Is automotive demand stabilising in Poland?

29 April 2024

As prices continue to fall, automotive demand appears to be slowly stabilising in Poland. Marcin Kardas, head of valuations at Eurotax Poland (part of J.D. Power) explores the latest trends with Autovista24 editor Tom Geggus.

After a period of turbulence in 2023, the Polish passenger car market appears to be slowly stabilising. At the beginning of the year, new-car prices were seen to rise. This was mainly due to an increase in vehicle equipment requirements.

Although new prices are rising nominally, the actual cost of a new car becomes more attractive once large discounts are factored in. This is linked to the sale of cars from 2023, which has not followed common practice in recent years.

Therefore, Poland has seen a large increase in registrations, reaching 138,696 units in the first quarter of 2024 according to PZPM. This equates to a growth of 12.9% compared with the first three months of last year.

Used-car market still suffering

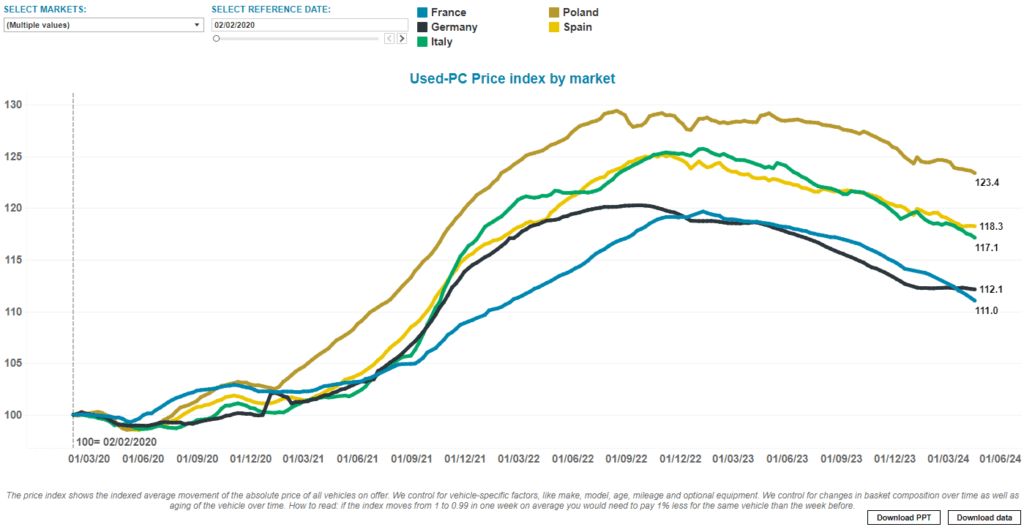

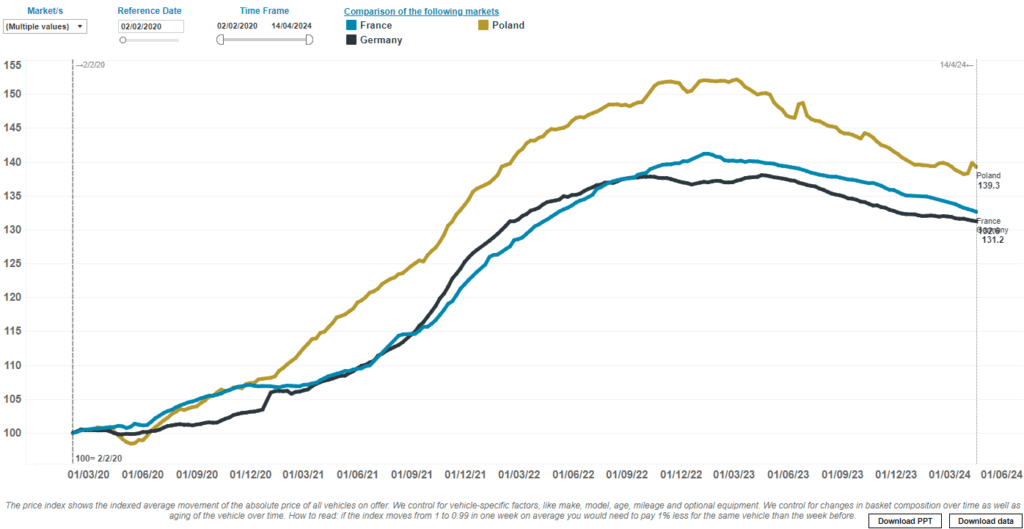

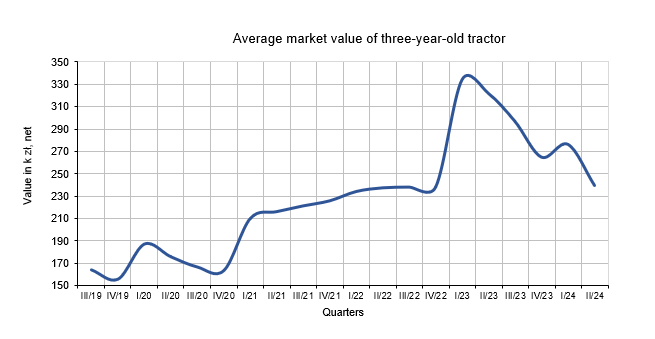

Prices in the Polish used-car market are still trending downwards. However, the speed of the descent is slowing. The rate of change between peaks and troughs in the first quarter of 2024 are smaller than in the previous year.

Yet demand is unstable and prices on the market continue to strain for equilibrium. It is worth noting that the dynamics of change in the Polish market are similar to other European markets.

There is also a noticeable discrepancy between real transaction prices and posting on online portals, especially by private users. This is the result of several factors, including sellers having paid more in a time of higher prices. The market’s turnaround has not yet been felt by these owners.

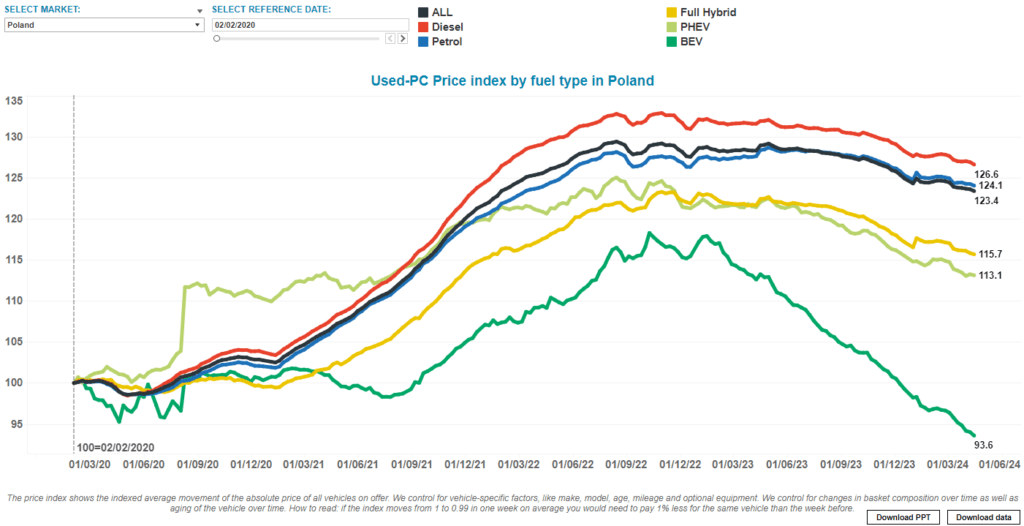

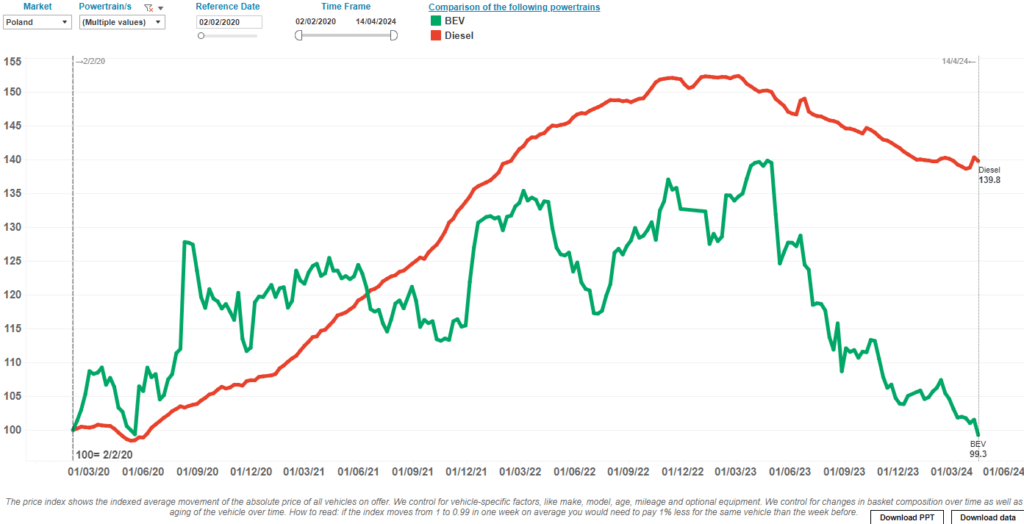

Diesel demand returning?

