Can the Brussels Motor Show remain a sales-focused event?

14 January 2026

The Brussels Motor Show is intrinsically linked to the Belgian new-car market. But with the event now gaining international attention, can it continue to drive leads and sales? Autovista24 journalist Tom Hooker discusses the topic.

Over its 102 editions, the Brussels Motor Show has remained a hotbed of sales activity for local dealers. As a result, every year the Belgian new-car market experiences a unique seasonal effect in January and February. According to Autovista24 calculations of FEBIAC data, registrations peaked in the first quarter of 2025.

‘The Brussels Motor Show is always very important for the Belgian market. This is where more than one-third of the sales in the full year are made. So, you must start well at the Brussels Motor Show if you want to have a great year in Belgium,’ Stéphane Cesareo, communications director for Stellantis Europe, USA and China, told Autovista24.

In turn, this performance helps carmakers justify their attendance from a financial viewpoint, instead of a standalone marketing exercise.

‘Brussels traditionally was a sales show. That is something we want to keep. It pays off for the importers of the brands to be here. It is not just investing money, it is also a return,’ FEBIAC CEO Frank van Gool told Autovista24.

Providing sales reach

This seasonal sales spike is not just caused by the Brussels Motor Show. Brands use the period of heightened activity to present attractive discounts and promotions. In turn, it has influenced a local car-buying mindset.

‘It is the only time of the year when you can reach most of the Belgian people looking for a new car. Everyone has been waiting since the summer for the Brussels Motor Show to find a good deal,’ Julien Libioul, communication and public affairs manager at Ford Motor Company Belux, told Autovista24 at this year’s event.

‘It is known in the Belgian culture that if you want to buy a new car, wait for the Brussels Motor Show. You will have an extra incentive to find a good price,’ he highlighted.

New international focus

Overshadowed by international events such as Geneva, Detroit and CES, the Brussels Motor Show used to hold a lower profile.

Speaking to Autovista24, Raf Van Nuffel, vice president of product at Hyundai Motor Europe, commented: ‘In the end, you still find many customers who really like to see cars physically.

‘But some other motor shows are not what they used to be. So, the Brussels Motor Show is benefiting from that and getting a bit more international attention,’ he commented.

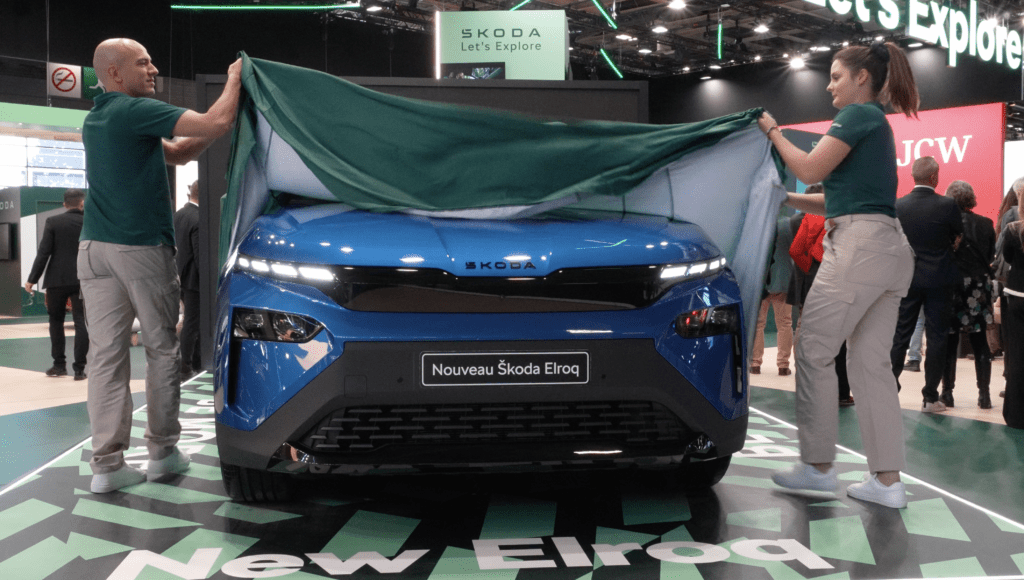

Hyundai held the world premiere of its Staria electric vehicle (EV) at the event. The model formed part of a long list of global, European and Belgian debuts at the Brussels Expo.

