Facing autonomous disillusionment

18 September 2020

18 September 2020

A growing number of stakeholders has begun to address the legal, ethical and technological challenges around autonomous vehicles. The limited-use cases for autonomously driving vehicles may prove to be even more challenging. Autovista Group’s chief economist, Christof Engelskirchen, covers the top five issues with autonomous technology from a use case perspective and what level’ of autonomy we should expect in our next vehicle.

The electric car, the connected car, the autonomous car, all great ideas take time. Like the battery-electric vehicle (BEV) that was conceived in the 1880s. Some 140 years later and it is far from being a breakthrough success. On that basis, the self-driving car still has around 132 years to go, if you consider 2012 as the starting point of the autonomous revolution. In that year, it became legal for Google’s autonomous car to drive on the roads of Nevada under one condition: a human driver had to be on board.

Since then, a lot has happened with respect to technology and legislation. A completely new universe of high-tech companies, traditional car manufacturers, suppliers and startups has emerged around autonomous driving technology (Figure 1).

Figure 1: Participating and exhibiting companies at Automotive Lidar 2020, 22-24 September

This impressive line-up of companies has made strong progress in driving technological development and standards forward. However they have not yet been able to overcome the autonomous disillusionment we are facing collectively as an industry, namely that autonomous cars have a limited-use case for the near future. So what are the top five issues from a use case perspective?

This impressive line-up of companies has made strong progress in driving technological development and standards forward. However they have not yet been able to overcome the autonomous disillusionment we are facing collectively as an industry, namely that autonomous cars have a limited-use case for the near future. So what are the top five issues from a use case perspective?

- The full Level 5 autonomous vehicle, in other words, a vehicle that does not have a steering wheel and never requires an intervention from a driver, is science fiction. There will always be circumstances where intervention from the driver will be required. Fog, rain, snow, lack of connectivity, other non-autonomous traffic, emergencies and peculiar traffic situations beyond the norm (such as passing the Arc de Triomphe in Paris) represent obstacles that have pushed Level 5 off the technology roadmap.

- If driver intervention is still required, the cost for autonomous-driving technology comes on top of everything else. A combination of LiDARs, cameras, radar systems anddriver-monitoring technology will be required. At present, this means a medium-to-high five-digit figure of additional expenses will be added to the bill. In addition, the commercial vehicle fleet, including buses, trucks and taxis, will need to continue to pay a driver.

- The business case for the autonomous car in a commercial setup only works if you can take the driver out of the equation. That requires Level 4 autonomous technology, where no driver intervention is required in specific areas; e.g. driving a certain route on the highway or on a campus would be possible, even in cities with very specific routes. Legally, and from a certification perspective, there will be performance and safety standards that need to be met. There cannot be performance differences at Level 4 autonomous technology. Just to reiterate, if the car is on a Level 4 route or in a Level 4 area, there is no driver required. That means that the car needs to fully manage any upcoming challenges or emergencies independently. There is no human intervention on a Level 4 route or in a Level 4 area. Once this cannot be guaranteed, you are effectively talking about Level 3 autonomous driving.

- Physical lane separation will likely be a requirement for the coming years of Level 4 autonomous technology. Any unnecessary challenges will need to be avoided (for example, a non-Level 4 vehicle driver interfering with a Level 4 vehicle) both for safety reasons but also as they would disrupt the flow. A physically separated lane, that hosts Level 4 vehicles exclusively, is expensive. Dubai is considering establishing such a system as an addition to its public transport infrastructure. A train on rails would serve the same purpose.

- Level 3 technology ‘a system where intervention from a driver may be required’ is questionable as a concept. Asking drivers to monitor an autonomous driving system could be a stretch. Imagine dosing off while driving 130 km/h on a highway when an engagement request suddenly sounds. This hypothetical situation may leave drivers feeling unsafe. Not to mention questioning whether they would be willing to pay a medium-to-high five-digit Euro premium to equip such a system? Moreover, what would that mean for used-car values? For those reasons, Level 3 is currently not a concern for many OEMs. Level 4 is and Level 3 could be a spin-off, as it would not make sense to develop a Level 3 system as a stand-alone technology.

