Hydrogen will dominate the automotive market by 2040

11 October 2019

11 October 2019

Many years ago, the automotive market divided into just petrol and diesel propulsion but due to a need for lowering emissions and a decline in the diesel market, there are multiple options on sale today and other developments in the pipeline.

By 2040, some of Europe’s biggest markets will have introduced a ban on the sale of new petrol and diesel vehicles, with some hybrids also falling foul of the legislation. These decisions, along with bans on diesel vehicles in some major European cities, is likely to affect sales in the coming years. So what will be the dominant propulsion technology by 2040?

Leading the way

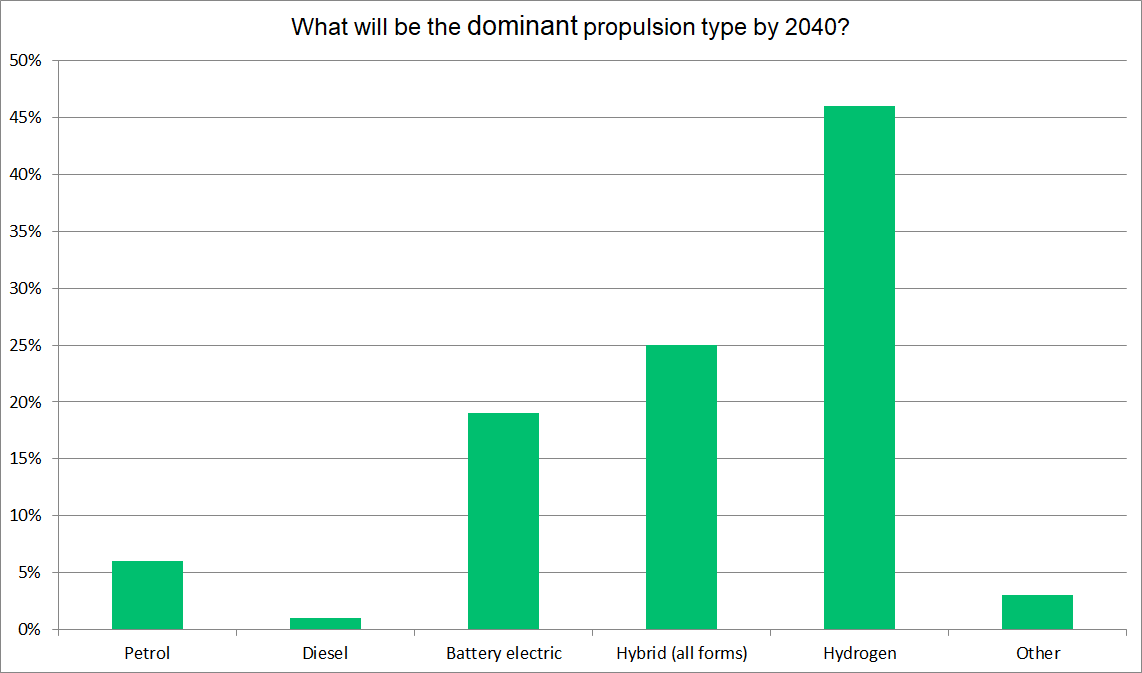

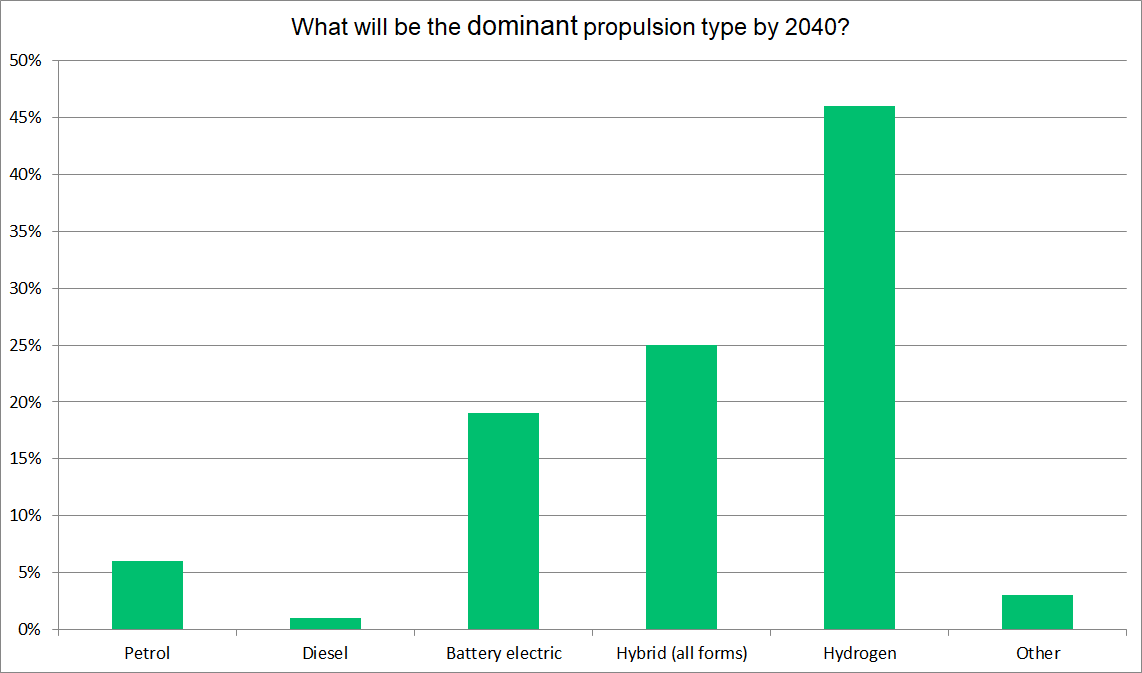

The latest Autovista Group poll revealed that readers of the Daily News Brief believe in hydrogen. With a 46% share, the option dominated the thoughts of those taking part. Hydrogen offers everything that petrol and diesel vehicles do, in their range and refuelling times, while producing zero emissions. The only waste product from the generation process is water.

Currently, hydrogen is a niche fuel, developed by a handful of manufacturers including Toyota and Hyundai. Yet there are calls to improve the European hydrogen infrastructure, and other carmakers are starting to turn to the technology now their EV programmes are taking shape. By 2040, therefore, it could well be a leading fuel type, especially useful for long-distance driving and in logistics.

Toyota is so keen that the future is hydrogen that it has already announced a second-generation model of its Mirai. The concept will be shown at the Tokyo show later this month and is scheduled for launch in 2020, initially in Japan, North America and Europe.

Hybrid offering

Despite the potential for some hybrid models to fall foul of legislation on bans in some countries, a quarter (25%) of voters felt the technology would be the dominant propulsion type. Of all the alternative vehicles on the roads around the continent today, hybrids are the most popular.

In Q2 this year, of the 9.2% market share that alternative fuel types had in the European market, 5.1% were hybrids. Sales of hybrids grew by 38.2% in the three months from April to June, as drivers find them a good bridge between the traditional internal combustion engine and full-electric technology. Most carmakers are including hybrids in their electrification strategies and as the technology has been around for over a decade, thanks to Toyota, it has a good foothold in the market already.

Sales of plug-in hybrids (PHEVs) have fallen in Europe. However, there is a possibility that once carmakers develop electric technology further, and can increase the electric-only range of PHEVs, sales may again increase.

Electric-only

