Is London’s Ultra Low Emission Zone impacting residual values?

24 July 2019

24 July 2019

By Neil King

The Ultra Low Emission Zone (ULEZ) was introduced in London in April. Diesel cars registered before September 2015 do not meet the required emissions standard to enter the ULEZ for free, accounting for more than 80% of all diesel cars registered in London. Residual values (RVs) of diesel cars in the 48 month/80,000km scenario deteriorated at a quicker rate than petrol cars in May and June. This compounds a broad downturn in RVs in the UK since March but the impact of the ULEZ will be even more keenly felt when the zone is widened in 2021.

Diesel deterioration

Drivers who enter the ULEZ in a vehicle that does not meet Euro 4 standards (petrol cars) or Euro 6 standards (diesel cars) have to pay a daily charge, which equates to £12.50 (€14.50) for cars, vans and motorbikes, and £100 (€116) a day for lorries, buses and coaches. This is on top of the £11.50 (€13.35) congestion charge.

As Euro 4 applies to all petrol cars registered since January 2006, only the oldest petrol cars are affected by the ULEZ. However, Euro 6 applies to all diesel cars registered since September 2015 and the vast majority of diesel cars in the UK capital are therefore affected.

NimbleFins reports that ′data obtained from the DVLA/DfT indicates that 673,554 diesel cars in London as of Q3 2018 were first licensed before September 2015 and likely don’t meet European emission standards. The number of diesels not meeting emission standards represents 81% of all diesel cars in London, or 25% of all cars in the capital.’

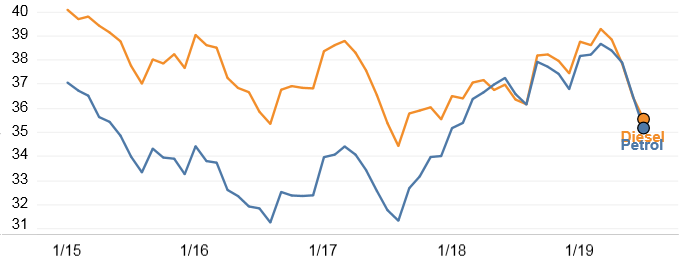

The performance of diesel RVs in the 48 month/80,000km scenario has been broadly in line with petrol RVs in the UK since late 2018 but there was a clear deviation in May and June – immediately following the introduction of the ULEZ in London in April.

RV% advantage of diesel vs petrol cars, UK, 48months/80,000km, January 2015 to July 2019

Source: Residual Value Intelligence, Autovista Group

ULEZ extension

Many people in the London area are undoubtedly already less interested in buying used diesels, especially those that are not Euro 6-compliant, at a time when owners are looking to sell them on. However, this will be significantly more pronounced with the planned extension of the ULEZ to the orbital North and South Circular Road on 25 October 2021.

Anthony Machin, Head of Content and Product at Glass’s, the UK arm of Autovista Group, comments that ′Only when the ULEZ grows to the North-South Circular will we see significant moves away from old diesel.’

′We will probably see a bigger impact on vans than cars as these drivers need to enter the zone and do not necessarily live inside the ULEZ to get a discount – this could potentially increase RVs on Euro 6 vans,’ Machin adds.

Aside from the extension of the ULEZ, the discount from local councils, such as the Borough of Islington, for people who live within the zone will be removed for older cars. However, Machin highlights that ′by the time the discount from local councils is removed for older cars, Euro 6 cars will be at least six years old so if a customer wants an older diesel car to swap to they will be more affordable.’

Broad oversupply

High historic new car volumes have buoyed used car supply in the UK but this had been absorbed by resilient used car demand and so residual values (RVs) had been performing well. 2016 was a record year for the new car market though and with the extension of many lease vehicles last year, used car volumes are especially high.

Although the ULEZ has certainly exacerbated this by increasing the supply of used cars, especially diesels that are not Euro 6-compliant, in and around central London, and reducing their demand, this broad oversupply is the main reason for the weakness of residual values in the UK.

Accordingly, Glass’s, the UK arm of Autovista Group, has revised its RV outlook downwards. It remains uncertain, however, whether the ongoing Brexit uncertainty is now also having a negative impact on used car demand in the UK and, in turn, residual values too.

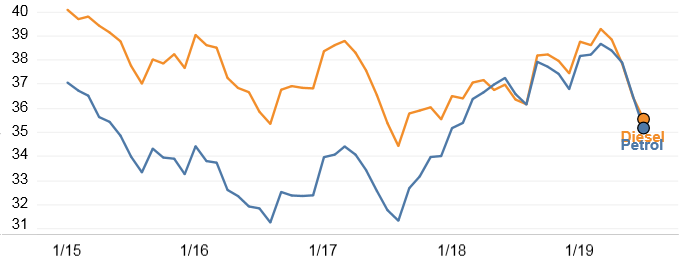

Petrol and diesel cars, UK, trade percentage, 48months/80,000km, January 2015 to July 2019

Source: Residual Value Intelligence, Autovista Group

ULEZ extension

Many people in the London area are undoubtedly already less interested in buying used diesels, especially those that are not Euro 6-compliant, at a time when owners are looking to sell them on. However, this will be significantly more pronounced with the planned extension of the ULEZ to the orbital North and South Circular Road on 25 October 2021.

