New-car registrations recede across Europe in October

03 November 2020

3 November 2020

Autovista Group senior data journalist Neil King considers the slump in registrations in France, Italy and Spain in October.

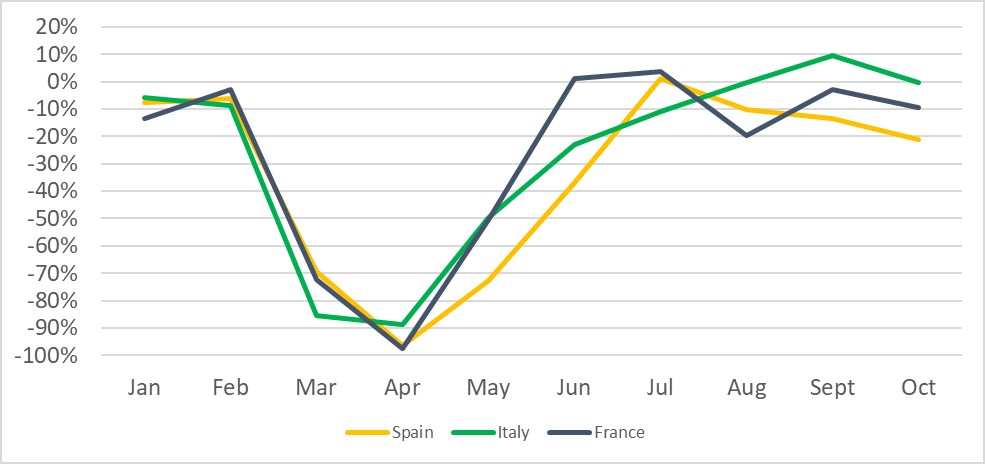

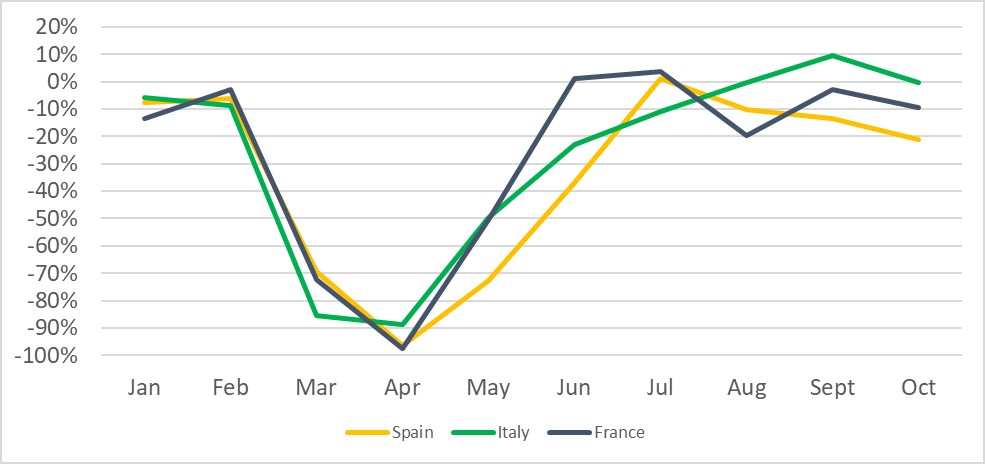

Despite the existence of government-backed incentives in France, Italy and Spain, new-car registrations in October have dropped over the month, according to the respective automotive trade associations.

Following the lifting of coronavirus (COVID-19) related lockdowns earlier in the year, the countries’ automotive markets had shown signs of recovery. However, all three contracted for the third consecutive month in October, with the exception of the incentive-induced growth in Italy during September.

New-car registrations, France, Italy and Spain, year-on-year percentage change, January to October 2020

Source: CCFA, ANFIA, ANFAC

New-car registrations were 9.5% lower in France in October 2020 than in the same month of 2019 (there was one less working day in the month than in October 2019), according to the latest data released by the CCFA, the French automotive industry association. This is a greater downturn than the 3.0% year-on-year contraction in new-car registrations in the country in September. However, factoring in the lower number of working days (22 in October 2020 versus 23 in October 2019), the CCFA has calculated that the market declined by 5.4% based on an equal comparison.

