Dealers facing a myriad of challenges over the next five years

21 January 2019

21 January 2018

Dealers need to build a greater online presence for their dealership if they are to continue to be relevant. But in a rapidly evolving automotive market, our research shows they recognise this is far from being the only challenge cropping up in the near future.

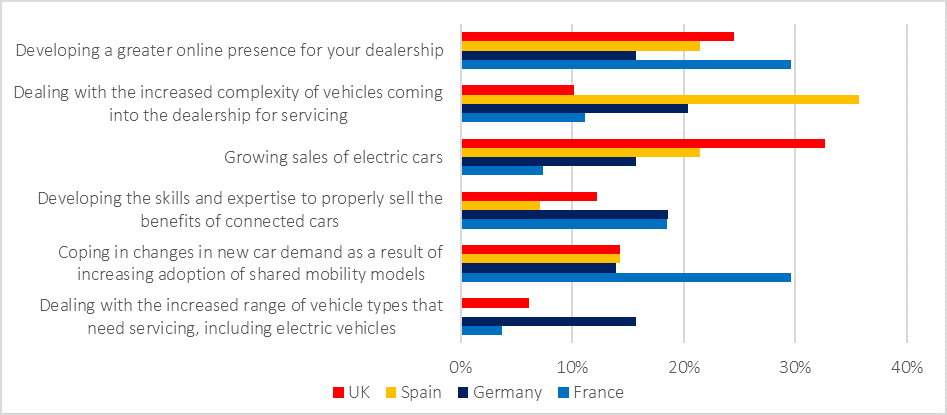

Research conducted by Autovista Intelligence in November and December 2018 asked dealers about the most important challenge facing the sector over the next 3-5 years. Some 19% of dealers across four countries (France, Germany, Spain and the UK) identified the need to increase their online presence. With consumers of all ages using the internet as the first port of call when researching a new purchase, dealers know that they have to embrace on this vital online market in order to attract buyers and sell vehicles at the best price.

However, almost as many respondents (18% of the sample) highlighted the challenges posed by growing sales of electric vehicles (EVs). They also noted that with the addition of greater ADAS and connected features, vehicles were becoming more complex to maintain, making it harder to provide services that satisfy the broad needs of the automotive mass market.

The advent of the connected car is also expected to pose problems within sales operations. By comparison with the most desirable optional extras in the past, such as leather seats and alloy wheels, connected features are relatively invisible and their benefits still poorly understood by consumers. If dealerships are to be able to maximise the revenue they gain from the connected car, then having staff that can clearly communicate those benefits to consumers will be critical.

Growing sales of EVs is regarded as much more of a priority in the UK, where one-third of respondents identified this as the major challenge for the mid-term. Following the emissions scandal, UK consumers are increasingly nervous about buying diesel, but do not yet view EVs as a viable alternative. In the midst of such uncertainty, they are preferring to delay any elective purchases.

How to adapt to new models of shared mobility was a concern for dealers in France, but this is still a relatively minor concern in other markets. This suggests that most dealers still regard shared mobility models to be in their infancy and unlikely to disrupt new car sales in the medium term. This is unlikely to change until vehicles with level 4 or 5 autonomy become a reality.

Dealers concerned about their online presence