Automotive manufacturers are shifting connected-car patent strategies to avoid litigation

11 July 2022

Connected vehicles can create pitfalls for carmakers, and it is all about patents, writes Autovista24 journalist Rebeka Shaid.

Patent litigation in the automotive industry is not a new theme, but with cars becoming more connected and autonomous, modern vehicles could infringe patents in many technological areas. That is because new cars are increasingly turning into computers on wheels, merging services in the areas of computer processing, media streaming, and calling, to name but a few.

This rapid increase in smart technology brings with it potential risks. Patent infringement suits in the automotive sector by so-called non-producing entities (NPEs) have been on the rise, with carmakers trying to protect themselves from potential intellectual property conflicts. There are several ways to go about this.

Patent pools – an insurance policy?

Patent pools offer one way to evade potential lawsuits. They are of growing interest to carmakers, allowing a group of at least two companies to cross-license patents. It is one of the safest options to access a range of patented technologies, especially in the field of autonomous and connected vehicles.

Licensing wireless connectivity patents to carmakers is Avanci’s bread and butter. Founded in 2016, the startup allows owners of patented cellular technology and automotive companies to work cooperatively.

Describing itself as a one-stop marketplace, Avanci offers a single joint licence to the majority of cellular standard-essential patents. Around 42 automotive brands and more than 65 million vehicles are now licensed by the company, Mark Durrant, Avanci vice president of marketing and communications, told Autovista24.

‘We are the only [patent] pool licensing cellular standard-essential patents in the automotive space,’ said Durrant. ‘What Avanti offers is predictability, efficiency, and fair pricing.’

The independent company gives access to 4G, 3G, and 2G standard-essential patents owned by 49 patent owners, including the likes of LG Electronics, Nokia, Panasonic, Qualcomm, and Vodafone. Avanci is also working on a 5G offering as carmakers are readying themselves to up the levels of technology in connected vehicles. Carmakers pay $15 (€14.7) per vehicle for an Avanci licence that covers 2G, 3G and 4G patents.

Durrant said that Avanci signed BMW as a first licensee in 2017, and other major carmakers soon followed suit. Volkswagen, Volvo, Jaguar, Lucid, Polestar, GM, Audi, and Bentley are just some of the manufacturers that have signed up to Avanci’s patent licence agreement.

‘The German auto industry has been a leader in participating with us. But equally, we have recently signed Ford,’ said Durrant. ‘We are now in discussions with Korean, Japanese, and Chinese carmakers as well.’

Legal disputes

Ford recently signing an agreement with Avanci comes in the wake of a legal battle the US manufacturer was embroiled in. Ford was brought to court in Munich, accused of violating wireless-technology patents. The manufacturer faced a potential production ban in Germany, with the lawsuit centring on microchips found in Ford cars.

The plaintiffs in this headline-grabbing lawsuit include a group of eight owners of a 4G mobile-communications patent. But now that Ford has joined the Avanci pool, a settlement is expected, and the carmaker has gained protection from future patent lawsuits.

Ford’s case is not the only one. Mercedes-Benz, then known as Daimler, was also engulfed in a lengthy tech war with Nokia. Last year, the manufacturer agreed to settle the claim by paying Nokia for using its patents. While terms of the deal were not disclosed, it was the first time the German carmaker paid Nokia for patents.

The companies bringing these cases forward want carmakers to pay royalties for using technologies in a number of applications. This includes vehicle communications and navigation systems, but also tech found in autonomous-driving cars. Manufacturers want suppliers to pay instead.

