How battery health certificates tackle the €92 bn BEV remarketing challenge

14 December 2020

With market shares of BEVs rising in Europe to 30% and above by 2030, a sizeable asset risk is forming. Autovista Group and its German subsidiary, Schwacke GmbH, forecast that battery health certificates could improve remarketing results by up to €450 per vehicle in the compact-vehicle segment. Autovista Group chief economist Dr Christof Engelskirchen explores how remarketing risks could be reduced by up to €2.3 billion with such a certificate – in a win-win scenario.

According to the latest and further improved sales forecasts, electrically-chargeable vehicles (EVs) – such as battery-electric vehicles (BEVs) and plug-in hybrid vehicles (PHEVs) – could represent 40% of new-car registrations by the year 2030 (BloombergNEF and Deloitte). There are even more bullish forecasts out there. However, there is still a long way to go: in 2019 in Europe, EVs accounted for less than 4% market share. Substantial government incentive schemes will have increased the share significantly in 2020, but in the context of a lower absolute total number of cars sold due to COVID-19.

Europe’s most mature EV market, Norway, recorded an EV market share of 50% in 2019, with BEVs accounting for 80% of that. If the total number of new-car registrations by 2030 in Europe is expected to be at a similar level to 2019, around 15 million units, six million cars could be electric, of which around five million would be BEVs (80%). That would represent a 30% market share for the BEV. In 2019, roughly 400,000 BEVs were sold.

Leasing/PCP

Leasing is growing across the entire market, for example by 9% to 40% from 2018 to 2019 in Germany. The vast majority of BEVs already have some sort of leasing/PCP arrangement – which means the asset risks will remain with the OEM, a leasing company or a fleet operator. Individual car holders shy away from absorbing the asset risks for the BEV, and leasing allows for the better management of the customer relationship as the digitalisation of the sales-and-marketing value chain lowers barriers to entry.

Remarketing performance for BEVs has been difficult to quantify in the past, as there were few used-car transactions. More mature EV markets used to absorb the majority of used BEVs. This is changing with saturation. National used-car markets need to adapt to the BEV challenge. With the rising market share of BEVs, remarketing risks become more substantial.

There is good momentum in the build-up of charging infrastructure, which could support residual-value (RV) formation for the BEV. Furthermore, costs for the internal combustion engines (ICE) will rise related to the Euro 7 norm (2025), as more potent emissions-after-treatment technology is required.

On the negative side, BEVs exhibit stronger lifecycle effects than ICE vehicles, i.e. over the lifecycle of the model they depreciate faster. The main reasons are technological advancements in range and list-price reductions. On top of this come hefty government discounts in several markets. RVs for BEVs could come under pressure, if demand in the new-car market is over-stimulated by incentives and demand in used-car markets does not develop fast enough.

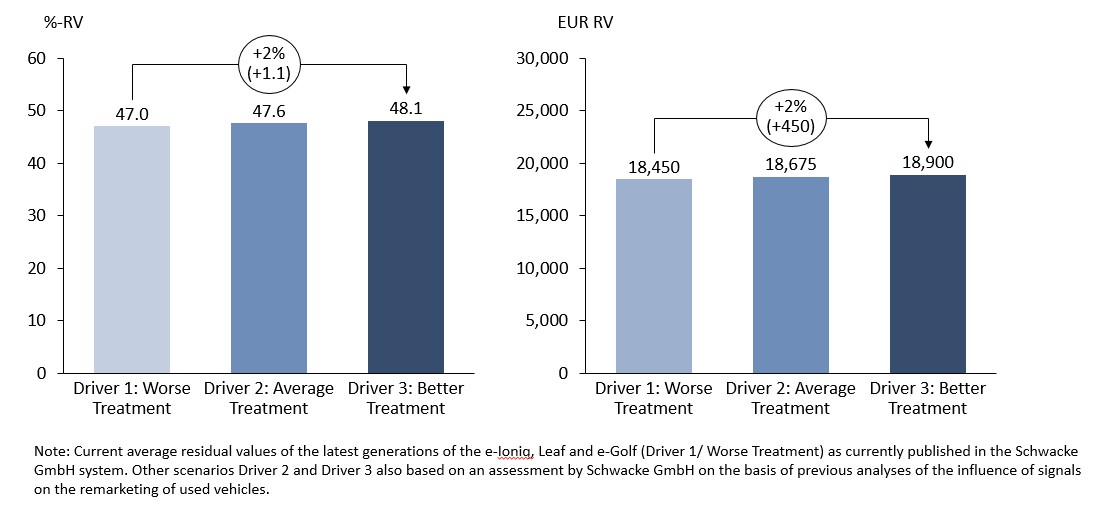

At current market forecasts, as published by Schwacke, at 36 months/45,000km/trade, a BEV in the compact/C-segment on average costs €18,450. Multiplied with five million BEV transactions in 2030, this represents €92 billion of remarketing value – and a substantial remarketing risk.

