How important are smart factories to the future of car production?

01 December 2022

Cars are becoming smarter and so are automotive production sites. Autovista24 journalist Rebeka Shaid explores the factories of the future.

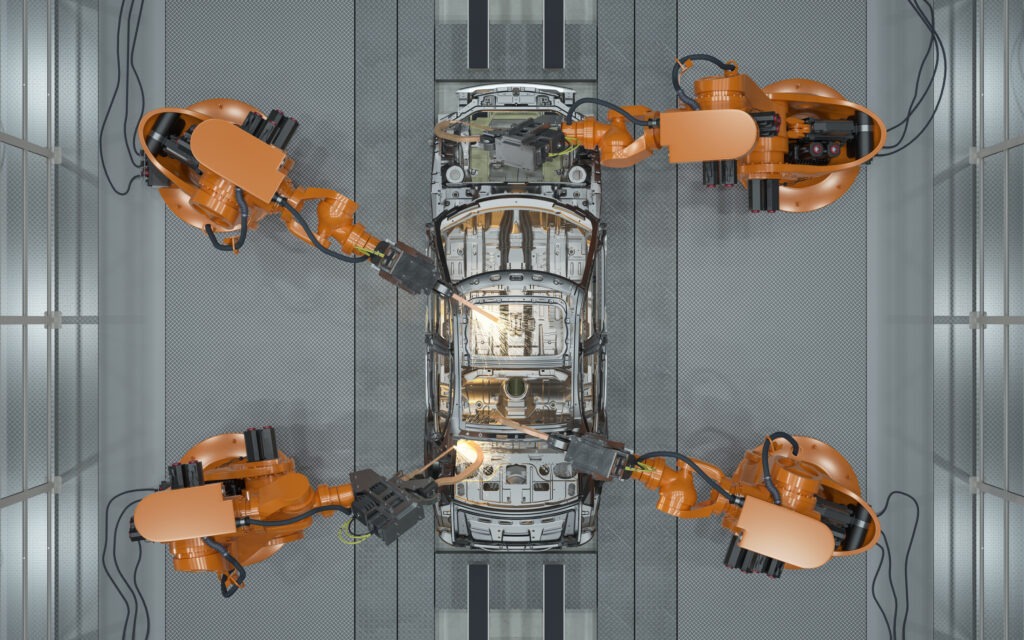

In the digital age, manufacturers and suppliers are investing heavily in smart factories. The aim is to increase flexibility and efficiency, while also lowering costs. Robots, 5G, artificial intelligence (AI), virtual reality, drones, data analytics and business-intelligence tools, as well as cloud and connected technologies, are just some of the features that can be found in smart factories.

What are smart factories?

Smart factories rely on connectivity and intelligent manufacturing, focused on digitised, automated, and networked production processes. Dubbed ‘factories of the future’, these sites use advanced technologies to analyse data, with systems learning and adapting in real time.

‘The most distinctive feature of smart factories is that they manage to function without too much human intervention,’ Markus Haupt, SEAT executive vice-president for production and logistics, told Autovista24.

‘This allows them to be much more flexible since they can work autonomously without problems, thanks to the large volume of information that is processed. In this way, the products that are manufactured are adapted to the needs of the moment, generating a much more versatile production.’

The automotive industry is going through a rapid transformation and manufacturers are no longer just carmakers. They are evolving into technology companies, writing code, and creating smart electric products.

Digitalisation is one of the key drivers behind smart factories, but this progress is happening at different speeds within the car sector. So, where are automotive companies when it comes to smart manufacturing and what does the future hold?

Tesla and the gigafactory

To answer this question, it is worth looking at some of the main players. Electric-vehicle (EV) maker Tesla is one of the pioneers in this field. Automotive experts already point to the company when asked what the future of car production will look like.

Tesla’s gigafactories – a term coined by CEO Elon Musk – are often described as trailblazing and high-tech. The carmaker opened a production site in Grünheide near Berlin this year that analysts view as Europe’s most cutting-edge factory.

Tesla pitches the site as its ‘most advanced, sustainable and efficient’ facility yet, with the carmaker saying it will be the first location in Europe to manufacture cells in-house together with electric vehicles. Located in the middle of the continent and the region’s largest automotive market, the site is set to spur the shift to electrification.

Tesla’s Model Y is already among the best-selling cars in Europe. In Germany, it even outperformed the nation’s most popular car, the Volkswagen Golf, with nearly 10,000 registrations in September. The company aims to eventually produce half a million cars a year in Germany. This would not be possible without relying on innovative solutions, including the use of robotics.

EVs drive automation

It is largely the use of AI during manufacturing that makes Tesla stand out from the crowd, from smart cart-like machines to robots that can lift an entire car. In the future, the company hopes to deploy humanoid robots to carry out repetitive tasks.

Automation in smart factories is key, with robots carrying out ‘superhuman tasks’. The International Federation of Robotics (IFR) found that the use of robotics and automation is growing at a significant pace. The automotive industry is one sector likely to see steady growth, with electrification a key driver behind this development.

‘There is a need to invest in new production lines for electric vehicles as the transformation of the automotive industry continues. Ambitious political targets force the industry to invest, first into research and new models, and then into production. The automotive industry will remain a major customer of industrial robots, may it be in the retooling of existing production lines or in the creation of battery production capacity for electric vehicles,’ the IFR’s statistical department told Autovista24.

The organisation emphasised that automotive manufacturers are already using highly automated production processes and will remain one of the largest adopters of robots globally. It added that many automotive manufacturers that invested in traditional high payload, caged robots for basic assembly, are now also investing in collaborative applications for final assembly and finishing tasks.

