‘Domestic uplift’ boosts carmakers’ market shares and residual values

28 July 2022

Autovista24 analysis reveals that carmakers benefit from a domestic uplift in terms of both new-car registrations and residual values (RVs), explains senior data journalist Neil King.

It comes as no surprise that carmakers typically command a high sales share of their home new-car markets. The ‘domestic uplift’ effect has a positive impact on RVs compared to other markets too.

However, high volumes on the used-car market do not help local brands to outperform their international rivals. In fact, a high fleet share is especially detrimental to RV performance.

Carmakers, therefore, have to strike the right balance between sales volumes, especially in the fleet sector, and flooding the used-car market, with a negative impact on prices.

French brands perform best at home

The latest figures from the French carmakers’ association, the CCFA, show that the Peugeot, Citroën, and Renault brands combined accounted for 41.8% of new-car registrations in the country in the first half of 2022. This is about three times higher than the 14.7% share the three brands captured across Europe, according to ACEA, the European Automobile Manufacturers’ Association.

Patriotism and supporting the domestic economy are likely key elements in this stark contrast. Yet domestic carmakers also often tailor to the design and equipment preferences of their compatriots. Local players also benefit from a more extensive dealer network and greater media exposure than their international competitors.

‘This is for national reasons, as it is for German brands in Germany, but is also because of the importance of their dealer network and fleet customers favour French brands over foreign rivals,’ commented Yoann Taitz, Autovista Group regional head of valuations and insights, France & Benelux.

Peugeot, Citroën, and Renault perform better in France than in Germany, Italy, and Spain. This analysis benchmarks the €RV forecast of brands, against their closest rivals, averaged over the past three months and represented as an index. The index is an aggregation of RV comparisons, which are built at the model and trimline level and adjusted for list-price differences.

€RV index of Peugeot, Citroën and Renault in France, Germany, Italy, and Spain

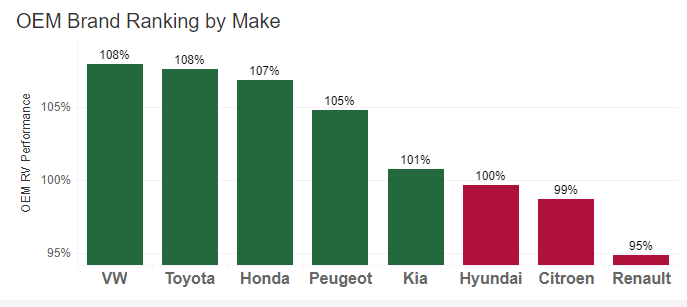

Although the RVs of brands benefit from a domestic uplift, this does not mean that they perform better than all their rivals. In France, the Hyundai and Kia brands have a higher benchmark index than Citroën and Renault, while Volkswagen (VW), Toyota and Honda all outperform Peugeot. VW benefits from being perceived as a near-premium brand and Toyota performs well because of its local manufacturing presence in France, as well as its focus on hybrid-electric vehicles (HEVs).

‘Plug-in hybrids (PHEVs) are bought 80% to 85% by fleet users, whereas HEVs are bought 80% by private users,’ Taitz noted. This also helps to explain the healthy €RV index of Toyota as used-car buyers are predominantly private buyers.

Fleet impact on RV performance

The fleet sector is crucial for the uptake of domestic cars in markets with an established automotive industry, such as France, Germany, and Italy.

‘Especially for fleets, big companies in France usually buy only French brands and do not let the user choose something else, in order to preserve the image of the company,’ noted Ludovic Percier, RV and market analyst, Autovista Group France.

This limitation does not apply to used-car buyers, but the fleet angle still impacts RVs and, along with other factors, still plays a key role in giving brands a domestic uplift. This is clear when considering the forecast residual-value performance of brands.

‘Values of vehicles with a high fleet share are impacted at 36 months. This is for instance the case for C-segment cars, which are much more popular in the fleet channel than among private buyers. If you compare the Peugeot 3008, which is an important fleet player, and a Toyota RAV4, which is much more popular with private buyers, the RVs of the RAV4 RVs are better than the 3008,’ Taitz added.

This is a case in point of how a high fleet share is damaging to a brand and/or model’s RV performance, especially if a high volume of de-fleeted vehicles floods the used-car market simultaneously.

€RV index of selected volume brands in France

Domestic uplift for Fiat and SEAT

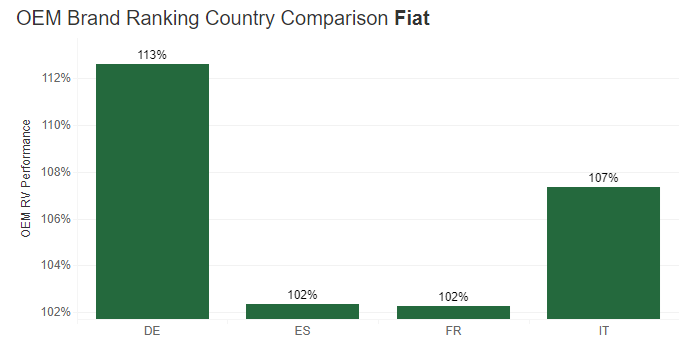

Fiat and SEAT also benefit from a domestic uplift in their respective home markets of Italy and Spain, although both brands achieve a higher €RV benchmark index in Germany, unlike Peugeot, Citroën, and Renault in France.

In contrast to the dominance of French brands at home, Fiat captured just 14.4% of the new-car market in Italy in the first half of 2022, according to the Italian carmakers’ association, ANFIA. This means that de-fleeting is less likely to impact Fiat’s RV performance, with the brand achieving a €RV benchmark index of 107% in Italy, compared to 102% in France and Spain. This is only surpassed by a score of 113% in Germany, where the Fiat 500 is especially popular. Nevertheless, Fiat scores lower than VW, Honda, and Toyota in Italy, the same as Peugeot in France, as well as Hyundai.

€RV index of Peugeot, Citroën and Renault in France, Germany, Italy, and Spain

In Spain, SEAT also benefits from a domestic uplift when it comes to RVs, with the brand scoring 98% compared to 93% and 95% in France and Italy, respectively, and a similar score in Germany. As in France and Italy, however, SEAT is outperformed by VW, Toyota, and Honda. Furthermore, Fiat, Renault, and Hyundai all have higher €RV index scores too.