How will COVID-19 shape used-car markets – September 2020 update

16 September 2020

The September update of Autovista Group’s whitepaper: How will COVID-19 shape used-car markets? considers the ongoing impact of COVID-19 across Europe.

Three-speed RVs: UK and France benefit from pent-up demand post-lockdown

Following the emergence of Europe’s automotive sector from coronavirus (Covid-19) lockdowns, a ‘three-speed’ development of residual values (RVs) has prevailed across the region. Senior data journalist Neil King explores the region’s variations.

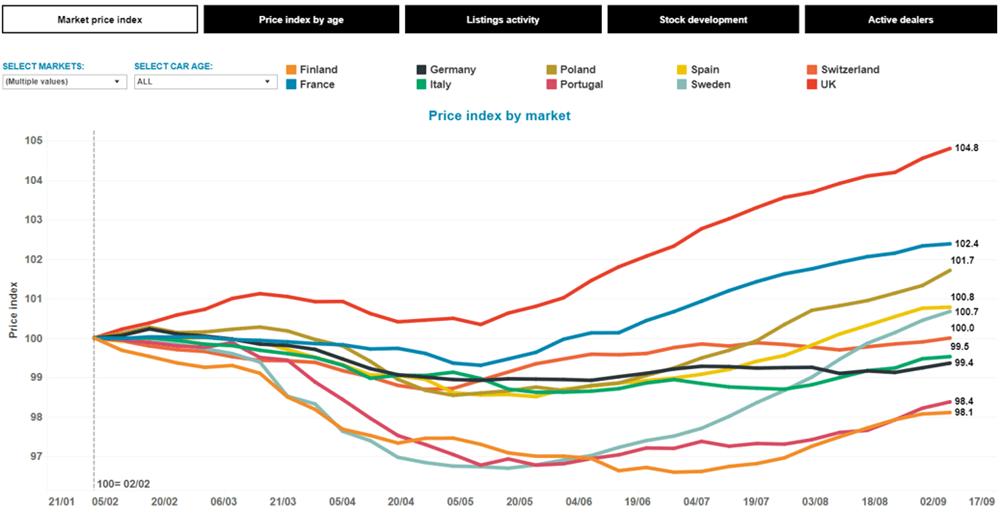

The UK and France have enjoyed a rally, driven by pent-up demand in the initial post-lockdown period. Autovista Group’s Covid-19 tracker, which tracks 12 European markets, shows that the index of RVs, compared to early February, has risen since mid-May and peaked at 104.8 (a 4.8% rise) in the UK and 102.4 (a 2.4% rise) in France in the week to 6 September. The start month was February, with a value of 100.

The UK is enjoying the release of pent-up demand, both from the lockdown and the uncertainty running up to the country’s departure from the European Union on 31 January. It also faces a starker vehicle-supply challenge than any other market, which is filtering through to higher RVs as used car demand outstrips supply. ‘Stock of both new and used cars is the biggest issue in the UK. This is driving up used prices and we do not see the bubble bursting quite yet. It’s September and even convertible demand is still high, with values increasing,’ commented Anthony Machin, head of content and product at Glass’s.

French revolution

France benefitted from pent-up demand and a new incentive scheme that came into effect on 1 June. The €8 billion package includes a €7,000 grant for private buyers of new battery-electric vehicles (BEVs) costing less than €45,000 (€5,000 for fleet buyers), while buyers of new plug-in hybrids (PHEVs) can claim a €2,000 subsidy.

Additionally, France doubled its premiums for those looking to trade in older vehicles for a cleaner model, with a €3,000 grant for vehicles with internal combustion engines (ICE) and €5,000 for BEVs and PHEVs. Crucially, the enhanced trade-in bonus also applies to used cars and hence the notable rise in RVs. However, the scheme reached its 200,000-vehicle cap before the end of July and the Ministry of Ecological Transition announced the replacement of the recovery scheme with a conversion bonus, applicable from 3 August.

‘In France, OEM plants restarted late and slowly, creating a lack of new car stock in July and even more in August. Moreover, as people have defected from the new car market to the used car market, increasing demand, the low stock of used cars explains the ongoing increase in residual values. This is especially true in the A- and B-segments, where the conversion bonus is working really well, but this is not the case for all fuel types and segments,’ commented Yoann Taitz, operations director of Autovista Group in France.

Used-car transactions surged: 595,942 used cars changed ownership in France in June, 29.1% more than in June 2019, according to data published by the French carmakers’ association CCFA. This was followed by year-on-year growth of 13.3% in July and 16.8% in August. Nevertheless, there were still 9.2% fewer used car transactions in the first eight months of 2020 than in the same period in 2019.

Autovista Group anticipates a slowdown in the RV development in France and our latest RV outlook calls for prices of used cars to be 0.3% lower in France at the end of 2020 than when the Covid-19 crisis erupted in Europe, in March. Nevertheless, this is one of the most resilient expectations among the 18 European countries covered in this whitepaper, as you will find from later chapters.

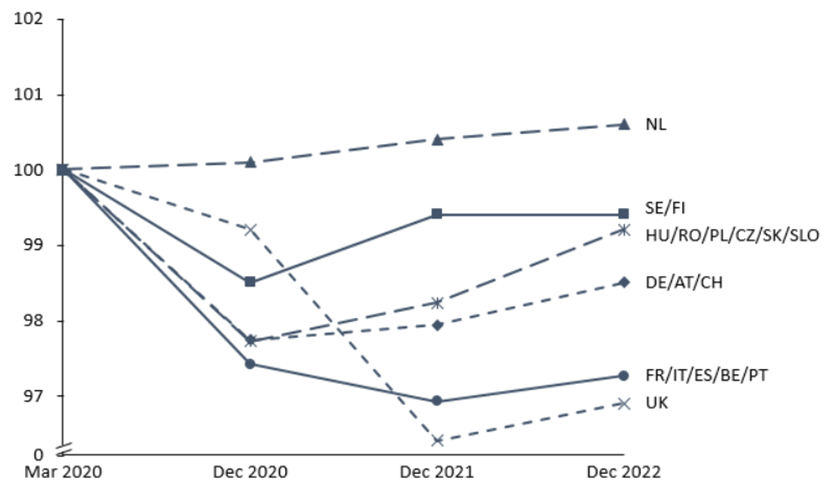

Figure 1: Three-speed RV graph – indexed price development across Europe

Source: Autovista Group, Residual Value Intelligence, Covid-19 tracker

Rapid-reaction markets

Sweden, Finland and Portugal all had rapid negative reactions to Covid-19. Dramatic lockdown measures were not introduced in Sweden and Finland, but RVs fell from early February to mid-May in both markets.

However, RVs have climbed in Sweden since mid-June and recorded 100.7 on the index in the week to 6 September, i.e. 0.7% higher than in early February. ‘The used car market has recovered fine as stocks are decreasing and sales volumes and values are rising,’ said Johan Trus, head of data and valuations Nordics. ‘People were not allowed to travel to other countries, so the summer vacation has been spent in the country, and then people needed a car to travel. In addition, car exports have picked up.’

In Finland, the index of RVs fell from early February to only 97 in mid-June and has remained at the lowest level in Europe since. ‘Finland is still running on low numbers, and we don’t see the same quick recovery as in Sweden. The import of young used Swedish cars has picked up again too, in combination with lower used car values than normal, already before the crisis started,’ Trus commented.

Portugal also endured falling RVs since the tracker index started in February, but a more pronounced downturn commenced at the end of March. As in Finland, the price index is only showing a modest increase and has not recovered to pre-coronavirus levels.

‘Used-car sales continue to recover quicker than new car sales. In July, used car sales grew 25% year-on-year whereas new car sales fell 16.9%, although this was a significant improvement on June, when the drop was 56.2%. There was just a small 0.1% decline in new car sales in August, but the drop was 8.6% including light commercial vehicles,’ said Joao Areal, editorial manager of Autovista Group in Portugal.

