Price pressures continue to impact used LCVs in Europe

18 October 2024

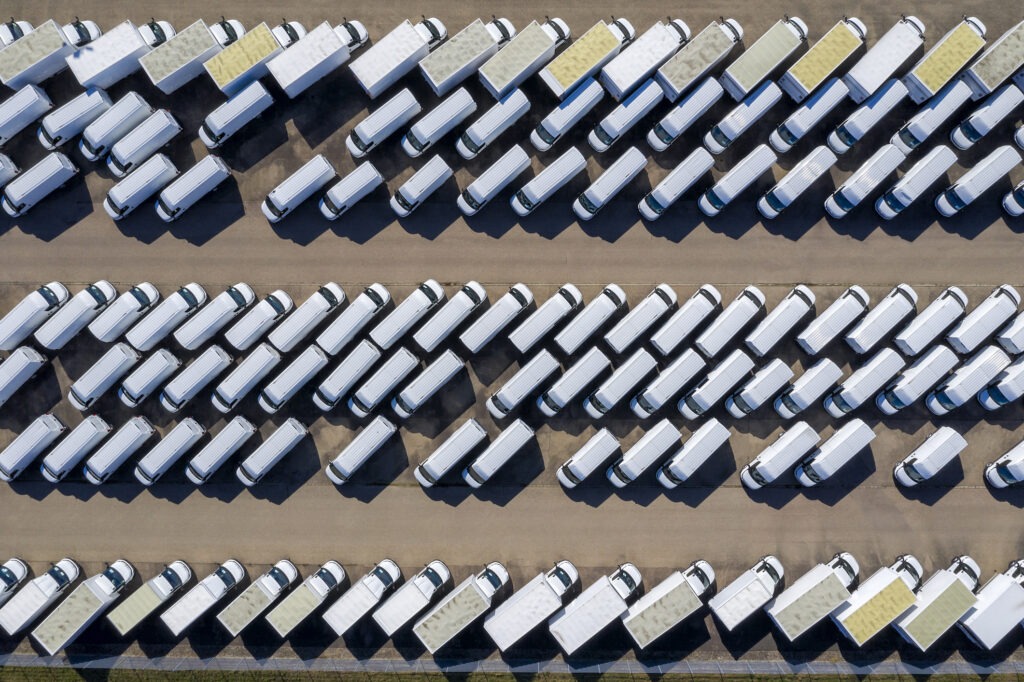

Used light-commercial vehicles (LCV) across Europe came under continued price pressures in the third quarter of 2024. Autovista Group experts from Germany, Poland, and the UK consider the causes with Autovista24 editor Tom Geggus.

Autovista Group’s price index has highlighted an ongoing trend for used LCVs across Europe. The average movement of absolute prices of vehicles on offer has continued to trend downwards.

In many markets, this has been the result of aggressive pricing strategies. As demand slows, manufacturers have attempted to stoke interest by adjusting the cost of new models.

However, discounting can have serious implications for vehicles already on the used-LCV market. If a new model is available at an improved price, older LCVs with miles on the clock become less appealing.

This is a particular problem in the electric vehicle sector. Newer models are rapidly improving in terms of range and technological capabilities. This makes recently de-fleeted models even less attractive as they are not as capable.

Electric LCVs are especially affected, with many commercial operators still hesitant about switching to a plug-in model. With few government incentives and a lack of dedicated charging infrastructure, many businesses are sticking with diesel powertrains.

This is despite the implementation of green regulations on the operation and sale of internal-combustion engine (ICE) vehicles. So, how have these influencing factors become apparent in Germany, Poland, and the UK?

Divergent trends in Germany

‘As in the second quarter of 2024, Germany’s used-LCV price index continued to show a negative trend in the third quarter,’ said Kai Seidemann, LCV market analyst at Schwacke. The diverge between it and the passenger-car market has increased, although the two are running in parallel.’

Breaking down price developments by age, the 31-to-53-month cluster is still heavily affected by declining prices. Meanwhile, younger used LCVs, up to 12 months of age, are showing a slightly positive trend. This looks to be the result of the various and significant price changes being made by nearly all manufacturers.

‘Price reductions can stabilise residual values presented as a percentage of new-car list price (%RV). The absolute value in Euros is determined by the current new list price,’ explained Seidemann. ‘This means the market stabilises according to %RVs while absolute values fall in a similar fashion across different age brackets.’

Equipped with this information, powertrain trends come into sharper focus. Battery-electric vans experienced the greatest price reductions so far this year. After incentives ended in the country, manufacturers reduced the price of their all-electric models, creating a sense of stability at first glance.

