How has the Hungarian vehicle market developed?

07 October 2021

The Hungarian Institute for Forensic Sciences’ (HIFS) annual conference plays host to a range of experts. They decipher market trends, reveal recent regulations, and inspect new technologies for an audience including analysts, assessors, and insurers. Eurotax’s country manager, Dr Roland Madacsi, and regional head of valuations, Zsolt Horvath, unpacked their presentation for Autovista24.

Eurotax, part of Autovista Group, has presented at the HIFS conference every year over the last decade. While the event did not occur in 2020 due to COVID-19, the pandemic was a central theme this year. Madacsi and Horvath’s presentation utilised volume data to analyse Hungary’s new- and used-car markets, as well as establish projections for coming years.

An ageing fleet

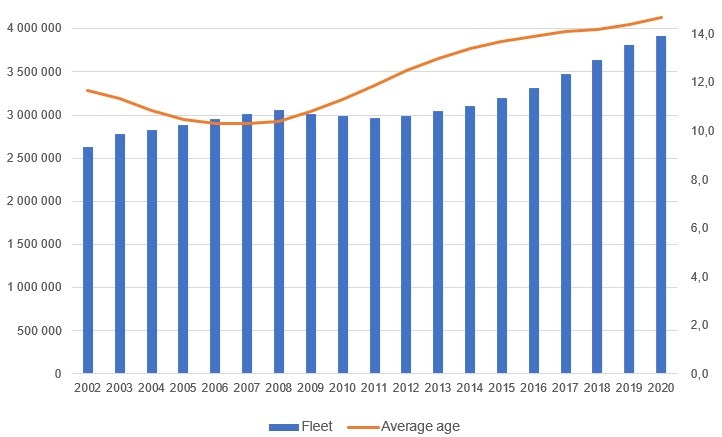

Over the last two decades, the Hungarian passenger car parc has seen relatively stable growth. Looking back at 2002, the country had just over two and a half million passenger cars on the road. In the following years, there was only a slight shrinking between 2009 and 2011. Numbers then began to climb in 2012, building up to nearly four million in 2020.

Passenger-car fleet size and average age

This growth has been chiefly thanks to new-car registrations and private imports from the likes of Germany, Austria, and the BeNeLux countries. However, this has not been the nation’s only upward trend; Hungary’s passenger-car fleet has also been ageing. Last year, the average age was 14.7 years, up by roughly five years compared with 2010, when the credit crisis began taking its toll.

Biggest brands in Hungary

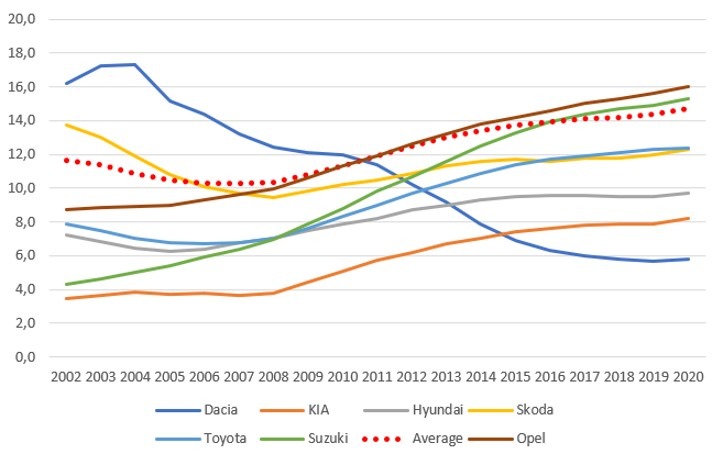

A point of great interest for the HIFS audience is brand performance. The Eurotax team returns to fleet age, but this time filtering by brand. Nearly all makes trended upwards, ageing from roughly 10 years in 2010 to nearly 15 years in 2020. For example, last year, Opel and Suzuki’s fleets had an average age of 16 years and 15.5 years respectively. However, the two brands have been leading new-car sales in Hungary for nearly three decades. Opel boasts a fleet share of 12.7% and Suzuki 10.9%, which means an increasing, but maturing stock.