‘In the next months, we will understand if the demand for used cars continues to grow or if this was due to pent-up demand built during the lockdown. The car market represented more than half of consumer credit in July but of this amount, 85% was for used cars. Although we can see a recovery in the car market, we are still far from pre-Covid-19 values,’ added Areal.

Late starters

The rest of Europe’s tracked markets remain ‘late starters’, where several effects are balancing each other out. The first reason for the ongoing stability in many markets is that they have essentially remained ‘on hold’. In Italy for example, ‘the market has been waiting for a better understanding of the full impact of the economic crisis, especially considering that many experts are convinced that we could face a second wave and a new lockdown in autumn,’ explained Marco Pasquetti, forecast and data specialist of Autovista Group in Italy.

RVs fell again in Italy from late June to late July. This is partly because of the incentives to support the country’s automotive industry, which came into effect on 1 August. ‘There is also the Ecobonus incentive scheme, but the amount allocated is insufficient in our opinion (so far). We think that we’ll see an impact on values starting from September,’ Pasquetti added.

The significant disruption to new car supply and registrations is also impacting RVs in ‘late-starter’ markets. In Germany for example, used car transactions were just 6% lower in the first eight months of the year than in the same period in 2019, according to the KBA. They have even performed better than last year for two consecutive months. New car registrations have been far more affected, however, and are still 29% lower in the year-to-date than in 2019.

‘The lack of new car supply still boosts young used car sales, but dealers seem to be unnecessarily discounting them even more than before the crisis, probably in favour of a quicker turnaround of stock. After a proper autumn, we expect stronger price competition at dealers in the last two months of the year as they compensate for the loss in new car sales with higher used car turnover,’ commented Andreas Geilenbrügge, head of valuations and insights at Schwacke.

The situation is a bit more optimistic than before in Spain, but the country faces the same challenge. ‘The automotive sector is resisting the crisis better than expected, helped by the measures to boost the sector that the government put in place. The production stoppages have also reduced pressure on used car stock and the average number of stock days is much longer now. However, there are fewer new used cars coming into the dealers and I think the MOVES and RENOVE plans and/or the high discounts for new cars and young used cars will end up affecting transaction prices in the coming months,’ said Ana Azofra, valuation and insights manager at Autovista Group in Spain.

Switzerland saw the same dramatic decline in new car sales volumes as elsewhere. ‘So, nearly new cars, aged 0-6 months, served to fill the gap left by missing new cars and increased their values temporarily. However, used cars aged 0-6 months, as well as those aged seven to 17 months, are losing ground again as new car sales slowly regain some of the terrain lost during the lockdown,’ commented Hans-Peter Annen, head of editorial for Autovista Group in Switzerland.

‘Now manufacturers have resumed production and all the individual new car incentives are back, this will most likely increase the used car stock volume and the pressure on RVs,’ Annen added.

Meanwhile, there has been continued positive development of RVs in Poland. ‘I can observe continuous good demand for young used vehicles. They are a lower financial risk for buyers in the volatile market situation. Besides, list prices are growing very fast. That’s probably due to expected penalties for CO2 targets and the introduction of WLTP and the new Euro 6d norm, with more complicated engines (mild-hybrids),’ commented Marcin Kardas, head of the Autovista Group editorial team in Poland.

‘On the one hand, the financial contracts between companies and fleet suppliers are extended, which will cause a lack of the youngest used cars on the market. But a lot of people still work from home so don’t need a car and the economy remains unstable. In this environment, it is really hard to predict the direction of RVs. Growing list prices will decrease them but strong demand for used cars will positively influence them. To recognise the real post-Covid effect, we should wait a bit longer, but I don’t expect significant changes in the coming months,’ concluded Kardas.

A golden age for used car markets?

Dr Christof Engelskirchen, chief economist at Autovista Group, speaks to our leading data scientists, Dr Anne Lange and Markus Halonen, who help make sense of used car market trends during the Covid-19 ramp-up phase.

Christof: As we described in the first chapter, we see very different RV developments across Europe. Finland, Portugal are down. France, the UK, and to some extent also Poland, are up. The rest of the markets are trailing around the 100-point index mark, on average. In these markets, we do not see any negative or positive impact on used car price levels due to Covid-19, yet.

Clearly, used car price development is an important indicator of the strength of a country’s economy. When you look at our data, what factors currently affect used car price formation?

Anne: This chapter captures well how the three different clusters of countries behave during the ramp-up phase. What we usually see is a solid, yet lagged, relationship between stock market performance and used car prices, as long as the stock market represents a good reflection of the economic mood of a country. Currently, that is not the case. Low interest rates and hopes that Covid-19 may be contained shortly have pushed stock prices up. When we look at activities at dealers, we see that the initial shutdown has led to an increase in days in stock of cars. When dealers reopened, they initially began to manage prices down to clear out stock.

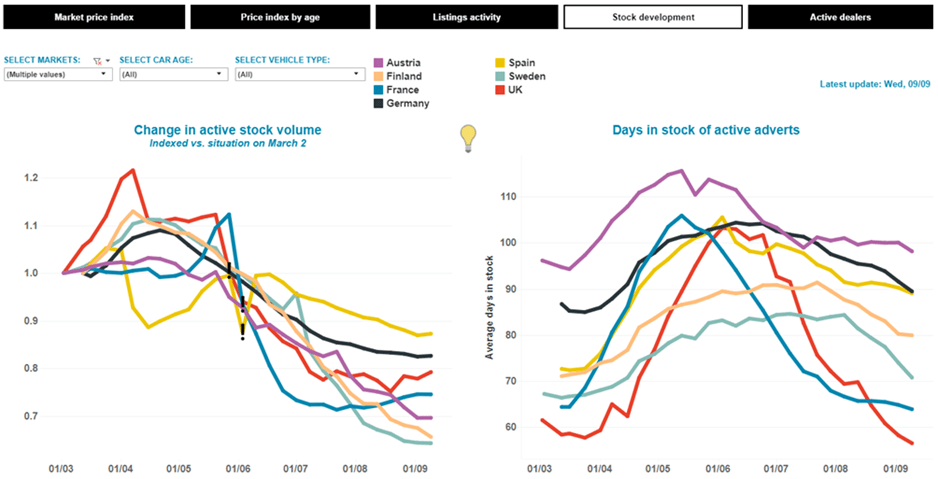

Markus: Yes, this was in the beginning of the crisis, where the supply of used cars was still stable as previously ordered cars were delivered to customers, which brought used cars in stock (see Figure 2, left chart). The used car demand was weak during the first weeks of the crisis and thus used car stock was increasing (see Figure 2, right chart).

Already in mid-April, the stock levels started to drop. This was because the inflow to stock decreased as new car deliveries collapsed but used car demand and sales volume was already improving. Today, days in stock are almost at pre-Covid-19 levels in some markets, which is remarkable (see Figure 2, right chart).

The three clusters we are describing make sense. Initial used car price drops are either slightly recovering, or stabilising, or even rising in markets like UK and France, for very different reasons, which have been well captured in the first chapter (see Figure 1).

Figure 2: Change in active stock levels and days in stock of active adverts across Europe

Left chart shows how active stock at dealers has been declining; right chart shows how days in stock rose initially during lockdowns and have been declining during the ramp-up phases to below pre-Covid-19 levels. Source: Autovista Group Covid-19 tracker

Christof: Are we in a phase of the market, where trends can already be safely interpreted or is it more affected by external events? I am referring to the massive incentive scheme in France also for used car buying, which has pushed RVs up. And I am referring to the weak-British-pound- and supply-shortage-induced lack of new and used cars on the market that meet some pent-up demand and lifts prices up in the UK?

