Germany: November new-car registrations drop indicating poor second half

03 December 2020

3 December 2020

A total of 290,150 new-passenger cars were registered in Germany in November 2020, down by 3% on the same month last year. Holding a market share of 39.4%, the number of private registrations increased by 22.8%, while those for commercial slumped by 14.7%.

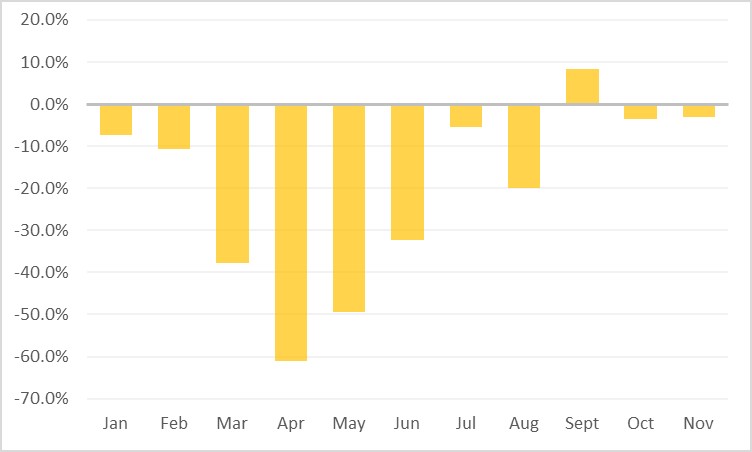

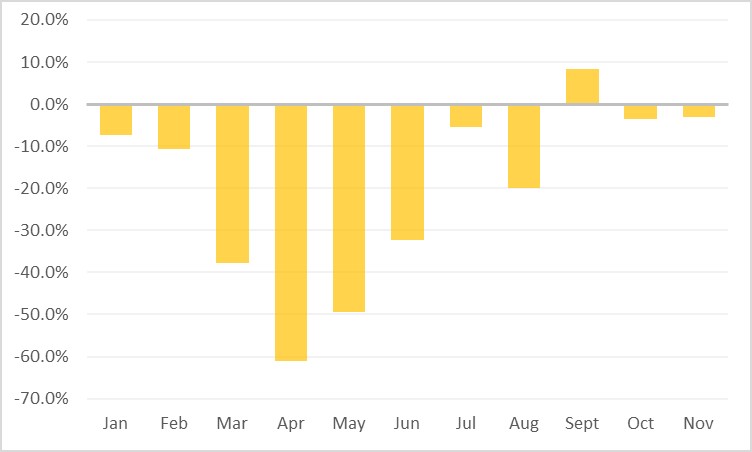

The latest figures from the Kraftfahrt-Bundesamt (KBA) reveal another month of decline for Germany after new-car registrations fell by 3.6% in October. While these drops are far smaller than the plunges seen in the first half of the year, it puts to bed any hopes of a more positive second half after a promising 8.4% rise in September. A total of 3,181,846 new vehicles were registered up to and including November, down 18.7% compared to the same period in 2019.

The decline in Germany is smaller than those seen in France, Spain and Italy during November, mainly thanks to the country’s lighter lockdown which allowed dealerships to remain open. France imposed closures, while Italy and Spain saw regional restrictions throughout the month.

New-car registrations, Germany, year-on-year percentage change, January to November 2020

Data source: KBA

Vehicle types and drives

With a share of 22.4%, SUVs continued to hold a commanding portion of the market, although this was despite a decrease of 1.7%. Compact vehicles in the C-segment followed shortly after accounting for 19% of the market, down 8.5 %. The smaller B-segment increased its market share by 12.6% to 15.9%.

Minivans experienced a drop of more than 20%, while motorhomes saw a boom in registrations, up 110.8%. Some 10,492 new motorcycles also brought the two-wheeler market a significant increase of 133.8% last month. The commercial vehicle sector saw some positive developments, with a 22.5% increase in new tractors, buses up 11.6%, and trucks up 3.8%.

Following an apparent trend, alternative drivetrains did see another boom in November compared with the same month in 2019. New battery-electric vehicles (BEVs) soared by 522.8% with 28,965 units registered. A total of 71,904 hybrids drove an increase of 177.2%, including 30,621 plug-in hybrids (PHEVs), which achieved an increase of 383.4%. Liquid and natural gas together achieved an increase of 51.9%, securing a market share of 0.5%.