Anthony Machin, Head of Content and Product at Glass’s, the UK arm of Autovista Group, comments that ′Only when the ULEZ grows to the North-South Circular will we see significant moves away from old diesel.’

′We will probably see a bigger impact on vans than cars as these drivers need to enter the zone and do not necessarily live inside the ULEZ to get a discount – this could potentially increase RVs on Euro 6 vans,’ Machin adds.

Aside from the extension of the ULEZ, the discount from local councils, such as the Borough of Islington, for people who live within the zone will be removed for older cars. However, Machin highlights that ′by the time the discount from local councils is removed for older cars, Euro 6 cars will be at least six years old so if a customer wants an older diesel car to swap to they will be more affordable.’

Broad oversupply

High historic new car volumes have buoyed used car supply in the UK but this had been absorbed by resilient used car demand and so residual values (RVs) had been performing well. 2016 was a record year for the new car market though and with the extension of many lease vehicles last year, used car volumes are especially high.

Although the ULEZ has certainly exacerbated this by increasing the supply of used cars, especially diesels that are not Euro 6-compliant, in and around central London, and reducing their demand, this broad oversupply is the main reason for the weakness of residual values in the UK.

Accordingly, Glass’s, the UK arm of Autovista Group, has revised its RV outlook downwards. It remains uncertain, however, whether the ongoing Brexit uncertainty is now also having a negative impact on used car demand in the UK and, in turn, residual values too.

Petrol and diesel cars, UK, trade percentage, 48months/80,000km, January 2015 to July 2019

Source: Residual Value Intelligence, Autovista Group

Source: Residual Value Intelligence, Autovista Group

Source: Residual Value Intelligence, Autovista Group

ULEZ extension

Many people in the London area are undoubtedly already less interested in buying used diesels, especially those that are not Euro 6-compliant, at a time when owners are looking to sell them on. However, this will be significantly more pronounced with the planned extension of the ULEZ to the orbital North and South Circular Road on 25 October 2021.

Anthony Machin, Head of Content and Product at Glass’s, the UK arm of Autovista Group, comments that ′Only when the ULEZ grows to the North-South Circular will we see significant moves away from old diesel.’

′We will probably see a bigger impact on vans than cars as these drivers need to enter the zone and do not necessarily live inside the ULEZ to get a discount – this could potentially increase RVs on Euro 6 vans,’ Machin adds.

Aside from the extension of the ULEZ, the discount from local councils, such as the Borough of Islington, for people who live within the zone will be removed for older cars. However, Machin highlights that ′by the time the discount from local councils is removed for older cars, Euro 6 cars will be at least six years old so if a customer wants an older diesel car to swap to they will be more affordable.’

Broad oversupply

High historic new car volumes have buoyed used car supply in the UK but this had been absorbed by resilient used car demand and so residual values (RVs) had been performing well. 2016 was a record year for the new car market though and with the extension of many lease vehicles last year, used car volumes are especially high.

Although the ULEZ has certainly exacerbated this by increasing the supply of used cars, especially diesels that are not Euro 6-compliant, in and around central London, and reducing their demand, this broad oversupply is the main reason for the weakness of residual values in the UK.

Accordingly, Glass’s, the UK arm of Autovista Group, has revised its RV outlook downwards. It remains uncertain, however, whether the ongoing Brexit uncertainty is now also having a negative impact on used car demand in the UK and, in turn, residual values too.

Petrol and diesel cars, UK, trade percentage, 48months/80,000km, January 2015 to July 2019

Source: Residual Value Intelligence, Autovista Group

ULEZ extension

Many people in the London area are undoubtedly already less interested in buying used diesels, especially those that are not Euro 6-compliant, at a time when owners are looking to sell them on. However, this will be significantly more pronounced with the planned extension of the ULEZ to the orbital North and South Circular Road on 25 October 2021.

Anthony Machin, Head of Content and Product at Glass’s, the UK arm of Autovista Group, comments that ′Only when the ULEZ grows to the North-South Circular will we see significant moves away from old diesel.’

′We will probably see a bigger impact on vans than cars as these drivers need to enter the zone and do not necessarily live inside the ULEZ to get a discount – this could potentially increase RVs on Euro 6 vans,’ Machin adds.

Aside from the extension of the ULEZ, the discount from local councils, such as the Borough of Islington, for people who live within the zone will be removed for older cars. However, Machin highlights that ′by the time the discount from local councils is removed for older cars, Euro 6 cars will be at least six years old so if a customer wants an older diesel car to swap to they will be more affordable.’

Broad oversupply

High historic new car volumes have buoyed used car supply in the UK but this had been absorbed by resilient used car demand and so residual values (RVs) had been performing well. 2016 was a record year for the new car market though and with the extension of many lease vehicles last year, used car volumes are especially high.

Although the ULEZ has certainly exacerbated this by increasing the supply of used cars, especially diesels that are not Euro 6-compliant, in and around central London, and reducing their demand, this broad oversupply is the main reason for the weakness of residual values in the UK.

Accordingly, Glass’s, the UK arm of Autovista Group, has revised its RV outlook downwards. It remains uncertain, however, whether the ongoing Brexit uncertainty is now also having a negative impact on used car demand in the UK and, in turn, residual values too.

Petrol and diesel cars, UK, trade percentage, 48months/80,000km, January 2015 to July 2019

Source: Residual Value Intelligence, Autovista Group

Source: Residual Value Intelligence, Autovista Group