Remarketing, the overlooked challenge for EVs

22 February 2018

22 February 2018

The challenges that are hindering a rapid uptake of electric vehicles (EV) are widely reported, but their performance in the used car market is rarely discussed. Sonja Nehls, Head of Car to Market at Autovista Group considers the issue, from setting EV residual values and total costs of ownership to addressing the remarketing challenge.

Emissions targets and the demise of diesel is pushing EVs

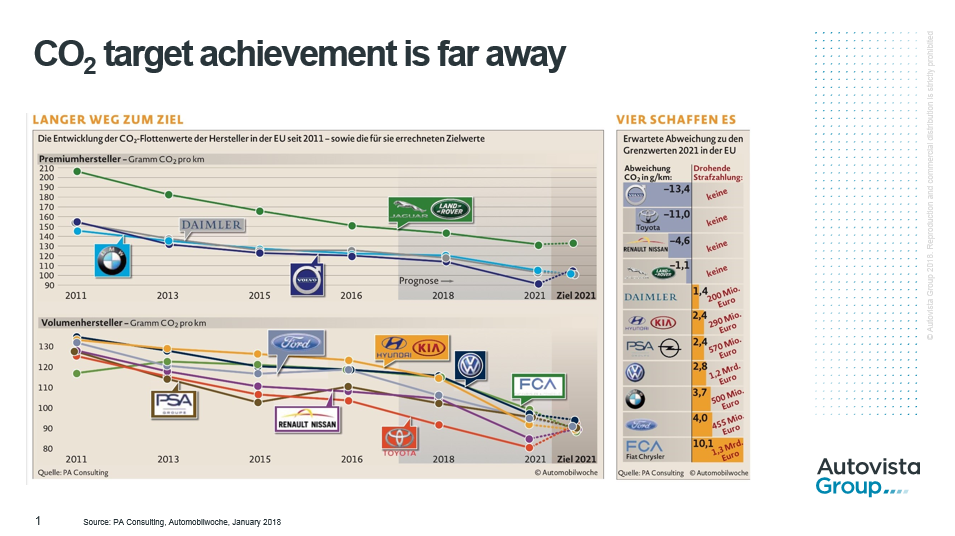

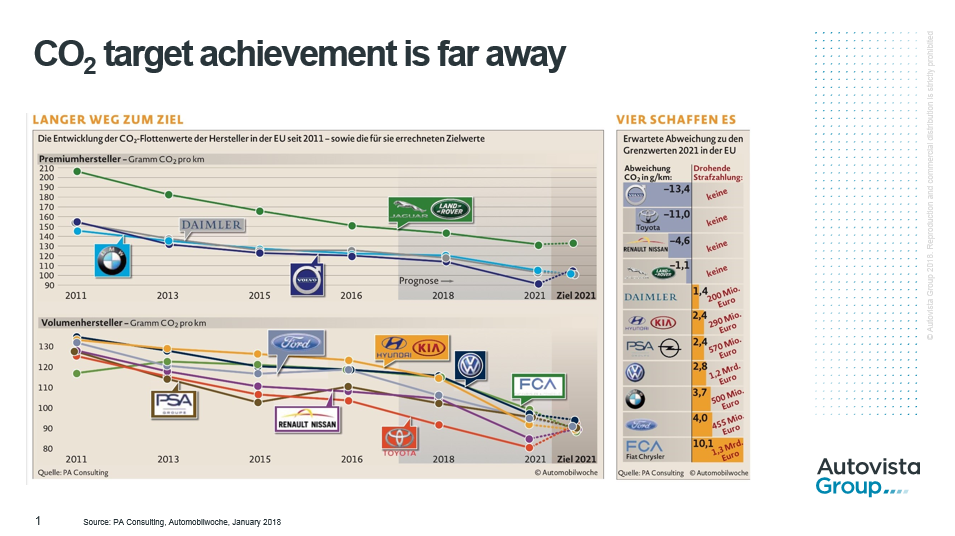

Carmakers regularly highlight the struggle they face to meet Europe’s CO2 emissions targets for 2021. This has been exacerbated by the increasing share of SUVs and, of course, petrol cars as consumers defect from diesel. As a case in point, CO2 emissions from vehicles rose for the first time in years in the UK, France and Germany during 2017. The expected ongoing growth in demand for SUVs and the new WLTP emissions testing procedure will also make it even more difficult for carmakers to achieve the 2021 CO2 targets.