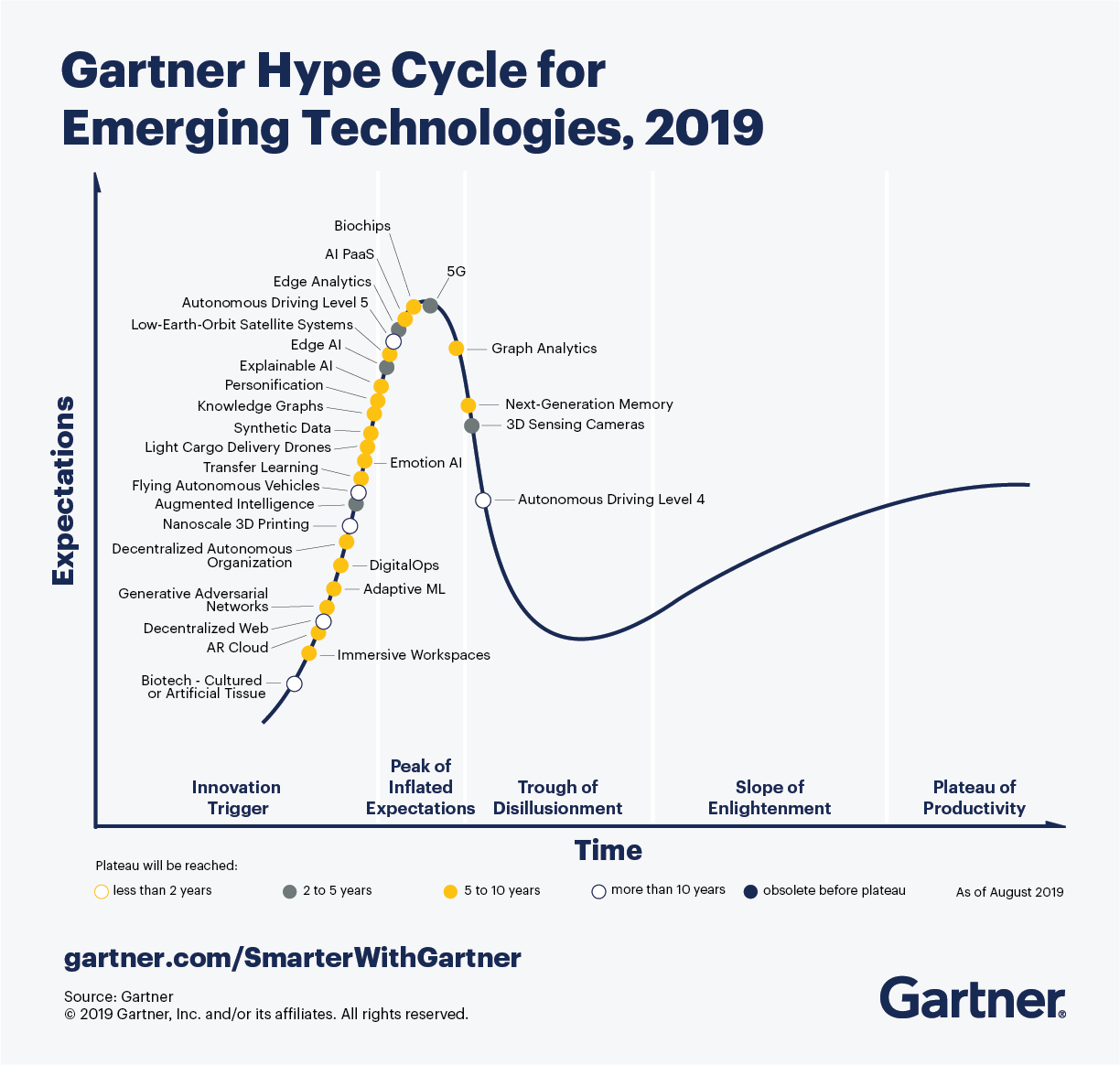

Gartner publishes a hype cycle for emerging technologies (Figure 2). Last year’s curve already shows Autonomous Driving Level 4 is post-hype and Level 5 almost at its peak. In their next update, the disillusionment might be even more visible.

Figure 2: Gartner Hype Cycle for Emerging Technologies 2019

To conclude, autonomous driving Level 4 is the desirable technology as there are business cases that could work.

To conclude, autonomous driving Level 4 is the desirable technology as there are business cases that could work.

Take the following example. A non-autonomous truck delivers goods to a hub, where the trailer is hooked to a Level 4 truck. That truck drives a distance of 500-1,000km in a dedicated lane, autonomously and without a driver, to the next hub. From there, a non-autonomous truck delivers the goods to the final destination. On university campuses,factory sites, or places like airports, transport could be organised with Level 4 people movers. For private individuals and their vehicles, consumers can look forward to improved ADAS, or Level 2+ technologies as expensive features: for example a 60km/h hands-offsteering wheel and eyes-off-road traffic jam assistant.

Autonomous cars will continue to be insured by the vehicle holder

Under the scenarios described above, cars with autonomous features will continue to be insured as individual vehicles by the holder of the vehicle. That system has proven to be highly effective. Suing an OEM, or one of the many suppliers, in an attempt to hold them liable for causing an accident is not what the holder of the vehicle or victim of the accident should be concerned with; insurers should pursue that route and they already do.

With Level 2+ features or further advanced driver-assistance systems, differentiation is possible between one OEM and another. These features will also impact the ability to remarket the vehicle, the most important building block for any leasing rate. Furthermore, it will be of interest for those looking at total cost of ownership optimisation for their fleet.