The incentives introduced on 1 June for new battery-electric vehicles (BEVs) and plug-in hybrids (PHEVs) remain, but the additional bonus for trading in older cars for cleaner new and used cars was exhausted before the end of July. The scrappage scheme reached its 200,000-vehicle cap after just two months, although the Ministry of Ecological Transition did announce the replacement of the recovery scheme with a conversion bonus, which has been in effect since 3 August.

′Orders were quite good at the start of October, but they deteriorated sharply at the end of the month,’ explained François Roudier, spokesperson for the CCFA. Roudier added that sales revenues are ′healthier’ than is usual for the end of the year, with more sales to private buyers and less discounted prices meaning ′margins have held up well.’

In the first 10 months of 2020, new-car registrations in France were 26.9% lower than in the same period in 2019. However, the CCFA reports that demand is 39.1% lower on the basis of a comparable number of working days.

Roudier warned that ′we must remain cautious about the management of the last months of 2020.’ Between the unpredictable behaviour of consumers in the face of bonuses and penalties, and the ongoing effects of COVID-19, ′we have a difficult end of the year,’ he concluded.

Pain in Spain

In Spain, 74,228 new cars were registered during October, 21.0% fewer than in October 2019 according to ANFAC, the Spanish vehicle manufacturers’ association. ′The negative evolution of the pandemic, together with the uncertainty regarding the related social and economic consequences, is causing a generalised fall in sales, which could be even worse without the support plans approved for the sector,’ ANFAC commented.

The MOVES II and RENOVE schemes were introduced in July and the new-car market saw a 1.1% increase in the month. Since then, however, there have been respective monthly declines of 10.1% and 13.5% in August and September, and now 21.0% in October. It is therefore clear that weak underlying consumer demand is the problem in the country. Measures to deal with the second wave of COVID-19 infections, and the calculation of the registration tax based on WLTP emissions figures from January 2021 are further complicating the recovery.

Noemi Navas, communications director of ANFAC, explained that ′the purchase assistance plans are good tools to achieve stimulation of the market and prevent the falls from being even worse. The crisis situation is going to extend into 2021 and if we do not want the sector and its employment to fall even more, it will be necessary to maintain the support. At ANFAC, we are very concerned about the effect that an increase in the registration tax would have, due to the switch to WLTP, in a market that cannot overcome the COVID-19 crisis.’

′It is important to make the buyer understand that if they intend to change cars, they should not postpone the decision. From January, there is a risk of a rise in prices as a consequence of the entry into force of the WLTP regulation, which will mean that vehicles that were previously exempt from registration tax will have to pay as the parameters for measuring CO2 emissions change,’ added Tania Puche, communications director of the Spanish dealer association GANVAM.

Italy back in negative territory

In Italy, the year-on-year downturn in October reported by the industry association ANFIA was just 0.2%, although the result would have been positive (up by about 4%) had there not been one less working day. Nevertheless, this does mark a return for the country to negative territory following the 9.5% growth in new-car registrations in September due to the new government incentives that came into effect at the beginning of August as part of the Decreto Rilancio (Relaunch Decree). While the market still contracted in that month, demand improved but delivery times delayed many registrations until September.

′In this phase, we are engaged in ministerial meetings for the presentation of the proposals of the Italian automotive industry in relation to the recovery plan, an opportunity not to be missed to support the sector in this difficult industrial transition. We are working on the four pillars necessary to guarantee its strategic repositioning and competitive advantage: interventions to support investment in research and innovation; the promotion of smart and shared-mobility projects; interventions on human capital and financial interventions to support businesses. We hope that these lines of action are considered a priority and may have sufficient space in the final plan,’ commented Paolo Scudieri, president of ANFIA.

The key to recovery of new-car markets revolves around countries agreeing budgets for 2021, and improving economic certainty and consumer confidence to boost spending. However, with a second wave of COVID-19 cases washing across Europe, and accompanying lockdowns, the industry certainly does face a difficult end to 2020.

Source: CCFA, ANFIA, ANFAC

New-car registrations were 9.5% lower in France in October 2020 than in the same month of 2019 (there was one less working day in the month than in October 2019), according to the latest data released by the CCFA, the French automotive industry association. This is a greater downturn than the 3.0% year-on-year contraction in new-car registrations in the country in September. However, factoring in the lower number of working days (22 in October 2020 versus 23 in October 2019), the CCFA has calculated that the market declined by 5.4% based on an equal comparison.