With diesel cars losing market share following the Dieselgate scandal and the change in both attitude and government policy to vehicle emissions control across Europe, the residual value (RV) advantage of diesel cars is also eroding. For most carmakers, meeting emissions targets with diesel is no longer a viable solution. As a result, they are accelerating their electrification strategies, with countless models being launched in the coming years.

Key challenges for EVs

With all the new models coming to the market, it is essential to overcome issues and prejudices that have hindered the uptake of EVs in the past. The challenges are widely reported as: usability, consumer acceptance and affordability.

Usability: covers range anxiety and the charging network. The driving range of electric vehicles has already improved, and this will continue to be the case as battery technology advances. Similarly, countless carmaker and government-funded initiatives exist which seek to rapidly develop the charging infrastructure.

Consumer acceptance: changes relatively slowly and most people are still reluctant to embrace EVs. We believe that this will take at least until 2025 to change, but with increased focus and policy initiatives on clean air strategies, the EV market is surely about to mature.

Affordability: list prices and total cost of ownership (TCO) are still considerably higher for an EV than for cars with an internal combustion engine (ICE), particularly if government incentives are excluded. Battery costs will be further reduced through technological advancement and improving economies of scale, and in turn, list prices for new EVs will become more affordable, and the disadvantage will diminish.

EV residual value and TCO setting

We are more optimistic about the EV market:Â we consider that the market for new EVs will take off after 2021, but what is less certain and is rarely even covered in the press is the used car market. As mentioned above, there are few market observations for used EVs, and they are also held in stock for longer than their ICE counterparts.

Depreciation is a core component of TCO, and so the RV of EVs should be considered as a crucial driver in their future uptake. Autovista Group has been analysing and forecasting residual values for EVs since 2009 but even now, we cannot rely on robust market observations as the used car market for EVs is practically non-existent. This is largely because historic EV volumes have been stubbornly low.

