EVs take 10% of European market share in Q3

05 November 2020

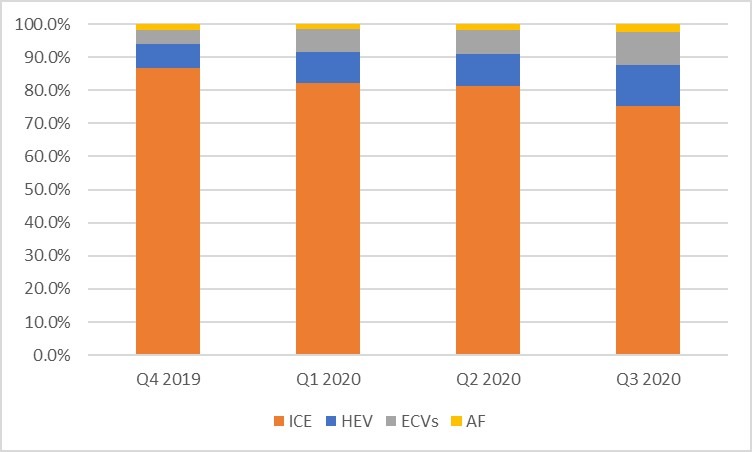

In the third quarter of 2020, almost one in 10 passenger cars sold in the EU was electrically-chargeable (9.9%), compared with 3% in the same period last year, according to the latest data from the European Automobile Manufacturers Association (ACEA). Cars driven by internal combustion engines (ICE), accounted for more than 75% of the market from July to September. However, this is down from the 88.6% share diesel and petrol commanded in the same period in 2019.

As green European coronavirus (COVID-19) recovery plans push for the adoption of less polluting transportation, more consumers are taking advantage of incentive schemes that promote electromobility. Accordingly, this has ′disadvantaged conventionally-powered vehicles,’ ACEA explained.

New-passenger cars in Europe by fuel type over last four quarters

Still leading the market

During Q3 2020, ICE-driven cars lost further ground as their overall market share dropped from 88.6% in July-September 2019, to 75.4% this year. Diesel cars accounted for 27.8% of total passenger car sales in the EU, with registrations sinking by 13.7% to 766,146 units.

Petrol sales posted an even stronger drop of 24.3%, going from over 1.7 million units in Q3 2019 to 1.3 million units in the same period this year. This represents a market share of 47.5%, with petrol going below the 50% mark for the first time since 2016. With the exception of Cyprus, all EU markets saw declines in demand for petrol cars during the three-month period. This included the four major markets: Germany (down 26.2%), France (down 23.2%), Italy (down 20.3%), and Spain (down 19.9%).

Three-digit increases

From July to September 2020, registrations of electrically-chargeable vehicles (ECV) more than tripled to reach 273,809 units and a market share of 9.9% (up 211.6%). According to ACEA, this strong growth is chiefly attributable to COVID-19 recovery incentives introduced by governments. The association states this has ′been largely to the benefit of buyers of battery and plug-in electric cars.’

Accordingly, demand for plug-in hybrids (PHEVs) has also soared in Q3, going from 29,557 units last year to 138,348 new cars sold in 2020 (up 368.1%). Both Germany and France recorded percentage increases of over 400% each, up 465.5% and 407.1% respectively. Growth in the registration of battery-electric vehicles (BEVs) was also strong across the EU (up 132.3%), totalling 135,461 units over the three-month period.

Hybrid-electric vehicles (HEVs) remained the bestselling alternatively-powered vehicle type in the EU, posting an increase of 88.8% in Q3 2020. In total, 341,092 hybrid-electric cars were sold from July to September 2020, representing 12.4% of the EU car market.

Alternative fuels

Demand for cars running on alternative fuels – ethanol (E85), liquid petroleum gas (LPG) and natural gas (NGV) – slowed down in the third quarter of 2020 (down 6.8%). However, this was at a more moderate pace compared to the previous quarter. This was mainly the result of declining sales of natural gas-fuelled cars (down 13.2%), while registrations of LPG vehicles remained almost unchanged (up just 0.8%).

All alternatively-powered vehicles (APVs) combined represented almost 25% of the EU car market in Q3 2020, with sales doubling from 337,108 units last year to 678,777 this year (up 101.4%). Among the four major markets, Germany (up 159.8%) and France (up 144.1%) posted the biggest increases, mainly driven by strong sales of plug-in hybrids, followed by Italy (up 60.3%) and Spain (up 51.6%)