Petrol vehicles increase domination of European sales

04 September 2019

Petrol vehicles increase domination of European sales

4 September 2019

The European new car market has shifted further towards petrol vehicles in the second quarter of the year.

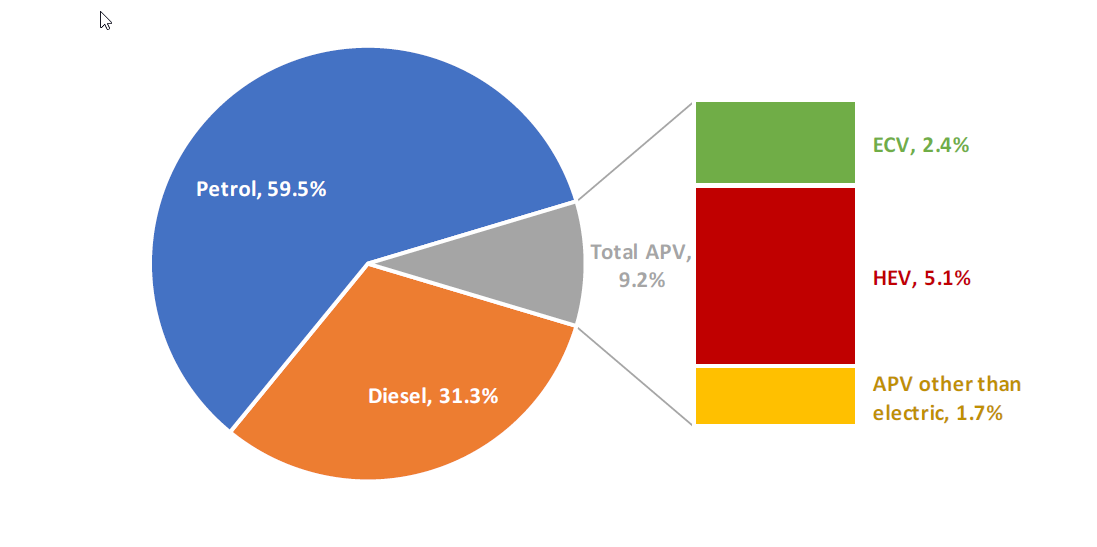

The fuel type now represents nearly 60% of all new passenger car registrations, while demand for diesel has continued its decline, according to figures released by the European Automobile Manufacturers Association. Electrically chargeable vehicles, such as battery electric (BEV) and plug-in hybrid (PHEV) accounted for 2.4% of sales, with all alternatively powered vehicles combined making up 9.2% of the EU market.

Petrol and diesel

Demand for new petrol cars continued to increase in the five major European markets, except for Germany, which saw a 5% drop. The best performer of the rest was Italy, which posted a 27.4% gain, followed by France (up 5.6%), Spain (up 4.3%) and the UK (up 0.6%).

The Central European countries also saw a surge in demand for petrol vehicles, with registrations increasing by 7.2%. Petrol expanded its market share from 56.7% to 59.5% in the second quarter of 2019 across the entire continent.

By contrast, the number of diesel cars registered across the EU decreased by 16.4% to 1.3 million units, with diesel's market share falling from 36.3% in the second quarter of 2018 to 31.3% this year. In Germany, however, demand for diesel recovered slightly, up 3.5% in the second quarter.

The biggest drop in the major markets was in Spain, where 28.1% fewer diesel vehicles were sold. Italy (down 21.2%), France (down 17.6%) and the UK (down 17.3%) followed this. Across the whole of Europe, diesel sales fell 16.4% in the quarter.

Alternative power

During the second quarter, registrations of alternatively-powered cars in the European Union showed strong growth, up 28.5%. Some 98,553 electrically chargeable vehicles were registered, up 35.6% compared to Q2 last year. Sales of BEVs almost doubled (up 97.7%), while demand for PHEVs declined in the second quarter of 2019 by 13.6%.

Hybrid vehicles posted strong results with growth of 38.2%, as 210,348 units sold from April to June this year. However, registrations of LPG and natural gas cars remained flat in the second quarter, mainly due to a sharp drop in demand for natural gas vehicles.

Each of the five largest EU car markets saw registrations of alternatively powered vehicles increase significantly. Germany (up 60.7%) recorded the highest percentage gains, boosted by strong demand for hybrid electric vehicles, followed by Spain (up 35.8%) and France (up 20%).

Year-to-date

In the first six months of 2019, petrol vehicle sales have increased by 2.5% across the continent, with Germany the only one of the big five not increasing its sales. Diesel, however, has declined by 17.2%, with Germany again the odd-one-out, its increase of 3% not just the only market in the big five to post a rise in sales, but the only market in the whole of Europe to do so.

This highlights just how important the diesel industry is to Germany, a country that is doing everything possible to improve the tarnished image of the fuel. Carmakers are coming round to the idea of hardware retrofitting of older vehicles, while city bans seem to be doing little to discourage drivers. Indeed, it is possible that bans on Euro 4 and Euro 5 engines are driving sales of cleaner diesel vehicles.

The registrations of all alternatively powered vehicles increased by 27.5%, although unit sales were just 724,599 for the year-to-date, compared to 4,818,367 petrol vehicles and 2,574,756 diesels. Considering this number includes 398,915 hybrid cars (up 36.5% over the first six months), which have been on sale for over a decade, the push towards vehicle electrification still has some work to do to convince drivers in giving up traditional engines.

PHEV sales suffered a drop of 6.9% in the first half, while BEV registrations rose 90.9%, with 125,344 units shipped.