How electric is Volkswagen’s future?

20 March 2020

20 March 2020

What does it mean for a carmaker to be fully committed to an electric future? What kind of roadmaps does it need? Where should funds be invested? Daily Brief journalist Tom Geggus pulls apart Volkswagen Group’s 2019 annual report and media conference in search of answers.

′The future of the car, ladies and gentlemen, is electric.’ A decade ago, this statement might have seemed a little outlandish. In its 2010 annual report, Volkswagen Group(VW) acknowledged that ′carbon-neutral mobility is the future’, but continued to see electric drives and conventional combustion engines existing side by side for ′several more decades.’ Yet 10 years later, Herbert Diess, VW’s chairman of the management board, told a digital audience in the group’s annual media conference that electric-cars were indeed the way forward.

In the summer of 2019, VW enhanced its ′Together strategy’, which focused on making the group more efficient, innovative and sustainable. Now known as ′Together 2025+’, the manufacturer wants to sustainably shape mobility for the future, with a focus on electric vehicles (EVs). ′With electric drives, digital connectivity and autonomous driving, we want to make the automobile cleaner, quieter, more intelligent and safer,’ the carmaker outlined in its annual report. So how has VW been setting about achieving this futuristic, sustainable and electrified goal?

Battery boom

In his speech, Diess identified 2020 as a watershed year with the introduction of CO2 targets in the European Union (EU). He explained that profitable EVs (including plug-in hybrids) were the most efficient way to meet new regulatory fleet targets. Counting 15 electric models and 18 new plug-in hybrids, Diess said ′with our product portfolio, we are well-positioned to tackle 2020 and 2021.’

The group’s EVs have certainly been seeing a great deal of interest. Diess confirmed that the order backlog for some cars extends beyond the middle of the year. Whilst this confirms consumer appetite for vehicles like the Audi e-Tron, it also highlights gaps in the manufacturer’s ability to meet said demand. With battery bottlenecks halting production of Audi’s all-electric SUV this year, the need for greater consistency in component supply is palpable.

VW anticipates it will need 300 gigawatt-hours’ worth of battery cells to produce their targeted 3 million electric cars by 2025. To meet this demand, the manufacturer aims to establish further partnerships in China, Europe and the USA to work alongside its current battery suppliers.

Internally, VW has pooled its in-house battery-cell expertise in its ′centre of excellence.’ This department is responsible for the development, procurement and quality assurance of battery cells. In 2019, the centre of excellence piloted a line for cell production, building up expertise in cell design. In a 50/50 joint venture with Northvolt AB, the group will build a 16GWh battery-cell factory in Salzgitter, Germany. VW’s €900 million investment in the project was announced in June last year, with production expected to begin between the end of 2023 and the beginning of 2024.