Battery electric (BEVs) came in third place with 19%, despite carmakers currently pushing forward with the development of the technology to meet strict European emissions regulations as the diesel market collapses. Diesel itself polled poorly, with just 1% feeling it would be dominant by 2040.

Sales of BEVs have been low for some time, despite impressive growth numbers. Although there was an increase in sales during Q2 in Europe, of 97.7%, the volume amounted to just 63,589 units – compared to 2,443,743 sales of petrol models. It is unknown what will happen as more manufacturers bring their new models to market and charging infrastructures grow.

Petrol, currently dominating the market, scored 6% in the poll, showing that the industry believes the technology has had its time and as the development of alternative technologies continues, they will erode the 59.5% market share that petrol holds.

Finally, the ′other’ category scored 3%, with most people suggesting bicycles as the dominant propulsion type, with others even suggesting horses.

Currently, hydrogen is a niche fuel, developed by a handful of manufacturers including Toyota and Hyundai. Yet there are calls to improve the European hydrogen infrastructure, and other carmakers are starting to turn to the technology now their EV programmes are taking shape. By 2040, therefore, it could well be a leading fuel type, especially useful for long-distance driving and in logistics.

Toyota is so keen that the future is hydrogen that it has already announced a second-generation model of its Mirai. The concept will be shown at the Tokyo show later this month and is scheduled for launch in 2020, initially in Japan, North America and Europe.

Hybrid offering

Despite the potential for some hybrid models to fall foul of legislation on bans in some countries, a quarter (25%) of voters felt the technology would be the dominant propulsion type. Of all the alternative vehicles on the roads around the continent today, hybrids are the most popular.

In Q2 this year, of the 9.2% market share that alternative fuel types had in the European market, 5.1% were hybrids. Sales of hybrids grew by 38.2% in the three months from April to June, as drivers find them a good bridge between the traditional internal combustion engine and full-electric technology. Most carmakers are including hybrids in their electrification strategies and as the technology has been around for over a decade, thanks to Toyota, it has a good foothold in the market already.

Sales of plug-in hybrids (PHEVs) have fallen in Europe. However, there is a possibility that once carmakers develop electric technology further, and can increase the electric-only range of PHEVs, sales may again increase.

Electric-only

Battery electric (BEVs) came in third place with 19%, despite carmakers currently pushing forward with the development of the technology to meet strict European emissions regulations as the diesel market collapses. Diesel itself polled poorly, with just 1% feeling it would be dominant by 2040.

