Germany plans to reduce the tax on electric vehicles used as company cars

31 July 2018

31 July 2018

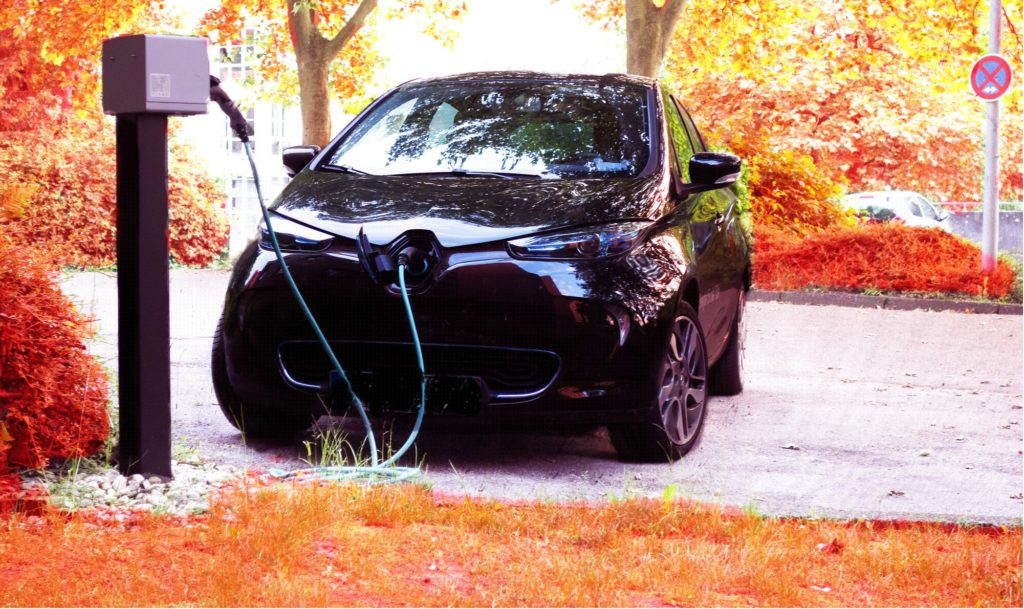

Germany’s coalition government wants to boost the numbers of electric and hybrid vehicles used as company cars by increasing incentives through their taxation.

Currently, an employee who uses his company car privately is taxed 1% of the list price. The government plans for this to be halved to 0.5% for electric and hybrid cars purchased or leased from 1 January 2019 through to 31 December 2021. The cabinet is expected to discuss this new bill in the coming week.

For electric vehicles (EVs), the current rule is considered financially unattractive because of a previously higher initial cost of purchase. The country is seeing an increase in sales, with around 17,000 new EVs registered in the first half of 2018, an increase of almost 70% compared with the same period last year. However, this represents a market share of just 0.9%. At the beginning of the year, only a small number of EV premiums had been applied for.

The diesel vehicle is still the most popular choice of company car in Germany. Although overall registrations of vehicles fuelled by diesel have declined over the last few months, in line with other European markets, demand continues to be largely driven by commercial customers who buy for their fleets and therefore the company car market is more resilient to such sales drops.

′We need another powerful boost in electric mobility,’ said SPD parliamentary vice Sören Bartol. ′With the tax incentives for e-service cars, the entry into the mass market can succeed.’

However, FDP politician Oliver Luksic has criticised the planned step, suggesting that instead of spending money of offering further subsidies to the few, the government should instead be looking at increasing the charging infrastructure nationwide to drive EV sales.

There are currently around 13,500 public and partially public charging points at around 6,700 charging stations across the country according to the BDEW. Compared to the end of June 2017, this is an increase of about 25%.

With Germany aiming to have one million EVs on the roads by 2020, the charging infrastructure and sales market are growing at too slow a rate. It is now believed that this ambitious target is no longer possible to achieve.

Stefan Kapferer, chairman of the BDEW, said: The energy industry is continuing to push the expansion of charging stations, even though it is by no means profitable given the small numbers of electric cars on the roads today. However, it is an investment in the future.

′If electric mobility in Germany is to make its breakthrough over the next few years, the automotive industry will finally have to launch models that can compete in terms of price and performance with petrol and diesel models.’