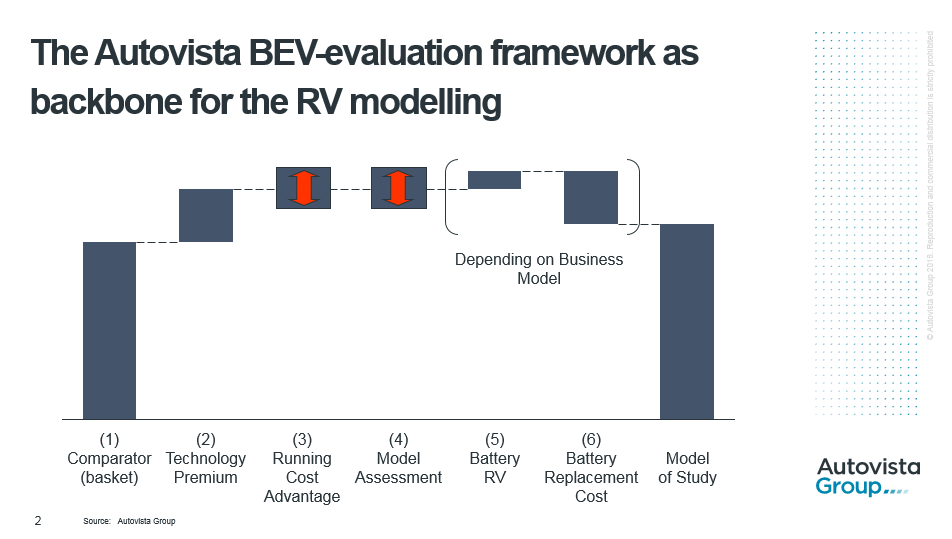

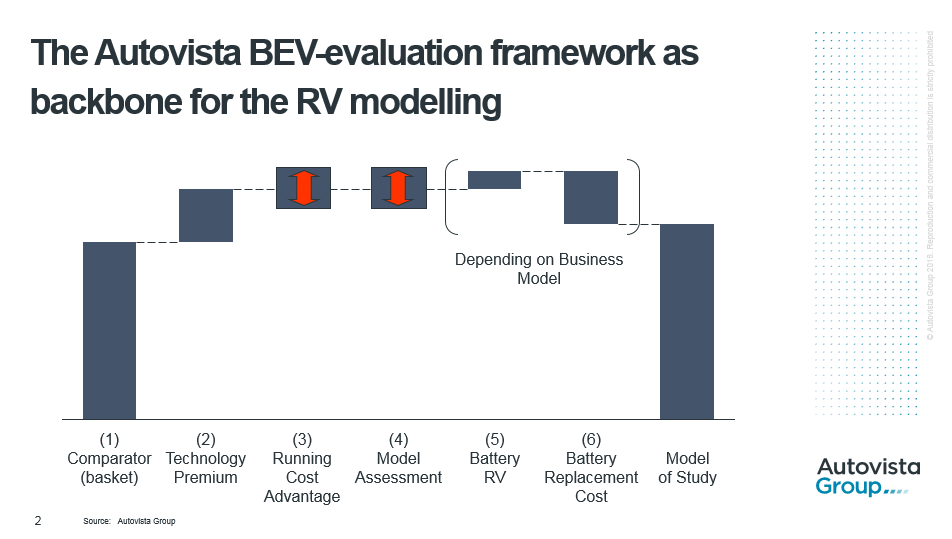

To overcome this, we have developed a specific methodology to determine RVs for electric vehicles. As a starting point, this methodology uses a comparable ICE model or group of models with well-established and reliable RVs. We then add a specific technology premium and running cost advantage depending on the segment and market. We also benchmark the model against its core rivals in terms of concept, pricing and specification.

Finally, we take into account the RV of the battery itself as well as battery replacement costs, which leaves us with the forecast RV for the battery electric vehicle.

With diesel cars losing market share following the Dieselgate scandal and the change in both attitude and government policy to vehicle emissions control across Europe, the residual value (RV) advantage of diesel cars is also eroding. For most carmakers, meeting emissions targets with diesel is no longer a viable solution. As a result, they are accelerating their electrification strategies, with countless models being launched in the coming years.

Key challenges for EVs

With all the new models coming to the market, it is essential to overcome issues and prejudices that have hindered the uptake of EVs in the past. The challenges are widely reported as: usability, consumer acceptance and affordability.

Usability: covers range anxiety and the charging network. The driving range of electric vehicles has already improved, and this will continue to be the case as battery technology advances. Similarly, countless carmaker and government-funded initiatives exist which seek to rapidly develop the charging infrastructure.

Consumer acceptance: changes relatively slowly and most people are still reluctant to embrace EVs. We believe that this will take at least until 2025 to change, but with increased focus and policy initiatives on clean air strategies, the EV market is surely about to mature.

Affordability: list prices and total cost of ownership (TCO) are still considerably higher for an EV than for cars with an internal combustion engine (ICE), particularly if government incentives are excluded. Battery costs will be further reduced through technological advancement and improving economies of scale, and in turn, list prices for new EVs will become more affordable, and the disadvantage will diminish.

EV residual value and TCO setting

We are more optimistic about the EV market:Â we consider that the market for new EVs will take off after 2021, but what is less certain and is rarely even covered in the press is the used car market. As mentioned above, there are few market observations for used EVs, and they are also held in stock for longer than their ICE counterparts.

Depreciation is a core component of TCO, and so the RV of EVs should be considered as a crucial driver in their future uptake. Autovista Group has been analysing and forecasting residual values for EVs since 2009 but even now, we cannot rely on robust market observations as the used car market for EVs is practically non-existent. This is largely because historic EV volumes have been stubbornly low.

