EU registrations likely to decline in 2019

22 February 2019

22 February 2019

Last year’s new car sales saw growth of just 0.1% across Europe, as a difficult diesel market and WLTP woes dragged the market down in the second half of 2018.

While vehicle supplies are starting to recover, evidenced by the modest decline of 1.6% in the UK in January 2019, the diesel market continues to be an enigma. Although diesel sales grew in Germany in January as supply improves, the decline in diesel demand across Europe is not being cancelled out by a rise in sales of petrol cars. Meanwhile, the alternative fuel vehicle (AFV) segment is still growing at a slow rate. Yet 2019 will see models from Audi, Daimler, Porsche, Volkswagen and more come to market, increasing options for car buyers.

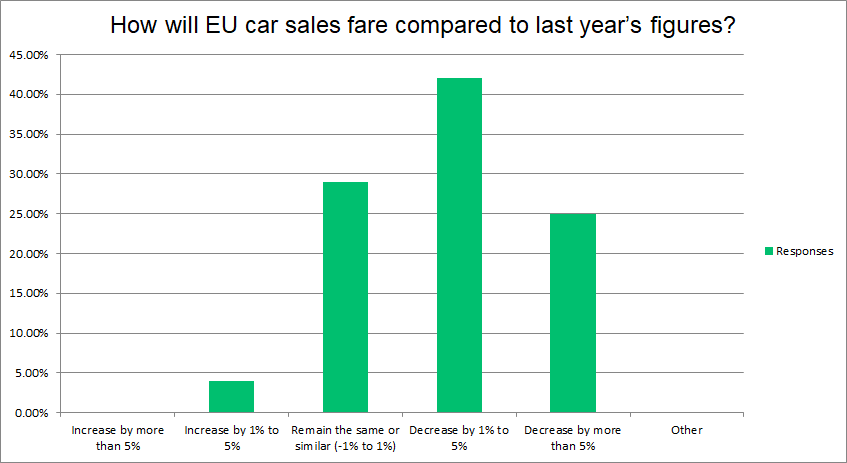

Therefore, there is no clear-cut answer to how registrations will pan out in Europe in 2019, with so many variables thrown into the mix. The European Automobile Manufacturers Association (ACEA) suggests that the market will stagnate, with sales close to the 15 million unit level of 2018. Autovista Group wanted the opinion of Daily Brief readers and therefore asked them how EU car sales would fare compared to 2018.

The majority (42%) felt that the market would suffer a small decline in 2019, of between 1-5%. This would be slightly at odds with ACEA’s prediction. However, this also seems like a plausible answer, with the declining diesel market dragging figures down. Petrol cars can only make up so much of the numbers, with slow AFV sales adding a small amount. The diesel decline is also likely due to drivers of the technology holding onto their cars for longer, therefore removing buyers from the market. Also, Brexit fears are causing financial fluctuations, meaning some, particularly in the UK, are likely to hold back on big purchases for the time being. Meanwhile, the German economy is slowing and Italy has fallen into technical recession.

With 29%, the next most popular choice was the market remaining the same, with movement of -1% to +1%. This is in line with ACEA forecasts and could be achievable with the increase in the AFV market and the clearing of the WLTP-induced backlog in the first few months of the year. This would counter predicted losses in diesel technology enough to bring sales in line with 2018 levels.

In a close third was a market decline of more than 5% compared to 2018, which garnered 25% of the vote. Should the trajectory of sales in the last months of 2018 continue, as was seen in January’s numbers, then such a decline could materialise. Nevertheless, with markets in flux, the second half of 2019 could see sales pick up, especially if electric models such as Audi’s e-tron and Daimler’s EQC prove popular.

Only 4% of respondents felt the European new car market would grow by 1-5% in 2019, highlighting the lack of confidence. With the number of challenges facing the industry, together with political and economic uncertainties, it is unlikely a large amount of growth will be seen.