Semiconductor shortage continues to impact automotive production

19 January 2021

19 January 2021

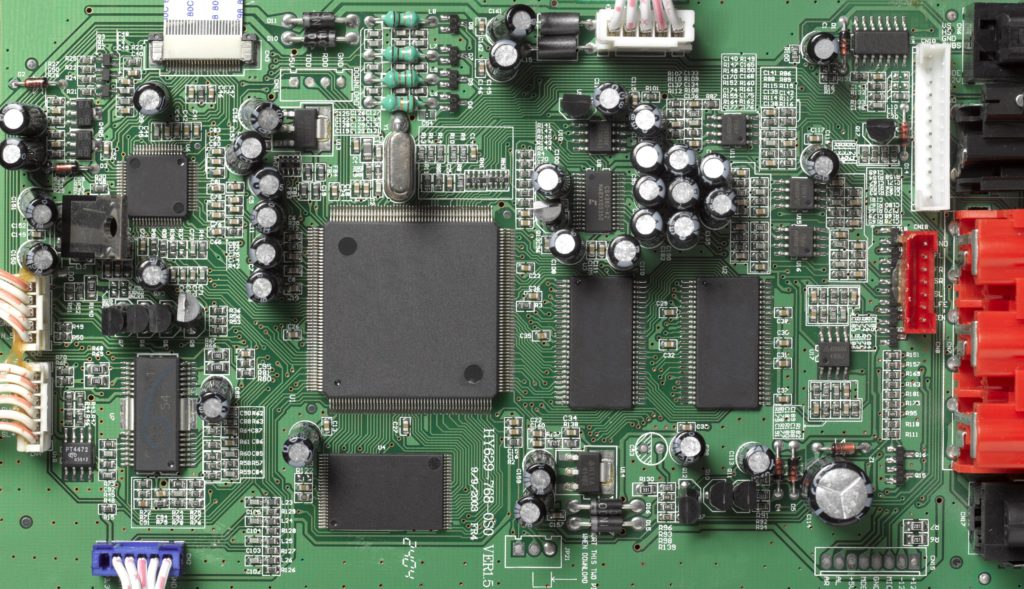

A shortage of semiconductors is continuing to cause production disruptions within the automotive industry. After Volkswagen Group, Continental and Bosch confirmed manufacturing delays last month, more OEMs are coming forward to reveal the extent of the issue.

This week, Audi confirmed it has had to furlough 10,000 workers as the semiconductor drought dried up supply chains, leaving production lines parched. Ford has also halted production at its Saarlouis plant in Germany for roughly a month and will concentrate on existing customer orders, a move that could cause availability issues for popular models such as the Ford Focus. The list of impacted OEMs goes on, but why does a lack of semiconductors leave the automotive industry gasping?

As a building block for every new technology; from mapping capabilities to connectivity platforms and advanced driver-assistance systems (ADAS), semiconductors are essential for automotive progress. But suppliers of the component redirected production capacities to other sectors, like consumer electronics, as carmakers saw their sales slump because of COVID-19. Now, as the automotive industry tries to get back on its feet, especially with a renewed emphasis on electromobility and new technologies, semiconductors have become even more essential.

10,000 furloughed

Speaking recently to the Financial Times, Markus Duesmann, chairman of the board of management of Audi, confirmed the furloughing of 10,000 workers due to chip shortages slowing production lines. Audi will ′do everything we can to keep it below 10,000 [fewer models produced] for the first quarter,’ Duesmann told the publication. With COVID-19 still looming over the industry, the chairman described the shortage as a ′crisis upon a crisis.’

Audi told the Autovista Group Daily Brief that it was considering a number of options to reduce the fallout of the shortage. ′We are currently looking at a range of countermeasures and alternatives designed to mitigate the impact of the supply bottleneck and, in turn, minimise the number of vehicles affected,’ the OEM said. ′Any improvement largely depends on the semiconductor industry.’

Going into more granular detail, it explained that, following the usual Christmas shutdown, production at Audi’s Ingolstadt plant resumed on all three assembly lines at the start of this week as planned, on all shifts. Then, on 21 and 22 January, as well as calendar week four, assembly lines one (A4, A5) and two (A3, A4, A5) will be shut down. Work also resumed at the Neckarsulm site as planned on 11 January, on all shifts. Production of the A4 limousine and A5 cabriolet will stop provisionally from 18 to 29 January. ′As things currently stand, all other model series are being produced as normal without restrictions,’ the carmaker confirmed.

Production resumed at the Gyor plant in Hungary as planned after the Christmas break. ′Over the coming weeks, engine production will operate essentially according to the planned shift patterns; reduced shift patterns may be introduced in certain engine segments,’ Audi said. ′The automotive production took place according to the planned shift pattern in calendar week 2. This will be followed by a reduced shift pattern in calendar weeks 3 and 4.’ On 7 January, production at the Brussels plant resumed as planned as well, with no cuts currently planned.

Audi Mexico will be adjusting its shift patterns because of COVID-19 and the semiconductor bottlenecks. ′Production will take place in one shift in calendar weeks 3 and 4,’ the carmaker said. ′The aforementioned shift patterns apply up to and including 31 January. We are keeping a close eye on the situation and will make the necessary decisions on a case-by-case basis.’

Elsewhere in the industry

Due to lower demand and the semiconductor shortage, Ford suspended production at its Saarlouis plant in Germany from 18 January to 19 February. This will impact the manufacturing of the Ford Focus for Europe. ′When we restart production, our priority will be to build vehicles that have already been ordered by customers,’ the carmaker told Autovista Group’s Daily Brief.

′We are closely monitoring the situation and adjusting production schedules to minimise the effect on our employees, suppliers, customers and dealers across Europe,’ Ford said. ′At this time, we do not anticipate any similar actions at our other European facilities.’

Mercedes-Benz recognised the worldwide shortage of semiconductors, but said that thanks to a high level of flexibility its plants could react to such fluctuations at short notice and adapt its operational program accordingly. ‘The Mercedes-EQ electric offensive remains a top priority,’ the carmaker told Autovista Group’s Daily Brief. It went on to say that while it is still too early to be able to make any statements about specific impacts, it is continuously monitoring and evaluating the situation with its suppliers.

Volkswagen, Honda, Nissan, Subaru, and Fiat (now part of Stellantis following the merger of Fiat Chrysler Automobiles and PSA Group) have all reportedly been impacted by the shortage as well. They were all approached for comment by Autovista Group, but were unable to respond prior to publication.