The incentives introduced on 1 June for new battery-electric vehicles (BEVs) and plug-in hybrids (PHEVs) remain, but the additional bonus for trading in older cars for cleaner new and used cars was exhausted before the end of July. The scrappage scheme reached its 200,000-vehicle cap after just two months, although the Ministry of Ecological Transition did announce the replacement of the recovery scheme with a conversion bonus, which has been in effect since 3 August.

′Orders were quite good at the start of October, but they deteriorated sharply at the end of the month,’ explained François Roudier, spokesperson for the CCFA. Roudier added that sales revenues are ′healthier’ than is usual for the end of the year, with more sales to private buyers and less discounted prices meaning ′margins have held up well.’

In the first 10 months of 2020, new-car registrations in France were 26.9% lower than in the same period in 2019. However, the CCFA reports that demand is 39.1% lower on the basis of a comparable number of working days.

Roudier warned that ′we must remain cautious about the management of the last months of 2020.’ Between the unpredictable behaviour of consumers in the face of bonuses and penalties, and the ongoing effects of COVID-19, ′we have a difficult end of the year,’ he concluded.

Pain in Spain

In Spain, 74,228 new cars were registered during October, 21.0% fewer than in October 2019 according to ANFAC, the Spanish vehicle manufacturers’ association. ′The negative evolution of the pandemic, together with the uncertainty regarding the related social and economic consequences, is causing a generalised fall in sales, which could be even worse without the support plans approved for the sector,’ ANFAC commented.

The MOVES II and RENOVE schemes were introduced in July and the new-car market saw a 1.1% increase in the month. Since then, however, there have been respective monthly declines of 10.1% and 13.5% in August and September, and now 21.0% in October. It is therefore clear that weak underlying consumer demand is the problem in the country. Measures to deal with the second wave of COVID-19 infections, and the calculation of the registration tax based on WLTP emissions figures from January 2021 are further complicating the recovery.

Noemi Navas, communications director of ANFAC, explained that ′the purchase assistance plans are good tools to achieve stimulation of the market and prevent the falls from being even worse. The crisis situation is going to extend into 2021 and if we do not want the sector and its employment to fall even more, it will be necessary to maintain the support. At ANFAC, we are very concerned about the effect that an increase in the registration tax would have, due to the switch to WLTP, in a market that cannot overcome the COVID-19 crisis.’

′It is important to make the buyer understand that if they intend to change cars, they should not postpone the decision. From January, there is a risk of a rise in prices as a consequence of the entry into force of the WLTP regulation, which will mean that vehicles that were previously exempt from registration tax will have to pay as the parameters for measuring CO2 emissions change,’ added Tania Puche, communications director of the Spanish dealer association GANVAM.

Italy back in negative territory

In Italy, the year-on-year downturn in October reported by the industry association ANFIA was just 0.2%, although the result would have been positive (up by about 4%) had there not been one less working day. Nevertheless, this does mark a return for the country to negative territory following the 9.5% growth in new-car registrations in September due to the new government incentives that came into effect at the beginning of August as part of the Decreto Rilancio (Relaunch Decree). While the market still contracted in that month, demand improved but delivery times delayed many registrations until September.

′In this phase, we are engaged in ministerial meetings for the presentation of the proposals of the Italian automotive industry in relation to the recovery plan, an opportunity not to be missed to support the sector in this difficult industrial transition. We are working on the four pillars necessary to guarantee its strategic repositioning and competitive advantage: interventions to support investment in research and innovation; the promotion of smart and shared-mobility projects; interventions on human capital and financial interventions to support businesses. We hope that these lines of action are considered a priority and may have sufficient space in the final plan,’ commented Paolo Scudieri, president of ANFIA.

The key to recovery of new-car markets revolves around countries agreeing budgets for 2021, and improving economic certainty and consumer confidence to boost spending. However, with a second wave of COVID-19 cases washing across Europe, and accompanying lockdowns, the industry certainly does face a difficult end to 2020.

Source: CCFA, ANFIA, ANFAC

New-car registrations were 9.5% lower in France in October 2020 than in the same month of 2019 (there was one less working day in the month than in October 2019), according to the latest data released by the CCFA, the French automotive industry association. This is a greater downturn than the 3.0% year-on-year contraction in new-car registrations in the country in September. However, factoring in the lower number of working days (22 in October 2020 versus 23 in October 2019), the CCFA has calculated that the market declined by 5.4% based on an equal comparison.