Anne: There are certainly some anomalies affecting current used car price trends. For example, the French incentive scheme, that subsidises used car buying and drives RVs up and the UK’s shortage of supply of new and used cars, that drives RVs up. During the last couple of weeks, also holiday season caused a small dip in market activity.

There is one emerging trend that may last longer: people may exhibit a financial cautiousness and rather turn to a used car than a new car. This is further compounded by the lack of available new cars. In addition, those that used to rely on public transport may opt for some budget alternatives, thus driving demand for the older user cars up.

Markus: The reason for the decreasing active stock (number of active adverts) is simply that the dealers are selling out more cars than they are buying. For example, in Finland and Sweden, the used car selling volume has been truly at a high level lately. In June this year, used car retail sales volumes were higher than in June 2019. High sales but lower than normal inflow of used cars keeps the stock falling.

We have some anomalies, like the French used car incentive scheme, pushing RVs up, but even in those countries where schemes are different or non-existent, there are commonalities: used car sales volume is at good level, stock decreasing and prices increasing. On top of what Anne said, a reason for the currently good demand for used cars is that people did spend less money on vacation and during the lockdown. Patterns of consumption have changed, at least temporarily. Used car markets are benefitting.

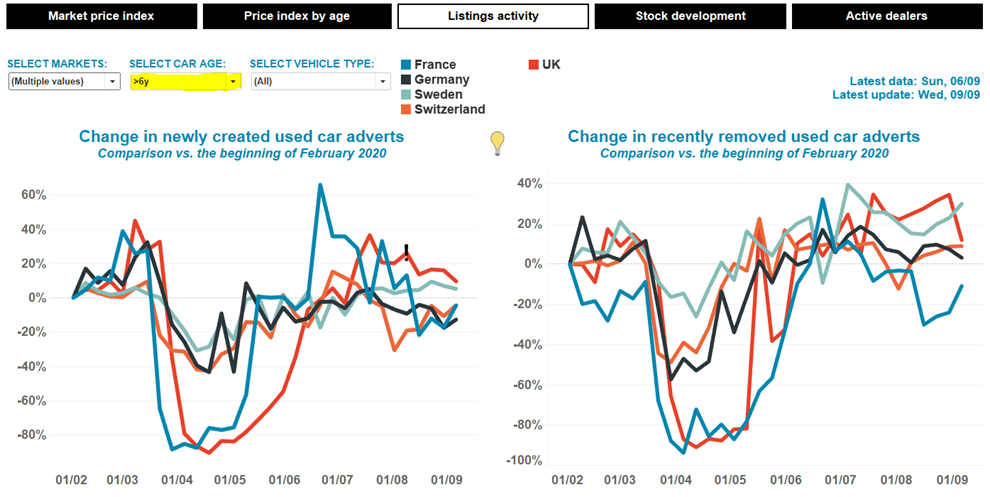

Christof: When we look at the very old used cars (>6 years), they usually perform pretty well in the current economic climate. Used car buyers seem to be looking for budget alternatives at times where they avoid public transport. However, there is a peculiar pattern for the nearly new young vehicles vs. the very old used cars. In many markets, we see that the older used cars perform relatively better than the very young ones, for example in Germany, France, Spain, and in particular in the UK. In Austria, Belgium, Finland and Sweden, the very young cars outperform the older ones. Is this driven by supply shortage more than differences in demand?

Anne: Let me try to sort through this. In most countries, we can see a lower supply of less than 1-year-old used cars to the market than pre-Covid-19 (see Figure 3, left chart). For cars six years and older, there are the same amount or more cars offered by dealers than pre-lockdown (see Figure 4, left chart). You are therefore describing two trends that have very different root causes. There is a lack of supply of new and very young used cars currently supporting price realisation for very young used cars. For the very old used cars, it is rather the strong demand for them that helps keep prices stable and rising.

Christof: People ask questions about our methodology for publishing used car price development. How sensitive is our methodology for outliers? How quickly do we capture emerging trends?

Markus: Our methodology is based on market observation data that we source from various portals all across Europe on a daily basis. We control for outliers, data errors and non-actively managed cars. This works reliably.

I am not sure what the background is to question around controlling for irregular market conditions. Irregular market conditions like the Covid-19 pandemic have an effect on used car prices, and that is what we are capturing with our data models. For measurement accuracy, we have implemented rolling values, where past days’ trends are captured as well as the current days’ realities. We put more weight on recent values in the statistical models. There is only a very small lag in how fast we see emerging trends, much smaller than for any economic modelling.

Christof: Has dealer activity picked up again? Are we back to normal? In which markets have dealers achieved the full turnaround in activities?

Anne: The number of dealers that are active in the market is almost back to pre-pandemic times with a typical holiday dip in recent weeks, although there is less new advertising activity than selling activity overall. Dealers are still clearing out their stock. Numbers indicate a shortage of young used cars.

Markus: The golden period of used car remarketing continues into September in many markets, despite gloomy economic outlooks. It is mostly driven by supply shortage of new cars and very young used cars, as well as pent-up demand.

Christof: Any word of advice?

Markus: Keep riding the wave of currently strong used car demand. A well-managed used car business is most important for car dealers during these difficult times, where fewer new cars are sold than normally.

Anne: I agree. Tougher times may be ahead, and our editorial teams are publishing the Covid-19 Whitepaper to discuss the RV forecasts for 2020, 2021, 2022 by scenario. My advice would be to keep reviewing the latest outlooks provided later in this whitepaper.

Figure 3: Change in market activity across Europe (young used)

Left chart shows how active stock at dealers for cars up to one year old has been declining and rising but they are still at a below pre-Covid-19 level; right chart shows that sales of these very young used cars is on pre-Covid-19 levels on average. Source: Autovista Group Covid-19 tracker

Figure 4: Change in market activity across Europe (older used)

Left chart shows how active stock at dealers for cars older six years is increasing to pre-Covid-19 levels or slightly above; right chart shows that sales of these older used cars exceeds pre-Covid-19 levels. Source: Autovista Group Covid-19 tracker

The double-edged sword of EV government incentives?

Autovista Group’s chief economist Dr Christof Engelskirchen ponders the pros and cons of electric-vehicle (EV) purchase incentives.

High up-front discounts granted on the purchase of new cars and their negative impact on residual values (RVs) is a phenomenon well described and frequently observed in the automotive industry. We covered it in our recent piece on the impact of sales planning on residual values. Lower residual values do not only represent a direct economic loss for those with vehicles on their balance sheets. Low residual values also prevent profitable new car sales, as they make it almost impossible to offer competitive and sustainable leasing rates.

Many governments are determined to support the particularly battered automotive industry, which is confronting several expensive fights. They are battling with new technologies, new competitors, the shift to zero-emission and depressed margins. The pandemic and the associated lockdowns have intensified the pressure. Recovery will take considerable time. Many jobs are at risk, and it is sensible for governments to soften the blow by supporting the transition financially.

There is one caveat: too often, the government-funded stimulus programmes focus solely on stimulating demand for new cars. Governments should avoid this and other common mistakes such as:

- Up-front, transparent and long-term incentives send the signal that new cars are overpriced without them. Lower transaction prices of new cars will lower transaction prices of used cars. A good example of this can be seen in France, where many years of a bonus/ malus system have depressed the used car price of battery-electric vehicles (BEVs);

- Governments risk creating an oversupply of used cars. The German government has reduced company-car taxes for many plug-in hybrid electric vehicles (PHEVs) by 50% (and 75% for BEVs). That makes them highly attractive as company cars, in particular, PHEVs due to their versatility. There is a substantial risk that the rise in the supply of used PHEVs will not meet the same demand on used car markets, as there is no similar relative benefit for a used car buyer to choose PHEV over petrol;

- Even though government programmes mostly stimulate alternative powertrain types, the massive support, which is granted – easily 10%-20% of the list price, delivers negative spillovers on all used car prices, even those of internal combustion engine (ICE) vehicles. The higher the stimulus is, the higher the spillover effects become;

- Reducing VAT for used cars is a mistake, as it directly lowers the signalled retail used car price. Germany has implemented such a measure for the period July and December 2020, VAT rates are reduced from 19% to 16% – for used cars. This will effectively drive signalled retail used car prices on internet portals down by 2.52%. The idea of stimulating used car purchases can be RV-supportive if done correctly: ex-post refund of part of the VAT or simply a purchase incentive for used cars, like in France and to a lower extent in Spain, works better; and

- Incentives are like a drug, and an exhausted incentive scheme creates a bigger demand gap. Many push the purchase of their vehicle forward because of a scheme, currently observed in France where used car prices are rising because their purchase is incentivised by the government. The scheme will likely run out by the end of July. There is the risk that further schemes need to follow, as was the case in Italy during and after the financial crisis 2008/2009. We should also expect that schemes in France and Spain will be extended if they are exhausted too quickly.

