Dealer sales restricted in half of Europe’s car market

27 January 2021

27 January 2021

Europe’s car dealers continue to face COVID-19 restrictions, with dealerships in some markets currently closed, except for servicing, maintenance and repair (SMR) work and online ′click-and-collect’ sales. Autovista Group analysis uncovers that about half of Europe’s automotive market is currently affected by dealer restrictions. Senior data journalist Neil King discusses the findings.

Across many European markets, dealers are open for business as usual, or rather ′business as unusual’, with strict COVID-19 rules in place, such as the mandatory wearing of face masks and the use of hand sanitiser. New-car registrations will be less severely impacted in these markets, compared to those where dealers cannot open for the physical sale of cars. Nevertheless, they are clearly not escaping COVID-19, and the resulting economic impact, unscathed.

Of the 15 European markets under review, dealers have been least affected in Sweden and Finland, where showrooms have never closed throughout the pandemic. ′There are restrictions on the number of people allowed inside at the same time, but not a full closure,’ commented Johan Trus, Autovista Group head of data and valuations, Nordics. This has translated into comparatively robust new-car registrations, which were down ′only’ 18.2% and 15.6% respectively in 2020.

Dealers in Italy and Spain have not been affected since the end of the first lockdown period, in May-June 2020, and all dealers in France have resumed normal activity since December. However, this does not preclude governments introducing lockdowns again in the future.

′There are currently many discussions about whether we should go into a tighter lockdown, like the one we had from March to May-June, but there is no agreement yet. Our economy has been badly damaged and the decision may be to continue with at least low business activity. There could be a few specific cases in particular locations, however, in general, dealers remain open,’ said Ana Azofra, valuations and insights manager at Autovista Group, Spain.

