Autovista Group reaction to the German Government subsidies for used EVs

26 February 2020

26 February 2020

The increased environmental bonus for electric vehicles (EVs) in Germany, announced early in November 2019, has come into force after the European Commission raised no objections. In an additional measure, young used EVs will also be incentivised, but there are repercussions for residual values as well as demand for new models, writes Neil King, senior data journalist at Autovista Group.

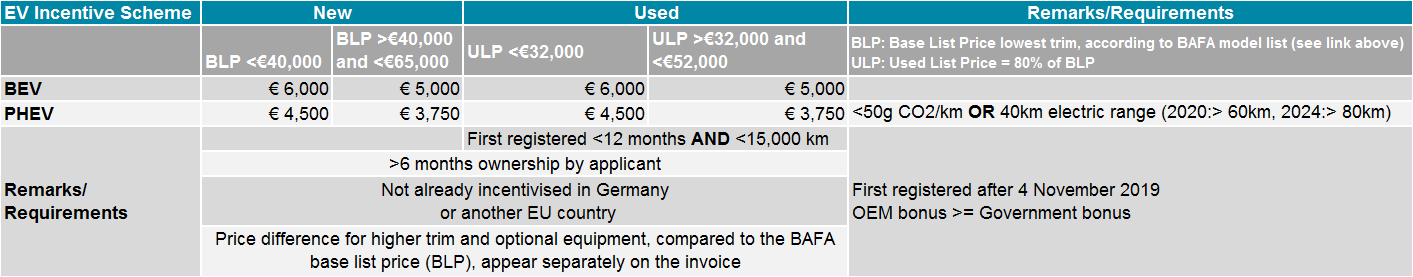

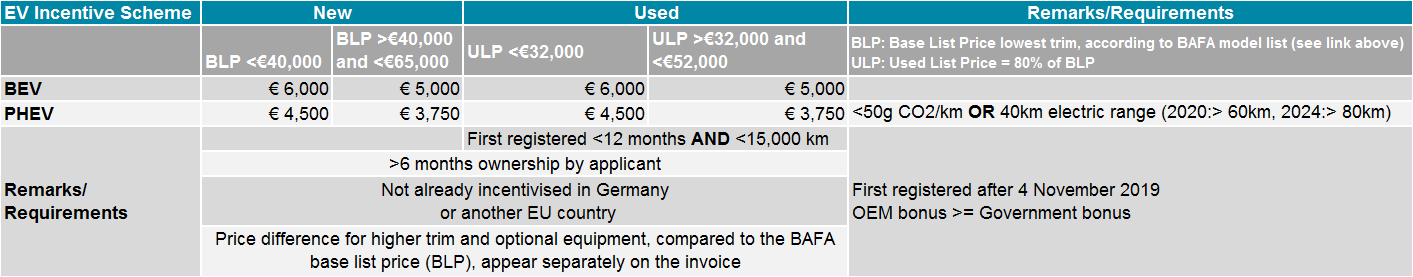

As outlined back in November, the ′Umweltprämie’ (environmental bonus) for battery-electric vehicles (BEVs) with a net list price of less than €40,000 has been increased from €4,000 to €6,000. For those with a net list price between €40,000 and €60,000, the subsidy has risen from €4,000 to €5,000 and BEVs costing up to €65,000 are now also eligible. Plug-in hybrids (PHEVs) will also continue to be subsidised, with the incentive rising from €3,000 to €4,500 for vehicles with a net list price up to €40,000. However, funding for PHEVs with a net list price between €40,000 and €65,000 will only increase to €3,750, instead of €4,000 as was previously announced. Half the subsidy is payable by the German Government, and the carmaker contributes the other half.

EVs that qualify for the environmental bonus are included in a list published on the website of the German office for trade and export control (Bundesamt fÃœr Wirtschaft und Ausfuhrkontrolle, BAFA), which gives the net list price of the base model. Optional extras are not factored into the price.