Interest in diesel vehicles is gradually returning. A primary reason for this is the high discounts and greater availability of models with a low mileage.

This makes them more attractive compared to their petrol counterparts. Increasing pressure on the European Commission and its climate policy is also helping turn public opinion back in favour of diesel engines.

Unstable electric mix

The market for new electric vehicles (EVs) is becoming increasingly competitive, with prices dropping sharply. This has a direct impact on the used-car market, where two-to-three-year-old models must be heavily discounted to become attractively priced. For this reason, a dynamic decline in their value has been observed for about six months.

In addition to rapidly falling prices, the advancing technology and performance of these vehicles are also problematic. EVs with a battery that is several years old cannot compete with the latest cells. Additionally, Tesla’s price drops, innovations in production processes and changes in pricing policies have also affected the market.

As a brand that is often considered a leader in the EV segment, the prices set by Tesla are seen as a benchmark for competitors. If Tesla lowers the prices of its models, other companies may feel pressured to adjust their prices to remain competitive.

Additionally, Chinese models are debuting in higher numbers, with local carmakers coming under increasing price pressure. With attractive pricing policies, these vehicles hope to encourage customers to abandon European brands.

In Poland, however, these offerings are still being organised, and are mainly internal-combustion engine (ICE) models. This means an imminent tightening of prices in the cheaper market segments.

Declining van values

The used-van market continues to see large declines in value, especially for vehicles up to seven years old. This is independent of segment and appear greater for the youngest vehicles. Used stock is evidently rising and returning to pre-pandemic levels. Dealers continue to pursue an aggressive discounting policy, which is tied to the increased availability of new vehicles.

As of July this year, the Vehicle General Safety Regulation will come into effect for all new vehicles, expanding standard equipment to include new safety systems. Several refreshed models will debut on the market, but for now, it is difficult to predict whether this will affect purchase prices.

Despite values continuing to trend downwards, the first signs of market stabilisation are appearing. Orders for new vehicles look optimistic, and registration levels are not indicating a slump. By March 2024, a total of 16,128 units had been delivered in the year, representing a gradual increase of 1.9% compared to 2023, according to PZPM.

Additionally, the time needed to sell a used-vehicle across all segments has been declining for the past two months. It is still too early to talk about a breakthrough, but it seems the market is slowly stabilising. Declining residual value rates are likely to slow, but much depends on the condition of the economy.

Commercial EVs struggle

Used commercial EVs continue to see steep declines in value. This is particularly evident in the heavy-duty segment. However, the used-commercial market still has a very poor model offering, with those vehicles available only capable of a limited performance.

Ranges between 100km and 200km are not suitable in these use cases. For the time being, this price trend is unlikely to change.

The Polish commercial vehicle market has yet to see any Chinese infiltration, which would increase price pressures and diversify offers.

A deep crisis

The heavy truck market is still experiencing severe problems. Demand for transportation is low and competition is huge. Rates are declining despite the increase in transportation costs. In this situation, carriers are rapidly reducing fleets, and the only purchases on the used market are to replace either older or damaged vehicles.

Stocks of used tractor-trailers, the market’s largest segment, are growing. Demand is particularly low for mega models, dedicated to the automotive and international transport industries.

However, the problem is no longer affecting just tractors dedicated to international transport. For the first time, light distribution vehicles up to 18-tonnes gross-vehicle weight (GVW) are also being impacted. This is normally a stable segment, serving the domestic market, with vehicles in use for a long time. But an unprecedented level of discounting has now been recorded, indicating a slump in local transportation.

Construction vehicles, mainly dump trucks, are also no longer in demand. More of them are appearing in bids, and prices are falling. The market is mired in a deep crisis, and so far, there are no signs of recovery.

The big problem with the demand for new trucks can be seen in the registration statistics. In the first three months of 2024, 7,724 units had been registered, down 13.1% year-on-year according to PZPM.

Economic indicators, which could affect the trend, do not point towards a drastically improving situation, although GDP growth forecasts are optimistic. For the time being, however, the economic impetus for transportation development is lacking.