Petrol still commanded the largest market share at 40.4%, but with a drop of 32.3% when compared to November 2019. Meanwhile, diesel fell to a market share of 24.3% after a drop in registrations of 25.2%. Average CO2 emissions fell by 18.8% to 126.2 g/km.

Brand performance

Among the German brands, Opel (up 17.1%), Audi (up 3.1%) and Mercedes (up 0.5%) all achieved increases in registrations. Meanwhile, Smart (down 49.2%), VW (down 18.4%) and Ford (down 15.8%) all saw double-digit declines in registrations. With 17.6% of the market, VW again achieved the largest share of new registrations.

Imported brands saw a largely positive November. Double-digit increases of more than 30% were recorded for Tesla (up 500%), Fiat (up 42.7%) and Toyota (up 33.1%). Registrations for Renault (up 29.2%) and Citroen (up 28.6%) also rose by more than 20%. In contrast, Ssangyong (down 48.0%), Jaguar (down 34.8%), Mitsubishi (down 27.0%), Alfa Romeo (down 21.9%) and SEAT (down 21.6%) all saw double-digit declines. The largest share of new registrations among the imported brands was recorded by Skoda with 5.9%.

As the automotive industry continues to fight coronavirus (COVID-19), work with tightening regulations, and adapt to new technologies, the German government announced in November it is considering a €2 billion aid package for the sector. With the funds slated to help carmakers and industry suppliers make the switch to greener engines and automated driving, this money could help the industry during a difficult period.

Data source: KBA

Vehicle types and drives

With a share of 22.4%, SUVs continued to hold a commanding portion of the market, although this was despite a decrease of 1.7%. Compact vehicles in the C-segment followed shortly after accounting for 19% of the market, down 8.5 %. The smaller B-segment increased its market share by 12.6% to 15.9%.

Minivans experienced a drop of more than 20%, while motorhomes saw a boom in registrations, up 110.8%. Some 10,492 new motorcycles also brought the two-wheeler market a significant increase of 133.8% last month. The commercial vehicle sector saw some positive developments, with a 22.5% increase in new tractors, buses up 11.6%, and trucks up 3.8%.

Following an apparent trend, alternative drivetrains did see another boom in November compared with the same month in 2019. New battery-electric vehicles (BEVs) soared by 522.8% with 28,965 units registered. A total of 71,904 hybrids drove an increase of 177.2%, including 30,621 plug-in hybrids (PHEVs), which achieved an increase of 383.4%. Liquid and natural gas together achieved an increase of 51.9%, securing a market share of 0.5%.

Petrol still commanded the largest market share at 40.4%, but with a drop of 32.3% when compared to November 2019. Meanwhile, diesel fell to a market share of 24.3% after a drop in registrations of 25.2%. Average CO2 emissions fell by 18.8% to 126.2 g/km.

Brand performance

Among the German brands, Opel (up 17.1%), Audi (up 3.1%) and Mercedes (up 0.5%) all achieved increases in registrations. Meanwhile, Smart (down 49.2%), VW (down 18.4%) and Ford (down 15.8%) all saw double-digit declines in registrations. With 17.6% of the market, VW again achieved the largest share of new registrations.

Imported brands saw a largely positive November. Double-digit increases of more than 30% were recorded for Tesla (up 500%), Fiat (up 42.7%) and Toyota (up 33.1%). Registrations for Renault (up 29.2%) and Citroen (up 28.6%) also rose by more than 20%. In contrast, Ssangyong (down 48.0%), Jaguar (down 34.8%), Mitsubishi (down 27.0%), Alfa Romeo (down 21.9%) and SEAT (down 21.6%) all saw double-digit declines. The largest share of new registrations among the imported brands was recorded by Skoda with 5.9%.

As the automotive industry continues to fight coronavirus (COVID-19), work with tightening regulations, and adapt to new technologies, the German government announced in November it is considering a €2 billion aid package for the sector. With the funds slated to help carmakers and industry suppliers make the switch to greener engines and automated driving, this money could help the industry during a difficult period.

Data source: KBA

Vehicle types and drives

With a share of 22.4%, SUVs continued to hold a commanding portion of the market, although this was despite a decrease of 1.7%. Compact vehicles in the C-segment followed shortly after accounting for 19% of the market, down 8.5 %. The smaller B-segment increased its market share by 12.6% to 15.9%.

Minivans experienced a drop of more than 20%, while motorhomes saw a boom in registrations, up 110.8%. Some 10,492 new motorcycles also brought the two-wheeler market a significant increase of 133.8% last month. The commercial vehicle sector saw some positive developments, with a 22.5% increase in new tractors, buses up 11.6%, and trucks up 3.8%.