Ralf Sulzbach, senior project manager, consulting, at Autovista Group, highlights that ′the list-price threshold has increased from €60,000 to €65,000. Consequently, some more of the comparatively expensive electric SUVs could become eligible for the bonus.’

For example, both the Audi e-tron 55 and Jaguar I-Pace S have a net list price just over the new €65,000 threshold. ′It seems obvious that this is not a random increase in the price threshold and these two manufacturers could rethink their pricing to benefit from the subsidy, possibly in conjunction with lower discounting,’ commented Andreas GeilenbrÃœgge, head of valuations and insights at Schwacke.

Retroactive application

The new subsidy rates are retroactively applicable to EVs registered after 4 November 2019, but the application date must be no later than 12 months after the start of ownership. The directive will expire on 31 December 2025 or when the budget is exhausted. As was the case previously, the federal government and car manufacturers will share the subsidy equally. The federal government is providing €2.09 billion for the extended subsidy.

For EVs registered up until 4 November 2019, the subsidy rates introduced on 28 May 2019 apply. These older guidelines also apply to vehicles registered from 5 November 2019, until the entry into force of the new amended subsidy directive, which have already received the manufacturer’s share of the incentive as per the directive of 28 May 2019.

Incentives for used EVs

In another measure, young used EVs will also be subsidised. The used EV must have been registered for a maximum of 12 months, have a maximum mileage of 15,000 km and must have been in the applicant’s ownership for a minimum of six months. Moreover, the vehicle must not have already benefitted from the environmental bonus for new cars in Germany or from a state subsidy in another EU member state. The BAFA model list also provides a used list price for each model, equating to 80% of the new list price, factoring in ′typical depreciation’.

The used-EV incentive applies to vehicles with a used list price for the base model in Germany of less than €52,000. For EVs with a used list price below €32,000, the incentive amounts to €6,000 for a used BEV and €4,500 for a used PHEV. For EVs with a used list price between €32,000 and €52,000, the incentive for a used BEV is €5,000 and €3,750 for a used PHEV.

The table below outlines the new incentives available for EVs in Germany. As noted above, half is payable by the German Government and the other half by the carmaker.

Repercussions: The good, the bad and the ugly

An advantage of the new incentive for used EVs is that OEMs can register cars as demonstrator models and still benefit from the incentive later down the line. It should be easier to find buyers for these ′demo’ models as transaction prices come down. Effectively, OEMs can increase their share of EVs through tactical registrations and, in turn, reduce their exposure to fines if they exceed their respective fleet-average emissions target in 2020.

This is clearly also a positive for buyers of used EVs as they can benefit from the incentive scheme, which will essentially stimulate the used-car market. ′Residual values of used EVs increased as demand outstripped supply, partly because buyers have to wait for up to 12 months for new EVs, opting for young used ones instead,’ Sulzbach said.

GeilenbrÃœgge added that ′EV offer prices are now declining after a peak in mid-late 2019. Especially young used cars, up to two-years-old, are suffering from rising volumes causing longer selling times and divergence between the offer and final sale prices. For three-year-old cars, it’s more stable with slightly declining stock days and offer/selling prices closer to each other but volumes are still growing and the price level is slightly heading downwards.’

The new incentives for young used EVs will naturally depress values, with a knock-on effect for older models. This phenomenon will be exacerbated if OEMs overindulge in tactical registrations, flooding the market with young used EVs that cannot find a home because of oversupply.

It is unclear as to how many used EVs would be eligible for the used-car incentive given that most will have already benefitted when registered new. However, between second registrations of EVs first registered in Germany and used EV imports, there is a risk of a downward spiral in residual values – especially for EVs, but also with a knock-on effect on other used cars.

Furthermore, this would curtail demand for new EVs, increasing the average emissions of OEMs and, in turn, the fines they have to pay. Germany in particular desperately needs to reduce its CO2 emissions from new cars, which rose again in 2019 (to 157g/km in WLTP terms, estimated to be 122g/km under NEDC). There is already a risk that manufacturers will self-register a high volume of EVs in 2020, especially towards the end of the year, but this does not bode well for 2021 with an oversupply of cut-price young used EVs available.

