BorgWarner finalises Delphi Technologies acquisition

07 October 2020

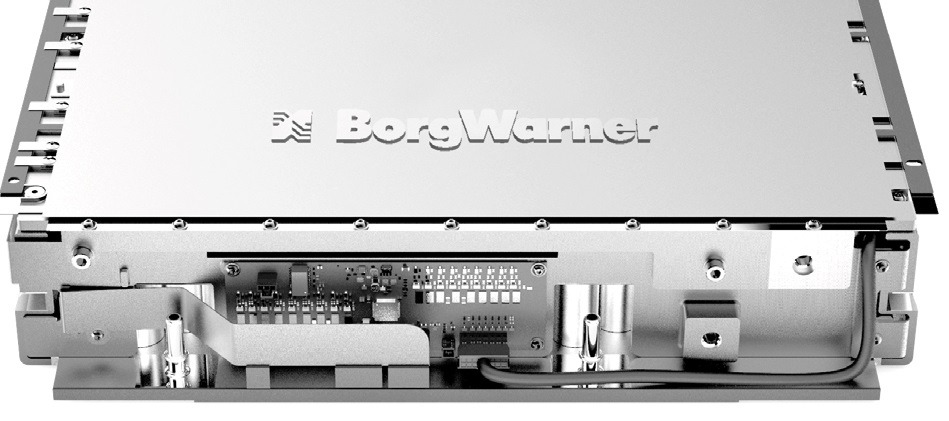

BorgWarner has completed its acquisition of Delphi Technologies. The combination will allow the vehicle powertrain supplier to secure a greater foothold in the electric-drive market.

Carmakers and component suppliers are all looking to gain ground in the electrification race. As emissions regulations and government incentives push consumer demand away from internal combustion engines (ICE) and towards electric drivetrains, the automotive industry is having to keep pace with change.

3 billion deal

First announced at the start of this year, the acquisition was valued at over €3 billion. It will allow BorgWarner to strengthen its power electronics products, capabilities and scale. The company believes this will help it establish a leading role in propulsion migration while maintaining flexibility across ICE, hybrid and electric vehicles (EVs).

‘We are pleased to complete our acquisition of Delphi Technologies,’ said Frédéric Lissalde, president and CEO of BorgWarner. ‘Through this combination, BorgWarner is even better positioned with a more comprehensive portfolio of industry-leading propulsion products and systems across combustion, hybrid and electric vehicles. We expect that the combination will also strengthen our commercial vehicle and aftermarket businesses.’

Delphi Technologies comes with a great deal of electronics know-how, with an established production, supply and customer base. This means customers can now access a range of integrated and standalone offerings of power electronics products, including high-voltage inverters, converters, on-board chargers and battery management systems. The combined company will also offer enhanced capabilities, including software, systems integration and thermal management.

‘We welcome Delphi Technologies’ colleagues around the world to the BorgWarner team and are excited about the opportunities we have together to address market trends towards electrification. I am proud of our global workforce, including our integration planning teams, for driving the business forward as we managed through the pandemic and laying a strong foundation for a seamless integration. I have great confidence that we will realise what we believe are significant benefits of this combination for our shareholders, customers and suppliers,’ Lissalde added.

Before the transaction is finalised, Delphi Technologies’ shareholders will still need to give it the green light, required regulatory approvals will need to be received, conditions relating to the indebtedness of Delphi Technologies will need to be satisfied, and customary closing conditions will require completion. A conference call on 8 October will outline additional details of the acquisition.

BorgWarner stockholders are expected to own approximately 84% of the combined company, while Delphi Technologies stockholders would own approximately 16%. Delphi Technologies common stock will also cease to be traded on the New York Stock Exchange.

Suppliers boost electric efforts

Many automotive component suppliers have been preparing for the electric race with investments, expansions and acquisitions. Back in 2018, Bosch partnered with Canadian startup Mojio to get more vehicles connected wirelessly, while ZF formed a joint venture with e.GO Mobile and also took a 35% stake in ASAP Holding to broaden its EV knowledge.

Last year, Valeo and Dana Incorporated announced a global collaboration to develop and supply 48-volt hybrid and EV systems. The joint venture looked to produce electromechanical systems for low-speed EVs as well as hybrid all-wheel-drive applications for light vehicles weighing up to 2.5 tons.

However, suppliers were already contending with poor financial results in 2019. Almost a year before coronavirus (COVID-19) shook the automotive market, Denso and Continental revealed large hits to their operating profits, while Valeo highlighted a dip in revenues. So, while manufacturers sprint to compete in the electrification race, the danger of financial fatigue remains ever-present. Which suppliers and carmakers make it across the finish line, is yet to be seen.

7 October 2020