Following an apparent trend, alternative drivetrains did see another boom in November compared with the same month in 2019. New battery-electric vehicles (BEVs) soared by 522.8% with 28,965 units registered. A total of 71,904 hybrids drove an increase of 177.2%, including 30,621 plug-in hybrids (PHEVs), which achieved an increase of 383.4%. Liquid and natural gas together achieved an increase of 51.9%, securing a market share of 0.5%.

Petrol still commanded the largest market share at 40.4%, but with a drop of 32.3% when compared to November 2019. Meanwhile, diesel fell to a market share of 24.3% after a drop in registrations of 25.2%. Average CO2 emissions fell by 18.8% to 126.2 g/km.

Brand performance

Among the German brands, Opel (up 17.1%), Audi (up 3.1%) and Mercedes (up 0.5%) all achieved increases in registrations. Meanwhile, Smart (down 49.2%), VW (down 18.4%) and Ford (down 15.8%) all saw double-digit declines in registrations. With 17.6% of the market, VW again achieved the largest share of new registrations.

Imported brands saw a largely positive November. Double-digit increases of more than 30% were recorded for Tesla (up 500%), Fiat (up 42.7%) and Toyota (up 33.1%). Registrations for Renault (up 29.2%) and Citroen (up 28.6%) also rose by more than 20%. In contrast, Ssangyong (down 48.0%), Jaguar (down 34.8%), Mitsubishi (down 27.0%), Alfa Romeo (down 21.9%) and SEAT (down 21.6%) all saw double-digit declines. The largest share of new registrations among the imported brands was recorded by Skoda with 5.9%.

As the automotive industry continues to fight coronavirus (COVID-19), work with tightening regulations, and adapt to new technologies, the German government announced in November it is considering a €2 billion aid package for the sector. With the funds slated to help carmakers and industry suppliers make the switch to greener engines and automated driving, this money could help the industry during a difficult period.

Data source: KBA

Vehicle types and drives

With a share of 22.4%, SUVs continued to hold a commanding portion of the market, although this was despite a decrease of 1.7%. Compact vehicles in the C-segment followed shortly after accounting for 19% of the market, down 8.5 %. The smaller B-segment increased its market share by 12.6% to 15.9%.

Minivans experienced a drop of more than 20%, while motorhomes saw a boom in registrations, up 110.8%. Some 10,492 new motorcycles also brought the two-wheeler market a significant increase of 133.8% last month. The commercial vehicle sector saw some positive developments, with a 22.5% increase in new tractors, buses up 11.6%, and trucks up 3.8%.

Following an apparent trend, alternative drivetrains did see another boom in November compared with the same month in 2019. New battery-electric vehicles (BEVs) soared by 522.8% with 28,965 units registered. A total of 71,904 hybrids drove an increase of 177.2%, including 30,621 plug-in hybrids (PHEVs), which achieved an increase of 383.4%. Liquid and natural gas together achieved an increase of 51.9%, securing a market share of 0.5%.

Petrol still commanded the largest market share at 40.4%, but with a drop of 32.3% when compared to November 2019. Meanwhile, diesel fell to a market share of 24.3% after a drop in registrations of 25.2%. Average CO2 emissions fell by 18.8% to 126.2 g/km.

Brand performance

Among the German brands, Opel (up 17.1%), Audi (up 3.1%) and Mercedes (up 0.5%) all achieved increases in registrations. Meanwhile, Smart (down 49.2%), VW (down 18.4%) and Ford (down 15.8%) all saw double-digit declines in registrations. With 17.6% of the market, VW again achieved the largest share of new registrations.

Imported brands saw a largely positive November. Double-digit increases of more than 30% were recorded for Tesla (up 500%), Fiat (up 42.7%) and Toyota (up 33.1%). Registrations for Renault (up 29.2%) and Citroen (up 28.6%) also rose by more than 20%. In contrast, Ssangyong (down 48.0%), Jaguar (down 34.8%), Mitsubishi (down 27.0%), Alfa Romeo (down 21.9%) and SEAT (down 21.6%) all saw double-digit declines. The largest share of new registrations among the imported brands was recorded by Skoda with 5.9%.

As the automotive industry continues to fight coronavirus (COVID-19), work with tightening regulations, and adapt to new technologies, the German government announced in November it is considering a €2 billion aid package for the sector. With the funds slated to help carmakers and industry suppliers make the switch to greener engines and automated driving, this money could help the industry during a difficult period.