Nickel price surge could make electric vehicles more expensive

04 April 2022

Car manufacturers rely on nickel to build electric vehicles (EVs), and large quantities of the raw material are mined in Russia. The country has one of the world’s largest reserves of the raw material – after Indonesia, Australia, and Brazil. Experts believe that Russia’s invasion of Ukraine could make EVs more expensive as carmakers and suppliers grapple with supply-chain disruptions.

Prices of nickel have surged in the past weeks, and questions around Russian supply loom large. Could this hamper the public acceptance of electric vehicles? Pedro Pacheco, analyst at tech research and consulting company Gartner, thinks so.

He told the German press agency that soaring nickel prices ‘threaten the adoption of electric cars’, and that the issue could drag on into next year. ‘2022 and 2023 will be very different to what it looked like at the beginning of the year,’ he said.

Price hikes seen in the supply chain are unlikely to make electric vehicles any cheaper, indeed the opposite could be the case. ‘This will certainly affect the acceptance of electric vehicles,’ said Pacheco.

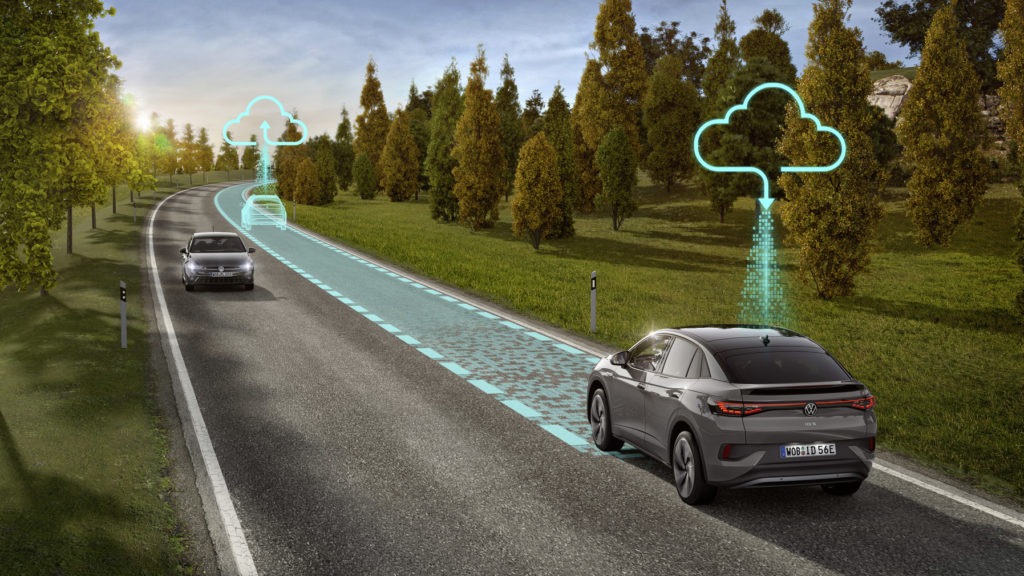

The recent developments in Ukraine are not only affecting EVs, but car manufacturing as a whole. Many European carmakers, such as Volkswagen (VW), have sourced wire harnesses from Ukraine, while Russia is a key supplier of palladium, which is used for catalytic converters. Internal-combustion-engine-powered vehicles are therefore also impacted by supply chain uncertainties.

Chinese carmakers to benefit

Pacheco does not rule out the possibility of Chinese car manufacturers reaping benefits from the tense geopolitical situation. These companies continue to have easy access to Russian raw materials, keeping automotive supply chains moving.

If the Ukraine conflict continues, it could help Chinese carmakers expand their market position in Russia and other parts of the world, Pacheco believes. Chery and Volvo-owner Geely are among the bestselling Chinese brands in Russia.

While many Western carmakers have halted exports and stopped car production in the country, China refuses to impose sanctions on Russia. Prices for new cars from foreign manufacturers in Russia surged by more than 15% in the week following the invasion of Ukraine, the Federal Service for State Statistics, Rosstat, reported.

Chip shortage adds to woes

Pacheco expects new mergers and acquisitions in the automotive industry as a result of the war. This follows Gartner’s earlier warning that the Ukraine conflict could further aggravate the semiconductor market, which has struggled with bottlenecks since the onset of COVID-19. Ukraine is an important supplier of neon, used in chip production.

‘Russia is an important producer of metals like aluminium, nickel, and copper. Aluminium is a conductor that is commonly used to manufacture passive components and in wire bonding,’ said Gaurav Gupta, vice-president analyst at Gartner.

‘Passive components, such as resistors and capacitors, are commonly used in all types of electronic equipment. Any disruption in the supply of any of these metals could cause prices to rise and subsequently impact the prices of semiconductor devices and electronic systems.’

Alternative nickel supplies

With the war raging on, carmakers and automotive suppliers are looking to secure raw materials from other countries. EV-battery startup Britishvolt has signed a deal to ensure supply of nickel from Indonesia. The company is building a gigafactory in the UK and is considering another in Indonesia.

Tesla appears to be dodging the nickel crisis by signing a ‘secret’ deal with mining company Vale, Bloomberg reports. The EV maker is said to have inked a multi-year agreement with Vale for nickel sourced from Canada. Meanwhile, VW recently formed EV-battery joint ventures in Asia to secure supplies of nickel and cobalt to improve cost efficiency.