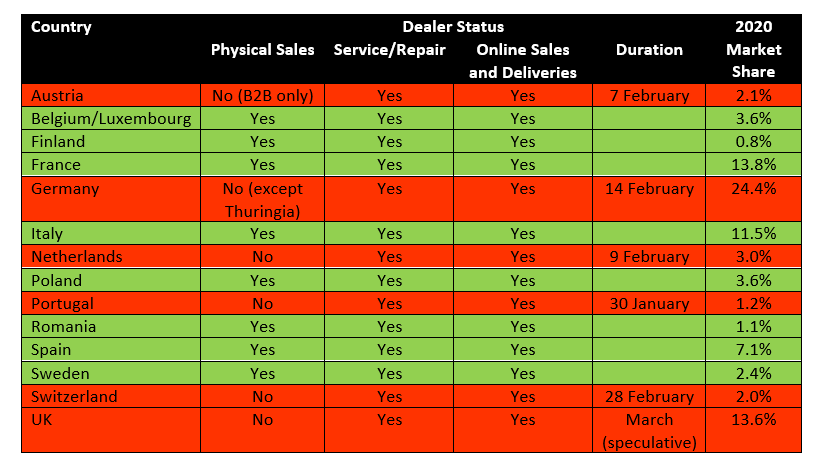

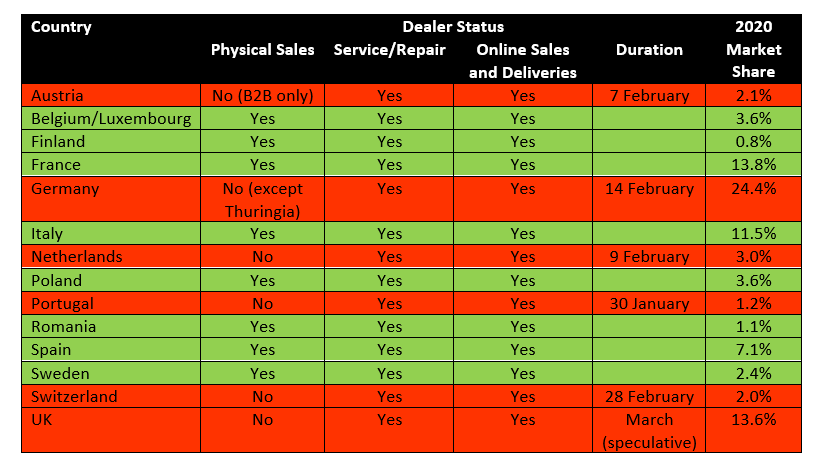

Physical closures across half of Europe

Six of the markets under review by Autovista Group are currently affected by restrictions on the physical sale of cars at dealerships; Austria, Germany, Netherlands, Portugal, Switzerland, and the UK. Based on 2020 new-car registrations, 46.3% of Europe’s car market, consisting of the EU and EFTA markets, as well as the UK, is impacted.

Germany is the largest market where dealers are subject to physical closures, recently extended until 14 February. This is despite the fact that ′wholesale and retail trade will remain open as far as possible. This includes grocery shops, pick-up and delivery services, beverage markets, pharmacies and drugstores, baby stores, medical and health-food stores, opticians, hearing-aid acousticians banks, post offices, dry cleaners and launderettes,’ clarified Andreas GeilenbrÜgge, head of valuations and insights at Schwacke.

Pick-up and delivery services do not apply to car dealers, although cars can still be collected in numerous states. ′Most dealers offer sales contact by phone/online and a delivery service for test drives and purchased vehicles. Interestingly, there is one state, Thuringia, that has been able to keep car dealerships open,’ added GeilenbrÜgge.

Collection restrictions

In the other markets where dealers face restrictions, cars ordered online can be delivered but limitations on collection vary.

For example, in Austria and Switzerland, ′the sale, handover and registration of a vehicle is still possible via click-and-collect but this has to be contactless,’ explained Robert Madas, Autovista Group valuations and insights manager, Austria and Switzerland.

Cars cannot be picked up, but can be delivered to a home or a public place in the Netherlands. However, ′there may be an extra measure, a curfew from 8:30pm to 4:30am, which could impact dealers in delivering new and used cars at the customer’s home or in a public place,’ commented Nico VanHalst, Autovista Group residual value manager, Netherlands.

The pick-up and collection of cars is still permissible across the UK, although this has only been possible from an outdoor location in Scotland since 16 January, with deliveries direct to customers the only option prior to this.

Dealer status, January 2021, and 2020 share of European new-car market

Germany is the largest market where dealers are subject to physical closures, recently extended until 14 February. This is despite the fact that ′wholesale and retail trade will remain open as far as possible. This includes grocery shops, pick-up and delivery services, beverage markets, pharmacies and drugstores, baby stores, medical and health-food stores, opticians, hearing-aid acousticians banks, post offices, dry cleaners and launderettes,’ clarified Andreas GeilenbrÜgge, head of valuations and insights at Schwacke.

Pick-up and delivery services do not apply to car dealers, although cars can still be collected in numerous states. ′Most dealers offer sales contact by phone/online and a delivery service for test drives and purchased vehicles. Interestingly, there is one state, Thuringia, that has been able to keep car dealerships open,’ added GeilenbrÜgge.

Collection restrictions

In the other markets where dealers face restrictions, cars ordered online can be delivered but limitations on collection vary.

For example, in Austria and Switzerland, ′the sale, handover and registration of a vehicle is still possible via click-and-collect but this has to be contactless,’ explained Robert Madas, Autovista Group valuations and insights manager, Austria and Switzerland.

Cars cannot be picked up, but can be delivered to a home or a public place in the Netherlands. However, ′there may be an extra measure, a curfew from 8:30pm to 4:30am, which could impact dealers in delivering new and used cars at the customer’s home or in a public place,’ commented Nico VanHalst, Autovista Group residual value manager, Netherlands.

The pick-up and collection of cars is still permissible across the UK, although this has only been possible from an outdoor location in Scotland since 16 January, with deliveries direct to customers the only option prior to this.

Dealer status, January 2021, and 2020 share of European new-car market

Dealers in Portugal are the latest casualty, with changes introduced on 15 January that included the closure of car dealers, except for online sales. The restrictions on physical transactions by dealerships are expected to be more short-lived than in other affected markets. ′The lockdown should end this week, on 30 January, as the maximum lockdown period allowed is 15 days and we are already in the second week,’ said Joao Areal, editorial manager of Autovista Group, Portugal.

