Monthly Market Update: Summer slump for European used-car markets

07 September 2023

Europe’s major used-car markets experienced a slight seasonal slump in August. From month to month, many countries saw demand sink lower than supply, putting residual values (RVs) under pressure.

Compared with July, the sales-volume index (SVI) posted double-digit drops in Spain (down 28.7%), Switzerland (down 25.8%) and France (down 11.7%). The declines in Austria and Germany were less pronounced, falling by 7.4% and 2% respectively.

As indicated by the active-market volume index (AMVI), the levels of supply to these five used-car markets sat above demand. Germany and France even saw figures improve compared with July, growing by 2.8% and 1.5% respectively.

Meanwhile, Switzerland (down 9.1%), Spain (down 7.5%) and Austria (down 6.1%) all saw downward momentum. The only outliers to this trend were Italy and the UK, where demand grew but supply shrank month on month.

Absolute trade RVs for 36-month-old cars at 60,000km saw the largest month-on-month declines in Spain (down 3.3%), the UK (down 2.9%), and Germany (down 2%). France was the only market to see an improvement, up 1% compared with July.

For many markets, results were slightly more marginal in terms of RVs presented as a percentage of retained list price (%RV). The UK experienced the greatest drop, down 3.1%, followed by Spain with a 1.6% fall, then Italy with a decline of 0.8%. However, France bucked the trend for a second time with %RV levels increasing by 1.4%.

There was another silver lining in August, as the majority of markets saw used-cars sales pick up pace. Spain recorded the greatest improvement, with used cars taking just over 68 days to sell on average, equating to a month-on-month drop of nearly five days.

The UK and France saw average sale speeds improve by 2.4 and 2.2 days respectively. Meanwhile, Switzerland dropped by 1.8 days, while Germany and Austria both fell by 0.9 days. Stock days only increased in Italy, up by 1.8 days.

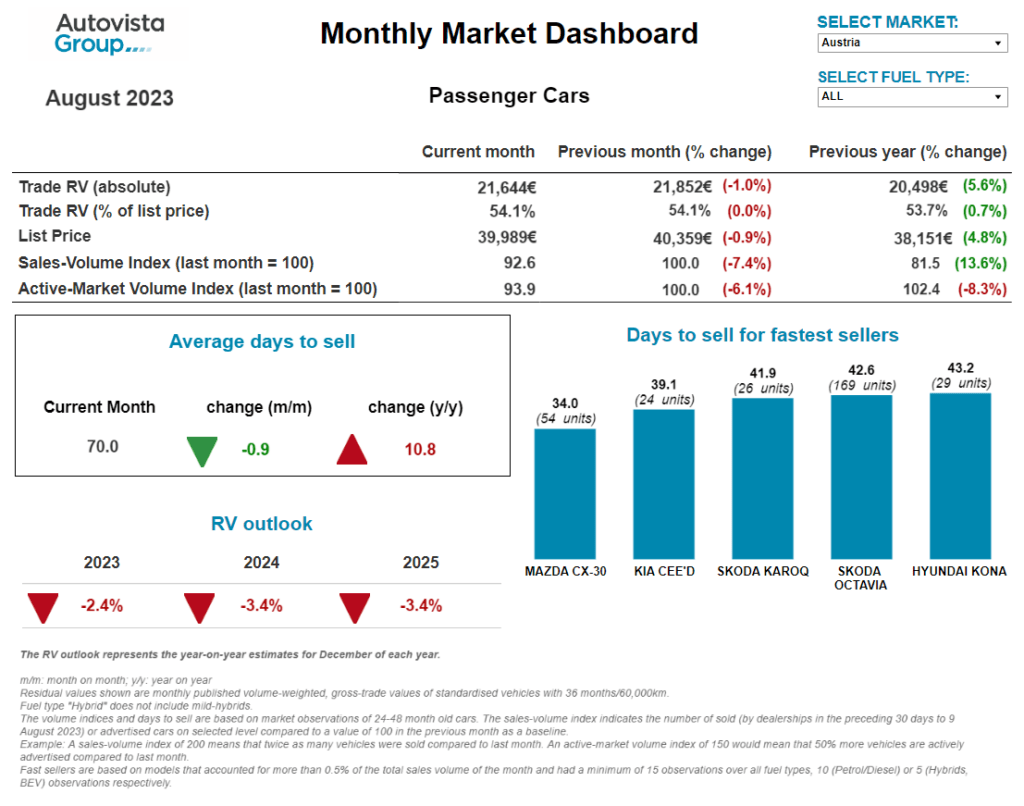

The interactive monthly market dashboard examines Austria, France, Germany, Italy, Spain, Switzerland, and the UK. It includes a breakdown of key performance indicators by fuel type, including RVs, new-car list prices, selling days, sales volume and active-market volume indices.