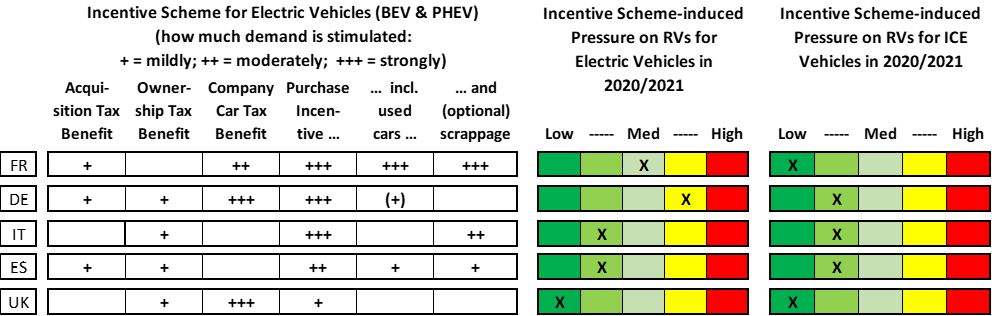

European incentive schemes: more pressure

The existing government incentive schemes in the big European markets and the UK are diverse and show how differently countries approach the topic. We compare them in Table 1. We have evaluated the relative strength of the stimulating effects for each dimension of the scheme, for example, there is a very strong stimulating effect derived from the very high purchase incentives for BEVs and PHEVs in France and Germany.

Acquisition tax benefits are relatively small in France, Germany and Spain. Where there are company-car tax incentives, they are usually very impactful as stimuli, e.g. in Germany and the UK. We evaluated company-car tax incentives in France as “moderately” impactful as in reality they apply only to BEVs (vehicles <20g CO2/km). For the UK, they also apply only to “zero-emissions vehicles”, but the magnitude of government support is higher than in France.

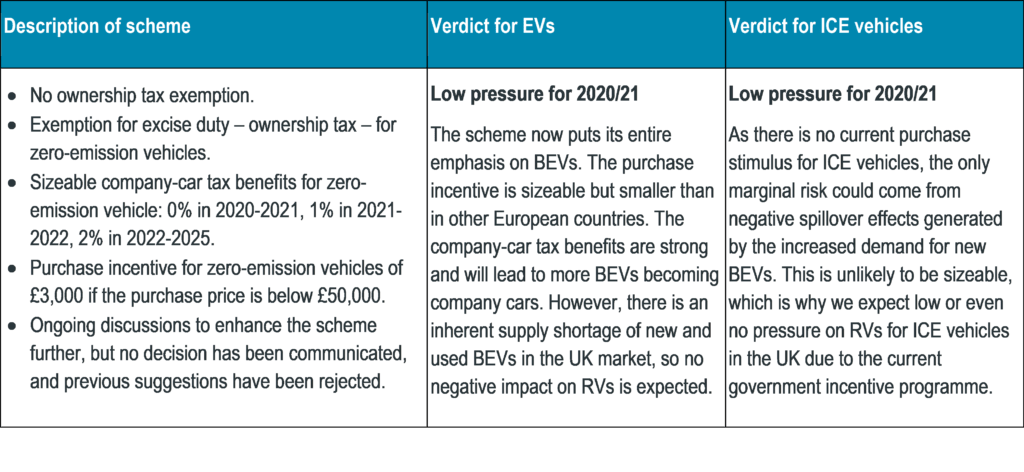

Our evaluation of the schemes covers previously existing schemes on top of the newly added schemes. The UK is the only market that has not introduced additional incentives post Covid-19 lockdowns, as discussions are ongoing.