′However, these measures were changed in the middle of the month and I think they will continue with a new 15-day lockdown period starting on 31 January,’ he added.

Registrations implications

Following double-digit declines in new-car registrations in Europe in 2020, the magnitude of the recovery in 2021 fundamentally depends on the duration and severity of restrictions to tackle COVID-19 and the accompanying economic impact. In markets where dealers are closed for physical car sales, a return to the year-on-year declines of about 30% seen in France and the UK in November, when lockdowns were in force, can be envisaged.

Even in markets where dealers remain open, demand may not fare much better in the short term. In Belgium for example, ′business volume looks rather disappointing, listening to dealers, despite what is loudly claimed. Forecasts are for a decline of 30% versus January last year, and the first quarter of 2021 should be down around 10% to 15%. The focus for brands is maintaining market share at all costs,’ commented Idesbald Vannieuwenhuyze, Autovista Group chief editor and valuations manager, Benelux.

However, ending on a more positive note, the development of online car-sales solutions, supported by ′click-and-collect’ services and home delivery and test drives, has dramatically reduced the impact on registrations, which suffered losses around 90% in many markets during the first wave of lockdowns in 2020. These measures also have a positive effect, even when dealer activity is not restricted, as consumers increasingly prefer to shop online than at a physical location, including for cars.

′Dealers have never been closed in Poland, but they still developed online solutions to reach more customers. For example, in Spring 2020, they offered vehicle delivery door-to-door to test and to buy. The bigger problem was the closure of registration offices, but this happened only at the beginning of 2020. The time to register used vehicles was also prolonged, but it did not block sales,’ commented Marcin Kardas, head of the Autovista Group editorial team in Poland.

Autovista Group has outlined its key predictions for the year ahead, focusing on new-car registrations, used-car demand and residual values, and tech advances.

A follow-up article will look in depth at the acceleration of online car sales during the pandemic.

Dealers in Portugal are the latest casualty, with changes introduced on 15 January that included the closure of car dealers, except for online sales. The restrictions on physical transactions by dealerships are expected to be more short-lived than in other affected markets. ′The lockdown should end this week, on 30 January, as the maximum lockdown period allowed is 15 days and we are already in the second week,’ said Joao Areal, editorial manager of Autovista Group, Portugal.

′However, these measures were changed in the middle of the month and I think they will continue with a new 15-day lockdown period starting on 31 January,’ he added.

Registrations implications

Following double-digit declines in new-car registrations in Europe in 2020, the magnitude of the recovery in 2021 fundamentally depends on the duration and severity of restrictions to tackle COVID-19 and the accompanying economic impact. In markets where dealers are closed for physical car sales, a return to the year-on-year declines of about 30% seen in France and the UK in November, when lockdowns were in force, can be envisaged.

Even in markets where dealers remain open, demand may not fare much better in the short term. In Belgium for example, ′business volume looks rather disappointing, listening to dealers, despite what is loudly claimed. Forecasts are for a decline of 30% versus January last year, and the first quarter of 2021 should be down around 10% to 15%. The focus for brands is maintaining market share at all costs,’ commented Idesbald Vannieuwenhuyze, Autovista Group chief editor and valuations manager, Benelux.

However, ending on a more positive note, the development of online car-sales solutions, supported by ′click-and-collect’ services and home delivery and test drives, has dramatically reduced the impact on registrations, which suffered losses around 90% in many markets during the first wave of lockdowns in 2020. These measures also have a positive effect, even when dealer activity is not restricted, as consumers increasingly prefer to shop online than at a physical location, including for cars.

′Dealers have never been closed in Poland, but they still developed online solutions to reach more customers. For example, in Spring 2020, they offered vehicle delivery door-to-door to test and to buy. The bigger problem was the closure of registration offices, but this happened only at the beginning of 2020. The time to register used vehicles was also prolonged, but it did not block sales,’ commented Marcin Kardas, head of the Autovista Group editorial team in Poland.