Supply grows stronger in Austria

Living costs in Austria continue to climb compared with 2022. In August, the SVI showed slower demand for used cars, with a month-on-month decrease of 7.4%. However, this was still up 13.6% on August 2022.

The supply of passenger cars between two and four years of age also increased, with the AMVI up 0.7% year on year. It is worth recognising that supply was significantly lower last year than before the COVID-19 pandemic hit at the beginning of 2020.

The average time needed to sell a used car fell again, hitting 70 days. However, this is still an increase of 10.8 days compared with August 2022. Petrol cars are currently selling the fastest, averaging around 68 days, followed by diesel cars with 69 days, hybrid-electric vehicles (HEVs) with 71 days and plug-hybrids (PHEVs) with around 78 days. Battery-electric vehicles (BEVs) sold more slowly at around 86 days.

‘With weakening demand and improving supply, %RVs of 36-month-old cars stagnated at 54.1%. This meant a 0.7% year-on-year gain, however, pressure on values looks set to keep building,’ said Robert Madas, Eurotax (part of Autovista Group) regional head of valuations, Austria, Switzerland, and Poland.

HEVs led the way with a %RV trade value of 57.9% followed by petrol (55.1%), diesel cars (54.4%) and PHEVs (53.1%). Meanwhile, 36-month-old BEVs held onto the least value, at 47.3%. More pressure on RVs can be expected should demand weaken and supply grow. This means the value of thirty-six-month-old cars will remain relatively high, just on a falling trajectory.

‘The market’s average %RV of a 36-month-old car at 60,000km is forecast to end 2023 approximately 2.4% down compared to December 2022. Next year, %RVs are expected to decrease further by around 3.4% due to weakening demand and increasing supply,’ Madas added.

Sales driven by budgets in France

‘August is always a special month in France,’ commented Ludovic Percier, Autovista Group residual value and market analyst for France. ‘Many companies close for the summer, people go on holiday, and the used-car market is always less active.’

This was confirmed by August’s SVI falling by 23% year on year. RVs were stable overall, with only slight increases in absolute and %RV terms. Petrol and diesel-powered cars followed this wider market trend, with very slight increases in absolute values and %RVs.

This demonstrates the resilience of diesel, given its tarnished reputation and the implementation of low-emission zones (ZFEs). However, the powertrain did see the largest month-on-month fall in transactions.

The RVs of hybrid-electric vehicles climbed in August, even as list prices fell compared with July. The %RVs of plug-in hybrid vehicles remained stable, but the powertrain’s list prices, and absolute RVs fell. BEV RVs remained firm even with Tesla’s pricing strategy, which has consequences not only for list prices but also stock-vehicle discounts.

Sales were still driven by budgets in August, with purchases pushed into lower segments. Older cars will suffer the least from this trend, and demand for small and inexpensive cars is set to continue. The Dacia Sandero, Toyota Aygo and Toyota Yaris were three of the fastest-selling used cars in France, averaging fewer than 33 stock days.

Dealers hold out in Germany

‘Used-car dealers still appear to be resisting a rapid drop in prices,’ pointed out Andreas Geilenbruegge, head of valuations and insights at Schwacke (part of Autovista Group). ‘A growing number of these businesses are instead accepting rising stock days before resorting to any price adjustments.’

This trend is helping slow the descent of prices for internal-combustion engine (ICE) models made between 2020 and 2021. Meanwhile, the absolute prices of younger used cars have already been altered downwards quite significantly, despite comparatively small volumes and low days in stock.

This occurred for two reasons. Firstly, more short-term tactical registrations from dealers, manufacturers and rental companies are returning to the market, meaning more used models aged six to 18 months are now available. Secondly, young used vehicles were particularly affected by price boosts in recent months. Levels developed faster than purchasing power could keep up with.

Conversely, HEVs benefitted from a very loyal clientele, greater demand-orientated volumes and very low offer thresholds for those willing to electrify. The powertrain also benefitted from a lack of government purchase incentives, meaning prices remained firm and did not pass on a burden to the used-car market. However, HEVs are currently experiencing a downturn due to the nearly intolerable level of absolute offer prices.