‘We really reinforced the international flavour this year. That is important because the local sales companies or importers do not always have the financial means to fully support these shows. They also need some support from their headquarters,’ noted van Gool.

‘We have never had so many brands at the show as we have today. We have 67 different brands and over 400 models on display. Almost all the brands that are commercialised here in Belgium and Europe are present at the show. Last year we had 300,000 visitors, and we are aiming for almost 350,000 visitors this year,’ he outlined.

A bigger sales opportunity?

While the event has enjoyed record attendance, the Belgian new-car market suffered a decline from January to December. According to FEBIAC, deliveries dropped by 7.5% year on year to 414,770 units. So, could the show’s international traction help the market to bounce back, or cause more struggles in 2026?

‘I do not think both aspects are threatening each other. I think we can keep up that approach without the risk that the local sales aspect would disappear,’ stated van Gool.

Kristof Winckelmans, PR manager at Astara Western Europe, added: ‘The importance of the Brussels Motor Show on the calendar is growing, not only because there are sales behind it, but also because there are not many shows left. That is beneficial for us as an importer and for the Belgian automotive industry as a whole.’

Private sales focus

Despite the fleet channel driving the Belgian new-car market, the event typically generates more sales from the private channel.

‘Belgium is quite an atypical market. We have approximately 60% of professional fleet customers and 40% approximately private customers. Within these private customers, we have to do 50% of our yearly volume during January and February,’ commented Olivier Van Hoorebeke, PR manager at Audi, Seat and Cupra, when speaking to Autovista24.

Yet, the nature of this sales process has changed along with the growth of the show. In the past, visitors could buy their new car directly at the event. Now, Brussels provides a chance to generate highly detailed leads, which are passed on to the relevant dealership. In turn, this presents an interesting benefit.

‘You could say people inform themselves on the internet, and they will go to their local dealership. But a lot of people are under pressure when they go into a showroom, and they do not feel at ease. Here at the motor show, customers can freely compare things without this commercial pressure of having to buy a car immediately,’ stated van Gool.

Private buyer preferences

As emissions standards tighten in the EU, carmakers are increasingly directing their focus to electric vehicles (EVs). Consequently, this is reflected in some of their show displays.

However, with Brussels’ unique position as a centre for private sales, carmakers are incentivised to show their full model range. This includes full and mild hybrids as well as internal-combustion engine (ICE) models, alongside the latest EVs. For example, Alpine presented its full range for the first time at the event.

‘The visitors, in general, are private consumers. So, it is vital that brands do not just show fleet cars. In Belgium, the fleet market is largely EVs. However, our hybrid model range is particularly important here,’ Ellen De Wilde, PR manager at Toyota and Lexus BeLux, told Autovista24.

Are sales the new success formula?

With its 2026 edition, it is safe to say that Brussels now carries an international stature. Its size could be compared to the Paris Motor Show and the IAA Munich.

New-car registrations declined heavily in France, even after the Paris event in 2024. Meanwhile, Germany saw marginal growth after being rooted in a decline for the majority of 2025. So, could Brussels’ mix of commercial and international flavour be a recipe for future motor show and new-car market success?

‘I do not know if it is a copy and paste to do this in other countries. I think it is also a very Belgian thing to have this show at the beginning of the year and the commercial aspect that goes with it,’ commented van Gool.

‘If there are dramatic changes in the way we use cars or if autonomous driving is really moving forward, then we will have to see if the concept of this motor show is still relevant or if we have to change or if it will disappear,’ he concluded.