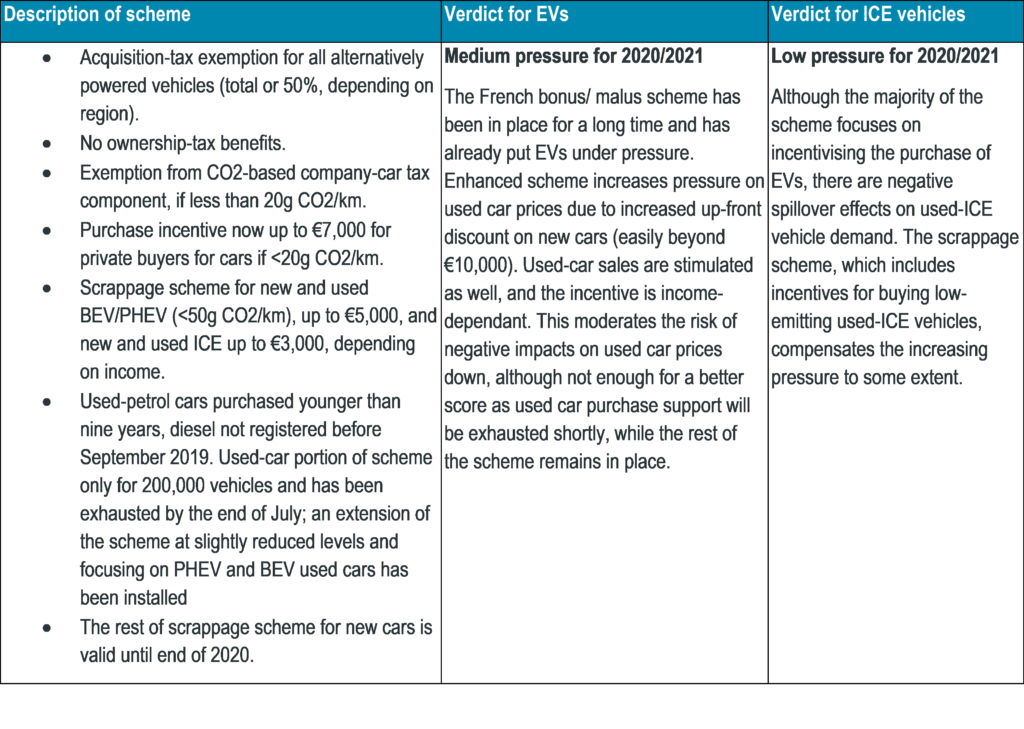

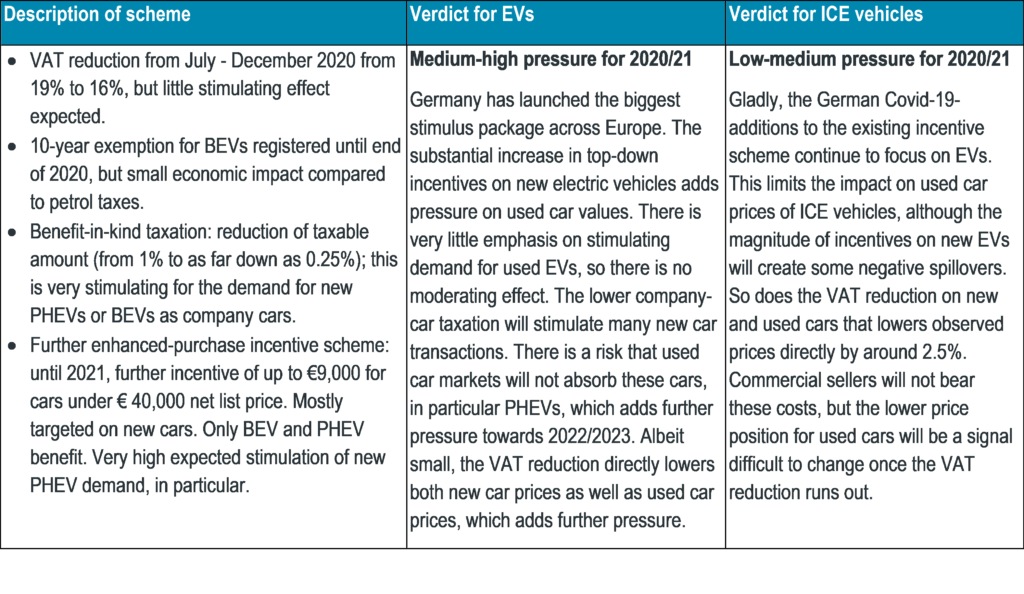

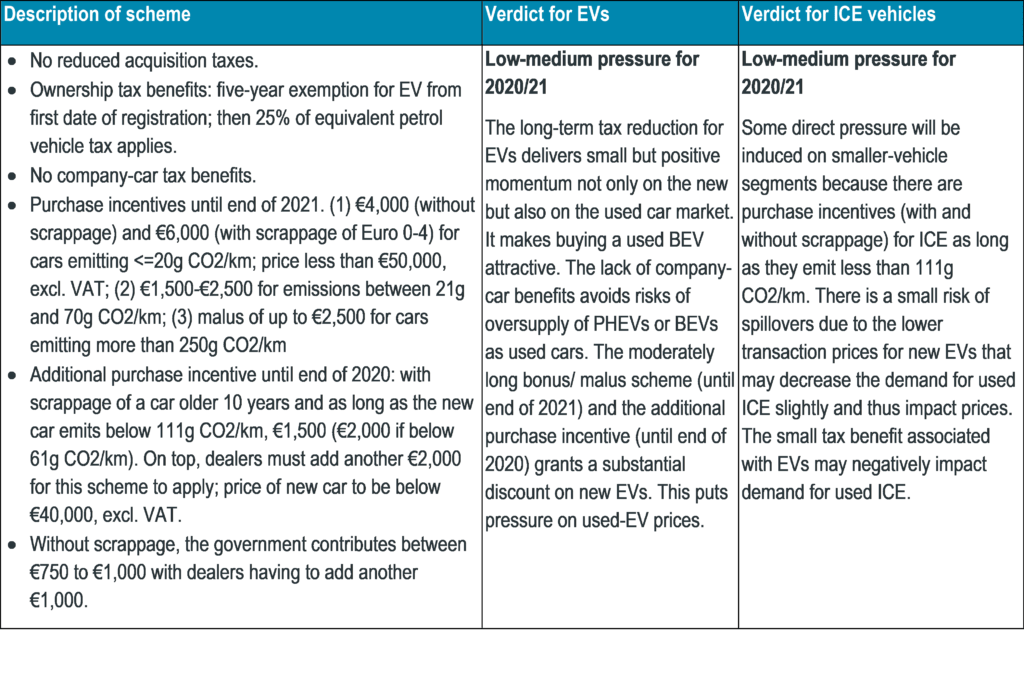

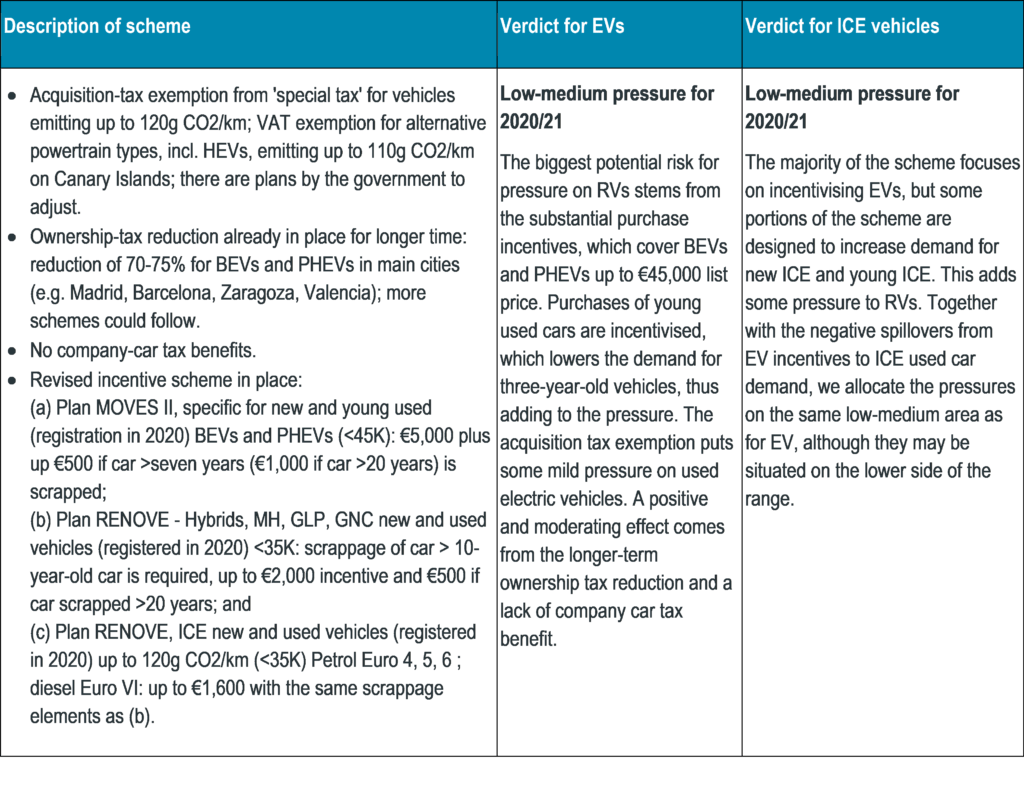

Table 2 describes the scheme and verdict for France, Table 3 for Germany, Table 4 for Italy, Table 5 for Spain and Table 6 for the UK.

Table 1: Government incentive schemes, their potency and risk of building up RV pressure

Table 2: France – high EV incentives; stimuli for used car purchases help ease pressure on RVs

Table 3: Germany – risk of higher pressure on EV RVs than in other markets

Table 4: Italy – among the highest purchase incentives for EVs

Table 5: Spain – sizeable ownership tax cut & high EV incentives; covers young used ICEs

Table 6: UK – no Covid-19-induced scheme, currently solely on zero-emission vehicles

Incentive schemes are necessary to compensate for an expected loss of private purchasing power as part of the economic crisis that will follow Covid-19 lockdowns. Most European countries have enhanced their schemes, and they offer very sizeable purchase incentives. Schemes are largely targeted on new electric vehicles (i.e. BEVs and PHEVs), which is why the expected negative impact on residual values is higher for electric vehicles. The schemes may create an oversupply of electric vehicles towards 2022.

We are less concerned about pressure building up for used ICE vehicles across Europe, as they receive less attention in government schemes. France is the only country that substantially incentivises the purchase of used ICE vehicles, in particular petrol, which effectively compensates for some of the discount-induced pressures. Spain incentivises the purchase of very young used ICE vehicles as well. Germany’s company car tax benefits may drive too many PHEVs into the market and Germany’s VAT reduction, which covers also used cars, creates a direct reduction of signalled retail used car prices of around 2.5%. Italy provides slightly higher purchase incentives than Spain, but both schemes are bullish. The UK has not yet adjusted their scheme post-Covid-19, but discussions are ongoing. So far, the UK’s scheme is creating the least risk for RVs.