The incentives introduced on 1 June for new battery-electric vehicles (BEVs) and plug-in hybrids (PHEVs) remain, but the additional bonus for trading in older cars for cleaner new and used cars was exhausted before the end of July. The scrappage scheme reached its 200,000-vehicle cap after just two months, although the Ministry of Ecological Transition did announce the replacement of the recovery scheme with a conversion bonus, which has been in effect since 3 August.

′Orders were quite good at the start of October, but they deteriorated sharply at the end of the month,’ explained François Roudier, spokesperson for the CCFA. Roudier added that sales revenues are ′healthier’ than is usual for the end of the year, with more sales to private buyers and less discounted prices meaning ′margins have held up well.’

In the first 10 months of 2020, new-car registrations in France were 26.9% lower than in the same period in 2019. However, the CCFA reports that demand is 39.1% lower on the basis of a comparable number of working days.

Roudier warned that ′we must remain cautious about the management of the last months of 2020.’ Between the unpredictable behaviour of consumers in the face of bonuses and penalties, and the ongoing effects of COVID-19, ′we have a difficult end of the year,’ he concluded.

Pain in Spain

In Spain, 74,228 new cars were registered during October, 21.0% fewer than in October 2019 according to ANFAC, the Spanish vehicle manufacturers’ association. ′The negative evolution of the pandemic, together with the uncertainty regarding the related social and economic consequences, is causing a generalised fall in sales, which could be even worse without the support plans approved for the sector,’ ANFAC commented.

The MOVES II and RENOVE schemes were introduced in July and the new-car market saw a 1.1% increase in the month. Since then, however, there have been respective monthly declines of 10.1% and 13.5% in August and September, and now 21.0% in October. It is therefore clear that weak underlying consumer demand is the problem in the country. Measures to deal with the second wave of COVID-19 infections, and the calculation of the registration tax based on WLTP emissions figures from January 2021 are further complicating the recovery.

Noemi Navas, communications director of ANFAC, explained that ′the purchase assistance plans are good tools to achieve stimulation of the market and prevent the falls from being even worse. The crisis situation is going to extend into 2021 and if we do not want the sector and its employment to fall even more, it will be necessary to maintain the support. At ANFAC, we are very concerned about the effect that an increase in the registration tax would have, due to the switch to WLTP, in a market that cannot overcome the COVID-19 crisis.’

′It is important to make the buyer understand that if they intend to change cars, they should not postpone the decision. From January, there is a risk of a rise in prices as a consequence of the entry into force of the WLTP regulation, which will mean that vehicles that were previously exempt from registration tax will have to pay as the parameters for measuring CO2 emissions change,’ added Tania Puche, communications director of the Spanish dealer association GANVAM.

Italy back in negative territory

In Italy, the year-on-year downturn in October reported by the industry association ANFIA was just 0.2%, although the result would have been positive (up by about 4%) had there not been one less working day. Nevertheless, this does mark a return for the country to negative territory following the 9.5% growth in new-car registrations in September due to the new government incentives that came into effect at the beginning of August as part of the Decreto Rilancio (Relaunch Decree). While the market still contracted in that month, demand improved but delivery times delayed many registrations until September.

′In this phase, we are engaged in ministerial meetings for the presentation of the proposals of the Italian automotive industry in relation to the recovery plan, an opportunity not to be missed to support the sector in this difficult industrial transition. We are working on the four pillars necessary to guarantee its strategic repositioning and competitive advantage: interventions to support investment in research and innovation; the promotion of smart and shared-mobility projects; interventions on human capital and financial interventions to support businesses. We hope that these lines of action are considered a priority and may have sufficient space in the final plan,’ commented Paolo Scudieri, president of ANFIA.

The key to recovery of new-car markets revolves around countries agreeing budgets for 2021, and improving economic certainty and consumer confidence to boost spending. However, with a second wave of COVID-19 cases washing across Europe, and accompanying lockdowns, the industry certainly does face a difficult end to 2020.