Supporting demand, not supply

We will closely observe the development of short-term registrations, and their impact on EV residual values and Christof Engelskirchen, chief economist of Autovista Group commented that ′we have been preaching for years that in order to stimulate the market for EVs incentives should be considered for used car buyers.’

′What we meant, however, was subsidies for electricity, home-charging infrastructure and general infrastructure. All of these measures would have a positive impact on the demand for EVs rather than the supply,’ Engelskirchen added.

Repercussions: The good, the bad and the ugly

An advantage of the new incentive for used EVs is that OEMs can register cars as demonstrator models and still benefit from the incentive later down the line. It should be easier to find buyers for these ′demo’ models as transaction prices come down. Effectively, OEMs can increase their share of EVs through tactical registrations and, in turn, reduce their exposure to fines if they exceed their respective fleet-average emissions target in 2020.

This is clearly also a positive for buyers of used EVs as they can benefit from the incentive scheme, which will essentially stimulate the used-car market. ′Residual values of used EVs increased as demand outstripped supply, partly because buyers have to wait for up to 12 months for new EVs, opting for young used ones instead,’ Sulzbach said.

GeilenbrÃœgge added that ′EV offer prices are now declining after a peak in mid-late 2019. Especially young used cars, up to two-years-old, are suffering from rising volumes causing longer selling times and divergence between the offer and final sale prices. For three-year-old cars, it’s more stable with slightly declining stock days and offer/selling prices closer to each other but volumes are still growing and the price level is slightly heading downwards.’

The new incentives for young used EVs will naturally depress values, with a knock-on effect for older models. This phenomenon will be exacerbated if OEMs overindulge in tactical registrations, flooding the market with young used EVs that cannot find a home because of oversupply.

It is unclear as to how many used EVs would be eligible for the used-car incentive given that most will have already benefitted when registered new. However, between second registrations of EVs first registered in Germany and used EV imports, there is a risk of a downward spiral in residual values – especially for EVs, but also with a knock-on effect on other used cars.

Furthermore, this would curtail demand for new EVs, increasing the average emissions of OEMs and, in turn, the fines they have to pay. Germany in particular desperately needs to reduce its CO2 emissions from new cars, which rose again in 2019 (to 157g/km in WLTP terms, estimated to be 122g/km under NEDC). There is already a risk that manufacturers will self-register a high volume of EVs in 2020, especially towards the end of the year, but this does not bode well for 2021 with an oversupply of cut-price young used EVs available.

Supporting demand, not supply

We will closely observe the development of short-term registrations, and their impact on EV residual values and Christof Engelskirchen, chief economist of Autovista Group commented that ′we have been preaching for years that in order to stimulate the market for EVs incentives should be considered for used car buyers.’

′What we meant, however, was subsidies for electricity, home-charging infrastructure and general infrastructure. All of these measures would have a positive impact on the demand for EVs rather than the supply,’ Engelskirchen added.

Repercussions: The good, the bad and the ugly

An advantage of the new incentive for used EVs is that OEMs can register cars as demonstrator models and still benefit from the incentive later down the line. It should be easier to find buyers for these ′demo’ models as transaction prices come down. Effectively, OEMs can increase their share of EVs through tactical registrations and, in turn, reduce their exposure to fines if they exceed their respective fleet-average emissions target in 2020.

This is clearly also a positive for buyers of used EVs as they can benefit from the incentive scheme, which will essentially stimulate the used-car market. ′Residual values of used EVs increased as demand outstripped supply, partly because buyers have to wait for up to 12 months for new EVs, opting for young used ones instead,’ Sulzbach said.

GeilenbrÃœgge added that ′EV offer prices are now declining after a peak in mid-late 2019. Especially young used cars, up to two-years-old, are suffering from rising volumes causing longer selling times and divergence between the offer and final sale prices. For three-year-old cars, it’s more stable with slightly declining stock days and offer/selling prices closer to each other but volumes are still growing and the price level is slightly heading downwards.’

