Group based on SMMT data

Residual-value upside

Among the Big 5 European car markets, the UK is most pessimistic about the economic consequences of the combination of coronavirus and the Brexit aftermath. There would seem to be little trust in how the UK Government has been dealing with the crisis and whatever pent-up demand there may be, the fragility of the economy is hugely concerning. Our Glass’s UK editorial team allocates the highest probability to the ″deep recession, slow recovery″ base-case scenario. That is one where it will take up to six months to gain control over the pandemic and where monetary and fiscal stimuli have hardly any positive impact on the economy and private consumption. As a result, economic growth in the UK will be negative in 2020 and 0% in 2021.

Despite stark pessimism in how the UK will digest the economic aftermath of the pandemic in combination with the Brexit negotiations, there is a positive note. The expected impact on used-car values is not as severe as in other markets even in this darker scenario. By 2021, the UK will have fully recovered in terms of used-car prices to levels close to today.

Limited elasticity

The main reason is the limited elasticity in the market, together with the fact that supply of new cars has dramatically reduced and is unlikely to ramp up again soon. The expectation is a continued supply shortage during the economic downturn. Whilst the weaker British Pound is not helping, there is some pent-up demand containing the risks of further drops in used-car values. Head of content and product at Autovista Group’s UK subsidiary Glass’s, Anthony Machin said: ′Across the world, the automotive industry faces unfamiliar challenges. In the UK, after a strong start to 2020, like many around the world the car market is closed as the population adapts to new ways of working, socialising and shopping.’