Autovista Group has outlined its key predictions for the year ahead, focusing on new-car registrations, used-car demand and residual values, and tech advances.

A follow-up article will look in depth at the acceleration of online car sales during the pandemic.

Germany is the largest market where dealers are subject to physical closures, recently extended until 14 February. This is despite the fact that ′wholesale and retail trade will remain open as far as possible. This includes grocery shops, pick-up and delivery services, beverage markets, pharmacies and drugstores, baby stores, medical and health-food stores, opticians, hearing-aid acousticians banks, post offices, dry cleaners and launderettes,’ clarified Andreas GeilenbrÜgge, head of valuations and insights at Schwacke.

Pick-up and delivery services do not apply to car dealers, although cars can still be collected in numerous states. ′Most dealers offer sales contact by phone/online and a delivery service for test drives and purchased vehicles. Interestingly, there is one state, Thuringia, that has been able to keep car dealerships open,’ added GeilenbrÜgge.

Collection restrictions

In the other markets where dealers face restrictions, cars ordered online can be delivered but limitations on collection vary.

For example, in Austria and Switzerland, ′the sale, handover and registration of a vehicle is still possible via click-and-collect but this has to be contactless,’ explained Robert Madas, Autovista Group valuations and insights manager, Austria and Switzerland.

Cars cannot be picked up, but can be delivered to a home or a public place in the Netherlands. However, ′there may be an extra measure, a curfew from 8:30pm to 4:30am, which could impact dealers in delivering new and used cars at the customer’s home or in a public place,’ commented Nico VanHalst, Autovista Group residual value manager, Netherlands.

The pick-up and collection of cars is still permissible across the UK, although this has only been possible from an outdoor location in Scotland since 16 January, with deliveries direct to customers the only option prior to this.

Dealer status, January 2021, and 2020 share of European new-car market

Germany is the largest market where dealers are subject to physical closures, recently extended until 14 February. This is despite the fact that ′wholesale and retail trade will remain open as far as possible. This includes grocery shops, pick-up and delivery services, beverage markets, pharmacies and drugstores, baby stores, medical and health-food stores, opticians, hearing-aid acousticians banks, post offices, dry cleaners and launderettes,’ clarified Andreas GeilenbrÜgge, head of valuations and insights at Schwacke.

Pick-up and delivery services do not apply to car dealers, although cars can still be collected in numerous states. ′Most dealers offer sales contact by phone/online and a delivery service for test drives and purchased vehicles. Interestingly, there is one state, Thuringia, that has been able to keep car dealerships open,’ added GeilenbrÜgge.

Collection restrictions

In the other markets where dealers face restrictions, cars ordered online can be delivered but limitations on collection vary.

For example, in Austria and Switzerland, ′the sale, handover and registration of a vehicle is still possible via click-and-collect but this has to be contactless,’ explained Robert Madas, Autovista Group valuations and insights manager, Austria and Switzerland.

Cars cannot be picked up, but can be delivered to a home or a public place in the Netherlands. However, ′there may be an extra measure, a curfew from 8:30pm to 4:30am, which could impact dealers in delivering new and used cars at the customer’s home or in a public place,’ commented Nico VanHalst, Autovista Group residual value manager, Netherlands.

The pick-up and collection of cars is still permissible across the UK, although this has only been possible from an outdoor location in Scotland since 16 January, with deliveries direct to customers the only option prior to this.

Dealer status, January 2021, and 2020 share of European new-car market

Dealers in Portugal are the latest casualty, with changes introduced on 15 January that included the closure of car dealers, except for online sales. The restrictions on physical transactions by dealerships are expected to be more short-lived than in other affected markets. ′The lockdown should end this week, on 30 January, as the maximum lockdown period allowed is 15 days and we are already in the second week,’ said Joao Areal, editorial manager of Autovista Group, Portugal.

′However, these measures were changed in the middle of the month and I think they will continue with a new 15-day lockdown period starting on 31 January,’ he added.