Coronavirus scenarios – how swiftly will economies recover?

Thoughts have turned towards a swifter economic recovery than initially expected. Is this wishful thinking? Will pent-up demand be exhausted soon? While economies emerge, a second wave of infections is hitting Europe. Here, Autovista Group’s experts analyse the latest trends and scenarios for Europe’s used car markets.

In our ambition to support analysis of the impact of the coronavirus on the automotive industry, we have developed a number of scenarios. The scenarios are based on risks associated with the following five mandatory parameters, as well as other country-specific factors that influence RV development:

- How long until the spread of infections is contained;

- The economic outlook for 2020, 2021 and 2022;

- On the supply side, expected issues in the supply chain for new car production;

- On the demand side, development of private consumption over the coming years; and

- An assessment of how effectively fiscal and monetary policy measures are working.

Views on economic recovery have improved

Before the lockdown, forecasts of GDP growth were around 2% for 2020 globally and slightly below 1% in the Eurozone – an outlook that had already been depressed compared to January and February baselines. Since then the view of the crisis and its economic impact had continuously darkened.

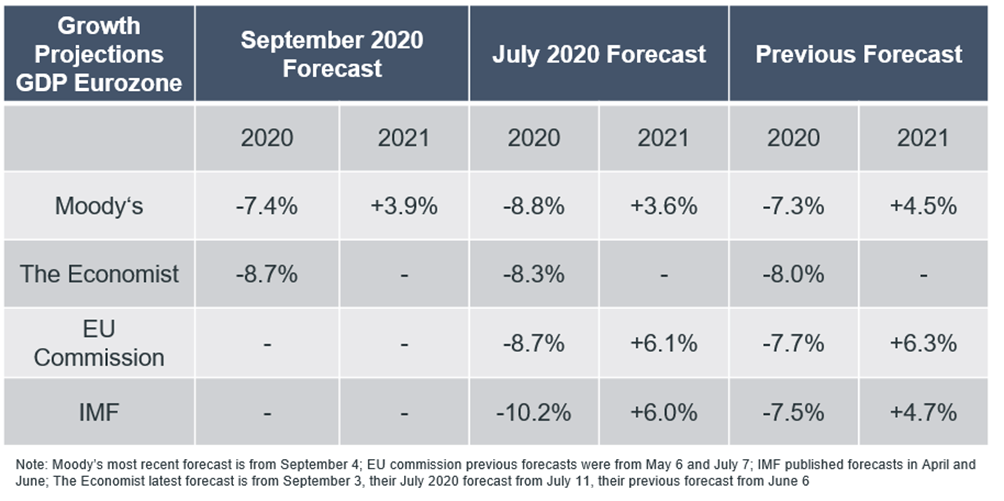

However, these forecasts seem to have bottomed out over the summer. In September 2020, newly published forecasts have improved (Table 7). For the Eurozone, Moody’s has established a full-year GDP forecast for 2020 of -7.4%. This is in line with their outlook from June of -7.3% and better than their outlook from July (-8.8%). We do not yet have new forecasts from the EU Commission or the IMF, which we had quoted in previous updates of this whitepaper. However, we expect improvements there as well.

Table 7: Growth projections GDP Eurozone

The immense levels of pent-up demand and the fact that the contraction of the economy was so severe during the Q1 and Q2 2020 drive a lot of the current economic rebound. Many forecasters stress the expectation that the v-shaped recovery will lose steam towards the end of the year and that recovery to pre-crisis levels will take until 2022 in the Eurozone.

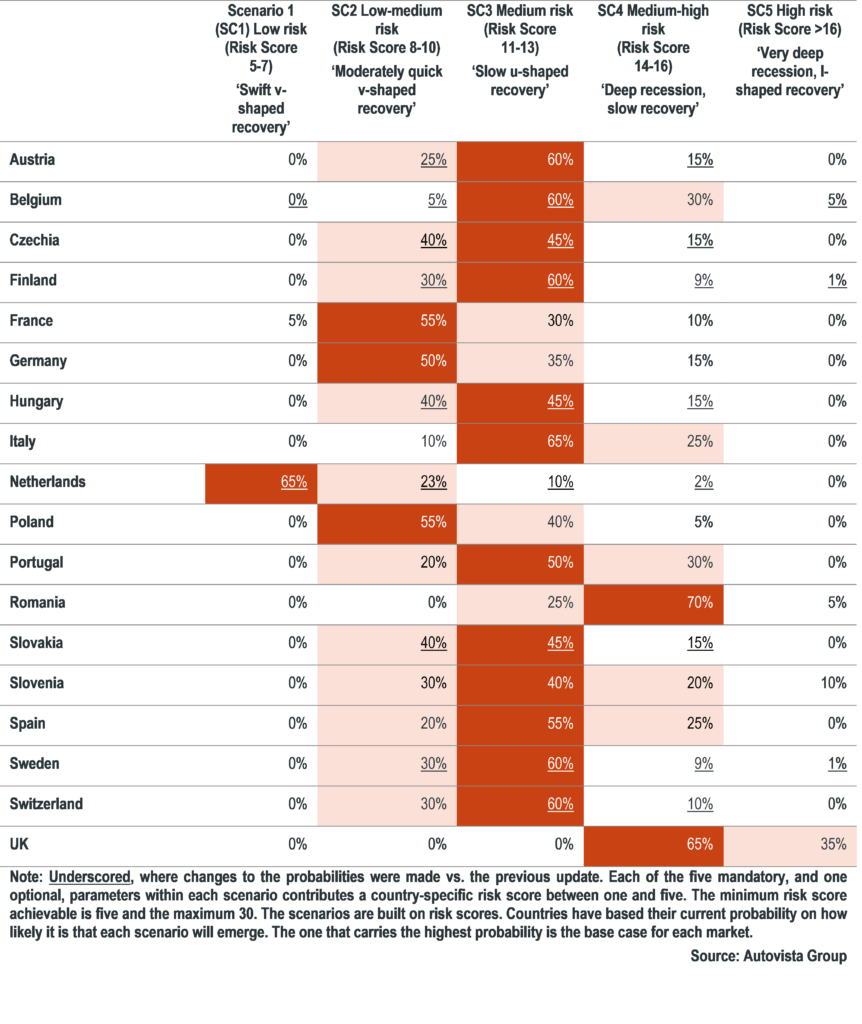

Most likely scenario: ‘medium risk’

In our August update of this whitepaper, 12 out of 18 markets were allocated to our ‘medium risk – slow u-shaped recovery’ scenario (SC3). That view has been confirmed for this September update. The same twelve countries expect that scenario to materialise with the highest probability.

For example, Italy has confirmed the likelihood of SC3 at 65% and that ‘there is no chance of a v-shaped recovery in the Italian market’, according to Marco Pasquetti, forecast and data specialist at Autovista Italy. ‘Despite some mild improvements in economic forecasts, the Italian economy will be worse affected than many others and experience a severe drop in GDP in 2020 and consumer purchasing power.’

Nevertheless, there has been an improvement of many scenario probabilities within this SC3 countries cluster. With the exception of Belgium, which slightly increased the likelihood for SC3 from 55% to 60% in this update, eight countries have increased likelihoods of a faster recovery via a change to the probabilities.

Austria, Czechia, Finland, Hungary, Slovakia, Sweden and Switzerland all increased the likelihood for SC2. The Netherlands editorial team have undertaken a major improvement of their outlook and are now allocating 65% to a SC1-type recovery (in August they still allocated 65% to a SC2-type recovery).