There was one brand’s fleet that did not conform to the ageing trend: Dacia’s. Its parc age in 2020 was only 5.8 years on average, compared with the market norm of over 14 years. Since 2010, the Romanian brand has seen some significant investment from Renault. This meant a lot of fresh models featuring new technology hitting the market at a very good price-to-value ratio. Accordingly, it has placed in the top six for new-car sales in Hungary over the last five years, increasing its fleet size by almost 500%.

Average age of fleet by brand

Dacia also benefited from a government incentive introduced in 2019. For families with three children, the government covered half the price of a new seven-seat vehicle with a price tag of approximately Ft5 million (€15,000) or less. This made the Dacia Lodgy an obvious choice for a lot of consumers as it was one of the cheapest seven-seaters available.

Reviewing registrations

10 years ago, the credit crisis saw new-car registrations in Hungary contract by 75% compared to the previous year. The market showed promising signs of a recovery, building speed with a 363% increase in registrations between 2010 and 2019. However, COVID-19 saw this comeback stall, resulting in an 18.9% decline in 2020.

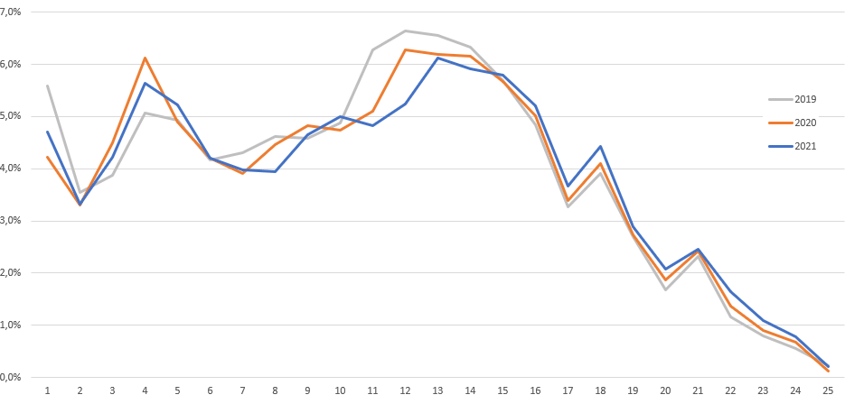

A month-by-month breakdown of new-car registrations from 2019-2021 tells the story of recent market complications. The effect of COVID-19 is apparent when comparing 2020’s March-to-April slump with the same period in 2019. 2021 showed promise in its first quarter, with imported brands helping guide registrations towards a pre-pandemic trajectory.

Monthly new-car registrations for 2019, 2020 and 2021

But any hopes were soon dashed by the semiconductor shortage, which severely impacted manufacturing. Delivery times plummeted from 10 to 12 weeks to a year in some cases. Some dealers even reported booking zero deliveries across October and November because of supply issues. Even though there was an 8% increase in registrations between January and August this year, Eurotax’s predicts a steep decline towards the end of 2021. Additionally, the country’s re-export rate continues to linger at around 25%, meaning there are even fewer vehicles available.

Drawing comparisons with nearby neighbours, it is best to consider the Visegrád Group, which is made up of Hungary, Poland, the Czech Republic, and Slovakia. Last year, Poland recorded the largest gross domestic product (GDP) of $594 billion (€511 billion). Next came the Czech Republic, with a GDP of $243 billion, Hungary with $155 billion, and Slovakia with $104 billion. Looking at the new car market, Poland recorded over 550,000 registrations in 2020, the Czech Republic 250,000, Hungary nearly 160,000, and Slovakia just over 100,000.