The new incentives for young used EVs will naturally depress values, with a knock-on effect for older models. This phenomenon will be exacerbated if OEMs overindulge in tactical registrations, flooding the market with young used EVs that cannot find a home because of oversupply.

It is unclear as to how many used EVs would be eligible for the used-car incentive given that most will have already benefitted when registered new. However, between second registrations of EVs first registered in Germany and used EV imports, there is a risk of a downward spiral in residual values – especially for EVs, but also with a knock-on effect on other used cars.

Furthermore, this would curtail demand for new EVs, increasing the average emissions of OEMs and, in turn, the fines they have to pay. Germany in particular desperately needs to reduce its CO2 emissions from new cars, which rose again in 2019 (to 157g/km in WLTP terms, estimated to be 122g/km under NEDC). There is already a risk that manufacturers will self-register a high volume of EVs in 2020, especially towards the end of the year, but this does not bode well for 2021 with an oversupply of cut-price young used EVs available.

Supporting demand, not supply

We will closely observe the development of short-term registrations, and their impact on EV residual values and Christof Engelskirchen, chief economist of Autovista Group commented that ′we have been preaching for years that in order to stimulate the market for EVs incentives should be considered for used car buyers.’

′What we meant, however, was subsidies for electricity, home-charging infrastructure and general infrastructure. All of these measures would have a positive impact on the demand for EVs rather than the supply,’ Engelskirchen added.

Repercussions: The good, the bad and the ugly

An advantage of the new incentive for used EVs is that OEMs can register cars as demonstrator models and still benefit from the incentive later down the line. It should be easier to find buyers for these ′demo’ models as transaction prices come down. Effectively, OEMs can increase their share of EVs through tactical registrations and, in turn, reduce their exposure to fines if they exceed their respective fleet-average emissions target in 2020.

This is clearly also a positive for buyers of used EVs as they can benefit from the incentive scheme, which will essentially stimulate the used-car market. ′Residual values of used EVs increased as demand outstripped supply, partly because buyers have to wait for up to 12 months for new EVs, opting for young used ones instead,’ Sulzbach said.

GeilenbrÃœgge added that ′EV offer prices are now declining after a peak in mid-late 2019. Especially young used cars, up to two-years-old, are suffering from rising volumes causing longer selling times and divergence between the offer and final sale prices. For three-year-old cars, it’s more stable with slightly declining stock days and offer/selling prices closer to each other but volumes are still growing and the price level is slightly heading downwards.’

The new incentives for young used EVs will naturally depress values, with a knock-on effect for older models. This phenomenon will be exacerbated if OEMs overindulge in tactical registrations, flooding the market with young used EVs that cannot find a home because of oversupply.

It is unclear as to how many used EVs would be eligible for the used-car incentive given that most will have already benefitted when registered new. However, between second registrations of EVs first registered in Germany and used EV imports, there is a risk of a downward spiral in residual values – especially for EVs, but also with a knock-on effect on other used cars.

Furthermore, this would curtail demand for new EVs, increasing the average emissions of OEMs and, in turn, the fines they have to pay. Germany in particular desperately needs to reduce its CO2 emissions from new cars, which rose again in 2019 (to 157g/km in WLTP terms, estimated to be 122g/km under NEDC). There is already a risk that manufacturers will self-register a high volume of EVs in 2020, especially towards the end of the year, but this does not bode well for 2021 with an oversupply of cut-price young used EVs available.

Supporting demand, not supply

We will closely observe the development of short-term registrations, and their impact on EV residual values and Christof Engelskirchen, chief economist of Autovista Group commented that ′we have been preaching for years that in order to stimulate the market for EVs incentives should be considered for used car buyers.’

′What we meant, however, was subsidies for electricity, home-charging infrastructure and general infrastructure. All of these measures would have a positive impact on the demand for EVs rather than the supply,’ Engelskirchen added.