LCV registrations fall in UK as used demand stays strong

12 August 2025

July saw registrations of light-commercial vehicles (LCVs) continue to fall in the UK. Meanwhile, there was no drop in demand for high-quality used stock. Andy Picton, specialist residual value analyst at Glass’s, examined the data with Autovista24 editor Tom Geggus.

The UK’s new LCV market recorded its eighth successive month of decline in July. This was also the weakest July for the market in three years. In total, 23,433 new vans, pickups and chassis variants were registered, down 5.1% year on year.

This did little to improve the year-to-date figures, which fell by 11.3% to 179,481 units. As a result, the SMMT’s third-quarter outlook has been lowered again. The market is now expected to decline by 8.7% to 321,000 units. This equates to a drop of more than 30,000 units.

The battery-electric vehicle (BEV) share of LCV registrations, weighing up to 3.5 tonnes, was also adjusted downwards. Now, 8.6% of the market is expected to be fully electric this year. A larger 13.7% share is expected next year. However, this is still below the zero-emission vehicle (ZEV) mandate target of 24% in 2026.

July saw demand shrink across all sectors except for vehicles between 2 and 2.5 tonnes gross vehicle weight (GVW), with registrations up 2.5%. Demand for vans under 2 tonnes GVW experienced the sharpest decline at 20.6%. Meanwhile, the pickup sector fell for the third consecutive month, down 17.3% year on year.

The market for vans and chassis between 2.5 and 3.5 tonnes GVW saw registrations fall by 4.6%. The 16,040 deliveries were 774 units fewer than in July 2024. Despite this, vehicles of this type remain the most popular, representing nearly 68.5% of all registrations.

Ford’s UK top two

Ford held on to the top spots in July, offering two of the UK’s most popular LCVs. The Transit Custom hit 3,784 registrations, ahead of the Transit at 2,461 units. The Mercedes-Benz Sprinter finished in third with 1,257 deliveries. The Vauxhall Vivaro claimed fourth with 1,125 units, and the Citroen Berlingo came fifth with 918 registrations.

The Renault Trafic secured sixth with 886 units. Then came the Toyota Hilux in seventh with 820 registrations, followed by the Peugeot Expert in eighth with 717 deliveries. The Ford Transit Courier was ninth with 693 units, with the Volkswagen (VW) Transporter coming 10th with 683 registrations.

BEVs keep climbing in UK

July marked the 10th straight month of increased all-electric LCV registrations up to 4.25 tonnes GVW. 2,442 units were registered compared with 1,415 twelve months ago. This equated to a monthly market share of 10.3%, up from 5.7% in July 2024.

In the year to date, BEV deliveries have followed a continuing positive trend. Registrations increased by 55.5% to 15,954 units. All-electric LCVs took a market share of 8.8%, up from 5.1% at the same point last year.

Manufacturers continue to invest heavily in decarbonisation. There are now over 40 different zero-emission van ranges and nearly 100 individual models available in the UK. However, uptake of these models is still at just over half the 2025 ZEV mandate target.

Eight straight months of LCV market decline highlights the current struggles and economic pressures businesses are facing. The lack of investment in a suitable LCV charging infrastructure remains a huge issue. This includes public sites, depots and shared hub locations. Accelerating infrastructure rollout and offering consistent and efficient local planning are essential for operators to be confident in the transition to a zero-emission future.

UK electric van market

Ford accounted for over 41% of all BEVs registered in July. This was nearly double that of second-placed VW, holding a 22.2% share. Mercedes-Benz achieved an 8.2% share in third. In fourth, Peugeot clocked a 5.7% market share, and Maxus took fifth with a 4.5% hold.

Citroen ended July in sixth with 100 units (4.1% share). Toyota finished in seventh with 92 registrations (3.7% share). Renault was eighth, selling 77 units (3.1% share), Vauxhall was ninth with 64 units (2.6% share), and Nissan was 10th with 57 units (2.3% share).

By range, the Ford E-Transit Custom accounted for over a quarter of all registrations in July, recording a 26.8% share. The VW.ID Buzz Cargo was second with a 20.2% hold, and the Ford E-Transit was third with a 10.1% share.

Joint sixth went to the Stellantis duo of the Peugeot e-Partner and the Citroen e-Berlingo with 86 units each (3.5% share). The Toyota Proace City Electric emerged eighth with 54 units (2.2% share). The Maxus eDeliver 9 came in ninth with 53 units (2.2% share). Finally, the Vauxhall Vivaro came 10th with 51 units (2.1% share).

After seven months of 2025, Ford has registered 4,596 (28.8% share) new BEVs across three different product ranges. VW finished second after registering 3,140 vehicles (19.7% share) between two product ranges. Meanwhile, Vauxhall sat in third, moving 1,948 (12.2% share) new BEVs over three different product ranges.

The plug-in hybrid (PHEV) van segment saw Ford, Toyota and VW register a combined 783 units. Ford led the way with deliveries of 442 Transit Customs, 143 Transit Connects and 50 Ranger PHEVs. Toyota followed with 147 Corolla Commercials, while VW added one plug-in Caddy. In the year to date, 5,636 PHEV LCVs have been registered, with Ford claiming a dominant 77.1% share.

UK used LCV market still hungry

Despite the well-documented challenges facing new LCV registrations, the used market remains eager for quality stock. This resulted in vastly improved auction sales and conversion rates throughout July.

An overall reduction in ex-rental stock at auction has seen higher-spec, low-mileage examples in metallic colours outperforming market expectations. Older, more affordable vehicles are proving popular too. These vehicles have fewer electronic gadgets and feature powertrains that are deemed more reliable and easier to maintain.