New-car prices rise

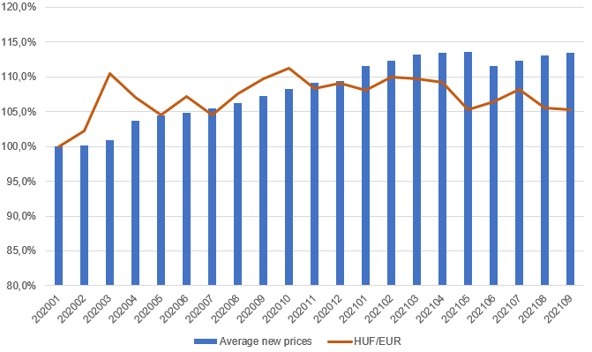

The average price of a new car has been on the rise in Hungary, increasing by 13% from January last year to September 2021. Over the course of 2020, this upward momentum was roughly mirrored by the Ft-€ exchange rate. But at the start of 2021, the Hungarian National Bank interjected, leading to a disruption of this trend.

New-car prices and HUF/EUR exchange rate

Soon, the dipping exchange rate was at odds with the average costs of a new car, which continued to climb. Developing vehicles to meet Euro 7 standards and corporate average fuel economy (CAFE) levels, as well as paying emissions fines, meant manufactures kept having to push prices up. This continues a long-term trend, where popular lower-to-middle end vehicles have seen a 33% price increase.

Acknowledging used-car adverts

Compiling used-car adverts by age, the Eurotax team reveals relatively consistent supply trends over the last three years. Most of the market belongs to 10-15-year-old cars, however, following the country’s ageing car parc, this does look to be shifting marginally towards older vehicles.

Roughly 60% of the country’s new-car registrations are attributable to company-car purchases. Their leasing windows run for 48 months on average. This explains the peak in adverts for four-year-old used cars, which are available once a company’s fleet refreshes.

Used-car adverts share by age

As the registration of new cars falters due to supply issues, used models have experienced a surge in demand. COVID-19 has also helped increase their popularity as consumers look to avoid public transportation and more expensive new vehicles. This has helped uphold the value of used cars, which in some cases are not experiencing any depreciation year-on-year.

Examining the popularity of three-year-old used cars by fuel type reveals a plunge in price for battery-electric vehicles (BEVs) and plug-in electric hybrids (PHEVs). This is due to the rapidly advancing capabilities and capacities of new electrically-chargeable vehicles (EVs). Suppose a consumer decides to commit to electromobility. In that case, it makes sense to opt for the more advanced model, which is only a few years younger than the used option, even if it means enduring longer waiting times on the new-car market.

Meanwhile, used diesel internal-combustion engine (ICE) models have seen continual price increases, making them the most expensive fuel type on the market. While undergoing negative press, these fossil-fuel-powered cars are placed under no restrictions in Hungary, so are still economical to operate.

Future-focused

Looking ahead, Eurotax expects fewer new car registrations over the next couple of months owing to semiconductor supply shortages and COVID-19 constraints. Meanwhile, developmental demands to ensure vehicles meet emissions standards will continue to increase new-car prices.

This will likely lead to a vacuum of 2020-2021 models come 2023-2025. The value of three- to four-year-old used vehicles can therefore be expected to rise. The Euro-exchange rate will also continue to play a key role. However, the extent of this will be determined by governmental and national bank strategies.

BEVs can be expected to see increased demand thanks to positive media coverage and tightening regulations. New market players will also introduce more competition, with more units produced, equalling lower prices over time. If the Hungarian government introduces EVs incentives, the likelihood of funds being used up rapidly is very high, which is exactly what happened in previous years. However, this will have a knock-on effect on the residual values of used EVs. Another consideration for EV adoption will be the development of infrastructure. The number, speed and accessibility of chargers must advance for consumers to seriously consider the power train as a viable alternative to ICE models.

The HIFS annual conference is over for another year, but the Eurotax team will continue to crunch numbers, assess trends and determine the outlook for countries like Hungary. For more market analysis across Europe, sign up to Autovista24’s daily email.