Cutting production times

Former VW Group CEO Herbert Diess recognised Tesla’s progress, and as Europe’s largest carmaker, the German brand has ambitious plans of its own. The company operates the world’s biggest automotive manufacturing plant in Wolfsburg, Germany, which is equipped with 5,000 robots.

Plans to build a new flagship EV site nearby look uncertain, with the company confirming executives are carrying out a review of the proposed plant. While no decision has been made yet, the concept demonstrates the magnitude of VW’s ambitions.

The proposed site promises to be net carbon-neutral, using what the carmaker describes as ‘the most innovative manufacturing methods.’ Production times would also be much lower, with VW expecting to produce one vehicle in 10 hours – matching Tesla’s timeframe. It hopes to set a standard for the industry when it comes to efficient and innovative manufacturing.

News outlets reported that the German carmaker is targeting up to 30% automation at the new electric-vehicle plant. When asked by Autovista24, the company declined to comment on these details.

‘Volkswagen wants to set standards and significantly reduce the pure production time per car compared to today’s production. There are several levers to achieve this ambitious goal: fewer variants, fewer components, more automation, leaner production lines as well as new logistics concepts. Basically, it is about minimising complexity,’ VW told Autovisa24.

Automating supply

SEAT, part of the VW Group, said one of its main goals is the automation of the manufacturing process and the company has taken several measures to realise its ambitions. High-effort but low-value-added tasks are already automated, such as the autonomous identification of defects; automatic measurements for quality checks using Industrial Computer Vision (ICV); automatic polishing of lack defects; predictive maintenance for welding guns; and machine learning for welding inspections.

The carmaker also wants to automate logistics processes, Haupt told Autovista24. ‘We not only have the most advanced automatic warehouse in Spain, but we are working towards an automatic supply from the warehouse to the consumer point, with both automated guided vehicles (AGVs) or autonomous mobile robots (AMRs). Looking to the future, we are working on a pilot to develop interfaces between different types of AMRs, in collaboration with other companies.’

Haupt highlighted the importance of digitalisation, with SEAT using virtual reality to analyse products and processes. The carmaker is also participating in VW Group’s digital production platform, a cloud environment made for manufacturing. The platform standardises the exchange of data across systems and factories.

‘All about digitalisation’

Meanwhile, German rival Mercedes-Benz told Autovista24 that its car production ‘is all about digitalisation.’

The luxury brand has built a digital ecosystem called MO360 for its vehicle production, describing it as an ‘office suite for your desktop computer with different applications for each task, but with a common user-friendly interface.’ The system integrates information from production processes and IT systems across manufacturing sites worldwide, also bringing together software applications.

Technologies like these are helping Mercedes-Benz pave the way for smart manufacturing. The company opened its German Factory 56 plant in 2020, pitching it as the future of production. It is equipped with a 5G network that enables data linking and product tracking on the assembly line. Moreover, it makes production more adaptable while a local 5G network means greater protection as data does not need to be made available to third parties.

‘Production of tomorrow’

Virtualisation is another key element in futuristic factories, and it features heavily for BMW, which is working on its own production initiatives. Earlier this year, the manufacturer presented its iFactory strategy – the ‘production of tomorrow’ – that it wants to implement across sites worldwide. The idea is to redefine automotive production.

The brand told Autovista24 that these sites will make constructive use of data science, AI, and virtualisation. ‘Digitalisation is a central enabler of the transformation. Linking relevant product, process, quality, and cost data enables end-to-end data consistency in the value chain and across all process chains and plants,’ the company said.

The carmaker has bold plans, following a clear vision of future factories, where people and robots work side by side while engineers collaborate in a shared virtual space. To achieve this goal, BMW has partnered with technology company Nvidia to plan manufacturing systems on the so-called omniverse platform. This allows planners around the globe to log in simultaneously and jointly develop production systems in the virtual world.

BMW called this process a revolution in factory planning. ‘The most exciting field at the moment is virtualisation,’ BMW told Autovista24. It added that by integrating products into the virtual factory early on, the company could reduce the amount of required planning and ensure lower investments and more stable launches for products.

‘By the end of 2022, we will have digital versions of the structures of all the major vehicle plants in the BMW Group production network,’ the carmaker said. ‘This solution offers huge potential, making our planning processes up to 30% more accurate, faster and more efficient.’

Sustainable production

Sustainability will also continue to play a role in smart factories, with carmakers increasingly shifting to renewable energy resources to cut emissions during production. After all, carmakers do not only want the future of car production to be smart, but also less taxing on the environment.

BMW is planning a new factory in Debrecen, Hungary, saying it will be the world’s first automotive plant that completely dispenses with the use of fossil fuels in its production processes. Circularity will be important in smart factories, with carmakers reusing production materials as much as possible.

This can take the shape of recycling metal offcuts and filings from milling and pressing. It can also mean using waste heat from cooling systems to warm indoor spaces and water in a closed-loop system, as BMW plans to do. Making use of smart-energy monitoring technologies will also track how power is used, making sure car production is as resource-efficient as possible – given Europe’s current energy crisis, this will be a smart move.

Automation, combined with digitalisation and the intelligent use of production data can all contribute to reducing energy and resource consumption, as well as CO₂ emissions and costs. The future, without a doubt, is digital. In the automotive industry, manufacturing will not only get more intelligent and data-driven, but it will also become more efficient and sustainable.

So, when will automotive smart factories likely reach their full potential? ‘That is difficult to say,’ BMW told Autovista24. ‘Because this is a permanent, continuous improvement process. Increasing computer performance and increasing connected systems, combined with growing AI, will ensure the continuous development of the smart factory in the coming years.’