New-car list prices jump in Austria as supply issues hit used-car market

04 May 2022

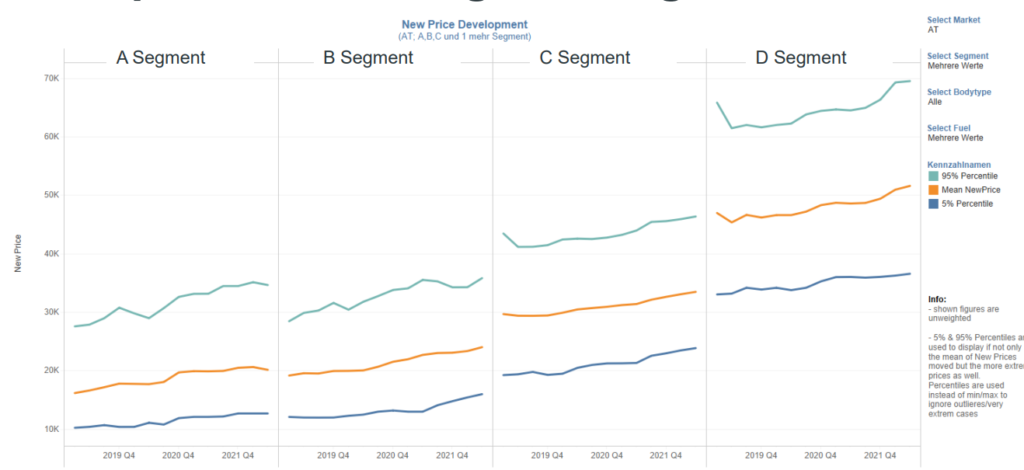

List prices for new cars in Austria have increased significantly since the onset of the COVID-19 pandemic. When compared to the first quarter of 2019, prices have jumped by nearly 18%. Meanwhile, the used-car market is suffering with a shortage of vehicle supply, while demand for vehicles remains stable.

Factors creating higher vehicle prices

Raw-material shortages and high energy prices have accelerated the local inflation rate in Austria, which reached a 40-year high in March 2022. But rising inflation is not the only reason why list prices have increased by almost a fifth in the country.

Emissions standards, a more diverse product portfolio and advanced equipment in vehicles, as well as the the standard fuel-consumption tax (NoVA) have impacted new-car list prices in the country. This is particularly evident in cheaper models, which have seen continuous price increases. This trend is likely to continue across the board, especially as supply-chain issues, including a lack of semiconductors and the impact of the war in Ukraine, continue to affect availability.

In Austria, 2020 was the weakest year for new-car registrations in 33 years. The market did not improve in 2021 because of the semiconductor shortage, and figures are still weaker than pre-pandemic levels, highlighting the challenges the automotive industry is facing at present.

Overall, consumers are increasingly turning to electric vehicles (EVs), with battery-electric vehicles (BEVs) being especially popular and reaching a market share of almost 14% among new-car registrations. Regarding light-commercial vehicles (LCVs), the introduction of the standard fuel-consumption tax initially led to high demand in 2021, but the market is now showing weaker demand in 2022.

Used-car market takes a hit

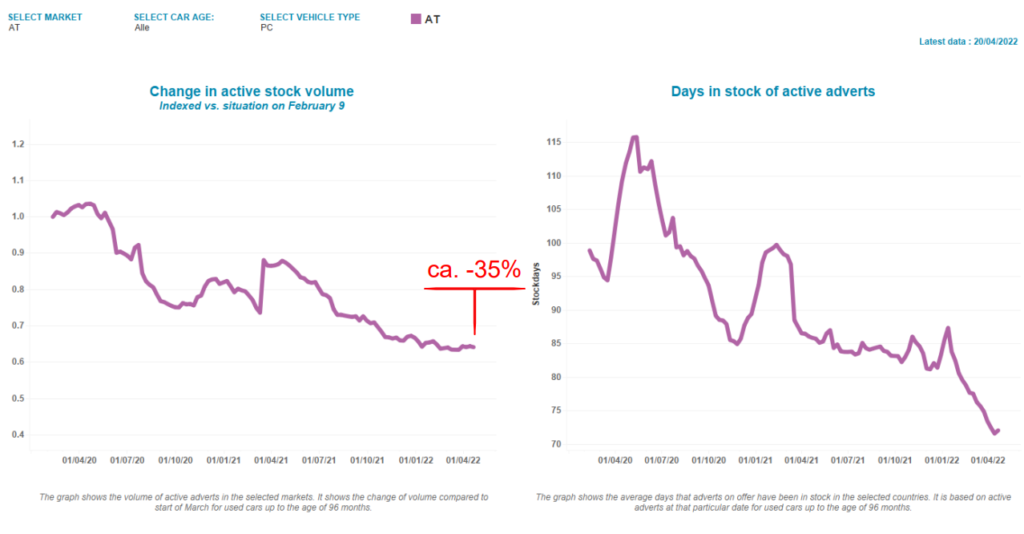

The used-car market saw healthy growth in 2021, with the number of cars changing owners on a par with 2019 pre-pandemic figures. But this year has been off to a slow start, with the first quarter seeing weaker demand.

This trend could, in part, be caused by supply issues. There are fewer vehicles available on the used-car market in Austria. Compared to the beginning of 2020, the number of used cars on offer has dropped sharply by 35%. With the stock volume decreasing, used cars also spend less time being listed. On average, used cars are now listed for 70 to 75 days.

Used diesel cars continue to be prevalent, gaining a market share of almost 59%. But things are starting to shift as EVs gain in popularity on the used-car market, with a share of 4.3% in 2022. The average age of a used car is increasing, with this currently standing at 9.4 years compared to 8.7 years in 2018.

Residual values are going up

The market environment for residual values (RVs) is marked by stable demand with scarce supply. The pandemic and the semiconductor chip shortage, as well as the war in Ukraine, are continuing to impact supply chains. In general, fewer cars are available and offer prices have risen sharply, increasing by 17% on average compared to February 2020.

Autovista Group analysts expect RVs to be up for all fuel types at the end of 2022. Residual values of 36-month-old vehicles were originally forecast to increase by 3.5% year on year, according to data presented during the latest webinar by Eurotax Austria, part of Autovista Group. However, in the April update, the RV Outlook for Austria has been upgraded to 7% growth in 2022 and RV declines are now expected across all fuel types in 2023.

The webinar offers more in-depth analysis of the automotive trends in Austria. Find the full German-language slide deck of the presentation below. A video of the webinar is also available for viewing and download.