Have provisional tariffs driven down EV forecasts in Europe?

14 August 2024

How have provisional tariffs on battery-electric vehicles (BEVs) made in China impacted European electric vehicle (EV) forecasts? Autovista24 editor Tom Geggus speaks with Neil King, head of forecasting at EV Volumes (part of J.D. Power), in a new podcast episode.

Forecasting the market trajectories of BEVs and plug-in hybrids (PHEVs) worldwide is no small feat. Variables include economic trends, current conflicts, industry behaviours and consumer confidence.

Protectionist policies, such as import tariffs, are being increasingly discussed and utilised globally. This makes them an important factor to consider when assessing the potential performance of EV markets.

So, how have the European Commission’s provisional tariffs on BEVs made in China impacted expectations and will growth be stunted? Are carmakers likely to raise prices and what other strategies might they employ?

Subscribe to the Autovista24 podcast and listen to previous episodes on Spotify, Apple and Amazon Music.

Show notes

How have global EV forecasts reacted to strong headwinds?

EU Commission confirms provisional tariffs on BEVs made in China

BEVs made in China face new provisional EU tariffs on top of existing duties

Has the plug been pulled on Europe’s new BEV market?

How to recharge Europe’s battery-electric vehicle market

The forecast

In his latest forecast, King outlined his expectations for light-vehicle markets worldwide. This covers both passenger cars and light-commercial vehicles. By the end of this year, Europe can expect to see overall year-on-year registrations growth of 2.6%.

While this is down on the 3.1% increase forecast in March 2024, it might be surprising that the market is still expected to grow. EVs in particular are currently facing numerous headwinds in Europe.

This includes major new-car markets shrinking or ending purchase incentive schemes. Germany suddenly withdrew its programme at the end of last year, while France revised its list of eligible vehicles. Switzerland also completely removed its 4% import tax exemption for BEVs.

Carmakers are also able to stay below their prescribed CO2 limits this year without the need to sell more EVs. This has meant their attention could currently return to turn back towards petrol and diesel models, which are typically more profitable.

Therefore, EV sales are forecast to grow by 4.9% this year, despite anticipated slower growth for the wider market. This means BEVs and PHEVs would collectively account for 21.8% of all new light vehicle sales in Europe.

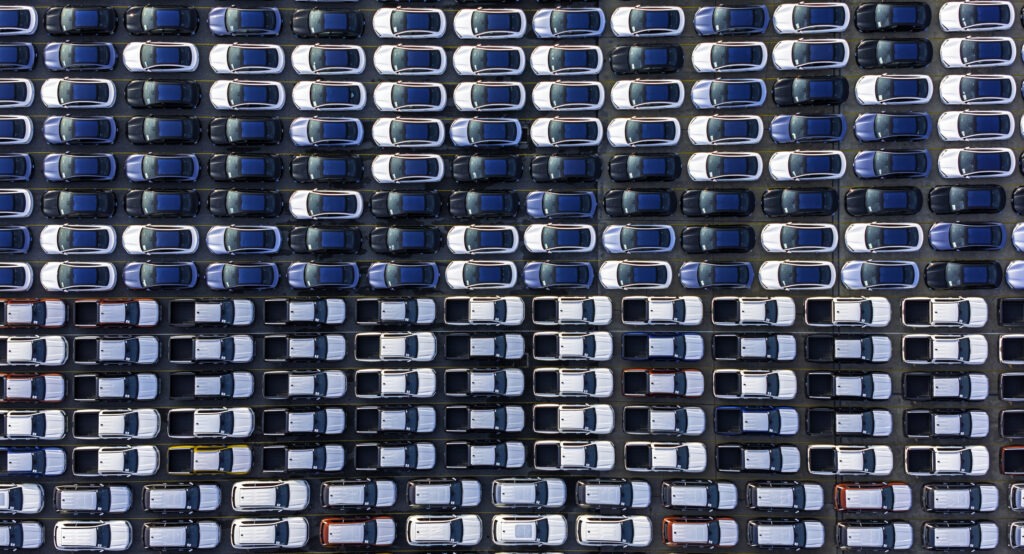

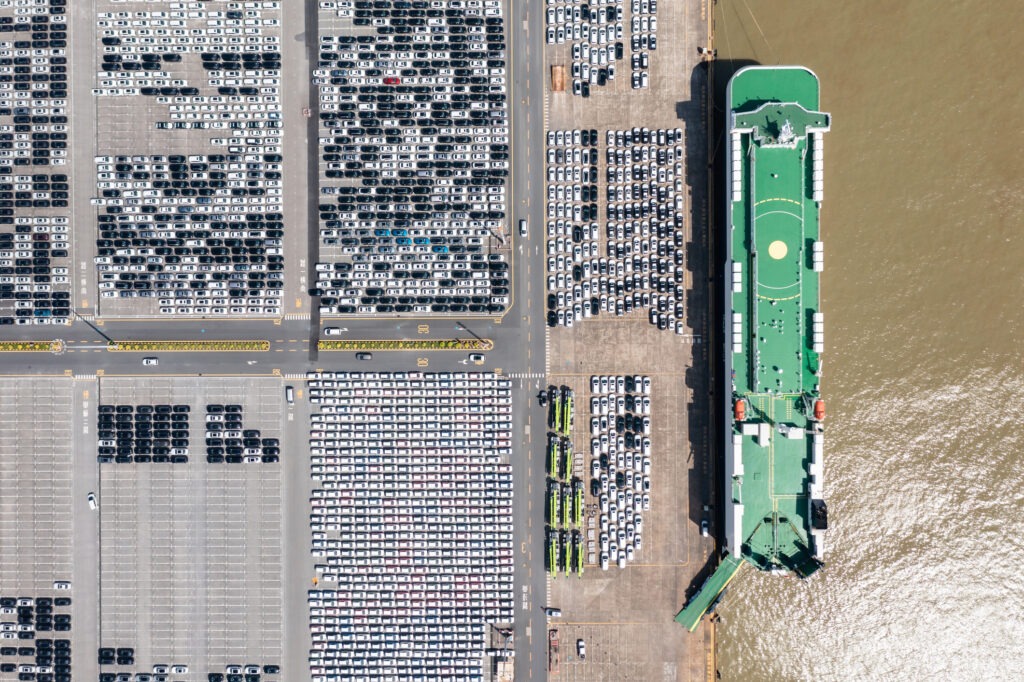

The tariff effect

One of the most important aspects of the EU Commission’s tariffs is that they are still provisional, so their effects are not concrete. Definitive duties are expected to be announced at the beginning of November. Before then, the Commission can be expected to continue talks with Chinese officials.

Reuters reported that the Chinese government has also turned to the World Trade Organisation (WTO) dispute settlement mechanism. The country’s commerce ministry said the EU’s preliminary findings lacked a factual and legal basis. Alongside this, carmakers currently only need to provide bank guarantees.

‘The import duties themselves are actually immaterial,’ King said. ‘It is only if and when they have an impact on prices. If the OEMs pass on their impact to consumers through high prices. That is when we would see an impact.’

Within this environment, the vast majority of carmakers have not adjusted their prices. Even if the duties do become definitive, carmakers have different strategies at their disposal. For some, absorbing any additional costs instead of passing on any price increase will be viable.

Carmakers may also take advantage of stock already shipped and imported into the region. In the long term, carmakers may also choose to produce models locally. This would not only avoid import tariffs but ensure EVs can keep their lifetime emissions down.