Sales of BEVs have been low for some time, despite impressive growth numbers. Although there was an increase in sales during Q2 in Europe, of 97.7%, the volume amounted to just 63,589 units – compared to 2,443,743 sales of petrol models. It is unknown what will happen as more manufacturers bring their new models to market and charging infrastructures grow.

Petrol, currently dominating the market, scored 6% in the poll, showing that the industry believes the technology has had its time and as the development of alternative technologies continues, they will erode the 59.5% market share that petrol holds.

Finally, the ′other’ category scored 3%, with most people suggesting bicycles as the dominant propulsion type, with others even suggesting horses.

Currently, hydrogen is a niche fuel, developed by a handful of manufacturers including Toyota and Hyundai. Yet there are calls to improve the European hydrogen infrastructure, and other carmakers are starting to turn to the technology now their EV programmes are taking shape. By 2040, therefore, it could well be a leading fuel type, especially useful for long-distance driving and in logistics.

Toyota is so keen that the future is hydrogen that it has already announced a second-generation model of its Mirai. The concept will be shown at the Tokyo show later this month and is scheduled for launch in 2020, initially in Japan, North America and Europe.

Hybrid offering

Despite the potential for some hybrid models to fall foul of legislation on bans in some countries, a quarter (25%) of voters felt the technology would be the dominant propulsion type. Of all the alternative vehicles on the roads around the continent today, hybrids are the most popular.

In Q2 this year, of the 9.2% market share that alternative fuel types had in the European market, 5.1% were hybrids. Sales of hybrids grew by 38.2% in the three months from April to June, as drivers find them a good bridge between the traditional internal combustion engine and full-electric technology. Most carmakers are including hybrids in their electrification strategies and as the technology has been around for over a decade, thanks to Toyota, it has a good foothold in the market already.

Sales of plug-in hybrids (PHEVs) have fallen in Europe. However, there is a possibility that once carmakers develop electric technology further, and can increase the electric-only range of PHEVs, sales may again increase.

Electric-only

Battery electric (BEVs) came in third place with 19%, despite carmakers currently pushing forward with the development of the technology to meet strict European emissions regulations as the diesel market collapses. Diesel itself polled poorly, with just 1% feeling it would be dominant by 2040.

Sales of BEVs have been low for some time, despite impressive growth numbers. Although there was an increase in sales during Q2 in Europe, of 97.7%, the volume amounted to just 63,589 units – compared to 2,443,743 sales of petrol models. It is unknown what will happen as more manufacturers bring their new models to market and charging infrastructures grow.

Petrol, currently dominating the market, scored 6% in the poll, showing that the industry believes the technology has had its time and as the development of alternative technologies continues, they will erode the 59.5% market share that petrol holds.

Finally, the ′other’ category scored 3%, with most people suggesting bicycles as the dominant propulsion type, with others even suggesting horses.

Currently, hydrogen is a niche fuel, developed by a handful of manufacturers including Toyota and Hyundai. Yet there are calls to improve the European hydrogen infrastructure, and other carmakers are starting to turn to the technology now their EV programmes are taking shape. By 2040, therefore, it could well be a leading fuel type, especially useful for long-distance driving and in logistics.

Toyota is so keen that the future is hydrogen that it has already announced a second-generation model of its Mirai. The concept will be shown at the Tokyo show later this month and is scheduled for launch in 2020, initially in Japan, North America and Europe.

Hybrid offering

Despite the potential for some hybrid models to fall foul of legislation on bans in some countries, a quarter (25%) of voters felt the technology would be the dominant propulsion type. Of all the alternative vehicles on the roads around the continent today, hybrids are the most popular.

In Q2 this year, of the 9.2% market share that alternative fuel types had in the European market, 5.1% were hybrids. Sales of hybrids grew by 38.2% in the three months from April to June, as drivers find them a good bridge between the traditional internal combustion engine and full-electric technology. Most carmakers are including hybrids in their electrification strategies and as the technology has been around for over a decade, thanks to Toyota, it has a good foothold in the market already.

Sales of plug-in hybrids (PHEVs) have fallen in Europe. However, there is a possibility that once carmakers develop electric technology further, and can increase the electric-only range of PHEVs, sales may again increase.

Electric-only

Battery electric (BEVs) came in third place with 19%, despite carmakers currently pushing forward with the development of the technology to meet strict European emissions regulations as the diesel market collapses. Diesel itself polled poorly, with just 1% feeling it would be dominant by 2040.

Sales of BEVs have been low for some time, despite impressive growth numbers. Although there was an increase in sales during Q2 in Europe, of 97.7%, the volume amounted to just 63,589 units – compared to 2,443,743 sales of petrol models. It is unknown what will happen as more manufacturers bring their new models to market and charging infrastructures grow.

Petrol, currently dominating the market, scored 6% in the poll, showing that the industry believes the technology has had its time and as the development of alternative technologies continues, they will erode the 59.5% market share that petrol holds.

Finally, the ′other’ category scored 3%, with most people suggesting bicycles as the dominant propulsion type, with others even suggesting horses.