To overcome this, we have developed a specific methodology to determine RVs for electric vehicles. As a starting point, this methodology uses a comparable ICE model or group of models with well-established and reliable RVs. We then add a specific technology premium and running cost advantage depending on the segment and market. We also benchmark the model against its core rivals in terms of concept, pricing and specification.

Finally, we take into account the RV of the battery itself as well as battery replacement costs, which leaves us with the forecast RV for the battery electric vehicle.

This then highlights a remarketing challenge for used EVs, especially as the increase in (mainly fleet) registrations of new EVs will result in a quick rise of supply on the used car market. The used car market is very different to the new car market and almost entirely depends on private customers. And those customers will be very cautious in the early years of electric mobility. As in the new car market, private demand will only slowly gain speed, and even this will be with a delay of at least three years as the vehicles flow through. The pressure that carmakers face because of the CO2 targets means there will be very attractive new car offers available too. These will directly compete with young used cars and put residual values under further pressure.

Recommendations for the remarketing challenge

The transaction price, depreciation and utilisation costs are naturally important for the used car buyer too. Utilisation costs may be attractive, but used EVs are less attractive for the second owner as most government incentives are offered only when the car is bought new. These naturally vary by market and are subject to change in the future. EVs also suffer greater depreciation later in the life-cycle. However, a more favourable TCO could be achieved through innovative ownership models or new used-car leasing concepts.

Essentially, the product package available to a used-car buyer needs to be attractive enough to compete against new car offers. It could, for example, include: a fixed price to install and support a wall-mounted charging point; free-of-charge software updates; and a rental car could be made available for longer journeys.

Generating sales to private consumers is, of course, the focus of the used car business but improving sales of new EVs to individuals also needs to gain importance in new car sales. Over time, this would build the momentum and acceptance of EVs in the used car market.

Dealers could offer a seamless and superior buying experience, both online and offline, ideally through specifically trained EV experience centres. This also ties in with an attractive product package and aftersales support.

Ultimately, carmakers need to become advocates for the future used EV buyer through a combination of developing used car product packages with product marketing, defining the EV buying process with dealerships and pushing new EV sales to private customers.

After all, strong and stable residual values are a prerequisite for selling new cars profitably, and EVs will play an increasingly important role.

This then highlights a remarketing challenge for used EVs, especially as the increase in (mainly fleet) registrations of new EVs will result in a quick rise of supply on the used car market. The used car market is very different to the new car market and almost entirely depends on private customers. And those customers will be very cautious in the early years of electric mobility. As in the new car market, private demand will only slowly gain speed, and even this will be with a delay of at least three years as the vehicles flow through. The pressure that carmakers face because of the CO2 targets means there will be very attractive new car offers available too. These will directly compete with young used cars and put residual values under further pressure.

Recommendations for the remarketing challenge

The transaction price, depreciation and utilisation costs are naturally important for the used car buyer too. Utilisation costs may be attractive, but used EVs are less attractive for the second owner as most government incentives are offered only when the car is bought new. These naturally vary by market and are subject to change in the future. EVs also suffer greater depreciation later in the life-cycle. However, a more favourable TCO could be achieved through innovative ownership models or new used-car leasing concepts.

Essentially, the product package available to a used-car buyer needs to be attractive enough to compete against new car offers. It could, for example, include: a fixed price to install and support a wall-mounted charging point; free-of-charge software updates; and a rental car could be made available for longer journeys.

Generating sales to private consumers is, of course, the focus of the used car business but improving sales of new EVs to individuals also needs to gain importance in new car sales. Over time, this would build the momentum and acceptance of EVs in the used car market.

Dealers could offer a seamless and superior buying experience, both online and offline, ideally through specifically trained EV experience centres. This also ties in with an attractive product package and aftersales support.

Ultimately, carmakers need to become advocates for the future used EV buyer through a combination of developing used car product packages with product marketing, defining the EV buying process with dealerships and pushing new EV sales to private customers.

After all, strong and stable residual values are a prerequisite for selling new cars profitably, and EVs will play an increasingly important role.

