Range anxiety: still a concern or a distant memory?

06 August 2019

Range anxiety: still a concern or a distant memory?

By Rebecca Platt, Car Editor, Glass’s

What is range anxiety? The fear that an electric vehicle has insufficient range to reach the end destination. With sales of battery electric vehicles (BEVs) on the rise, has range anxiety decreased or is it still a concern for drivers?

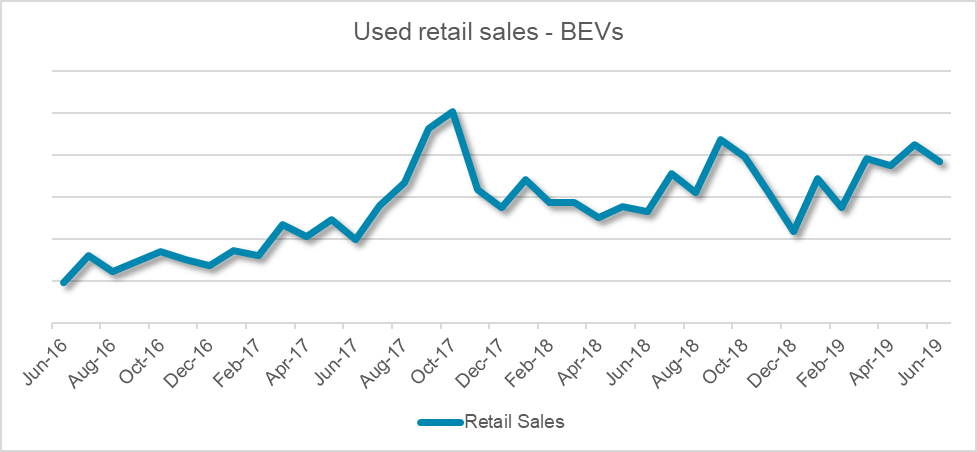

Over the past three years, sales of BEVs in the UK’s used retail market have increased, suggesting they are growing in popularity. The following graph shows EV sales growth in the used retail market since June 2016. BEVs now have a 0.9% share in the used car market in the UK, according to data from Glass’s Radar used retail analysis product.

Source: Glass’s

Source: Glass’s

Although the BEV market share may seem low, the relatively small battery range of many BEVs currently available in the used car market results in them not working for everyone. Most manufactures are heavily investing in BEV technology, which will result in this situation improving in time, as recent new releases show. As examples, the Renault Zoe can now achieve 242 miles and the new Hyundai Kona can achieve up to 279 miles. It is only a matter of time before these filter through into the used market, opening the technology up to many more consumers.

The charging infrastructure in the UK has been growing at a rapid rate. In the autumn 2017 budget, the Government pledged to mobilise around £400 million (€435 million) of investment into the UK’s charging infrastructure to support their aim of increasing the amount of BEVs on the roads.

Strategies to alleviate range anxiety are:

- Extensive charging infrastructure. Charging points need to be accessible as easily as fuel stations with the capability to charge rapidly.

- Higher capacity batteries at cost-effective pricing. Batteries capable of holding more charge and achieving a larger range at more affordable price points. With prices of BEVs high in comparison to their petrol/diesel equivalents, customers may find the cost too high to make the change.

- Battery swapping technology. Technology where you could drive to a BEV charging centre and simply swap the ′dead’ battery for a full one. At this moment, this seems the least likely to happen due to costs and safety. This technology is currently in use on forklift trucks but the batteries are much smaller. Upscaling to a BEV car battery could prove difficult and costly.

- Extended range. Battery capacities in BEVs are getting bigger to deliver additional range. Nissan’s second generation Leaf now has a range of 239 miles with the Leaf E+ compared to the standard vehicle with a range of 168 miles. This is more than enough mileage for the average driver to complete most journeys.

Manufacturers are targeting substantial growth in the fuel type but it is difficult to say whether range anxiety is still the biggest concern for drivers or if supply issues remain the biggest blocker to significant growth in the UK.

In July, the UK Government announced that company car drivers choosing to drive a BEV would pay no Benefit-In-Kind (BIK) tax in 2020/21. This has met with universal approval and has given manufacturers confidence to ramp up production for the UK market.

With BIK rates for BEVs only increasing by 1% per year for the following two years, the Glass’s team forecasts significant increases in demand. However, the charging infrastructure is still a consideration here. Whilst this issue remains, BEVs will continue to struggle to gain significant market share.

Range anxiety may always be an issue for some drivers whilst conventional fuel types still hold the market but with the BEV market share rising, the future is beginning to look electric.