Germany: The first half of 2019 from a residual value perspective

06 September 2019

Germany: The first half of 2019 from a residual value perspective

6 September 2019

By Andreas GeilenbrÜgge, Head of Valuations & Insights, Schwacke

Now that the first half of the year has passed and the summer break is over, it is worth taking a look at the development of the used car market in Germany. With the diesel and WLTP crisis years of 2017 and 2018 behind us, we expected calmer waters in 2019. And this – at least as far as we can tell so far – has transpired.

Diesel – No whining, but at a low level

The classically considered three-year-old used cars are more relaxed as far as diesels are concerned as their downward trend has slowed significantly. This is, as suspected, not least because of the diminishing supply of fleet cars from 2016 entering the used car market. However, the decreasing surplus of tactical[1] diesel registrations has markedly reduced the price pressure on older cars because of the lower amount of cheap very young used cars. Statistically, in 2017 and 2018, it only took a month longer for all of the previous year’s tactical diesel registrations to change hands. This could only be achieved with appropriate manufacturer and dealer concessions on prices. This year, on the other hand, the current rate of change of ownership of the cars first registered in 2018 is approaching pre-crisis levels again and they are, accordingly, achieving better prices. This is especially because in 2018, only three quarters of the already lower volume of tactical diesel registrations were generated and they consequently reached their lowest level since 2009. This is also good for used diesels that are two, three or four years old, the price levels of which – with lowering stock days – climbed in the first months of the year and even in the summer.

Petrol – rising volumes say it all

Petrol cars have a similarly animated, albeit different development behind them. They were able to further increase their price level in 2017, ahead of the diesel crisis, and defend against diesels in 2018 but they have been under pressure again since the middle of last year at the latest. This was mainly due to the increasing volumes of de-fleeted cars between 2013 and 2016 but also because of the sharp rise in the volume of tactical petrol registrations due to the crisis. More than twice as many petrol cars, usually no more than 12 months old, were delivered to used-car buyers than diesel cars (the pre-crisis ratio was about 1.3:1). And that coincided with a simultaneous increase in total volumes. In the meantime, the same is happening to two-year-old used petrol cars, which is also affecting three- and four-year-old cars returning to the market that now have to contend with slightly declining prices and longer stock days.

Full-hybrids – A future with obstacles

The real crisis winners from a residual value perspective are full hybrids. With the exception of a small weakness at the end of 2017 and beginning of 2018, they have consistently been able to increase their average price level and are still in positive territory this year. This is of course also because of the increasing influx of SUVs with strong residual values. The volume growth of used hybrids of different ages, predominantly Asian models, has been well received by the used market so far, with stock days at their lowest among cars with alternative powertrains.

The current obvious advantage over other “electrified” models (plug-in hybrids and battery electric models) means hybrids will also be an investment for the future. Their success among buyers driven by environmental concerns should not change significantly given their lack of dependence on a charging infrastructure. The conversion to these “plug-less” models is also very simple for former drivers of cars with combustion engines: you refuel as before, without having to charge. Their plug-in hybrid “siblings” have, on paper, significantly lower fuel consumption and emissions levels, which could make a difference to the detriment of full hybrids when it comes to future decisions on driving bans. However, such decisions are only likely to take effect in 2025-2030 and so today's buyers of three-year and older used hybrids will hardly be affected. Nevertheless, there is always a difference as far as the so-called “environmental bonus” and reduced company car tax is concerned, whereby full hybrids lose out due to their emissions and lower pure-electric range.

Electrics – the plug provides the thrust

The picture for previously mentioned plug-in hybrid and battery electric models, in addition to even rarer fuel types, is still quite indifferent as it is determined by the continued low market volumes and limited competition. The initial benefit from the crisis-driven weakness of petrol and diesel cars is overlaid with a more pronounced life-cycle development and is also associated with the advances in battery technology. In addition, the significant increase in fleet and tactical registrations is also having an effect. The latter are no longer adequately absorbed in the used car market, especially as far as electric vehicles are concerned. A significant proportion of electric vehicles appear to leave the country before being remarketed and the rest are plagued by relatively high average stock days. The state subsidies for buying new cars have only a slight effect on used car buyers, if at all, from the residual value perspective and can even be counterproductive. The reduced company car tax is uninteresting for used cars that are predominantly purchased and used privately and new car discounts, like the environmental bonus, tend to have a negative effect on resale prices due to the “cheap when buying new” message.

Stay positive– there's always something

The German used car market is stable overall in terms of volumes and price levels, albeit with a slight downward trend with the growing proportion of very young vehicles. Together with the less optimistic economic growth data that has been announced and stable to rising volume supply from the “used car producers” such as fleet and tactical registrations, there is a somewhat clouded outlook for the remainder of the year.

We see a steady increase in the car rental share, which appears to be partly substituting the trade channel. A tendency towards so-called tactical commercial registrations is also perceptible – these appear as company cars in the statistics but are only held for a short amount of time and, in turn, appear on the market as well-subsidised very young used cars. Furthermore, tactical registrations were at a seasonally unusual absolute level in July, which is reminiscent of last year’s WLTP-related market distortions ahead of the Euro 6d Temp Evaporative Emission Control System (EVAP) requirement.

A glimmer of hope is provided by soft factors such as the weakening diesel discussion, the legal approval of hardware retrofitting and positive news on the increased expansion of the charging infrastructure.

But who said 2019 would be easy?

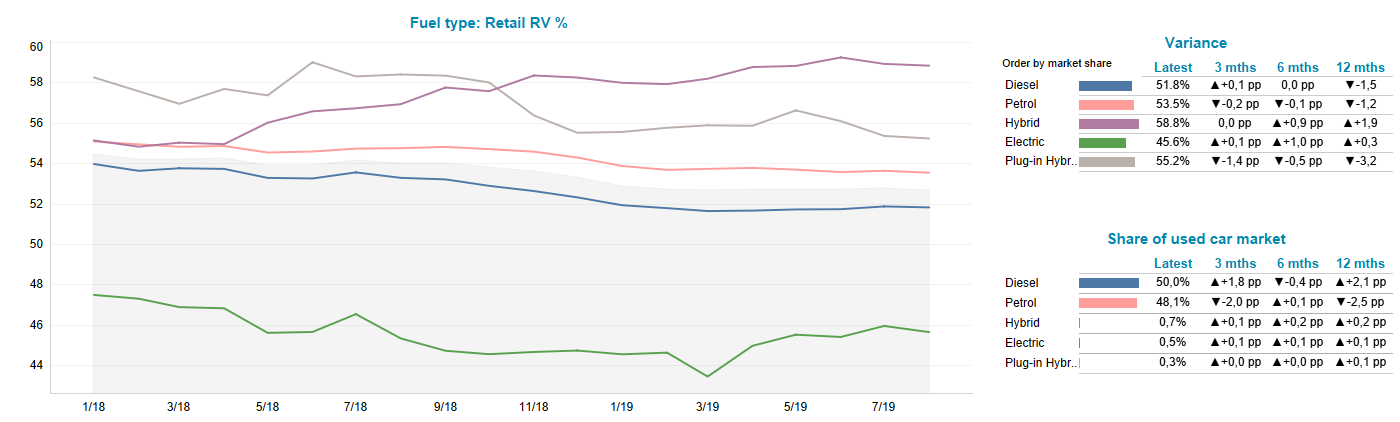

Germany, residual values by fuel type, retail percentage, 36 months/60,000km

Source: Residual Value Intelligence, Autovista Group

[1] Sum of manufacturer, trade and rental new car registrations