With diesel cars losing market share following the Dieselgate scandal and the change in both attitude and government policy to vehicle emissions control across Europe, the residual value (RV) advantage of diesel cars is also eroding. For most carmakers, meeting emissions targets with diesel is no longer a viable solution. As a result, they are accelerating their electrification strategies, with countless models being launched in the coming years.

Key challenges for EVs

With all the new models coming to the market, it is essential to overcome issues and prejudices that have hindered the uptake of EVs in the past. The challenges are widely reported as: usability, consumer acceptance and affordability.

Usability: covers range anxiety and the charging network. The driving range of electric vehicles has already improved, and this will continue to be the case as battery technology advances. Similarly, countless carmaker and government-funded initiatives exist which seek to rapidly develop the charging infrastructure.

Consumer acceptance: changes relatively slowly and most people are still reluctant to embrace EVs. We believe that this will take at least until 2025 to change, but with increased focus and policy initiatives on clean air strategies, the EV market is surely about to mature.

Affordability: list prices and total cost of ownership (TCO) are still considerably higher for an EV than for cars with an internal combustion engine (ICE), particularly if government incentives are excluded. Battery costs will be further reduced through technological advancement and improving economies of scale, and in turn, list prices for new EVs will become more affordable, and the disadvantage will diminish.

EV residual value and TCO setting

We are more optimistic about the EV market:Â we consider that the market for new EVs will take off after 2021, but what is less certain and is rarely even covered in the press is the used car market. As mentioned above, there are few market observations for used EVs, and they are also held in stock for longer than their ICE counterparts.

Depreciation is a core component of TCO, and so the RV of EVs should be considered as a crucial driver in their future uptake. Autovista Group has been analysing and forecasting residual values for EVs since 2009 but even now, we cannot rely on robust market observations as the used car market for EVs is practically non-existent. This is largely because historic EV volumes have been stubbornly low.

To overcome this, we have developed a specific methodology to determine RVs for electric vehicles. As a starting point, this methodology uses a comparable ICE model or group of models with well-established and reliable RVs. We then add a specific technology premium and running cost advantage depending on the segment and market. We also benchmark the model against its core rivals in terms of concept, pricing and specification.

Finally, we take into account the RV of the battery itself as well as battery replacement costs, which leaves us with the forecast RV for the battery electric vehicle.

With diesel cars losing market share following the Dieselgate scandal and the change in both attitude and government policy to vehicle emissions control across Europe, the residual value (RV) advantage of diesel cars is also eroding. For most carmakers, meeting emissions targets with diesel is no longer a viable solution. As a result, they are accelerating their electrification strategies, with countless models being launched in the coming years.

Key challenges for EVs

With all the new models coming to the market, it is essential to overcome issues and prejudices that have hindered the uptake of EVs in the past. The challenges are widely reported as: usability, consumer acceptance and affordability.

Usability: covers range anxiety and the charging network. The driving range of electric vehicles has already improved, and this will continue to be the case as battery technology advances. Similarly, countless carmaker and government-funded initiatives exist which seek to rapidly develop the charging infrastructure.

Consumer acceptance: changes relatively slowly and most people are still reluctant to embrace EVs. We believe that this will take at least until 2025 to change, but with increased focus and policy initiatives on clean air strategies, the EV market is surely about to mature.

Affordability: list prices and total cost of ownership (TCO) are still considerably higher for an EV than for cars with an internal combustion engine (ICE), particularly if government incentives are excluded. Battery costs will be further reduced through technological advancement and improving economies of scale, and in turn, list prices for new EVs will become more affordable, and the disadvantage will diminish.

EV residual value and TCO setting

We are more optimistic about the EV market:Â we consider that the market for new EVs will take off after 2021, but what is less certain and is rarely even covered in the press is the used car market. As mentioned above, there are few market observations for used EVs, and they are also held in stock for longer than their ICE counterparts.

Depreciation is a core component of TCO, and so the RV of EVs should be considered as a crucial driver in their future uptake. Autovista Group has been analysing and forecasting residual values for EVs since 2009 but even now, we cannot rely on robust market observations as the used car market for EVs is practically non-existent. This is largely because historic EV volumes have been stubbornly low.