Poland sees declines

‘Poland’s used LCV market continued to suffer from declining supply in the third quarter,’ said Marcin Kardas, head of valuations at Eurotax Poland. ‘Additionally, all segments experienced declining values, although this drop was slower than in the first half of 2024.’

Models between five and six years of age, with a gross vehicle weight (GVW) of 1 tonne, saw some of the largest discounts. Vehicles up to four years of age, weighing in at 3.5 tonnes GVW also saw heavy price adjustments.

This means faster stabilisation in the market’s heaviest segment, which is the only one not seeing average stock days increase. Models over seven years of age are returning to a normal long-term average, regardless of segment.

Compared to Germany, the rate of LCV depreciation in Poland is slowly stabilising and is no longer as severe. Asking prices look to be following a similar deteriorating trend.

‘The age structure on the market has proved interesting,’ said Kardas. ‘In September, asking prices were up to 34% higher than before the pandemic. This implies an even decline in values, independent of age.’

Sinking values are not only the result of falling demand but also fierce new-market competition. Huge discounting has forced the market to react. Stock models from 2023 are still available, highlighting the plight facing dealers as demand declines.

Self-registration struggles

LCV registrations have grown in Poland, up 1.6% year on year between January and September. According to industry body PZPM, the year-to-date figure reached 48,055 new units.

The problem is that a large proportion of these figures are self-registrations carried out by dealers. This enables the sale of stock vans which do not meet GSR2 equipment standards. Therefore, the market situation is worse than the statistics suggest.

This has not been improved by falling interest in electric vans. According to EV Volumes, only 1,128 LCVs were equipped with a battery-electric powertrain between January and August. This equates to a 33% drop compared with the same period last year.

Additionally, public subsidies for leasing, the primary source of financing for commercial vehicles, have been exhausted. However, large fleets and state institutions have been driving purchases of electric vans because of ESG policies and regulations.

The first wave of all-electric vans are now entering the used market, but demand is negligible. This translates into big drops in value, especially when compared to prices from a few years ago. Meanwhile, prices of new vans have also been falling, similar to a trend seen with passenger cars.

Intense price reductions are ongoing and imply a decline in the viability of electric vans for first-time users. This may further discourage repeat purchases, despite significant improvements in performance and range.

Asking prices confirm the difficult situation on Poland’s used-LCV market. The highly volatile trend is due to the very small range of used electric models on the market.

Electric vans need boost in UK

The UK’s new-LCV market could well reach the Society of Motor Manufacturers and Traders (SMMT) 2024 forecast of 351,000 registrations. However, battery-electric vans are highly unlikely to aid this effort. The powertrain is far more likely to fall short, bar a major turnaround in the fourth quarter.

‘This dashes hopes of complying with the zero-emissions vehicle (ZEV) mandate,’ said Andy Picton, chief commercial vehicle editor at Glass’s. ‘Only four manufacturers can be expected to meet the 10% sales target this year. All other van manufacturers are likely to fall significantly short of this goal.’

This situation leaves OEMs desperately lowering list prices in the hope of attracting more buyers. With a lack of purchase incentives and van-specific charging infrastructure, things are unlikely to improve.

Plug-ins and policies

Since coming into power, the new Labour government has not mentioned whether the plug-in-van-grant will continue beyond March 2025. Additionally, there has been no word on whether VAT on public charging would be lowered to 5%, matching domestic rates.

The government is set to announce its first budget at the end of October, but it is unknown if this will contain further information for the electric vehicle sector.

Additionally, the Congestion Charge exemption for zero-emission vehicles is set to be removed on 25 December 2025. This means drivers of these vehicles will also need to pay £15 to drive through parts of London. This will likely be challenged, as commercial vehicles will not be able to operate in the area without passing through the zone.

However, things are also looking difficult for companies aiming to make the most out of ICE-powered LCVs. For example, fuel duty has been frozen since 2011, but this could thaw out in the upcoming budget.

Labour previously stated it would bring forward the ban on the sale of new ICE cars to 2030, although no official announcement has been made. Whether LCVs should be included in this is also yet to be decided, alongside whether hybrids could get an extension to 2035.

The UK’s used LCV market

‘Volumes of used LCVs available at auction in the UK increased by 33% year on year in the third quarter,’ Picton added. ‘Compared with the same period in 2022, volumes were up by 44%.’

Most of this stock was registered at the end of the COVID-19 pandemic and during the semiconductor crisis. This means many of the models feature limited specifications. These LCVs are now coming back onto the market with higher mileages and in poorer conditions.

Increasing volumes of similar stock during 2024 has mainly resulted in falling prices. Only in-demand, higher-spec vans have seen their values holding up. This trend is likely to continue for the remainder of 2024.