Source: CCFA, ANFIA, ANFAC

New-car registrations were 9.5% lower in France in October 2020 than in the same month of 2019 (there was one less working day in the month than in October 2019), according to the latest data released by the CCFA, the French automotive industry association. This is a greater downturn than the 3.0% year-on-year contraction in new-car registrations in the country in September. However, factoring in the lower number of working days (22 in October 2020 versus 23 in October 2019), the CCFA has calculated that the market declined by 5.4% based on an equal comparison.

The incentives introduced on 1 June for new battery-electric vehicles (BEVs) and plug-in hybrids (PHEVs) remain, but the additional bonus for trading in older cars for cleaner new and used cars was exhausted before the end of July. The scrappage scheme reached its 200,000-vehicle cap after just two months, although the Ministry of Ecological Transition did announce the replacement of the recovery scheme with a conversion bonus, which has been in effect since 3 August.

′Orders were quite good at the start of October, but they deteriorated sharply at the end of the month,’ explained François Roudier, spokesperson for the CCFA. Roudier added that sales revenues are ′healthier’ than is usual for the end of the year, with more sales to private buyers and less discounted prices meaning ′margins have held up well.’

In the first 10 months of 2020, new-car registrations in France were 26.9% lower than in the same period in 2019. However, the CCFA reports that demand is 39.1% lower on the basis of a comparable number of working days.

Roudier warned that ′we must remain cautious about the management of the last months of 2020.’ Between the unpredictable behaviour of consumers in the face of bonuses and penalties, and the ongoing effects of COVID-19, ′we have a difficult end of the year,’ he concluded.

Pain in Spain

In Spain, 74,228 new cars were registered during October, 21.0% fewer than in October 2019 according to ANFAC, the Spanish vehicle manufacturers’ association. ′The negative evolution of the pandemic, together with the uncertainty regarding the related social and economic consequences, is causing a generalised fall in sales, which could be even worse without the support plans approved for the sector,’ ANFAC commented.

The MOVES II and RENOVE schemes were introduced in July and the new-car market saw a 1.1% increase in the month. Since then, however, there have been respective monthly declines of 10.1% and 13.5% in August and September, and now 21.0% in October. It is therefore clear that weak underlying consumer demand is the problem in the country. Measures to deal with the second wave of COVID-19 infections, and the calculation of the registration tax based on WLTP emissions figures from January 2021 are further complicating the recovery.

Noemi Navas, communications director of ANFAC, explained that ′the purchase assistance plans are good tools to achieve stimulation of the market and prevent the falls from being even worse. The crisis situation is going to extend into 2021 and if we do not want the sector and its employment to fall even more, it will be necessary to maintain the support. At ANFAC, we are very concerned about the effect that an increase in the registration tax would have, due to the switch to WLTP, in a market that cannot overcome the COVID-19 crisis.’

′It is important to make the buyer understand that if they intend to change cars, they should not postpone the decision. From January, there is a risk of a rise in prices as a consequence of the entry into force of the WLTP regulation, which will mean that vehicles that were previously exempt from registration tax will have to pay as the parameters for measuring CO2 emissions change,’ added Tania Puche, communications director of the Spanish dealer association GANVAM.

Italy back in negative territory

In Italy, the year-on-year downturn in October reported by the industry association ANFIA was just 0.2%, although the result would have been positive (up by about 4%) had there not been one less working day. Nevertheless, this does mark a return for the country to negative territory following the 9.5% growth in new-car registrations in September due to the new government incentives that came into effect at the beginning of August as part of the Decreto Rilancio (Relaunch Decree). While the market still contracted in that month, demand improved but delivery times delayed many registrations until September.

′In this phase, we are engaged in ministerial meetings for the presentation of the proposals of the Italian automotive industry in relation to the recovery plan, an opportunity not to be missed to support the sector in this difficult industrial transition. We are working on the four pillars necessary to guarantee its strategic repositioning and competitive advantage: interventions to support investment in research and innovation; the promotion of smart and shared-mobility projects; interventions on human capital and financial interventions to support businesses. We hope that these lines of action are considered a priority and may have sufficient space in the final plan,’ commented Paolo Scudieri, president of ANFIA.

The key to recovery of new-car markets revolves around countries agreeing budgets for 2021, and improving economic certainty and consumer confidence to boost spending. However, with a second wave of COVID-19 cases washing across Europe, and accompanying lockdowns, the industry certainly does face a difficult end to 2020.