To overcome this, we have developed a specific methodology to determine RVs for electric vehicles. As a starting point, this methodology uses a comparable ICE model or group of models with well-established and reliable RVs. We then add a specific technology premium and running cost advantage depending on the segment and market. We also benchmark the model against its core rivals in terms of concept, pricing and specification.

Finally, we take into account the RV of the battery itself as well as battery replacement costs, which leaves us with the forecast RV for the battery electric vehicle.

This then highlights a remarketing challenge for used EVs, especially as the increase in (mainly fleet) registrations of new EVs will result in a quick rise of supply on the used car market. The used car market is very different to the new car market and almost entirely depends on private customers. And those customers will be very cautious in the early years of electric mobility. As in the new car market, private demand will only slowly gain speed, and even this will be with a delay of at least three years as the vehicles flow through. The pressure that carmakers face because of the CO2 targets means there will be very attractive new car offers available too. These will directly compete with young used cars and put residual values under further pressure.

Recommendations for the remarketing challenge

The transaction price, depreciation and utilisation costs are naturally important for the used car buyer too. Utilisation costs may be attractive, but used EVs are less attractive for the second owner as most government incentives are offered only when the car is bought new. These naturally vary by market and are subject to change in the future. EVs also suffer greater depreciation later in the life-cycle. However, a more favourable TCO could be achieved through innovative ownership models or new used-car leasing concepts.

Essentially, the product package available to a used-car buyer needs to be attractive enough to compete against new car offers. It could, for example, include: a fixed price to install and support a wall-mounted charging point; free-of-charge software updates; and a rental car could be made available for longer journeys.

Generating sales to private consumers is, of course, the focus of the used car business but improving sales of new EVs to individuals also needs to gain importance in new car sales. Over time, this would build the momentum and acceptance of EVs in the used car market.

Dealers could offer a seamless and superior buying experience, both online and offline, ideally through specifically trained EV experience centres. This also ties in with an attractive product package and aftersales support.

Ultimately, carmakers need to become advocates for the future used EV buyer through a combination of developing used car product packages with product marketing, defining the EV buying process with dealerships and pushing new EV sales to private customers.

After all, strong and stable residual values are a prerequisite for selling new cars profitably, and EVs will play an increasingly important role.

This then highlights a remarketing challenge for used EVs, especially as the increase in (mainly fleet) registrations of new EVs will result in a quick rise of supply on the used car market. The used car market is very different to the new car market and almost entirely depends on private customers. And those customers will be very cautious in the early years of electric mobility. As in the new car market, private demand will only slowly gain speed, and even this will be with a delay of at least three years as the vehicles flow through. The pressure that carmakers face because of the CO2 targets means there will be very attractive new car offers available too. These will directly compete with young used cars and put residual values under further pressure.

Recommendations for the remarketing challenge

The transaction price, depreciation and utilisation costs are naturally important for the used car buyer too. Utilisation costs may be attractive, but used EVs are less attractive for the second owner as most government incentives are offered only when the car is bought new. These naturally vary by market and are subject to change in the future. EVs also suffer greater depreciation later in the life-cycle. However, a more favourable TCO could be achieved through innovative ownership models or new used-car leasing concepts.

Essentially, the product package available to a used-car buyer needs to be attractive enough to compete against new car offers. It could, for example, include: a fixed price to install and support a wall-mounted charging point; free-of-charge software updates; and a rental car could be made available for longer journeys.

Generating sales to private consumers is, of course, the focus of the used car business but improving sales of new EVs to individuals also needs to gain importance in new car sales. Over time, this would build the momentum and acceptance of EVs in the used car market.

Dealers could offer a seamless and superior buying experience, both online and offline, ideally through specifically trained EV experience centres. This also ties in with an attractive product package and aftersales support.

Ultimately, carmakers need to become advocates for the future used EV buyer through a combination of developing used car product packages with product marketing, defining the EV buying process with dealerships and pushing new EV sales to private customers.

After all, strong and stable residual values are a prerequisite for selling new cars profitably, and EVs will play an increasingly important role.