Registrations implications

Following double-digit declines in new-car registrations in Europe in 2020, the magnitude of the recovery in 2021 fundamentally depends on the duration and severity of restrictions to tackle COVID-19 and the accompanying economic impact. In markets where dealers are closed for physical car sales, a return to the year-on-year declines of about 30% seen in France and the UK in November, when lockdowns were in force, can be envisaged.

Even in markets where dealers remain open, demand may not fare much better in the short term. In Belgium for example, ′business volume looks rather disappointing, listening to dealers, despite what is loudly claimed. Forecasts are for a decline of 30% versus January last year, and the first quarter of 2021 should be down around 10% to 15%. The focus for brands is maintaining market share at all costs,’ commented Idesbald Vannieuwenhuyze, Autovista Group chief editor and valuations manager, Benelux.

However, ending on a more positive note, the development of online car-sales solutions, supported by ′click-and-collect’ services and home delivery and test drives, has dramatically reduced the impact on registrations, which suffered losses around 90% in many markets during the first wave of lockdowns in 2020. These measures also have a positive effect, even when dealer activity is not restricted, as consumers increasingly prefer to shop online than at a physical location, including for cars.

′Dealers have never been closed in Poland, but they still developed online solutions to reach more customers. For example, in Spring 2020, they offered vehicle delivery door-to-door to test and to buy. The bigger problem was the closure of registration offices, but this happened only at the beginning of 2020. The time to register used vehicles was also prolonged, but it did not block sales,’ commented Marcin Kardas, head of the Autovista Group editorial team in Poland.

Autovista Group has outlined its key predictions for the year ahead, focusing on new-car registrations, used-car demand and residual values, and tech advances.

A follow-up article will look in depth at the acceleration of online car sales during the pandemic.

Dealers in Portugal are the latest casualty, with changes introduced on 15 January that included the closure of car dealers, except for online sales. The restrictions on physical transactions by dealerships are expected to be more short-lived than in other affected markets. ′The lockdown should end this week, on 30 January, as the maximum lockdown period allowed is 15 days and we are already in the second week,’ said Joao Areal, editorial manager of Autovista Group, Portugal.

′However, these measures were changed in the middle of the month and I think they will continue with a new 15-day lockdown period starting on 31 January,’ he added.

Registrations implications

Following double-digit declines in new-car registrations in Europe in 2020, the magnitude of the recovery in 2021 fundamentally depends on the duration and severity of restrictions to tackle COVID-19 and the accompanying economic impact. In markets where dealers are closed for physical car sales, a return to the year-on-year declines of about 30% seen in France and the UK in November, when lockdowns were in force, can be envisaged.

Even in markets where dealers remain open, demand may not fare much better in the short term. In Belgium for example, ′business volume looks rather disappointing, listening to dealers, despite what is loudly claimed. Forecasts are for a decline of 30% versus January last year, and the first quarter of 2021 should be down around 10% to 15%. The focus for brands is maintaining market share at all costs,’ commented Idesbald Vannieuwenhuyze, Autovista Group chief editor and valuations manager, Benelux.

However, ending on a more positive note, the development of online car-sales solutions, supported by ′click-and-collect’ services and home delivery and test drives, has dramatically reduced the impact on registrations, which suffered losses around 90% in many markets during the first wave of lockdowns in 2020. These measures also have a positive effect, even when dealer activity is not restricted, as consumers increasingly prefer to shop online than at a physical location, including for cars.

′Dealers have never been closed in Poland, but they still developed online solutions to reach more customers. For example, in Spring 2020, they offered vehicle delivery door-to-door to test and to buy. The bigger problem was the closure of registration offices, but this happened only at the beginning of 2020. The time to register used vehicles was also prolonged, but it did not block sales,’ commented Marcin Kardas, head of the Autovista Group editorial team in Poland.

Autovista Group has outlined its key predictions for the year ahead, focusing on new-car registrations, used-car demand and residual values, and tech advances.

A follow-up article will look in depth at the acceleration of online car sales during the pandemic.