MEB platform

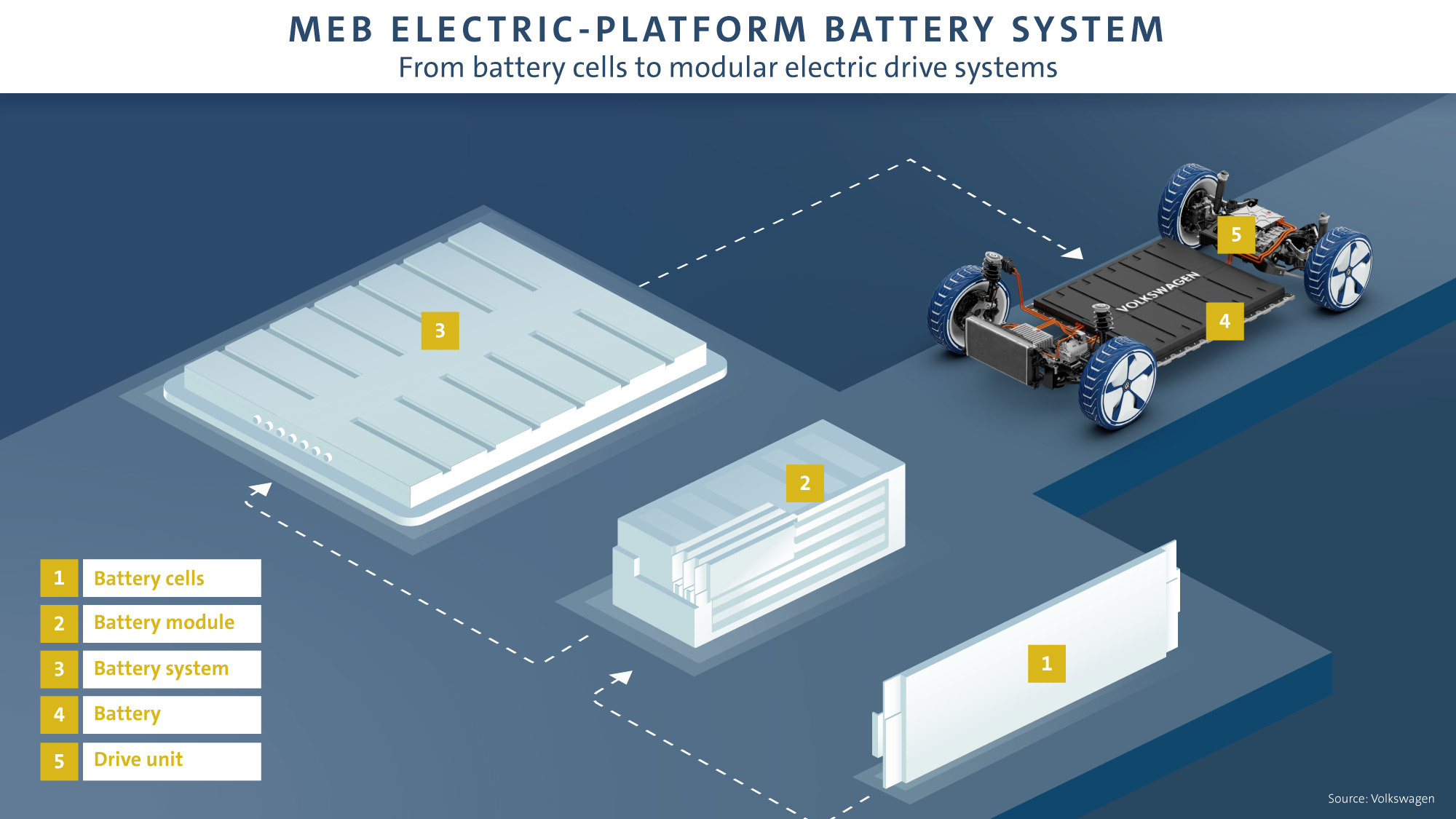

Finding solutions through internal development looks to be a running theme for VW. The manufacturer has developed the proprietary Modular Electric Drive (MEB) platform exclusively for electric models. This system will allow a modular approach to manufacturing EVs across VW brands. It will outline axle parameters, drive systems, batteries, wheelbases and weight ratios, allowing platforms to be streamlined and simplified.

Using this MEB framework, VW aims to offer up to 75 full EVs and approximately 60 hybrid models by 2029. The group’s first MEB models, the ID.3 and ID.4 will become available this year. With claims that the ID.3 will be a cheaper alternative to traditional engines in terms of total cost of ownership, this is VW’s debut into more affordable EVs and already has 30,000 pre-orders across Europe.

Digital developments

Alongside its MEB framework, VW wants to make software one of its key competencies as part of its Together 2025+ strategy. The Car.Software organisation began operating in 2019 to combine the group’s digital expertise. Approximately 3,000 IT experts currently work within Car.Software, but this number is expected to rise to more than 10,000 by 2025. The team is building ′VW.OS’, a proprietary operating system that will be installed in all VW’s vehicles in the future. According to Diess’s letter to shareholders, a modern VW has 10 times more software than a smartphone. In a few years, the plan is for this to increase to a factor of 20 to 30.

With an ever-growing information-based economy, this focus on cars as data drivers makes sense. As well as supplying data to power new in-car applications, VW plans to gather more detailed information through its vehicles. Understanding more about traffic density, air quality and hazardous situations will allow the group to capitalise on information, opening up new lines of business.

One of the areas where early data collection will be essential is autonomy. In July 2019, VW announced a $2.6 billion (€2.3 billion) investment for an equal share in Ford’s autonomous business Argo AI, which is developing an autonomous driving system. VW will be contributing its consolidated subsidiary Autonomous Intelligent Driving (AID), to assist the venture. This deal is planned to take place in the first half of 2020, subject to regulatory approval and other contributory conditions.

Truly future-focused?

To achieve greater electrification, digitalisation and autonomy of their vehicles, VW is investing in future technologies. In the 2019 fiscal year, the company filed 7,614 patent applications worldwide for employee inventions. A growing share of these patents cover ′cutting-edge’ fields according to the group. These fields include driver assistance systems, autonomy, connectivity and alternative drive systems.

All in all, the automotive division’s total research and development costs for 2019 totalled €14.3 billion and was 4.9% higher than in 2018. Along with new model development, VW’s focus was the electrification of its portfolio, more efficient engines, digitalisation and new technologies.

′In the next five years alone, €60 billion will be invested in topics of future relevance, €33 billion of which has been earmarked for e-mobility and over €14 billion for digitalisation,’ Diess said in his letter to shareholders.

The next 10 years will tell the story of how successful VW’s investment in these fields has been. Modular platforms like MEB may indeed be the answer to EV development, and data-driven services could prove vital to manufacturers. But one thing is for certain – if VW wants to be successful in this field, they will need to fully commit themselves to an electric future.

Images courtesy of Volkswagen AG.