Win-win situation

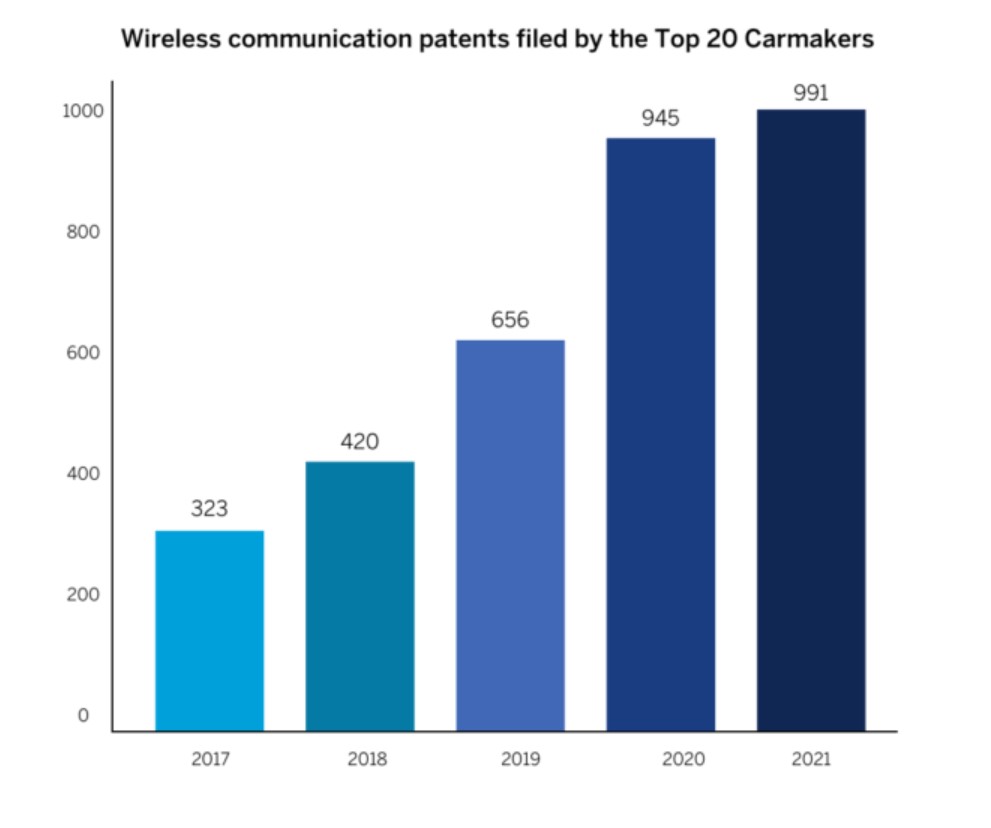

Patent pools offer one way to avoid litigation, but there is another. New research by intellectual property law firm Mathys & Squire shows that patents for wireless communications technology filed by the 20 largest carmakers surged to a record high in 2021. The data highlights that these automotive companies filed 991 patents related to autonomous-driving systems in the past year alone.

The data suggests that manufacturers have caught on. By generating their own wireless-communication patents, carmakers can prevent potential disputes with the telecoms industry, which is known to be more litigious than the automotive sector when it comes to intellectual property.

After all, when manufacturers can claim ownership of their technologies, lawsuits over the licensing of wireless systems can be avoided. Andrew White, partner at Mathys & Squire, said that the sudden dependence of manufacturers on wireless technology in autonomous vehicles, which might be owned by telecoms companies, propels carmakers into an unfamiliar legal landscape.

‘The automotive industry knows access to wireless-communication technology is vital to its future. Owning wireless-communication patents is a win-win for the automotive industry. It gives them valuable intellectual property in a growing field and reduces the risk of legal battles with telecoms firms,’ added White.

Growing automotive patent applications

In the age of autonomous driving, patent filings in the automotive industry have been on the rise. The European Patent Office (EPO) found that patent applications related to autonomous vehicles increased drastically between 2009 and 2018. Europe is taking a leading position and accounts for around a third of all patent applications around the world.

The EPO study highlights that established carmakers have to adapt to digital technologies in the realms of autonomous driving to keep up with equally powerful industries, including wireless communication and big data.

‘Self-driving vehicle (SDV) patent applications at the EPO originate from hundreds of different applicants operating in a wide variety of industries,’ the EPO told Autovista24.

‘The top 500 main applicants were responsible for 80% of all SDV applications at the EPO in the period 2011-2017. Companies operating in automotive, other transport or related machinery and electrical equipment filed half of these SDV-patent applications, while companies specialised in information and communication technologies (ICT for automotive) filed 32.8%, and telecom companies 13.6%.’

When taking a wider look at the number of patents owned by some of the largest car manufacturers between 2000 and 2020, Toyota was the most active. Traditionally, vehicle manufacturers have not viewed patents as a driver for revenues, but with the rapid advancement of technology increasing the value of a vehicle, that has changed.

International law firm Freshfields Bruckhaus Deringer found that the automotive industry is among the most active sectors for worldwide patent filings. It suggests that the human-machine interface (HMI) could yield the greatest profit potential, hence raising the litigation risk. This could have direct implications on list prices, with Freshfields adding that patent litigation risk for connected vehicles could add 10% to the price of a car.

With carmakers now increasingly competing with technology and telecoms companies, the patent strategy is shifting. Automotive manufacturers must think outside the box to keep up with the rising competition in innovative fields of technology, to which intellectual property rights are inevitably tied to.