Heavily discounted new vans are having a detrimental effect on late-year model auction prices. Although covering a relatively small percentage of the overall market, buyers are choosing to invest in better-value-for-money three-to-four-year-old stock. An oversupply of small vans in the marketplace has seen their values come under pressure.

An increase in the number of late-plate repossessions offered at auction is a sad reflection of wider economic struggles. With reserves set too close to the manufacturer’s list prices, these vehicles are struggling to find new homes. Damaged or higher mileage stock continues to sell, but reserves must be realistic.

Younger stocks boost used sales

Used LCV sales rocketed in July, up 45.3% on June. Helped by a much younger stock profile, the average age fell by 13.4 months. Meanwhile, the average mileage dropped by over 16,500 miles. As a result, average sales prices increased by over £750 (€867.8), exceeding the £9,000 mark. Meanwhile, first-time conversion rates increased to 87.9% from 82.1% last month.

Year-on-year, sales were up by 40.6%, while average sales prices increased by 21.3%. Average mileage over the last twelve months fell by nearly 25,000 miles. Average age dropped by 28.3 months from twelve months ago, and first-time conversions were up 16.3%.

Sales of Euro 6 vehicles increased by 4.8 percentage points (pp) to 91.4% in July. Sales of Euro 5 stock fell by 4.6pp to 6.2%.

Medium vans led demand, accounting for 38.1% of sales. Large vans followed with a 27.4% share, then small vans with 26.8%. The 4×4 pickup sector took 7.7% of the market, down 5pp. However, this segment also commanded the highest average sales price at nearly £13,200.

4×4 pickups also covered more distance than any other vehicle type in July at an average of 66,252 miles. However, this figure was down by some 3,500 miles compared to June.

Used electric van sales up

Sales of electric vans increased by over 40% in July, representing 2.4% of the overall auction market. The average age of these models fell by 2.7 months month on month to 31.5 months. This was 24.3 months less than the 55.8-month average recorded twelve months ago.

Average mileage fell from 18,055 miles last month to 14,041 miles and was 28.5% lower than in July 2024. First-time conversion rates struggled to reach 43%, down from 60.9% in June. Meanwhile, average sale prices fell to just over £9,550.

The medium van sector accounted for nearly 64.5% of all electric LCV sales in July. Small vans made up 30% and large vans 5.5%. The highest average mileages were covered in the small van sector at 16,841 miles. The lowest belonged to the medium van sector at 12,508 miles. Large electric vans attained the highest average sales price of £14,867 and the highest first-time conversion rate of 83.3%.

Diesel takes a drop

The number of used LCVs listed for sale in the retail market fell by 0.1% in July to just under 45,200 units. Diesel models made up most of the used LCVs on sale, taking a 91.2% share. Meanwhile, BEVs made up 4.9% of overall deliveries, ahead of petrol (2.3% share) and PHEVs (1.3% share). Those with manual transmissions accounted for 69.2% of listings, while automatic transmissions accounted for 30.8%.

Panel vans accounted for 58.6% of all LCVs on sale, and 14.7% were 4×4 pickups. Crew vans held 7.3%, while minibuses made up 3.4% and car-derived vans followed behind. 40.1% of listed vehicles were priced at £20,000 or more, and 37.4% were priced between £10,000 and £20,000. 17.7% sat in the £5,000 to £10,000 range. Only 4.8% of vehicles were priced below £5,000.

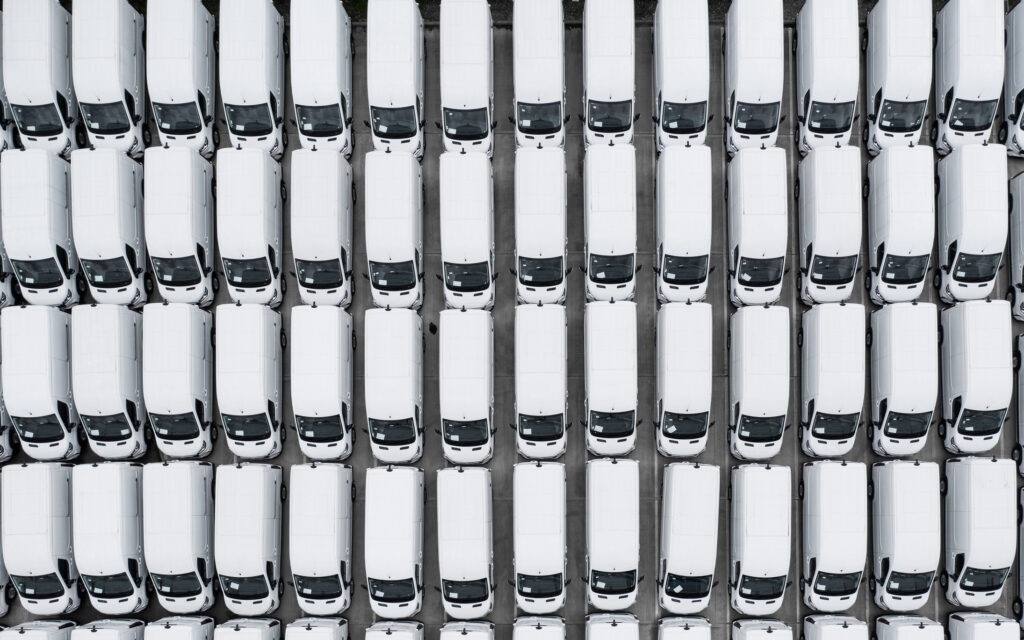

White vans led in popularity, accounting for just over half of all used LCV listings. Grey took a 16.8% share, black made up 10.4% of the market, then silver, blue and red followed behind. Average vehicle age was 54 months, down one month compared to June. Average mileage also declined, down 2.1% to 53,450 miles.