Gestamp plans IPO in Europe

14 March 2017

14 March 2017

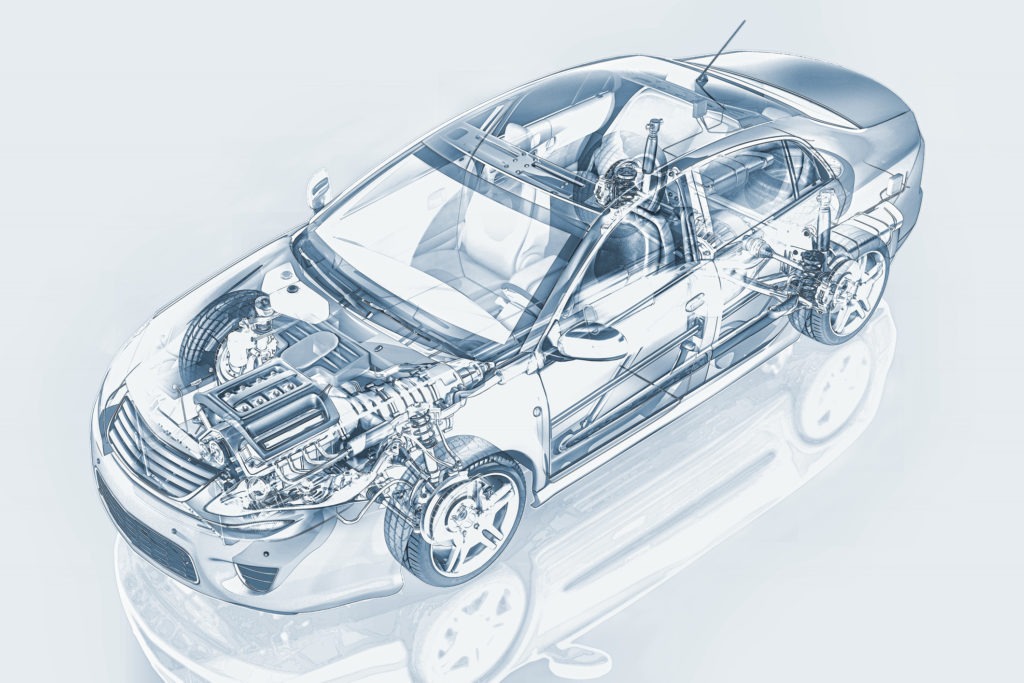

Car parts maker Gestamp is set to float its shares in Spain in the biggest initial public offering (IPO) so far this year. This could be a source for helping boost the supplier base in the UK after Britain leaves the EU.

Supplying parts from bodywork to door hinges for more than 800 models for OEMs including Volkswagen and Renault, it aims to sell at least 25% of its shares, valued at around €3.7 billion. This makes it the largest European IPO so far this year by both market capitalisation and amount raised.

Pre-tax profit last year rose by 37.7% to €348 million, with revenues up 7.3% to €7.5 billion.

The Riberas family wholly owned the business until last year, when it sold a 12.5% stake to Japan’s Mitsui. Gestamp chairman and CEO Francisco J Riberas said the float will allow the group to raise more money, raise its profile and attract more workers. It was formed in 1997 from several small companies that stamped car parts from sheet metal, creating Spain’s largest steel business.

Parts suppliers are in the spotlight due to increasing momentum to boost the component base in the UK to minimise any tariffs after Brexit. Gestamp became the first major automotive supplier to announce investment in the UK after the Brexit vote, when in September it announced a new £70 million stamping plant in Staffordshire, UK with clients including Jaguar Land Rover and BMW.