Used cars five years and older remained the market winners, despite rising supply volumes, relatively low stock days and continually high prices. On average, cars of this age are achieving five-figure sums, which is drawing dealer attention away from younger models. A market is therefore opening up given the expansion of agency systems into used-car offerings as well as the gradual decline of young ICE-powered models.

Small signs of growth in Spain

New-car registrations saw more positivity in July, up 22% year on year, marking seven consecutive months of growth. While the rent-a-car channel previously led the way, the companies and private individuals were responsible for pushing the figures forward in July.

‘The used-car market, which continues to be weighed down by a shortage of stock, showed slight signs of growth, up roughly 2% both in July and in the year to date,’ highlighted Ana Azofra, Autovista Group head of valuations and insights, Spain.

Despite low stock levels, used-vehicle prices fell faster in August. The average transaction price of a 36-month-old car at 60,000km fell by more than 3% month on month. This decline steepens to 4% and 5% in the case of BEVs and PHEVs, respectively. Both recorded extended sales periods, close to 80 days. This was nearly 20 days longer than HEVs and 10 more than petrol or diesel-powered cars.

Considering the evolution of used-car prices, only HEVs escaped the downward trend thanks to a positive buffer built up over recent months. This allowed the powertrain’s values to stabilise instead. There was also a change to the fastest-sellers ranking in August. Toyota’s hybrids retained fourth and fifth position but were overtaken by the Hyundai Tucson, BMW X1 and Mercedes CLA.

Switzerland sees %RVs sag

‘Supply into the Swiss used-car market has increased significantly in recent months,’ explained Hans-Peter Annen, head of valuations and insights, at Eurotax Switzerland. ‘Only younger used models continue to see lower levels of supply compared with the pre-COVID-19 pandemic period.’

Across all two-to-four-year-old passenger cars, the AMVI was 9.1% lower in August than in July, but 18.8% higher than a year earlier. Used-car transactions have slowed since the beginning of 2023 while living costs soared.

The SVI fell by 25.8% compared to July and is up 11% year on year. With increased supply and overall weakening demand in recent months, the average %RV of a 36-month-old car, decreased again. The figure fell to 50.3% in August, down 0.3% month on month, and down 1% year on year.

HEVs hit a %RV of 54.5% after a healthy year-on-year increase of 10.9%. Petrol cars were not far off this mark (51.2%), then diesel models (48.7%) and PHEVs (47.6%). Meanwhile, 36-month-old BEVs retained 47.1% of their original list price.

August saw stock days of two-to-four-year-old cars reach some 79 days. HEVs sold the quickest after an average of roughly 50 days, followed by petrol cars after 77 days, then diesel cars at 80 days, BEVs at 85 days and finally PHEVs after 92 days.

Used-car demand is expected to weaken amid overall high and stable supply. A further falling trend can be expected, although values of three-year-old used cars remain relatively high. The %RV level is forecast to finish 2023 down roughly 4% on December 2022. In 2024, levels are expected to fall again by around 4% year on year due to constant supply and lower demand.

Retail activity rises in UK

‘UK used-car retail activity improved in August according to the sales-volume index. Sales increased by 10.1% compared to July and 23% compared with August 2022,’ said Jayson Whittington, Glass’s (part of Autovista Group) chief editor, cars and leisure vehicles.

The average number of days it took a dealer to sell a used car also fell, down to 38.2 days. This equated to a decline of 2.4 days compared with the previous month and made for an impressive 10-day drop compared with August last year.

The AMVI shows that fewer cars were available in August than in July. The market saw a 4.5% decline in used cars advertised for sale, although there was 9.2% more than in August 2022.

BEV retail demand in August was similar to July, with a downward adjustment of just 0.5%. However, demand for all-electric models remains on a broader upward trajectory as unit sales were up 308.8% on August 2022. While there is no shortage of used BEVs, the dashboard indicates that there were 5.4% fewer units available for sale month on month.

BEVs sold more quickly in August, needing 7.3 fewer days on average than in July. While the powertrain clearly bounced back, sales still took 9.8 days more than last year. For the second consecutive month, a BEV was the fastest-selling used car in the UK, with the Tesla Model 3 taking just 17 days on average to sell.

The average three-year-old car retained 60.7% of its original cost-new price last month, down from 62.6% in July, but up from 60% in 2022. Accounting for the circa 30% rise in RVs that took place throughout 2021 and the relatively small depreciation (down 2.5%) in 2022, values remain surprisingly high.

‘But with used-car supply unlikely to increase throughout the remainder of 2023, Glass’s expects the average RV of a three-year-old used car to remain in line with December 2022 at year-end,’ Whittington concluded.