‘In the Netherlands, the government subsidies for private customers buying a new or used electric car have stimulated sales. In July, these were mainly the sales of new cars. In August, these were mainly the sales of used cars. Funds for new cars have been used up and the funds for used cars will soon be exhausted’, comments Nico VanHalst, residual value manager for the Netherlands. ‘Demand for used electric cars is high. Moreover, because sales of new cars are still 25% lower than the same period in 2019, we believe in a continued and rapid recovery of the market. We also expect the demand for used cars to continue to increase and have therefore moved from SC2 to SC1.’

The SC2 cluster now consists of France, Germany and Poland, who confirm their probability assessments. Poland allocates 55% to a SC2-type recovery. Marcin Kardas, head of the editorial team at Autovista Polska, confirms: ‘we still observe very positive developments of car markets in Poland. Sales of new passenger vehicles is growing and currently is on the level of -20% year on year. Imports of used cars from abroad are almost back at pre-pandemic levels.’

Romania and the UK have also confirmed their more pessimistic outlooks, still allocating the highest probabilities to a SC4. The UK will be severely hit by the double-whammy of Covid-19 and Brexit.

On a positive note, and in line with a stronger-than-expected economic rebound, we can see an overall improvement to the assessments: SC3 continues to dominate the outlooks across Europe, but SC2 probabilities have notably increased.

Robert Madas, valuations & insights manager for Austria and Switzerland summarises the issues several editorial teams pondered with regards to the September update when explaining the situation for this region: ‘We are now more optimistic than at the beginning of the crisis and in August. Currently there is high demand (and still limited supply) on the used car market. Asking prices have been rising since mid-May and have recovered to pre-Covid-19 levels. However, in both markets, uncertainty remains high regarding purchasing power and a general more subdued economic outlook. Therefore, we expect increasing promotional activity and discounts in the near future. Furthermore, government incentives for new cars (BEVs/PHEVs) will negatively affect used car values in Austria.’

Table 8: Risk scenarios for the impact of coronavirus

Impact on residual values

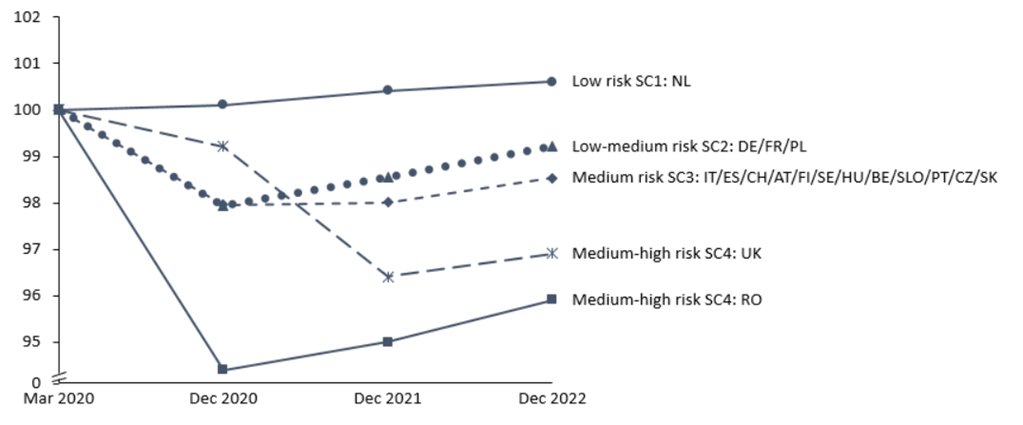

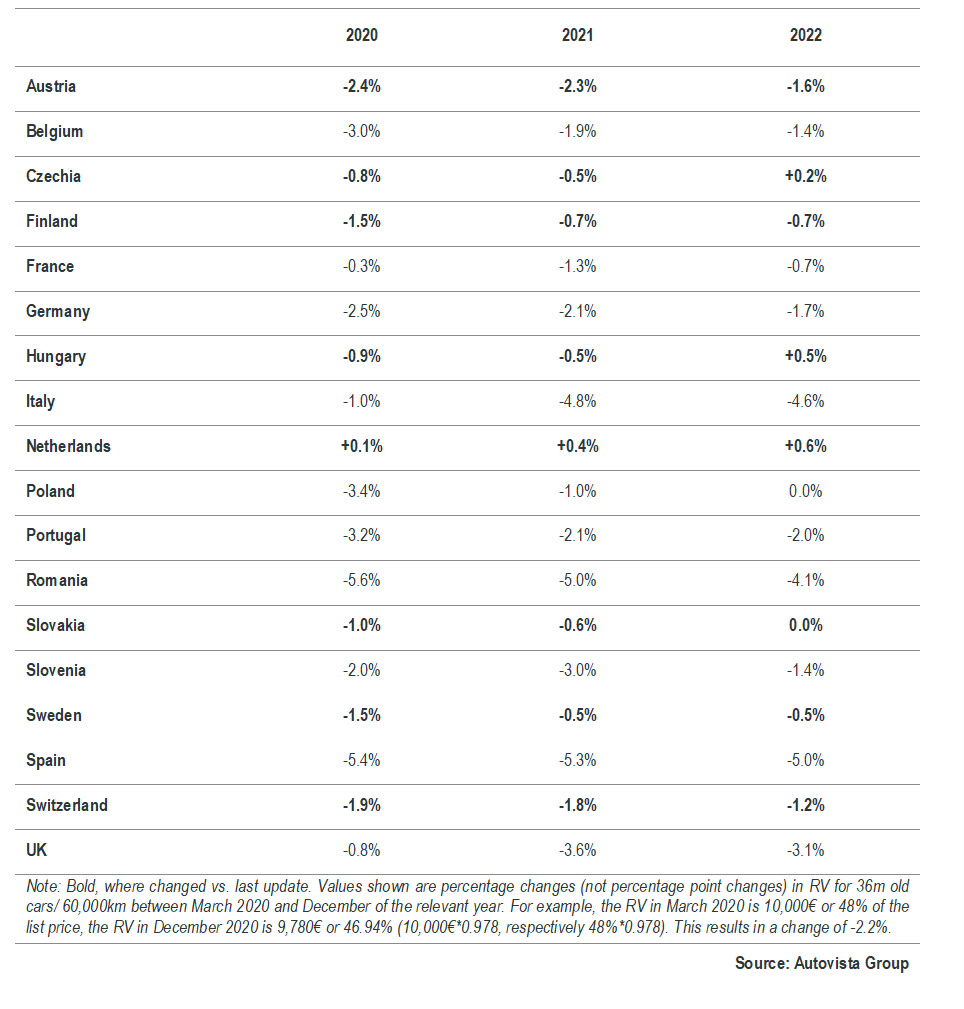

The impact on residual values depends on the most probable scenario and country-specific circumstances. Figure 5 shows the residual value development by scenario cluster, unweighted and indexed. Countries have been allocated to the scenario cluster according to their highest-probability scenarios.

The Netherlands is the first region to forecast a positive outlook on residual values. They expect that used car markets will rise above pre-crisis levels already this year and maintain on that trajectory over the next two years.

Poland, Germany and France confirm their RV outlooks in this update. France expects no substantial decline this year (see Table 9), in particular due to the government incentive scheme that also stimulated demand for used cars. The initial used car support portion was exhausted quickly but it was extended with a lighter support for used BEVs and PHEVs. The positive momentum on used car markets should continue for the time being.

In contrast, Germany’s head of valuations & insights, Andreas Geilenbrügge, points out that ‘the doubled governmental eco bonus on new BEVs and PHEVs does not yet fully impact used car prices but will during the course of the year. After a positive autumn, we expect stronger price competition during the last two months of the year to compensate for the loss in new car sales by higher used car turnover. That will put pressure on used car prices.’

Poland will be more elastic its used car market decline and recovery. Our teams expect a 3.4% drop in used car prices in 2020 and a fast recovery in 2021.

