Earning money with connected cars

31 July 2020

31 July 2020

As the automotive world embraces the connected car and the benefits the technology offers, Christof Engelskirchen, chief economist at Autovista Group, chats with David Coleman, director of automotive strategy at Deloitte, to discuss the most exciting developments and business cases for OEMs.

Q: The rise of the connected car is one of the automotive industry’s megatrends. What does the connected car mean for you?

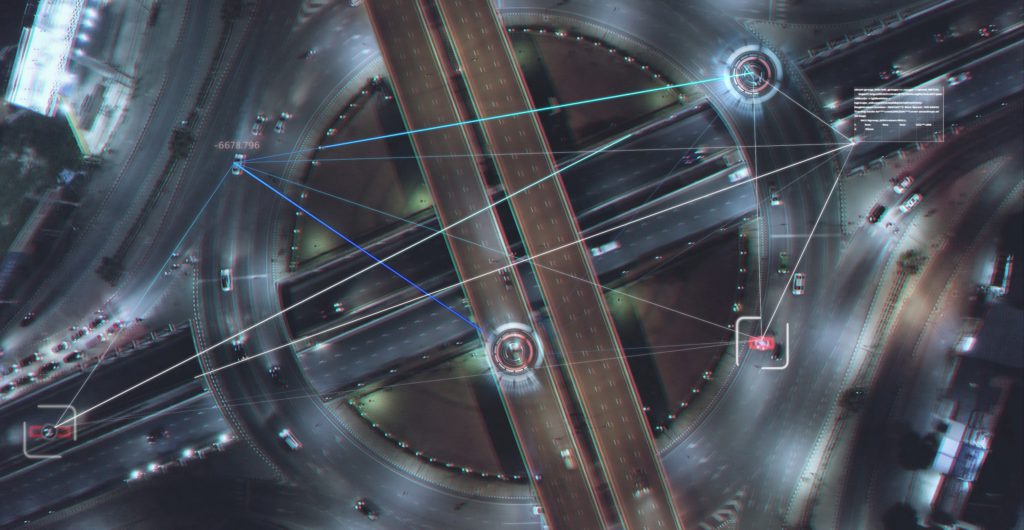

A: The connected car is one of the most exciting developments in vehicle technology in recent times. It enables data communication between the vehicle and the internet, as well as between the vehicle and infrastructure and/or other cars. Vehicle connectivity supports a range of services to the customer but is also critical to provide data to improve the vehicle, its systems and components.

Q: How do OEMs and suppliers approach the connected car? For example, many OEMs have adopted the Android Auto operating system (OS). Is this a good strategy?

A: A key battle in the automotive world is for ownership of the customer – i.e., the customer’s engagement, usage data, profile data, loyalty, etc. – and the battle is playing out between the tech giants and OEMs across OSs and services.

For OSs, OEMs need to choose between open-source solutions, such as Android Auto OS, or home-grown alternatives developed by the OEMs themselves. Open-source options offer speed to market, cost efficiency and a path towards potentially broader cooperation with tech giants. On the other hand, a home-grown OS offers complete customisation and control, and potentially broader monetisation options via Car as a Platform (CaaP). For example, OEMs could collect a fee from developers to build services on the OEM-owned platform and access customers directly, as well as take a commission on purchases made over the platform, or on in-app advertising.

Q: Have you calculated the business case for the connected car? What was the result?

A: The business case to invest in connected services is positive, but its value lies far beyond what is directly monetisable to the customer. Significant value is generated through connected sensors in the vehicle, measuring system and component performance, temperature, vibration, humidity, speed, and other data. AI and analytics techniques can use sensor data to help predict failures of systems and parts before they occur. Using this approach, OEMs can identify defects earlier in the vehicle lifecycle, fixing them in the factory, and limiting costly recalls. In one recent example, Deloitte helped Daimler generate savings in the tens of millions annually via connected sensor data analytics.

You can read the full interview with David Coleman here. In it, he talks about the end-use cases of connected cars and what data manufacturers can gather, as well as predicting the services that drivers may pay good money for, and discussing potential delays to the technology as the industry faces an economic crisis.