Key Priorities for OEMs as they Prepare for Brexit

10 July 2016

– June 2016

The vote to leave the European Union sparked market turmoil and a flurry of speculation about the future – but there are practical steps that automotive companies can take now to protect their new and used car sales while the future direction of the economy becomes clear.

Economists predict that the UK will enter recession following so-called Brexit until the economy is placed on a more stable footing with a clear, secure pathway to eventually leaving the EU.

In expectation of a slump in demand, companies need to consider what the recessionary impact on used car values might be.

Autovista Intelligence has identified three potential Brexit residual value scenarios

- Positive start – A strong, positive message from Brexit supporters calms the financial markets and economic/consumer confidence remains high. Residual value trends remain unchanged.

- Faltering start – A fall in confidence among consumers and financial markets in the short-term, but stability returns as the role of London as Europe’s financial centre is secure. Short-term falls in RVs of up to 5% are quickly reversed as economic stability returns.

- Into recession – The economy enters a recession which will lead to lower demand for used cars in the longer term, while higher interest rates and disruption to employment may lead to an increase in cars being returned due to early terminations and repossessions by funders. The depth of the decline mirrors the 2008 recession during the global financial crisis. Increasing supply and lower demand will lead to a fall in residual values of up to 20% during 2016/2017.

Once the UK gives notice of its intention to withdraw from the EU it will be up to two years before Brexit actually occurs and there is more clarity about its future outside Europe, but in the meantime companies have to continue with business as usual.

There are several key priorities automotive companies need to consider in the event of Brexit.

Companies will need to adjust their short-term expectations to account for the potential impact of falling consumer confidence, which will be affected by two important factors:

- Concern over increasing tax and financial costs – Chancellor of the Exchequer George Osborne has warned that the basic rate of income tax may rise by 2p and the higher rate by 3p to plug falling revenues as a result of Brexit. In addition, interest rates may rise if there is a continued slump in Sterling, pushing up the cost of loans and mortgages and dramatically affecting consumer purchasing power.

- Uncertainty over jobs – During campaigning in the referendum, a number of business leaders warned that a vote for Brexit would be damaging for jobs and risk future investment by companies in the EU. If managers and employees face an uncertain future, they are likely to postpone vehicle investment decisions until the future is more certain.

There is no blueprint for exit from the EU because the UK is the first country ever to make such a decision, but current forecasts from economists and financiers suggest the ′Into recession’ scenario is most likely. A number of experts support this view including the International Monetary Fund and global investor George Soros.

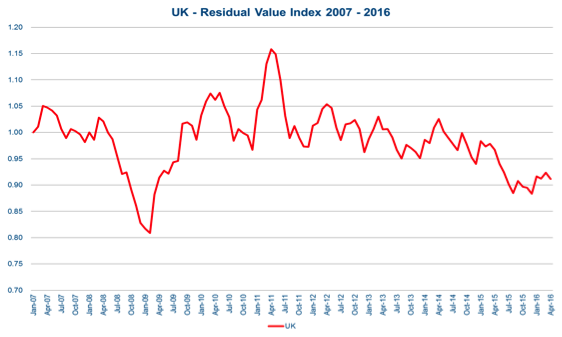

When the recession took hold nearly a decade ago, a collapse in consumer confidence sent average residual values for the UK plummeting by nearly 20%.

A swift recovery in values during 2009 was helped by unprecedented cuts to interest rates to 0.5% which stimulated activity in the used car market.

A post-Brexit government does not have this level of flexibility with interest rates and, after more than a decade of economic incentives to help the economy out of recession, there are fewer alternative options available to stimulate markets, which means recovery may take much longer.

If consumer confidence remains higher, particularly in relation to vehicle purchase decisions, Autovista Intelligence analysts point out that residual values can be propped up. However, recent oversupply due to record new car sales volumes in the UK in the past few years has meant that vehicle values have already been declining.

Communication will be a key factor over the coming weeks in the event of a victory for the Leave campaign.

Businesses will need to ensure information is widely shared at all levels of seniority to enable effective decisions to be made.

Regular feedback from dealers and salespeople in the frontline will be critical, providing the most immediate mechanism for senior executives to understand the emerging economic patterns from Brexit well in advance of the publication of any official data.

Cross-industry engagement between manufacturers, leasing companies, dealer networks and suppliers is also needed to pool information and provide a clearer picture of consumer attitudes.

John Maslen, editor of Autovista Intelligence, part of Autovista Group, said: ″While the long-term impact of any decision to leave the EU is an important area of focus, the immediate future is just as important, particularly when it comes to effectively managing vehicle sales and remarketing.

″Knowledge and insight is a very powerful resource in uncertain times, so it is important that companies make sure that they are well-informed and that information is shared throughout the business.″

POST-BREXIT ACTION PLAN

In the short-term, the focus for automotive companies should be to:

- Review and rephase new car volume and sales targets

Consumer confidence is expected to fall in the event of a win for the Leave campaign until the economic consequences become clear, amid warnings of tax and interest rate rises from economists. Therefore, historic expectations for vehicle sales and revenues set at a time of greater economic stability will need review.

- Adopt a flexible approach to the volume of vehicles entering the used car market

Create contingency plans to mitigate the potential impact of falls of up to 20% in residual values in the event of recession following a Brexit vote.

- Review Personal Contract Purchasing and leasing business

PCP accounts for a growing proportion of the UK market. There may be a requirement to encourage extensions of PCP and lease terms, to ensure continued ability of consumers to afford repayments and to avoid large numbers of early terminations. This will also postpone vehicle returns until markets improve and help support residual values.

- Maintain strategies for swift internal communication

Manufacturers, leasing companies and dealer networks need to act to maintain consumer confidence and purchasing levels. Customer-facing teams need clarity on new volume targets, offers and sales incentives to maintain the levels of new car sales without resorting to excessive discounts to achieve volumes, harming future residual values.

- Brief sales teams on available incentives

Review and develop offers to respond to the new economic environment following the UK’s decision to leave the EU. This may include direct incentives, such as improved warranties or payment protection plans that take the worry out of buying, and longer-term offers that benefit total cost of ownership, such as vehicle servicing packages.