While there are still twelve countries that allocate themselves to SC3, their RV outlooks have improved vs. the August update of this whitepaper. Towards the end of 2022, used cars will – on average – still trade around 1.5% lower than in March 2020 (Figure 5). In August, that figure was 3%. There are substantial country differences in this cluster. For example, Spain and Italy expect the most severe drops among their peers, of 5% in 2021 vs. March 2020.

Due to exchange rates weakening towards the Euro, several SC3 Eastern European countries expect less downward pressure on used car prices than in previous updates, e.g. Czechia, Hungary and Slovakia.

Sorted by country cluster (Figure 6), it becomes apparent that Southern Europe (we include France and Belgium), will be impacted the longest and feel the worst impact. In the DACH region – Austria, Germany and Switzerland – we expect a quicker recovery than in the South.

The Nordic region expects to come out even stronger than anticipated in August. We improved our outlook for Finland and Sweden vs. our August forecast: forecasts for both countries improved by around 0.5% points across 2020-2022. Sweden and Finland have been going through the crisis successfully, given they had a shorter lockdown (Finland) or even no lockdown at all (Sweden). RVs came under pressure quickly but have been recovering for some months now and are now at pre-crisis levels in Sweden. ‘The used car market has recovered fine. Since we did not have a lockdown, the values for Sweden and Finland went down in late March and April due to the overall fear and uncertainty about what would happen. Between May and August, used car prices have recovered,’ comments Johan Trus, head of data and valuations Nordics at Autovista. The RV outlooks for Finland and Sweden take more of a v-shaped recovery pattern (Figure 6).

Individual country forecasts are laid out in Table 9. Romania will be worst affected this year. The team expects a drop of 5% in 2020 and no full recovery by 2022 (-4.1% vs. March 2020). Spain, likewise, will not recover from an expected approximate 5% drop by 2022. Italy expects to trade 4.6% lower by the end of 2022 in comparison to levels in March 2020, before lockdown. They expect the biggest hit on used car values to occur in 2021, after a more moderate decline in 2020. The supply shortage of new cars in 2020 should soften the blow this year. Italy has been particularly exposed to the coronavirus pandemic, moving into a full-blown economic crisis that will affect private demand for used cars for a longer period. Italy confirms its assessment vs. the previous update of this whitepaper.

The pattern for the UK is different from the rest of the countries we cover, in particular, due to the combination of lack of supply and pent-up demand. Our resolve vs. the August update of this whitepaper remains unchanged. A no-deal Brexit scenario has even become more likely now, however. According to Anthony Machin, head of content and product at Glass’s: ‘compared to March 2020, we will see a slight drop still this year, but pent-up demand will lower the impact. The biggest impact will be in 2021, with values trading 3.6% lower than March 2020.’ In 2022, the UK will continue to see RVs perform at lower levels than in March 2020 (-3.1%).

Austria and Switzerland have both seen an update towards a more positive RV outlook than in August. Our Austrian editorial teams expect a -2.4% RV impact towards the end of 2020 (was -3.2%) and by the end of 2020 RVs should be 1.6% lower than pre-crisis levels (was -2.3%). For Switzerland, the adjustments are similarly positive but slightly smaller: a 1.9% drop in RVs still in 2020 vs. pre-crisis levels (was -2.4%). Towards the end of 2022, RVs should be down 1.2% vs. pre-crisis levels (was -1.6%).

Robert Madas, valuations and insights manager for the two markets, comments: ‘The price decreases in the used car markets of Austria and Switzerland were small in the beginning of the crisis. Asking prices have now recovered to pre-coronavirus levels due to pent-up demand. Recently, some vehicle categories even show an increasing trend. However, in both markets, we expect to see price decreases in the future due to the difficult economic outlook and the uncertainty regarding the purchasing power.’

For Belgium, we confirm our expectation of a downwards correction by the end of 2020, of 3% on average. Used car prices will stabilise around 1.9% lower than March 2020 levels in 2021 and remain at a slightly depressed level in 2022. ‘These are the anticipated average changes, but there are substantial differences to be expected between segments,’ according to Idesbald Vannieuwenhuyze, chief editor and valuations manager, Autovista Benelux.

Figure 5: Used car price development by scenario cluster; UK, Romania separated out (indexed)

Note: These clusters represent unweighted averages of countries and do not represent country-specific forecasts. Please refer to Table 8 for the country-specific forecasts. Source: Autovista Group

Figure 6: Used car price development by regional cluster (indexed)

Note: These clusters represent unweighted averages of countries and do not represent country-specific forecasts. Please refer to Table 8 for the country-specific forecasts. Source: Autovista Group

Table 9: Forecast percentage change in residual values EoY vs. March 2020

Conclusion

This is the fifth update to our analysis of the impact that the coronavirus will have on societies, the economy and used car markets.

The impact of the economic crisis on RVs will be felt differently depending on the circumstances in individual countries. Autovista Group expects a sharper drop in RVs in the Southern European countries, in some around 5-5.5% at the peak of the crisis. Austria, France, Germany, the Netherlands, Switzerland and the Nordics will not be hit as hard as the southern regions, based on the current risk assessment. A more elastic recovery could be anticipated in Eastern Europe, in particular Czechia, Hungary, Poland and Slovakia, not only due to currency weakening towards the Euro.

RV outlooks for Austria, Czechia, Finland, Hungary, Netherlands, Slovakia, Sweden and Switzerland have improved vs. our last update. These countries now expect a smaller drop in RVs and a (slightly) swifter recovery.

During the 2008/2009 financial crisis, we saw falls in RVs that were substantially higher than currently forecast in our most probable scenarios. At the time, declines of 12% on average across segments had built up over 12-18 months into the crisis. We confirm that we do not expect this level of impact on used car markets, as indicated in our risk scenario probabilities and RV forecasts.

Several things are different in this crisis. Governments have taken much stronger policy actions against the collapsing demand. The current economic shock is not paired with a lack of financing opportunity. In addition, after the peak of the crisis, we are seeing substantial pent-up demand as private consumers perceive the shock as temporary, and several incentive schemes support the purchase of new and used vehicles.

On the downside, a second wave of infections has arrived, and more restrictions are immanent. Several regions either have entered or may need to enter lockdown. This may serve another hit to battered economies and supply chains. While we are more optimistic than last month, we expect that the currently felt strong rebound of economies will lose some of its steam towards the end of the year.

We will update this analysis on a monthly or bi-monthly basis and see how assumptions and scenarios evolve and how quickly and extensively the used car market adapts.

Author

- Dr Christof Engelskirchen, Chief Economist, Autovista Group

Analysts & Contributors

- Hans-Peter Annen, Chief Editor, Autovista Switzerland

- João Areal, Editorial Manager, Autovista Eurotax Portugal

- Ana Azofra, Valuation and Insights Manager, Autovista Spain

- Dejan Butinar, Country Manager, Eurotax Slovenia

- Andreas Geilenbrügge, Head of Valuations and Insights, Schwacke (Germany)

- Markus Halonen, Director of Statistics and Data Analyses, Autovista Group

- Ulmis Horchidan, Chief Editor, Eurotax Romania

- Zsolt Horvath, Operations Manager, Eurotax Hungary

- Marcin Kardas, Head of Editorial Team, Autovista Polska

- Neil King, Senior Data Journalist

- Dr Anne Lange, Head of Data Science, Autovista Group

- Anthony Machin, Head of Content and Product, Glass’s (UK)

- Robert Madas, Valuations and Insights Manager Austria & Switzerland, Eurotax

- Marco Pasquetti, Forecast and Data Specialist, Autovista Italy

- Yoann Taitz, Operations and Valuations Director, Autovista France

- Johan Trus, Head of Data and Valuations Nordics, Autovista

- Roland Strilka, Director of Valuations, Autovista Group

- Nico VanHalst, RV Manager, Eurotax Nederland

- Idesbald Vannieuwenhuyze, Chief Editor and Valuations Manager, Autovista Benelux