The power of signals

A ‘market for lemons’ is defined as a market where the buyer of a product or service is unable to judge the quality of the product. The supplier, on the other hand, knows exactly what quality they are offering. The used-car market is a classic market for lemons. As is the market for hotel rooms. Such markets are inefficient. What happens is that, because good quality is desired by the consumer but cannot be validated, there is a risk of deceit. Buyers and sellers know this. The buyer reacts to the risk with a low willingness to pay, the supplier with reduced quality. A way out of this dilemma is the use of credible signals (see Figure 1), e.g. peer ratings on travel sites, OEM warranties or used-car programmes.

Figure 1: Overcoming information asymmetry with powerful signals

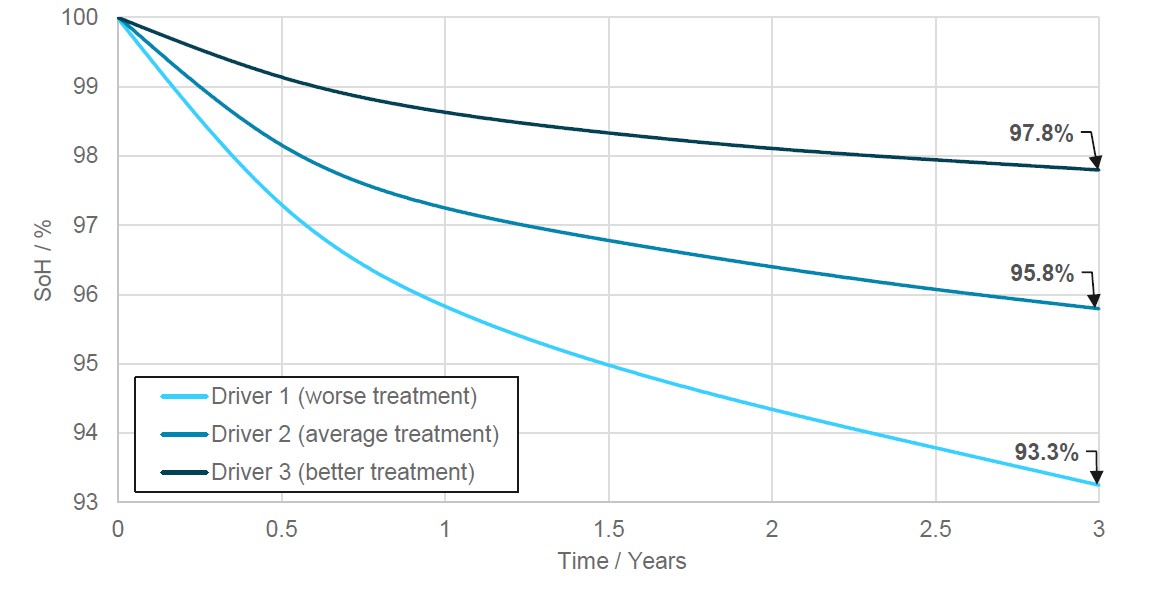

The BEV is subject to a particular information asymmetry around the remaining quality of its battery. Research from Twaice and TÜV Rheinland, presented in a joint whitepaper together with Autovista Group, shows that the remaining quality of a battery varies substantially depending on how the vehicle has been treated. There are more factors influencing the battery quality, e.g. temperature, but much in terms of the state of health (SoH) can be assessed by how the car was treated by the driver. The difference in remaining battery quality, subject to its usage profile, builds up fast. At the three-year point, the SoH varies between 93.3% and 97.8% (Fig. 2).

Figure 2: State of health of a battery in a BEV depending on driver vehicle treatment

(Source: Twaice, TÜV Rheinland)

Quality, once lost, cannot be recovered. Differences in suitability for daily use will materialise relatively quickly. Extended warranties for the BEV provide a powerful signal to the market, but only up to 80% of the SoH in most of the warranties.

More could be done to optimise remarketing results for the BEV. Schwacke has simulated that the difference between a better SoH of the battery represents a value of up to €450 per vehicle. Multiplied by the five million BEVs in 2030, that would represent €2.3 billion of higher remarketing results – in a win-win setup, as the actual value of a higher SoH would be a substantial benefit for the second-hand buyer as well.

Figure 3: Average C-Segment BEV forecast RV/36 months/45,000km/trade/Germany for different battery treatment

(Source: Autovista Group, Schwacke)

The alternative scenario of a lack of a powerful indication of the SoH of the battery results in remarketing performance at the level of “Driver 1: Worse Treatment”. That does not mean that all BEVs are treated badly, but that there is no willingness to pay a premium in light of no proof of better treatment.

The asset risk for the BEV will become substantial and we should explore every means to manage out some of the risk. Battery health certificates should improve remarketing results by a minimum of €1.1 billion (as batteries would be treated on an average level). If the battery health certificate stimulates a better treatment behaviour on average, remarketing results could improve by up to €2.3 billion. Why is it not more? Extended warranties serve as another powerful signal to the market. The battery health certificate would add more signalling power, in particular at the three-year point in time. Nevertheless, it is high enough to matter. With all the uncertainty around BEV remarketing, every win-win scenario leading to higher valuations should be more than welcome.